IBM Q2 strong across AI, software, infrastructure

IBM reported strong second quarter results, a revenue pop for its infrastructure business due to its new mainframe system and a growing backlog for its AI business.

Big Blue reported second quarter earnings of $2.2 billion, or $2.31 a share, on revenue of $17 billion, up 8% from a year ago. Non-GAAP earnings were $2.80 a share.

Wall Street was looking for IBM to report non-GAAP second quarter earnings of $2.65 a share on revenue of $16.59 billion.

During the quarter, IBM outlined a bevy of quantum computing advances and the launch of its latest Power server processor.

- IBM outlines quantum computing roadmap through 2029, fault-tolerant systems

- IBM sees quantum advantage 2026, fault tolerant quantum in 2029

- IBM CEO Krishna: Now is the ROI stage of enterprise AI

- IBM launches Flex Plan for quantum computing, aims to expand use cases

IBM unveiled Power11, a major update to its data center CPUs, with a focus on power and easier IT management. Power11 will power a line of high-end, mid-range and entry-level servers from IBM. IBM also said Power11 will be the first to support IBM Spyre Accelerator, which is built for AI inference workloads. Big Blue added that Power11 will be able to detect a ransomware threat in less than one minute with IBM Power Cyber Vault.

In the second quarter, IBM saw a pop in its infrastructure business and strong AI demand. CEO Arvind Krishna said:

"Our generative AI book of business continues to accelerate and now stands at more than $7.5 billion. With our strong first-half performance, we are raising our full-year outlook for free cash flow, which we expect to exceed $13.5 billion."

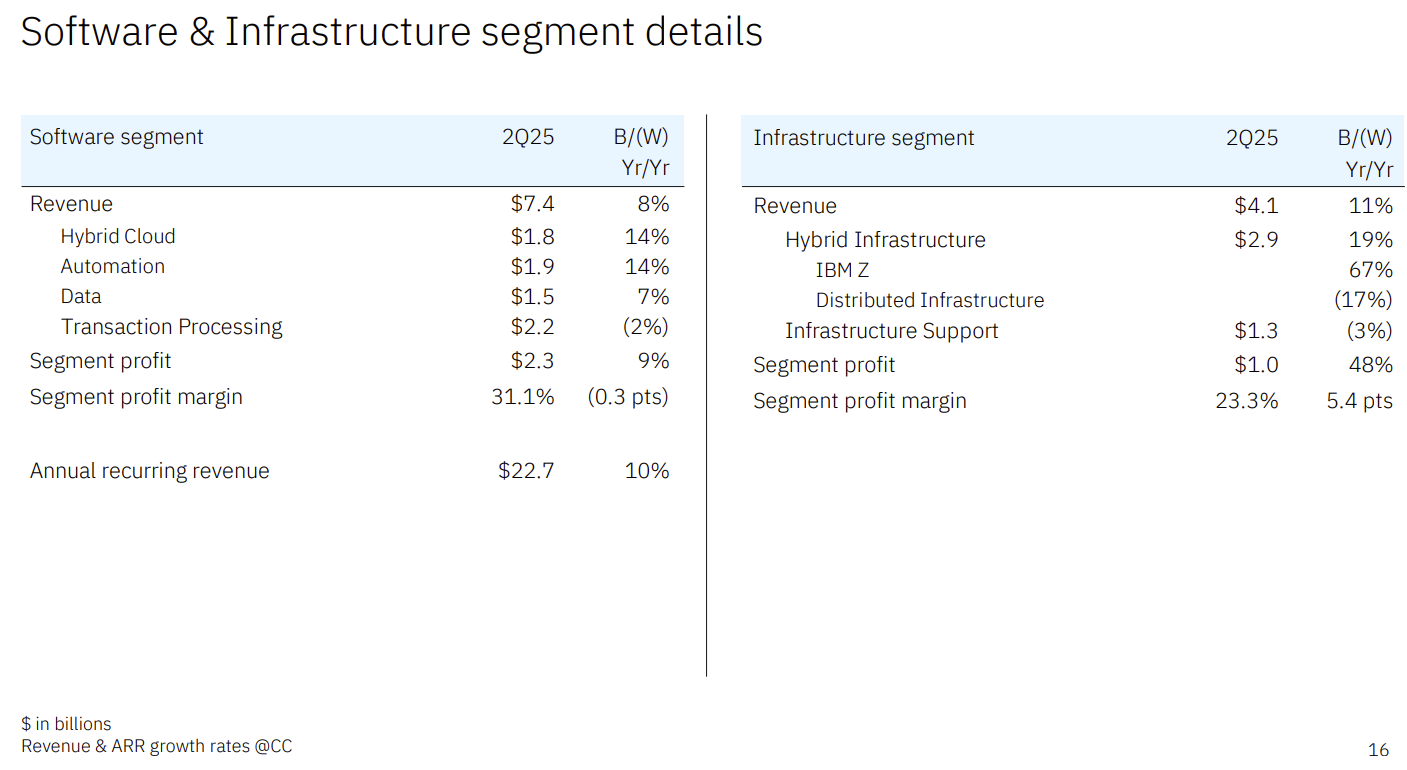

IBM said second quarter software revenue was up 10% compared to a year ago, consulting revenue was up 3% and infrastructure was up 14%.

Key takeaways:

- Red Hat revenue was up 16% in the second quarter.

- Automation revenue was up 16%.

- IBM Z revenue was up 70%.

- Hybrid infrastructure revenue was up 21%.

As for the outlook, IBM said it expects constant currency growth to be at least 5%. IBM has benefited from a weaker US dollar.

On a conference call, Krishna said:

- "Technology continues to serve as a key competitive advantage, allowing businesses to scale, drive efficiencies and fuel growth and we saw this play out in the quarter. While not a major factor overall, geopolitical tensions are prompting a few clients to move cautiously. US federal spending was also somewhat constrained in the first half, but we do not expect it to create long-term headwinds."

- "HashiCorp is also off to a great start, accelerating performance in our first full quarter since closing, and seeing early wins."

- "Infrastructure was up 11%, driven by a very strong start to z17. The new IBM Z is an embodiment of the hybrid cloud and AI capabilities we bring to clients."

- "We are transforming our enterprise operations using technology and embedding AI across more than 70 workflows, leveraging our own IBM software solutions across hybrid cloud, automation, and AI."

- "We’re seeing strong demand for our AI agents and assistants, RHEL AI, Granite models, as well as an accelerating need for our consulting services to deploy AI."