Akamai launches Gecko, aims to combine cloud compute, edge networks

Akamai announced plans to embed cloud computing across its edge network via an initiative called Gecko (Generalized Edge Compute) in a bid to grab AI inferencing, multiplayer gaming, streaming media, analytics and spatial computing workloads.

The company historically has been known as a content delivery network (CDN) provider but has moved into distributed cloud services. Akamai's bet is that cloud and edge networks will converge over time instead of being treated separately.

Akamai's IaaS vision: Become your cloud alternative | Why generative AI workloads will be distributed locally | Verizon sees enterprises building out private 5G networks | Constellation ShortListâ„¢ Digital Performance Management

For Akamai, the timing for Gecko is right given that more companies want to bring compute and inferencing to where data resides with lower latency. Given Akamai's distributed content delivery network locations, adding a traditional compute stack to the mix makes sense.

Dr. Tom Leighton, CEO of Akamai, said the Gecko initiative builds on top of the Linode acquisition and its existing distributed cloud network. "With Gecko, we’re furthering that vision by combining the computing power of our cloud platform with the proximity and efficiency of the edge, to put workloads closer to users," said Leighton.

On Akamai's earnings conference call, Leighton said:

"Traditional cloud providers support virtual machines and containers in a relatively small number of core data centers. Gecko is designed to extend this capability to our edge PoPs, bringing full stack computing power to hundreds of previously hard-to-reach locations. Deploying our cloud computing capabilities into Akamai's worldwide edge platform will also enable us to take advantage of existing operational tools, processes, and observability, enabling developers to innovate across the entire continuum of compute and providing a consistent experience from centralized cloud to distributed edge."

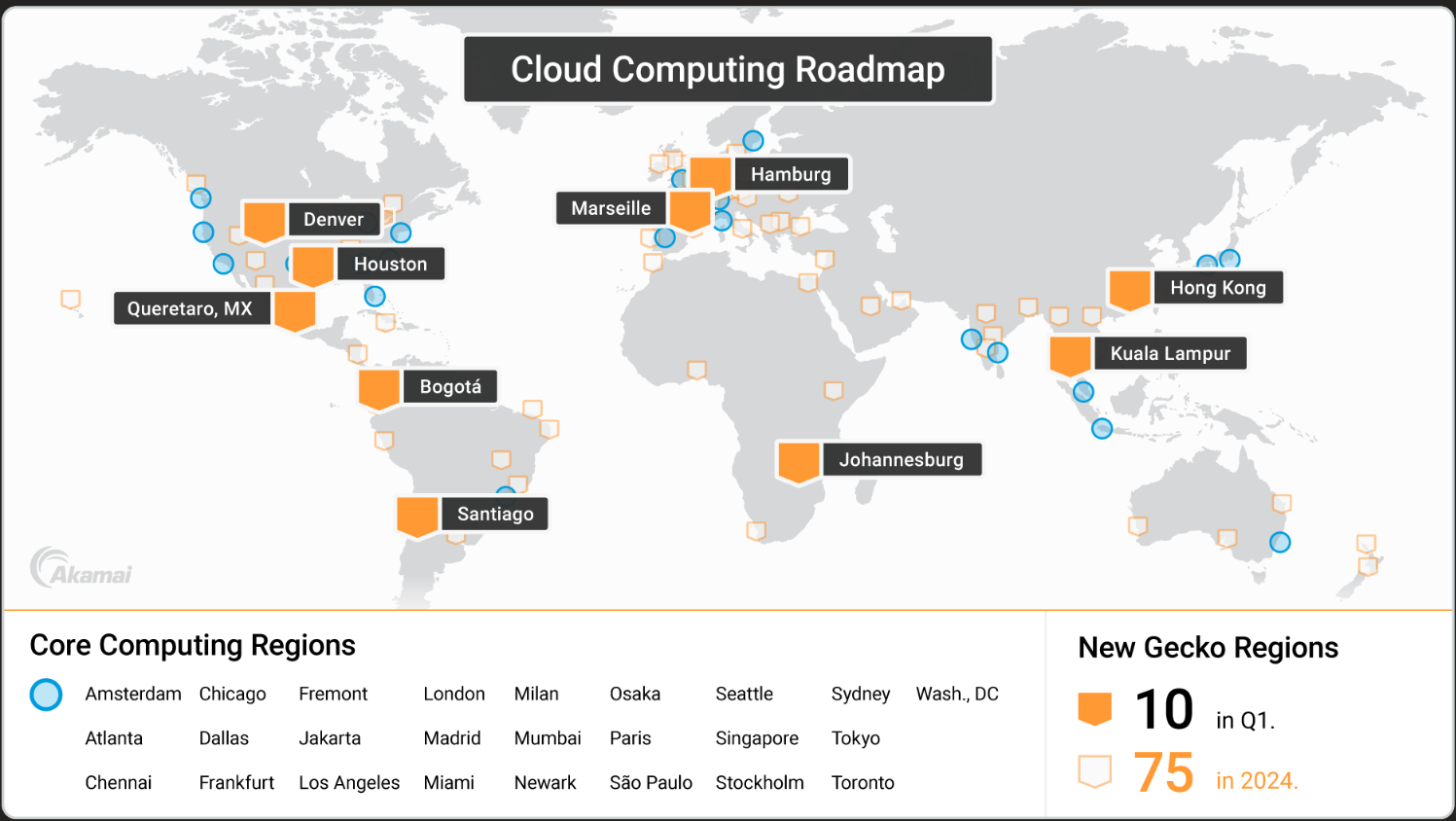

As part of the Gecko initiative, Akamai outlined a three-phased plan to embed compute in locations underserved by hyperscale cloud providers. The first nine locations for Gecko include Bogotá, Colombia; Denver, Colorado; Houston, Texas; Hamburg, Germany; and Marseille, France.

Akamai added that it has been conducting early trials of Gecko with enterprise customers and identifying use cases.

Here's what you need to know about Akamai's Gecko effort:

- Akamai plans to bring full-stack computing to its edge locations and leverage the networks tools, processes and observability technologies.

- Developers will be able to build applications for the cloud and edge as the networks and compute converge.

- Gecko's network will be global. Akamai said that it has deployed Gecko-architected regions in Hong Kong SAR; Kuala Lumpur, Malaysia; Querétaro, Mexico; and Johannesburg, South Africa. Santiago, Chile is planned to launch by the end of the first quarter.

- Akamai plans to add hundreds of cities to its cloud computing footprint to build beyond its 10 Gecko locations and existing 25 core computing regions.

- The second phase of the Gecko buildout will add containers to those regions. The third phase will include automated workload orchestration and a consistent user experience across core computing regions and the edge.

Leighton said:

"We accomplished what we set out to achieve last year in terms of infrastructure deployment, product development, jumpstarting our partner ecosystem, onboarding the first mission critical apps from some major enterprise customers, and achieving substantial cost savings as we moved our own applications from hyperscalers to the Akamai Connected Cloud."

Leighton said Akamai's cloud computing business is gaining customers in social media and software. Akamai also plans to be its own customer reference. He added:

"We also derived significant cost savings by migrating several of our own applications from hyperscalers to Akamai Connected Cloud. Our bot manager and enterprise application access solutions were among the first to migrate. Together, these products are used by over 1,000 customers and they generate over $300 million in annual revenue for Akamai."

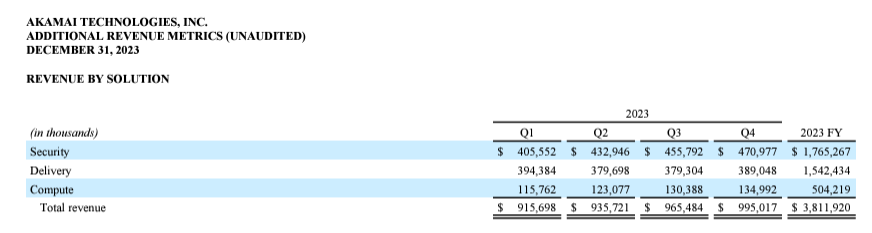

Separately, Akamai reported its first quarter earnings. The company reported fourth-quarter net income of $1.03 a share on revenue of $995 million, up 7% from a year ago. Security and compute revenue was 61% of total revenue in the quarter. Non-GAAP earnings in the quarter were $1.69 a share.

Akamai's cloud compute business revenue in the fourth quarter was $135 million, up 20% from a year ago. Content delivery revenue was $389 million, down 6% from a year ago, amid traffic declines and large customers that were renewing contracts. Security revenue was $471 million, up 18% from a year ago.

For 2023, Akamai reported net income of $3.52 a share ($6.20 a share non-GAAP) on revenue of $3.81 billion, up 5%.

Constellation Research's take

Constellation Research analyst Holger Mueller said:

"If one was wondering why Akamai acquired Linode in 2022 and Guardicore in 2021 – it is clear – cloud and security revenue were 60% of revenue in 2023 and security revenue was almost 50% of Q4 revenue. Akamai's traditional delivery revenue base declined. Akamai manages to cross sell effectively, adding a better platform for digital experiences beyond content delivery. But growth is pedestrian, and Akamai is one of the very few – if not the only vendor I comment on – who has a higher G&A than S&M and R&D. The question is whether Akamai can grow its content delivery business in 2024 or will it have to rely on security and compute. The Akamai vision remains compelling and offers CxOs an experience platform at the edge that can do it all."