Intel's Q4 strong amid PC rebound, outlook light: Here are the takeaways

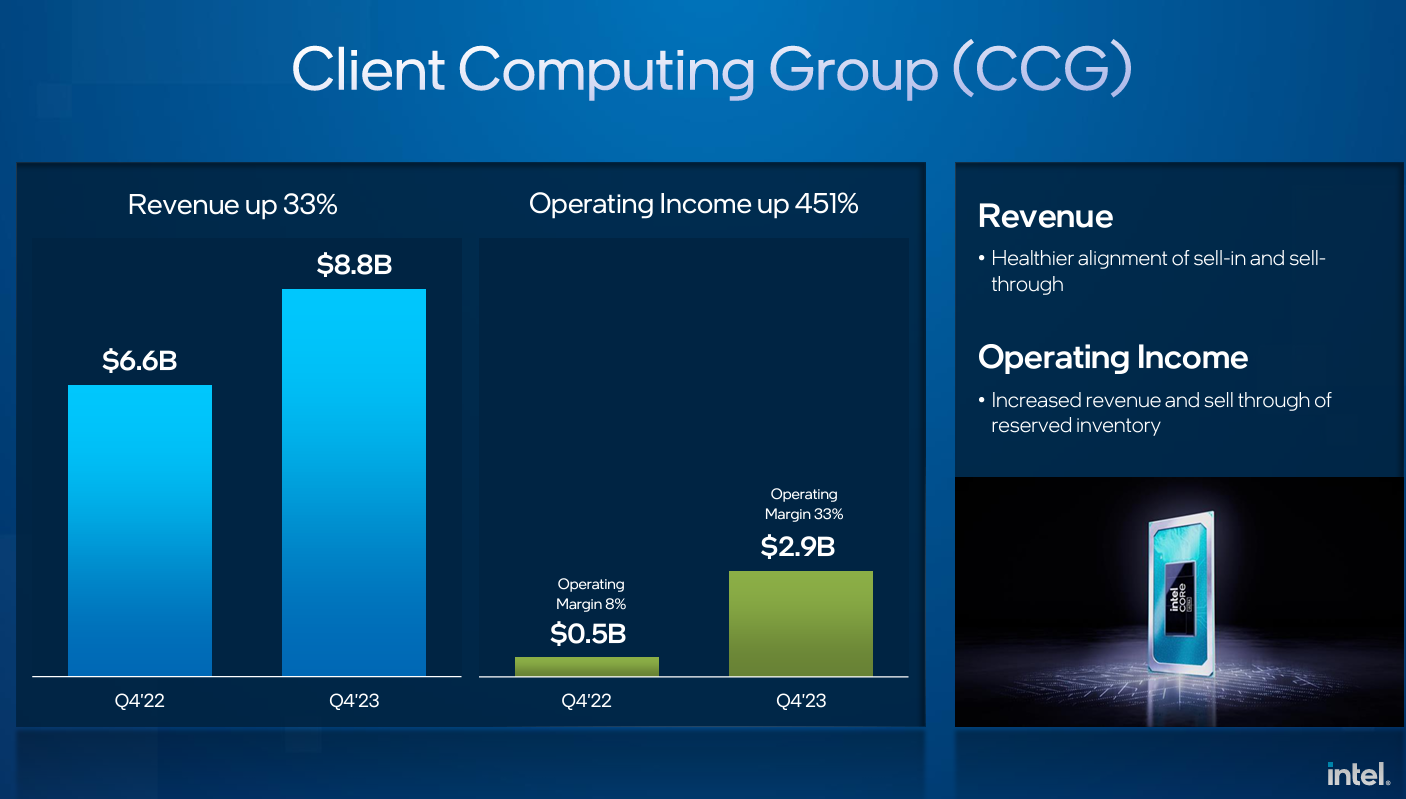

Intel reported better-than-expected fourth quarter results as its PC business continues to bounce back. Intel's client computing group posted fourth quarter growth of 33% from a year ago as its data center and AI and network and edge units showed sales declines.

However, the first quarter outlook disappointed relative to expectations.

The chipmaker reported fourth quarter net income of $2.7 billion, or 63 cents a share, on revenue of $15.4 billion, up 10% from a year ago. Non-GAAP fourth quarter earnings were 54 cents a share. Wall Street was expecting Intel to report fourth quarter earnings of 45 cents a share on revenue of $15.17 billion.

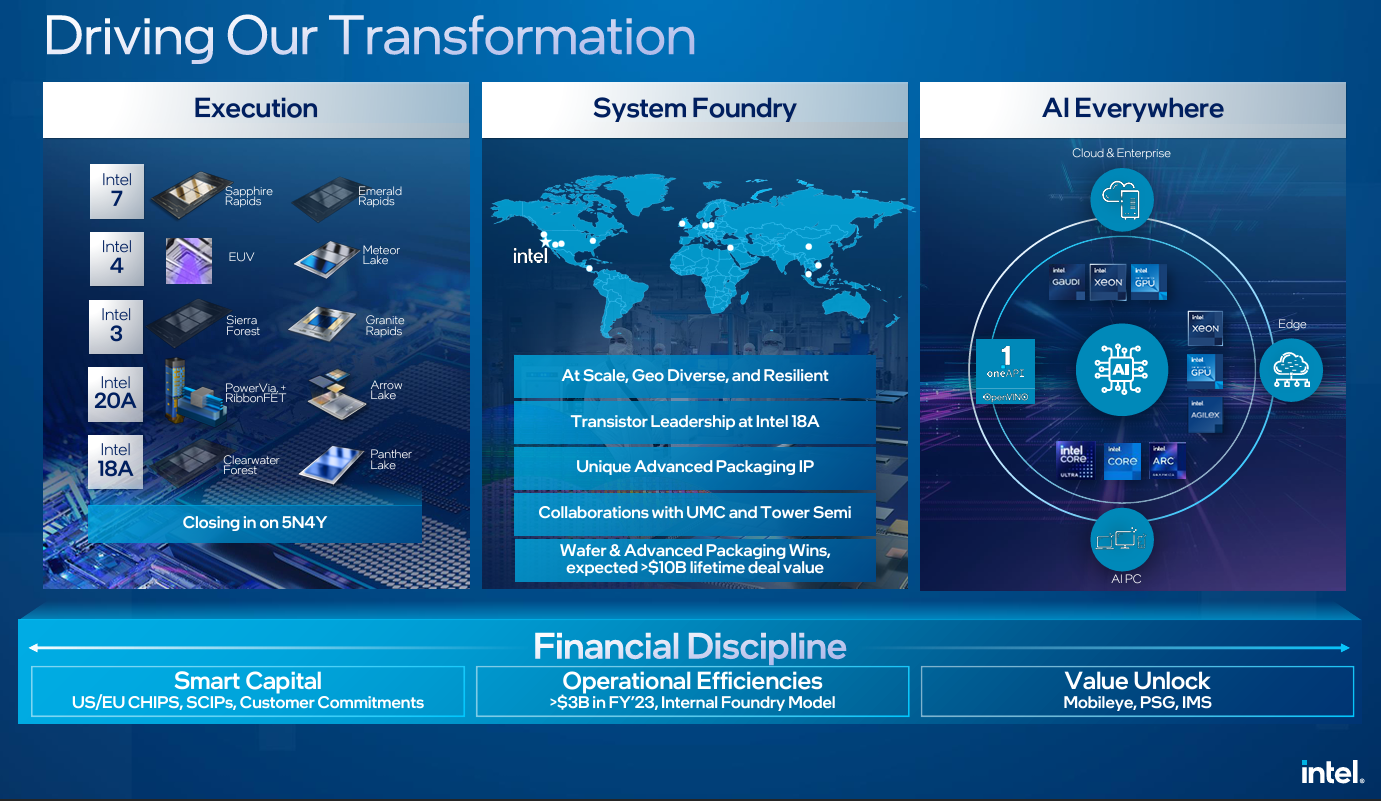

Intel's AI everywhere strategy rides on AI PCs, edge, Xeon CPUs for model training, Gaudi3 in 2024

Ahead of the results, Intel announced a foundry partnership with United Microelectronics Corp. (UMC). The two companies said they will collaborate to develop a 12-nanometer semiconductor process platform for mobile, communication infrastructure and networking. UMC, which offers foundry services, has decades of experience it can bring to Intel's US manufacturing efforts.

For 2023, Intel reported net income of $1.7 billion, or 40 cents a share, on revenue of $54.2 billion, down 14% from a year ago.

In a statement, CEO Pat Gelsinger said the company executed well and topped its expectations for the fourth quarter. For 2024, Gelsinger said "we remain relentlessly focused on achieving process and product leadership, continuing to build our external foundry business and at-scale global manufacturing, and executing our mission to bring AI everywhere."

CFO David Zinsner said the company hit its $3 billion in cost savings target in 2023 and expects to "unlock further efficiencies in 2024 and beyond."

By unit, Intel's fourth quarter was driven by the client computing group, which had revenue of $8.8 billion, up 33% from a year ago. For 2023, however, the client computing unit saw sales fall 8%. Intel saw its PC unit rebound in the third quarter.

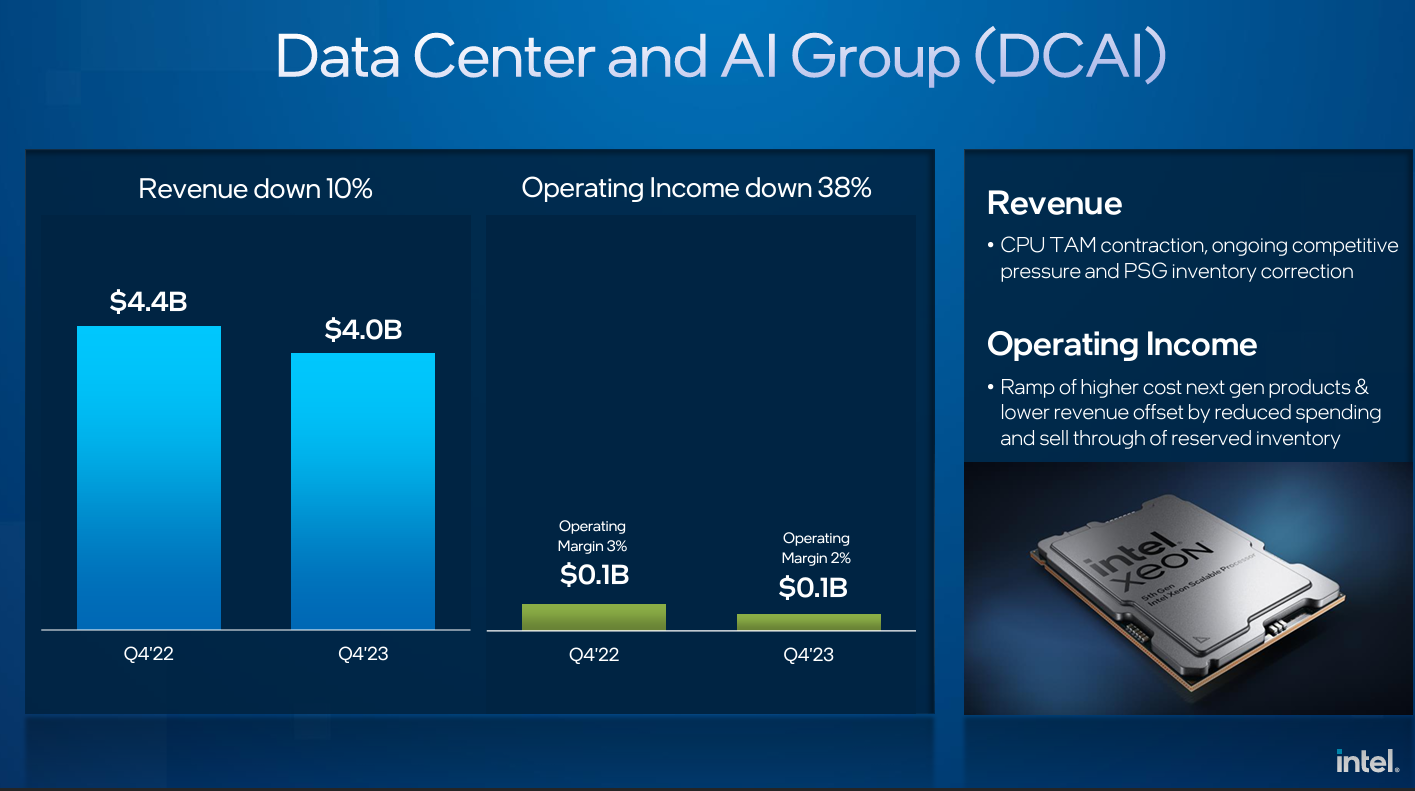

Intel's data center and AI group had fourth-quarter sales of $4 billion, down 10% from a year ago. For 2023, Intel's data center and AI unit had sales of $15.5 billion, down 20%. Intel has largely missed the GPU wave driven by generative AI. Intel's network and edge unit had fourth-quarter sales of $1.5 billion, down 24%. For 2023, network and edge sales of $5.8 billion were down 31% from a year ago.

The chipmaker's Intel Foundry Services had fourth-quarter sales of $291 million, up 63% from a year ago. For 2023, the foundry business had revenue of $952 million. Gelsinger said Intel's foundry business is on the right path. On a conference call, he said:

"While our ambitions will not materialize overnight, we made tremendous progress in both Q4 and fiscal year '23 towards our goal of becoming the second largest external foundry by 2030. The rapid adoption of AI by all industries is proving to be a significant tailwind for IFS as high-performance compute, an area where we have considerable wafer and packaging know-how and IP is now one of the largest, fastest-growing segments of the semiconductor market.

We made major strides in building our foundry ecosystem in 2023 with now over 40 strategic agreements across EDA design services, IP, cloud and U.S. military aerospace and government. Critical agreements with ARM and Synopsys continue to gain momentum."

As for the outlook, Intel projected first quarter revenue of $12.2 billion to $13.2 billion with non-GAAP earnings of 13 cents a share. That outlook was lighter than expectations.

Bottom line: Intel's transformation remains a work in progress.

Other notable quotes from Gelsinger on the conference call.

On AI:

"For the developer working with multitrillion parameter frontier models in the cloud, Gaudi and our suite of AI accelerators provides a powerful combination of performance, competitive ML perf benchmarks and leadership TCO.

As AI proliferates and the world moves towards more AI integrated application, there's a market shift toward local inferencing and smaller, more nimble models. It's a nod to both the necessity of data privacy and an answer to cloud-based inferencing cost and round trip latency."

On Xeon and servers:

"In Q4, our server business experienced solid sequential growth, consistent with market share, which we believe was flat with Q3 levels. Since launching 4th Gen Xeon in early 2023, we have shipped more than 2.5 million units with approximately 1/3 of all 4th Gen demand driven by AI. With our 5th Gen Xeon launch, we enable up to 42% higher AI inference performance compared to the industry-leading 4th Gen Xeon. 5th Gen Xeon has reached general availability at Alibaba is entering public and private previews with several CSPs and is on track to ship with OEMs next month."

On AI PCs:

"Core Ultra is the centerpiece of the AI PC, systems that are capable of natively running popular $10 billion parameter models and drive superior performance on key AI-enhanced applications like Zoom, Adobe and Microsoft. We expect to ship approximately 40 million AI PCs in 2024 alone with more than 230 designs from ultrathin PCs to handheld gaming devices to be delivered this year from OEM partners, Acer, Asus, Dell, HP, Lenovo, LG, MSI, Samsung Electronics and others."