Intel Q2 outlook weaker than expected

Intel's second quarter outlook was below expectations even though its first quarter was better-than-expected.

The chipmaker, which is trying to catch up in AI processors, said it expects second quarter revenue between $12.5 billion to $13.5 billion, well below the $13.61 billion Wall Street expected. Intel also projected non-GAAP earnings of 10 cents a share in the second quarter, well below estimates of 25 cents a share.

Intel's outlook overshadowed better-than-expected first quarter earnings. The company reported a first quarter net loss of 9 cents a share on revenue of $12.7 billion, up 9%. Non-GAAP earnings in the first quarter were 18 cents a share. Analysts expected Intel to report first quarter earnings of 14 cents a share on revenue of $12.78 billion.

CEO Pat Gelsinger said the company was making "steady progress." "We are confident in our plans to drive sequential growth throughout the year as we accelerate our AI solutions," he said.

- Intel launches Gaudi 3 accelerator with availability in Q2

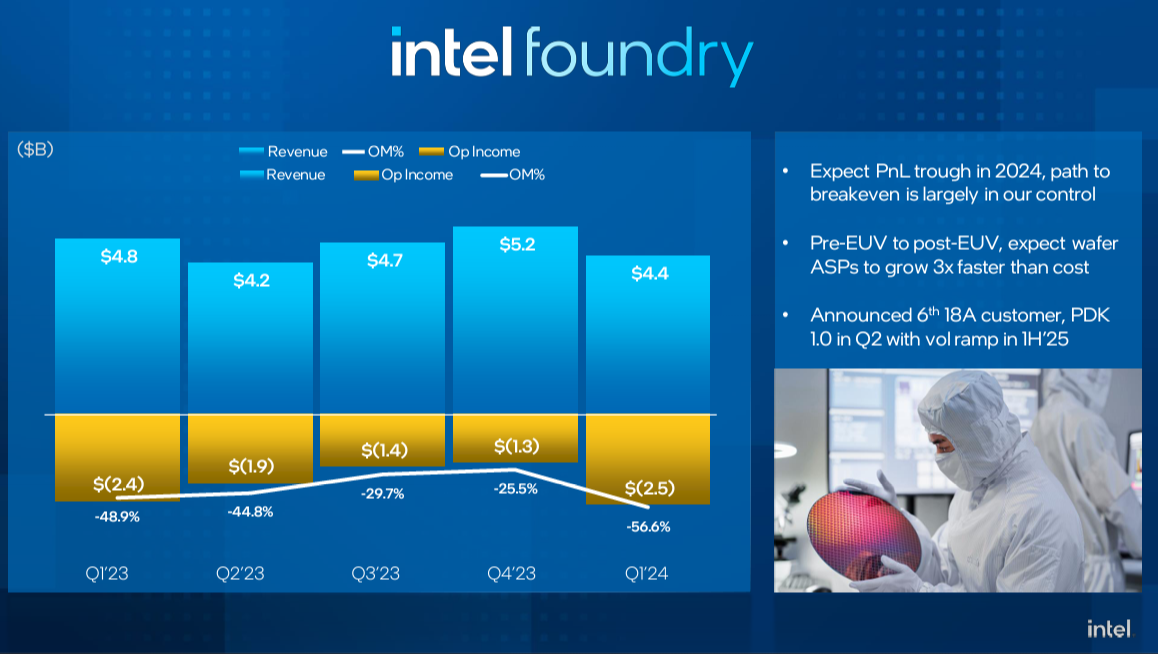

- Intel Foundry had $7 billion operating loss in 2023

- Intel Foundry sets roadmap, aims to be No. 2 foundry by 2030

By unit:

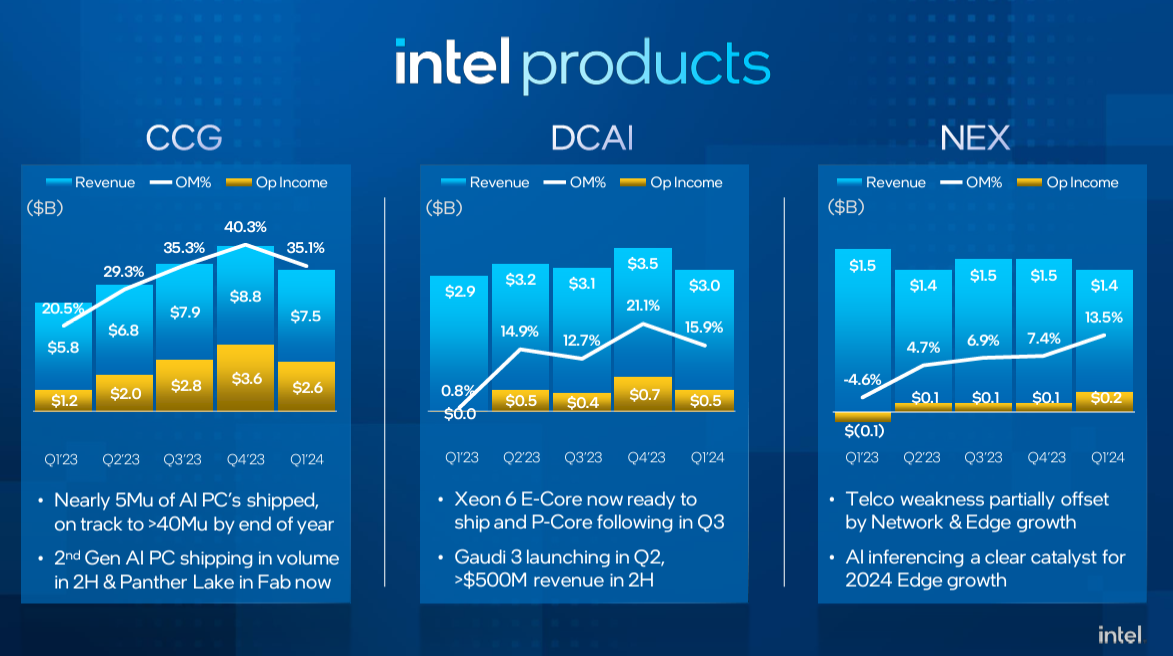

- Intel's Product revenue group had first quarter revenue of $11.9 billion, up 17% from a year ago.

- Client Computing Group showed growth of 31% to revenue of $7.5 billion. Intel said more than 5 million AI PCs have shipped since December.

- Data Center and AI had revenue of $3 billion, up 5%.

- Intel Foundry revenue was $4.4 billion in the first quarter, down 10%.

- Altera and Mobileye saw first quarter revenue declines of 58% and 48%, respectively.