Dell Technologies AI optimized server backlog swells to $2.9 billion exiting Q4

Dell Technologies reported a better-than-expected fourth quarter as the company saw strong demand for AI-optimized servers.

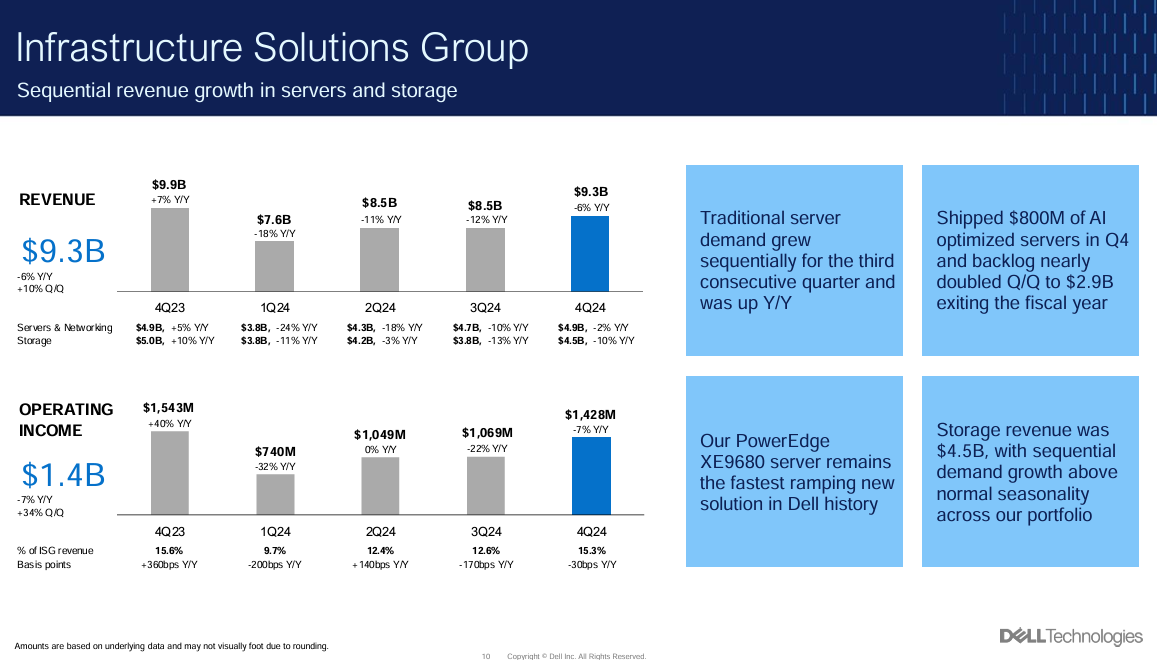

Jeff Clarke, vice chairman and chief operating officer, Dell Technologies, said orders for AI-optimized servers grew 40% sequentially and backlog doubled to $2.9 billion. "We've just started to touch the AI opportunities ahead of us, and we believe Dell is uniquely positioned with our broad portfolio to help customers build GenAI solutions that meet performance, cost and security requirements," said Clarke.

Dell shipped $800 million of AI optimized servers in the quarter. "We are also seeing strong interest and orders for AI optimized servers equipped with the next generation of AI GPUs, including the H200 and MI300X," said Clarke, referring to Nvidia and AMD GPUs, respectively. HPE's quarter was mixed and executives cited GPU deals as a reason for weaker sales.

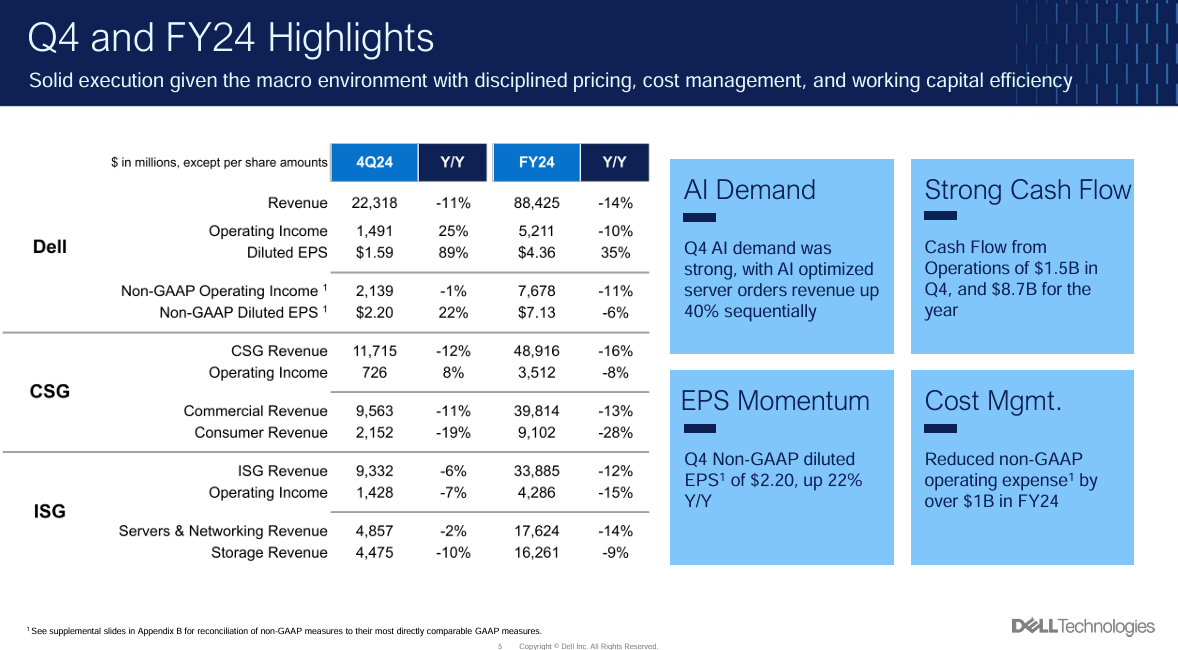

During the quarter, Dell Technologies managed through revenue declines compared to a year ago. The company reported fourth-quarter revenue of $22.32 billion, down 11% from a year ago, with net income of $1.16 billion, or $1.59 a share. Non-GAAP earnings for the quarter were $2.20 a share. Dell also unveiled a 20% hike to its annual dividend to $1.78 per share.

Wall Street was expecting Dell Technologies to report fourth quarter earnings of $1.72 per share on revenue of $22.17 billion.

For fiscal 2024, Dell reported net income of $3.2 billion, or $4.36 a share, on revenue of $88.42 billion, down 14% from a year ago. The company said it expects to return to growth in fiscal 2025.

By unit, Dell's Infrastructure Solutions Group had revenue of $9.3 billion, down 6% from a year ago. Operating income was $1.4 billion. Clarke said there's the obvious buildout in the public cloud for AI workloads, but enterprises are increasingly buying AI-optimized servers too. Dell can sell more richly configured GPU servers and attach services to them as enterprises build out.

"83% of all data is on-prem. More data will be created outside of the data center going forward that inside the data center today, that's going to happen at the edge of the network, a smart factory and oil derrick. We believe AI will ultimately get deployed next to where the data is created driven by latency.

We sold to education customers, manufacturing customers, governments. We've sold the financial services, business, engineering and consumer services. Companies are seeing vast deployments, proving out the technology. Customers quickly find that they want to run AI on-prem because they want to control their data. They want to secure their data. It's their IP and they want to run domain specific and process specific models to get the outcomes they're looking for."

The PC business had fourth quarter revenue of $11.7 billion, down 12$ from a year ago. Commercial PC revenue was $9.6 billion of that total. Operating income was $726 million.

In prepared remarks, Clarke said:

"FY 24 was one of those years that didn’t go as planned, but I really like how we navigated it. We showed our grit and determination by quickly adapting to a dynamic market, focusing on what we can control, and extending our model into a high growth AI opportunity."

Clarke added that AI-optimized PowerEdge XE9680 server sales were ramping quickly. He added that Dell's storage business should also fair well due to projected growth in unstructured data.