Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

Snowflake said it has inked a multi-year deal to bring Anthropic's Claude models to Snowflake Cortex AI. Anthropic's Claude will be a part of Snowflake Intelligence and Cortex Analyst.

The partnership with Anthropic will be part of Snowflake's agentic AI strategy.

In a statement, Snowflake said Claude 3.5 models will be available with in Cortex AI, which is built on AWS. The news landed as Snowflake reported earnings. Snowflake has been building out its AI offerings.

Key points of the Anthropic partnership include:

- Anthropic's Claude language models will be used to enhance data agents within Snowflake.

- Snowflake's Horizon Catalog, which is integrated into Cortex AI, will provide controls and guardrails to Claude 3.5 models.

- Snowflake is leveraging a special implementation of Amazon Bedrock to enable Anthropic's models to be used inside of Cortex AI. Anthropic's Claude 3.5 Sonnet will be available in AWS regions where Amazon Bedrock is available.

- Snowflake has committed to using Claude as one of the core models behind its agentic AI offerings. Snowflake's Cortex Playground has multiple models available in Cortex AI.

- Snowflake will optimize its offerings for Claude and the company will use Anthropic's flagship models internally.

For Anthropic, the Snowflake deal gives it more enterprise throughput. Anthropic has been building collaboration workflows to make Claude more of a digital coworker in enterprises.

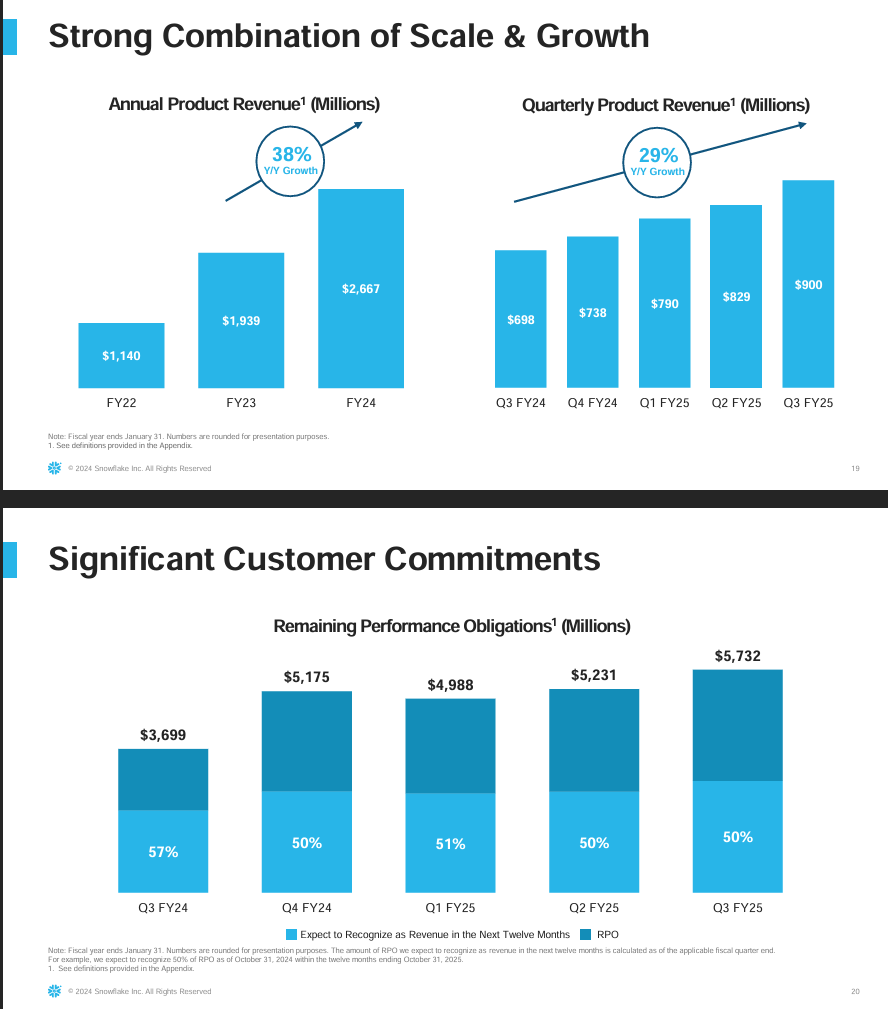

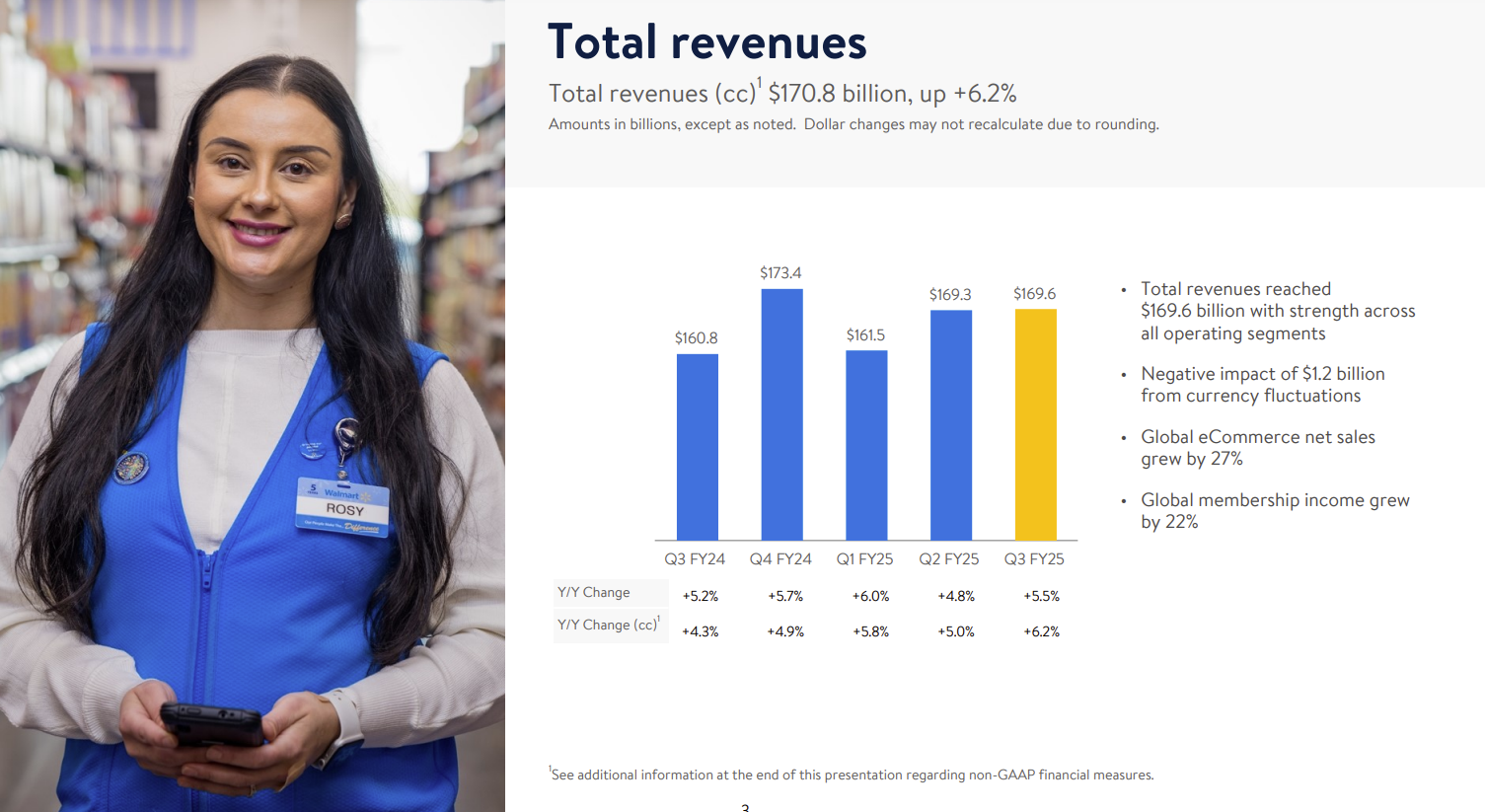

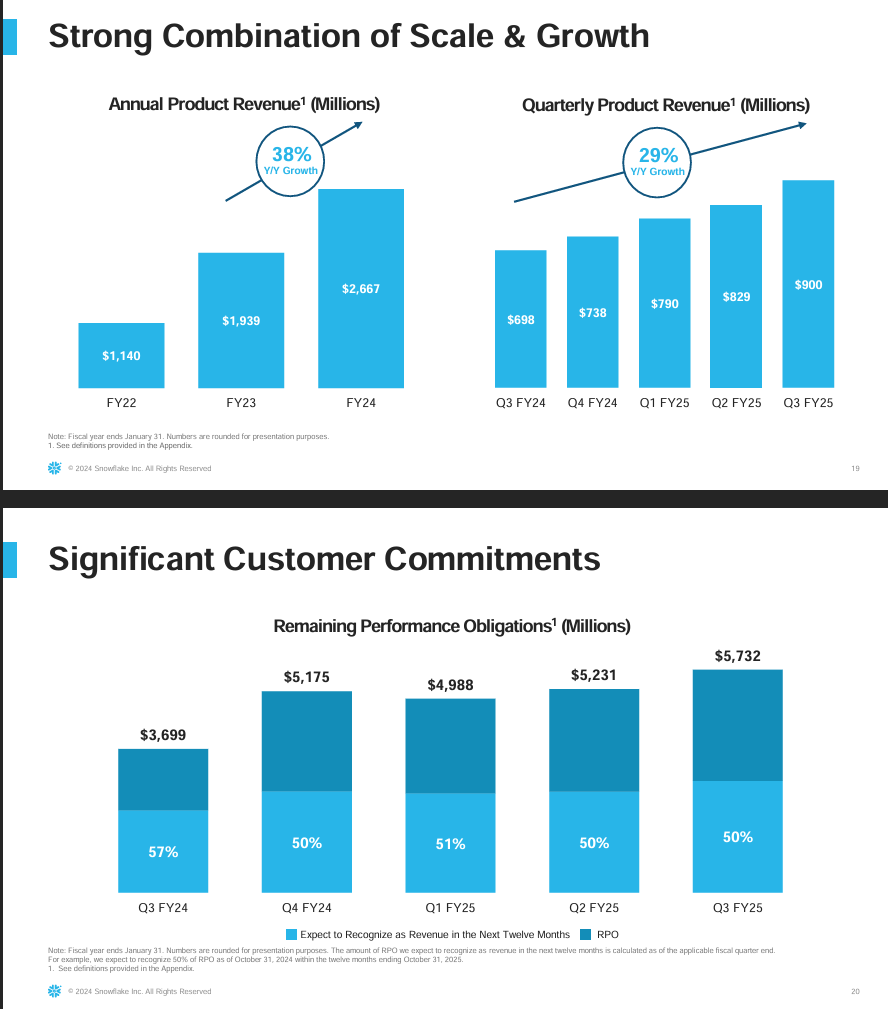

As for earnings, Snowflake reported better-than-expected third quarter earnings. The company reported a third quarter net loss of $324.3 million, or 98 cents a share, on revenue of $942.09 million. Non-GAAP earnings in the quarter were 20 cents a share.

Wall Street was looking for a non-GAAP profit of 15 cents a share on revenue of $898.46 million.

Snowflake said it had 542 customers in the quarter with trailing product revenue above than $1 million.

Sridhar Ramaswamy, CEO of Snowflake, said the company is driven to "to produce product cohesion and ease of use." He added that Snowflake is winning new business and expanding wallet share with existing customers and displacing competitors.

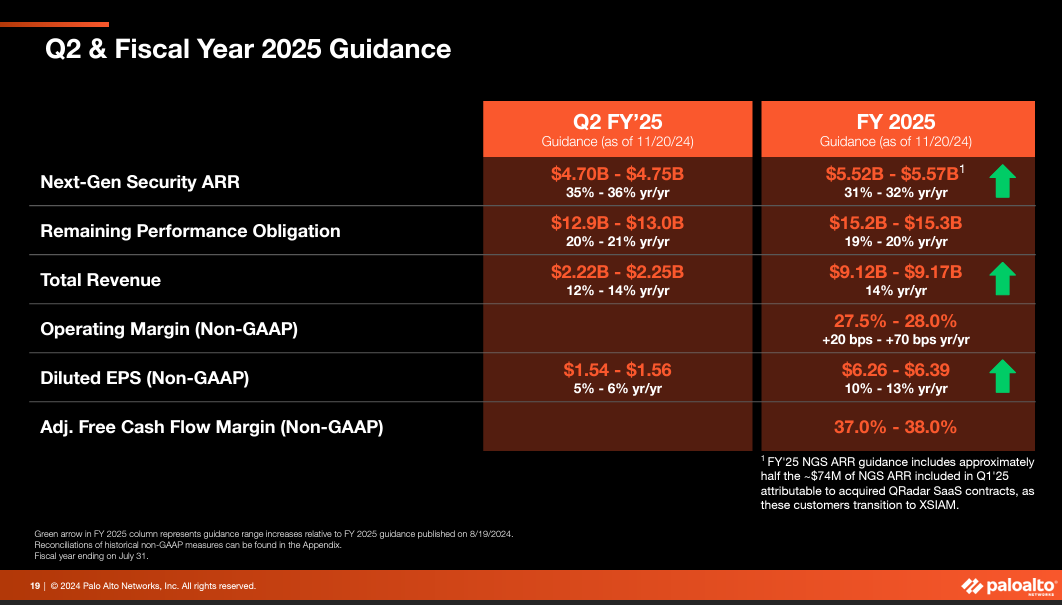

As for the outlook, Snowflake projected fourth quarter product revenue of $906 million to $911 million, up 23%. For fiscal 2025, Snowflake is projecting $3.43 billion in product revenue, up 29%.

Separately, Snowflake said it acquired open data integration platform Datavolo. The move is designed to add creation, management and observability of multimodal data pipelines for enterprises.

Ramaswamy said Datavolo will bring the ability to ingest both structured and unstructured dataflows. Datavolo's platform is built on Apache NiFi, a technology for secure data processing and distribution. Snowflake has made a series of recent moves in open source.

Constellation Research's take

Constellation Research analyst Andy Thurai said the Anthropic partnership is the headliner and a notable move for enterprises. For Snowflake, Anthropic gives it some LLM heft.

"Based on my conversation with enterprises, Anthropic seems to be the best performing model among the LLMs to date. Anthropic, co-founded by OpenAI employees, seems to be more efficient than the parent at a much cheaper cost. As of now, Anthropic's Claude 3.5 Sonnet is one of the top performing model in the market."

Constellation Research analyst Holger Mueller said Snowflake is returned to growth mode.

"Snowflake has accelerated again, which is good news for investors, as the hunger for insights inside the enterprise is growing. But growth comes at a price. Snowflake's operating losses for the last nine months are surprisingly close to its Q3 revenue. The good news is R&D spending has overtaken sales and marketing. That investment is certainly warranted given the transformational nature of AI for analytics and insights. In the long run though, Sridhar Ramaswamy and team need to bring cost and revenue in synch. The fourth quarter would be a good start."

Snowflake focuses on cost, ease of use, time to value

Ramaswamy outlined how Snowflake is winning business. The plan revolves around Cortex AI and giving customers confidence in the technical direction. For instance, enterprises try Snowflake and find they don't need a large team to manage and deploy and consume more of the platform.

With strong data warehousing and data engineering features, Snowflake can extend usage to Cortex AI. For Ramaswamy, the quarter was Snowflake's first big beat and raise of his short tenure.

Speaking on an earnings conference call, Ramaswamy said:

"Our product development engine continues to accelerate, as we launched the same number of tier 1 features to general availability in Q3 as we did in all of fiscal 2024. Our AI feature family Snowflake Cortex is showing significant adoption and we improved our go-to-market motion across the board and it's having a huge impact on new product adoption. We are firing on all cylinders."

Ramaswamy added that the company has become more efficient and eliminated "efforts that were underperforming."

Snowflake is also competing on ease-of-use, said Ramaswamy. "We also consistently hear a lot of feedback that some of our competitors' technology is highly complex and requires a ton of highly expensive engineering resources. And with complexity comes risk. What is one step in Snowflake is 10 on some other platforms, that's 10 times more chances to engineer a mistake," he said.

Other items:

- Snowpark is roughly 3% of revenue now.

- "Our push into interoperability and transforming data that previously would not have been addressed by Snowflake is proving to be a key differentiator with our customers. These features are now north of a $200 million run rate as of the end of Q3."

- "We are seeing massive adoption of open data formats especially truly open formats like Apache Iceberg."

- CFO Mike Scarpelli said that about 500 accounts have adopted Iceberg and the company has seen little friction moving them over.

- "It is clear that AI is going to change how people consume data. Not only is AI going to make structured and unstructured data more interchangeable, it is also going to heavily influence areas like business intelligence."

- Snowflake is pitching itself as a way to lower costs by using AI to handle more of the data processing journey.

Data to Decisions

Innovation & Product-led Growth

Future of Work

Tech Optimization

Next-Generation Customer Experience

Digital Safety, Privacy & Cybersecurity

snowflake

AI

GenerativeAI

ML

Machine Learning

LLMs

Agentic AI

Analytics

Automation

Disruptive Technology

Chief Information Officer

Chief Executive Officer

Chief Technology Officer

Chief AI Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Product Officer