C3.ai bets demonstration licenses deliver future growth

C3.ai is betting that it can land more enterprise customers with demo licenses issued to partners that highlight its AI applications and ultimately turn into long-term deals.

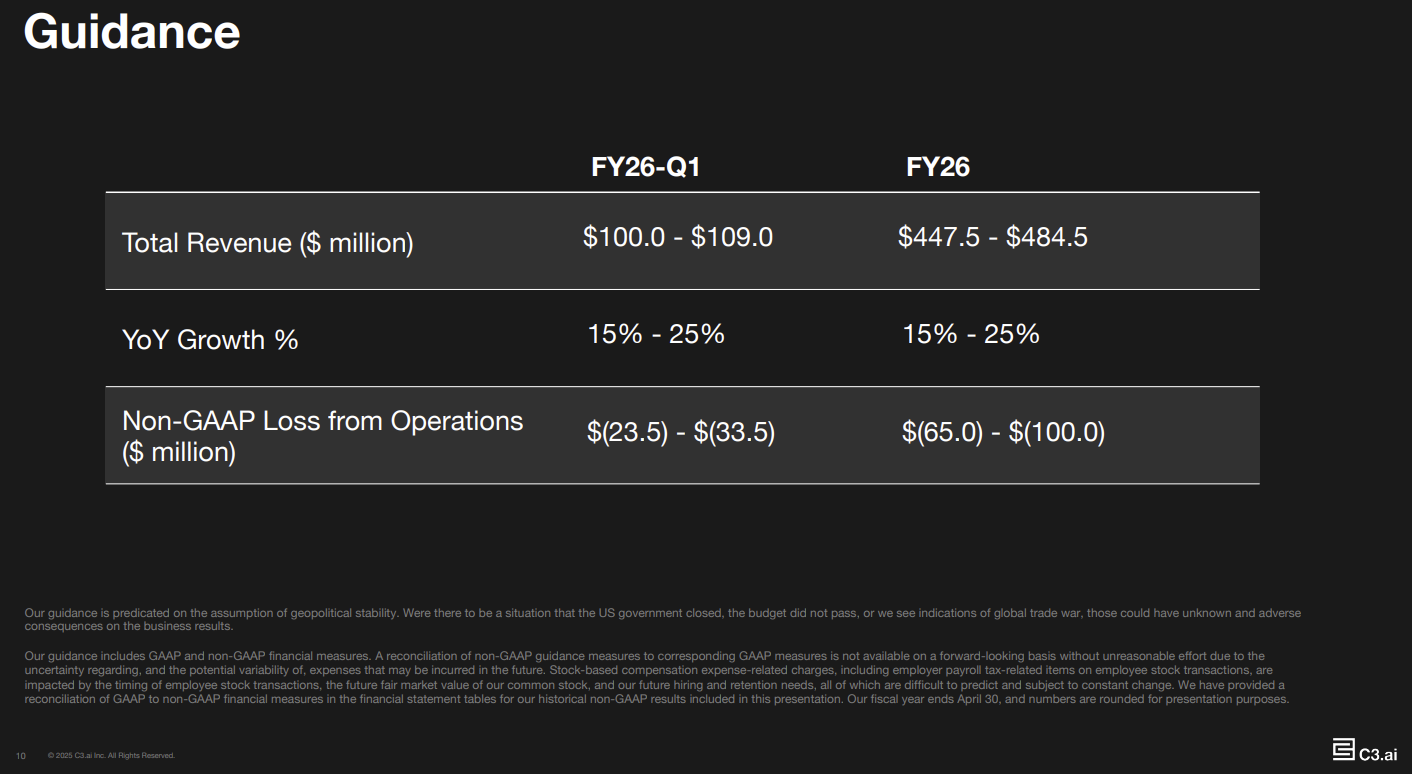

The company, which reported better than expected fourth quarter results, derived $33.8 million in demonstration versions of C3 AI applications out of total revenue of $108.7 million, up 26% from a year ago. C3.ai reported a net loss of 60 cents a share and an adjusted net loss of 16 cents a share. Annual revenue was $389.1 million, up 25% from a year ago, with a loss of $2.24 a share (41 cents a share non-GAAP).

CFO Hitesh Lath noted that C3.ai sells those licenses to distribution partners to demonstrate the software possibilities to customers and "accelerate AI adoption."

C3.ai has invested heavily in partnerships with the top cloud providers--Amazon Web Services, Microsoft Azure and Google Cloud--as well as systems integrators. Professional services revenue was $21.4 million, and $17 million of that sum was Prioritized Engineering Services, which "are undertaken when a customer requests that we accelerate the design, development and delivery of software features and functions that are planned in our future product road map," said Lath.

These demonstration licenses are a twist on what Palantir does with its bootcamps. The idea is to get enterprises to try the AI applications, see the value and then accelerate adoption. Going forward, Lath noted that Prioritized Engineering Services and subscriptions will be about 90% of revenue.

CEO Tom Siebel said the demo licenses were an investment into scaling C3.ai's applications. Siebel, who said he is back in the fold after health issues, said on the company's earnings call that C3.ai is using hyperscale cloud providers as a sales force multiplier.

He said:

"We have tens of thousands of salespeople at Azure. I believe tens of thousands of salespeople at AWS. Thousands of salespeople at GCP. They have lots of products to sell in their bag, and it's very confusing, so we need to make it simple. So in order to make it simple for them, we invested in building demo applications that run and take advantage of the full utility of the Azure stack or the AWS stack or the GCP stack. So these people in Frankfurt and Munich and Detroit and Madrid and Moline can go into their customer and give a demo of a complex application to customers show them what the economic benefit is of supply chain optimization, of demand forecasting, of predictive maintenance."

"We've done good work at arming our partners with demonstration licenses. Think about that as an investment in future growth."

C3.ai also providing demonstration licenses to customers. "We sold demonstration licenses to our customers. Why would we do that? Because Dow Chemical or Shell or Coke or Cargill or whoever or the United States Air Force, whoever it may be, they have a hugely successful application and they want to encourage others to use these applications. For example, the Air Force has 22 platforms today, and they want to deploy the application across 44 platforms," said Siebel.

For C3.ai, these demo licenses accelerate adoption, ease the change management and then convert to regular subscriptions. The bet for Siebel is simple: Turn those demo licenses into joint sales calls with much larger cloud vendors and then do deals quickly because enterprises already have master agreements in place. "It takes two to five months out of a contract negotiation process and accelerates the sales cycle," said Siebel.

Other notable items from the C3.ai earnings call from Siebel.

- "We have, depending on how you count, someplace between 20 and 100 agentic AI solutions out there in production, in the hands of happy customers. And if we were to spin that business out, just that business out, and take it to a Andreessen Horowitz or a Bessemer or Nvidia or whatever it is, that business alone would be valued at multiples of where C3 AI trades today and we all know that's a true statement."

- "One of the most notable achievements in Q4 was the renewal and expansion of our strategic partnership with Baker Hughes. This alliance, which began in 2019, has been a cornerstone of our success in the oil and gas sector, generating over $0.5 billion in revenue from this vertical and the chemical markets. The renewed agreement underscores the proven value we deliver through our joint efforts, enhancing efficiency, safety, reliability, and sustainability across upstream, midstream, and downstream operations."

- "I did get slowed down for a little bit. There's no question about it. And I had to work from home for a little while and take it easy and recover, but I will catch a red eye to Washington, D.C. tonight. I will be in Washington, D.C. again for three days. I think 10 days from now after attending a wedding in Cabo. So, just when you thought it was safe, I'm back."