IBM launches Qiskit services for quantum computing

IBM launched a series of Qiskit software services to go along with its IBM Quantum Heron-based systems. The effort comes as IBM aims to meld quantum computing and classical computing today while aiming for quantum advantage later.

At IBM's inaugural Quantum Developer Conference, the company said IBM Quantum Heron, which is available in Big Blue's quantum data center, can now use Qiskit to run certain classes of quantum circuits with up to 5,000 two-qubit gate operations.

Qiskit research:

- When Quantum SDKs Go to the Gym, Qiskit Wins

- IBM Boosts the Software Side of Quantum

- Everything you need to know about Qiskit 1.0

- IBM upgrades IBM Quantum Data Center with Heron

This ability enables quantum computers to address scientific problems in materials, chemistry, life sciences and physics.

IBM's big theme at its developer conference revolved around integrating quantum computing and classical supercomputing. IBM is looking to leverage its Qiskit to enable supercomputers to split up problems and allow algorithms to use classical or quantum computing to solve them.

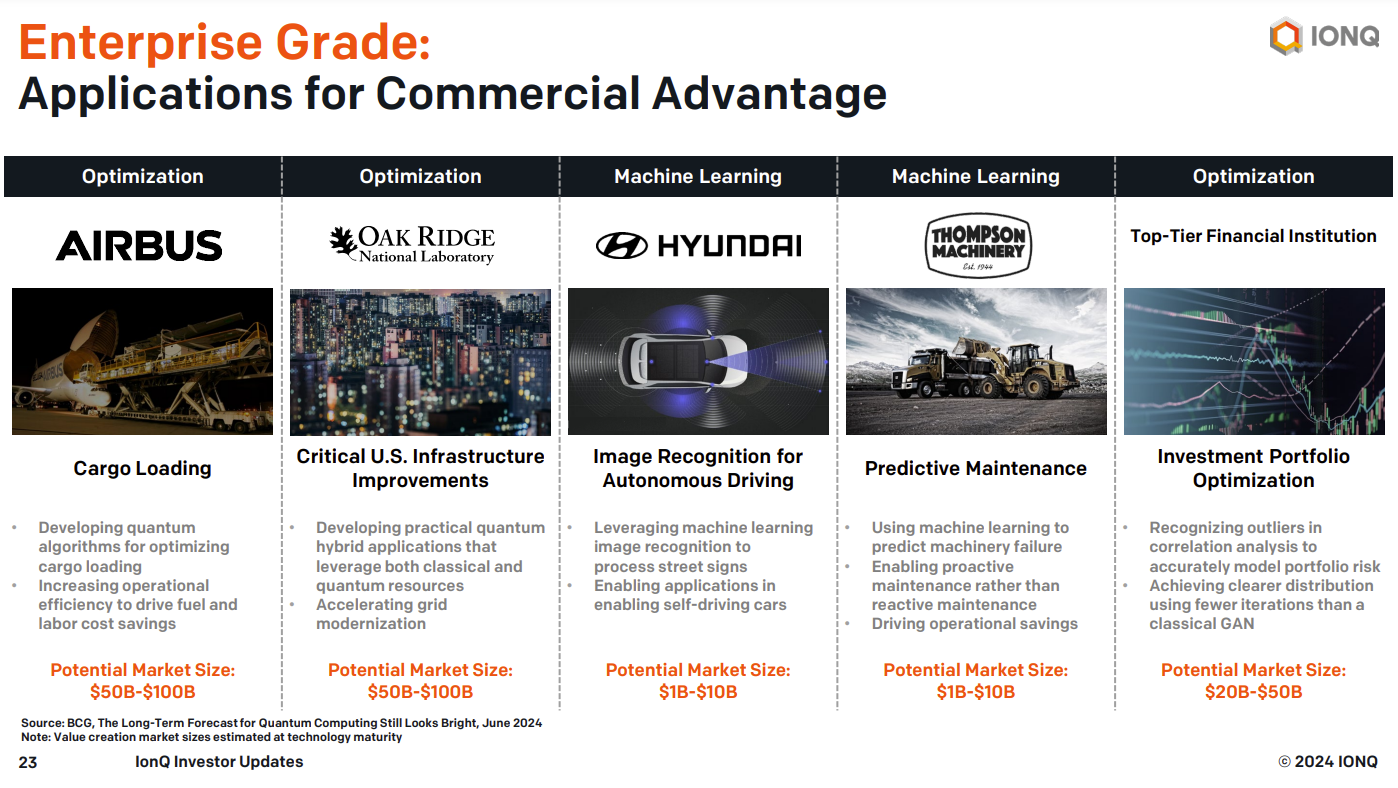

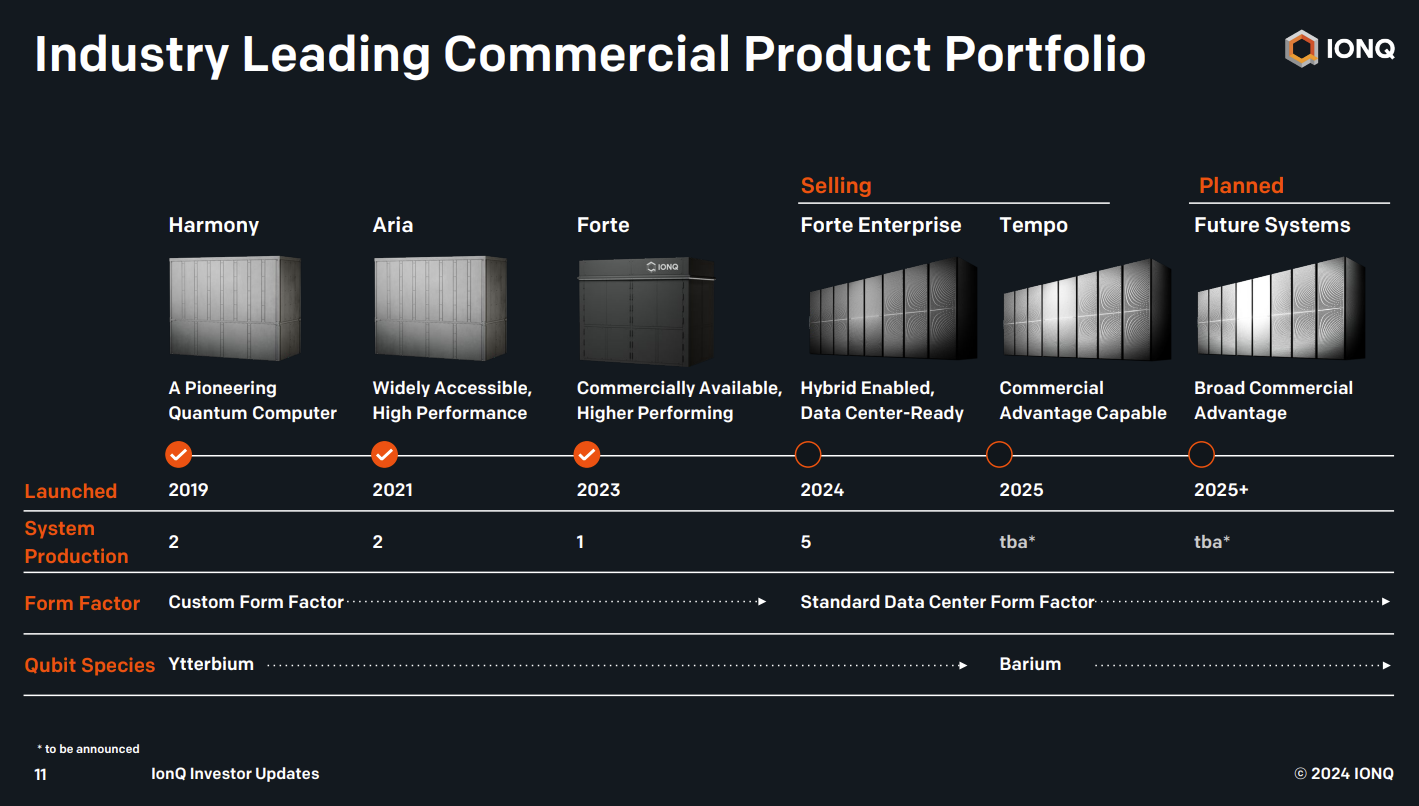

The IBM view was popularized by IonQ, which dropped talk of quantum advantage to focus on what quantum computing value can be delivered now. Most of quantum computing has come around to commercial benefits today, hybrid supercomputing and quantum advantage in the future.

- IonQ’s bet on commercial quantum computing working, acquires Quibitekk

- IonQ's quantum computing bets: Quantum for LLM training, chemistry and enterprise use cases

- Quantum Computing Platforms

- Quantum Computing Software Platforms

- Quantum Full Stack Players

- Will IonQ make quantum computing enterprise relevant in 2025?

- Why your quantum computing vendors are going to look familiar

IBM cited the RIKEN Center for Computational Science (R-CCS), Cleveland Clinic and Rensselaer Polytechnic Institute as companies bridging quantum computing with supercomputers with Qiskit.

New IBM Quantum Platform and Qiskit services include:

- Qiskit Transpiler Service to optimize quantum circuits for quantum hardware with AI.

- Qiskit Code Assistant to generate quantum code with IBM Granite generative AI models.

- Qiskit Serverless to run quantum and classical supercomputing approaches.

- IM Qiskit Functions Catalog, which will make services from IBM, Algorithmiq, Qedma, QunaSys, Q-CTRL, and Multiverse Computing available.

Constellation Research analyst Holger Mueller said:

"IBM is making good on it's promise of advancing its hardware progress, with Heron2 being 50x faster year over year. Now scientific use cases are suddenly feasible and the game changes from hardware to software. IBM is well positioned in software with the recent release of its Qiskit Functions Catalogue. The real milestone to watch will be the coupling of two Heron systems soon and that is what CxOs are looking for."

More quantum computing:

- IBM upgrades IBM Quantum Data Center with Heron

- IBM Boosts the Software Side of Quantum

- Quantinuum, Microsoft claim quantum reliability breakthrough

- Microsoft claims hybrid quantum breakthrough with Quantinuum, partners with Atom Computing

- Quantinuum raises $300 million, valued at $5 billion

- Classiq CEO Minerbi on the intersection of quantum computing, HPC and use cases

- Quantum Brilliance, Oak Ridge National Laboratory aims to meld quantum computing, HPC