IBM acquires HashiCorp for $6.5 billion, reports mixed Q1

IBM said it will acquire HashiCorp in a deal valued at $6.4 billion as it builds out its infrastructure and security lifecycle management tools to go along with its hybrid cloud and AI portfolio.

The purchase price equates to $35 a share in cash for HashiCorp shareholders.

IBM CEO Arvind Krishna said the acquisition will help customers "manage the complexity of today's infrastructure and application sprawl" as they build out hybrid cloud and generative AI infrastructure. HashiCorp is a play on hybrid and multi-cloud workflows and a solid add-on to Red Hat.

According to IBM, HashiCorp will accelerate its growth and cross-selling opportunities with Red Hat, watsonx, data security, IT automation and consulting. HashiCorp, which has more than 4,400 customers, is expected to be accretive to IBM's adjusted EBITDA within the first year of closing.

Krishna said:

"IBM’s and HashiCorp’s combined portfolios will help clients manage growing application and infrastructure complexity and create a comprehensive hybrid cloud platform designed for the AI era.â€

Constellation Research's take

Constellation Research analyst Dion Hinchcliffe said:

"Hashicorp is the latest in a long spree of acquisitions over the last year by IBM CEO Arvind Krishna to round out their cloud offerings to make them more competitive with the hyperscalers. Hashicorp has struggled at times to crack the enterprise sales market, despite being one of the cooler companies on the block. While IBM will undoubtedly use Hashicorp's strong developer 'street cred' as a proof point in its own offerings, it remains to be seen if Hashicorp can retain its perceived neutrality as a cloud infrastructure software provider at a time that robust multicloud and crosscloud support continues to grow in importance."

Constellation Research analyst Holger Mueller said:

"Hashicorp does not make sense for IBM. The services model lives from being independent and now they may look biased. And the service revenue around DevOps is going to dry up. The multicloud aspect of HashiCorp makes sense from an IBM credibility perspective."

Constellation Research analyst Chirag Mehta said:

"HashiCorp's switch from MPL 2.0 to BSL 1.1 for future products has sparked concern among developers. The BSL's perceived limitations on open-source contribution worry them, potentially impacting the long-term development of these products, particularly those previously under the more permissive MPL.

In light of IBM's strong commitment to open source, many developers are urging them to consider a license like Apache 2.0 for the new HashiCorp products. This license allows for wider modification and distribution, even commercially. By embracing a more open-source friendly license, IBM has a golden opportunity to gain developer trust, a crucial factor for successfully integrating HashiCorp's infrastructure and security solutions into their go-to-market strategy. Ultimately, this shift could strengthen both IBM's offerings and its position in the strategic multi-cloud and cybersecurity domains."

First quarter results

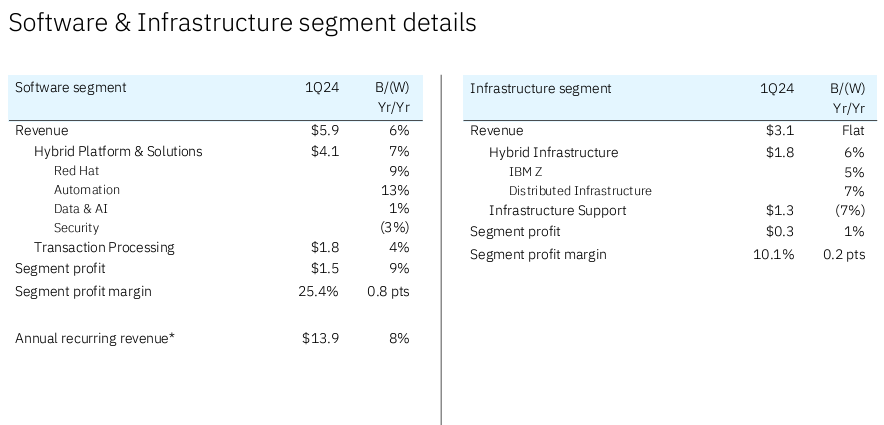

Separately, IBM reported its first quarter results. IBM reported first quarter earnings of $1.6 billion, or $1.69 a share, on revenue of $14.5 billion, up 1% in constant currency. Non-GAAP earnings for the quarter was $1.68 a share.

Wall Street was expecting IBM to report first quarter earnings of $1.59 a share on revenue of $14.54 billion.

- IBM said software revenue was up 5% in the first quarter with consulting revenue flat. Infrastructure revenue was down 1%.

- In software, Red Hat revenue was up 9% with automation up 13%. Data and AI revenue was up 1% and security fell 3%.

- For 2024, IBM is projecting revenue growth in the mid-single digit range with $12 billion in free cash flow.