Understanding your Digital Business Model by its Business Functional Requirements for Operational Technology

Vice President and Principal Analyst, Constellation Research

Constellation Research

Andy Mulholland is Vice President and Principal Analyst focusing on cloud business models. Formerly the Global Chief Technology Officer for the Capgemini Group from 2001 to 2011, Mulholland successfully led the organization through a period of mass disruption. Mulholland brings this experience to Constellation’s clients seeking to understand how Digital Business models will be built and deployed in conjunction with existing IT systems.

Coverage Areas

Consumerization of IT & The New C-Suite: BYOD,

Internet of Things, IoT, technology and business use

Previous experience:

Mulholland co authored four major books that chronicled the change and its impact on Enterprises starting in 2006 with the well-recognised book ‘Mashup Corporations’ with Chris Thomas of Intel. This was followed in…...

Read more

Part 4; The Enterprise Digital Business Platform; integrating the functions of a Digital Business together into a cohesive Enterprise.

The Digital Business transformation of how an enterprise does business through its Buy and Sell operations is frequently a creating of immense value and quite quickly too. However success brings its own challenges, namely the difficulties of integration an enterprise’s capability for order fulfillment via its internal processes for adding value.

Parts 1, 2, and 3 in this series introduced the changes in the front and back office functions and technologies and here in Part 4 the focus becomes defining the functions required of for an Enterprise level integration. The functions as a group are usually defined as making up the Enterprise Digital Business Platform.

The definition of the capability of a ‘Platform’, and what it does, has changed considerably from the original early Cloud days introduced ‘Platform as a Service’, or PaaS concepts. Today the major Technology vendors are all introducing increasingly sophisticated multi function Platforms that are part Infrastructure, part Middleware and part a Management and Policy Control capability as increased understanding of ‘Digital Business drives new requirements.

Not surprisingly the established technology venders approach to Digital Business Platforms starts from the direction of their installed products with the desire to extend the functionality into Digital Business and its Technologies. This approach offers the obvious beneficial value of making the ‘new’ work with the established IT systems, and can be particularly attractive if the internal value adding processes are complex with stable products. Against this is the argument that this continues the use of unnecessary, and unwelcome, IT practices and constraints based on Legacy Back Office IT into the new and radically different environment of Digital Business.

Enterprises that have moved to embrace Chief Digital Officers, new development practices in line with Services from vendor, and have ‘separated’ the two business and technology environments s will be very wary of this approach. Instead they will look to continue a path of Digital Business leadership achieved through the deployment of the new wave technologies by selecting ‘Best of Breed’ products from leading new startups. In their thinking the capabilities of a Digital Business Platform by its support as a Business and Technology Infrastructure for externally oriented ‘Services’.

Both arguments relating to approach; Back Office legacy driven or Front Office transformation based, are equally valid, though reality for some years to come, suggests that there will be both a need for both. It’s best to start by defining the complete functionality set that will be required and working towards this rather than working from a short-term ‘handy’ product set fit.

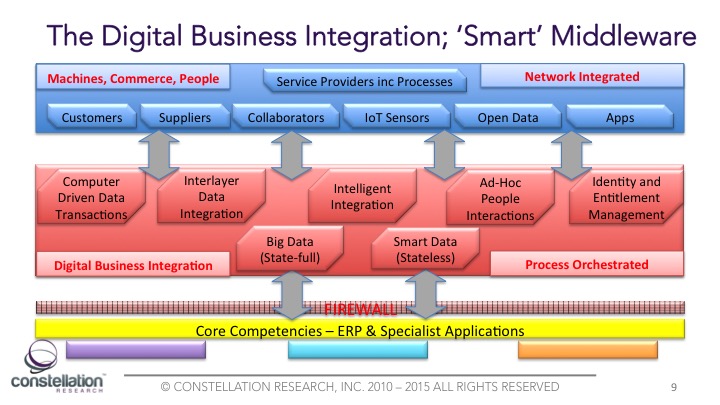

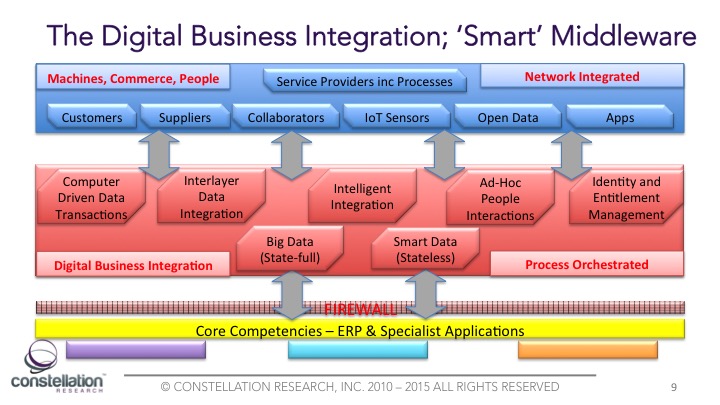

This introduces the diagram below where the red layer represents the Enterprise Digital Business platform containing the core functions that a fully functional Enterprise Digital Business Platform will require as a minimum. The layer above in Blue contains the functions that will need to make use of the Enterprise Digital Business Platform capabilities, and the layer below in yellow contains the current Enterprise IT Applications. Part 2 of this Blog series relates to the functionality of the Front Office Blue layer, whilst Part 3 relates to the functions of the Back Office yellow layer. Part 1 explained the fundamental difference between specifying, deploying, and operating the two layers.

A simple overall definition of a Digital Business Platform is difficult primarily because some functions such as ID management, or connection of Internet of Things, IOT, Sensors are more akin to functions normally defined as ‘Infrastructure’. Others, particularly those relating to increasing enterprise value through better trading of the market involving customers and suppliers would normally be thought of as business requirement focused.

Labeling a Digital Business Platform with terms taken from existing Enterprise IT is dangerously misleading, and as the title of this series of Blogs points out there is a need to redefine the Business Requirements into new technology alignments that correspond to the new Digital Business functions. Todays Digital Business Platform will continue to evolve towards the delivery of the seven, and in time maybe more, key functions identified.

At most simple explanation, and indeed the critical core function is to connect, and integrate the two different environments of the externally orientated Front Office emerging on the back of new technologies as ‘Digital Business’; with the existing internally orientated Back Office charged with automating and efficiently maintaining the secure and controlled processes of an Enterprise’s own Operations. The difficulty that this introduces can be understood by starting with the two functions in the diagram above of Big Data (State-full) and Smart Data (Stateless). These two forms of Data correspond to the difference between the environments of the Front and Back Office.

Back Office Enterprise IT Applications are Close-Coupled in predetermined fully defined relationships, as Enterprise IT has absolute control of the internal Back Office systems they can ensure that their primary duty of maintaining State-full Transactional Integrity is achieved;

Front Office Digital Business is entirely the opposite as the relationships occur as an when needed with neither enterprise able to predetermine on whose technology, or other factors. As such it is, Interactional, intentionally State-less and Loose Coupled as the relationships between participants and their technology products continuously and dynamically change.

The least difficult functions to describe and understand are the two that relate to, and interconnect with, the existing internal Enterprise IT applications and infrastructure. As they are effectively extensions of these operations it is logical to presuppose that these two functions will be managed as part of the existing IT department activities. See Part 1 in this series to understand the difference in Technology provisioning and alignment between the new external ‘Digital Business’ focused Front Office activities and the existing internal Back Office Enterprise IT environment.

The Identity and Entitlement Management function builds on providing and managing an ID for use inside the Firewall to access legacy applications. However this is a separate ID purely related to the person and their Enterprise employee records to provide an external Digital Business ID. Great care should be taken to ensure that there is no connection possible from gaining use of the external ID to access legacy Applications through the internal ID.

Coupled to the verification of the person, as an employee acting on behalf of the Enterprise is the authentication of their role and authority to participate in doing Digital Business. Though practiced for a number of years in the financial sector Entitlement Management is relative new to many Enterprises, with its capabilities to provide a Business Manager, (rather than an IT manager), to define exactly what Business actions and outcomes an employee can execute in Services and Outcomes.

In the Digital Business market place of dynamic opportune interactions previously unknown partners have to be able to use Entitlement Management to understand the authority vested in an employee to make commercial commitments. Equally enterprises should be able to reassure Auditors of their abilities to control new paperless Digital Book to Bill as well as current paper based processes.

The second of the functions that links directly to the internal Enterprise IT operations is Computer Driven Data Transactions, or Ecommerce, the necessary interchange between enterprises to record their commercial transactions. Together with the management of employees’ authority in commercial transactions these transactions are defined by legal and compliance regulations. In addition, unlike the remaining functions of the Digital Business Platform, this is also a separate firewall channel to Business critical state-full Application transactions. However this does not mean that Book to Bill processing, or even ID management, has to be performed through traditional IT Applications from behind the Firewall.

BPO for Services such as Invoicing are morphing into a full range of BPO Services charged by usage, or by outcomes i.e. per invoice; and as such Computer Driven Data Transactions are most likely to take the form of consolidated data exchanges with a trusted BPO Services partner through a secure Firewall channel.

Some of the comments applied to the Computer Driven Data Transactions can be applied to data received from Internet of Things, IoT, Sensors through the Inter-Layer Data Link function. Called the ‘Inter-Link’ layer for two reasons; the first that data from sensors could be presented in a wide variety of formats and needs to be treated inflight transformation before use; and the second to describe its distribution function from various sources to various consuming servers/services.

Some of the Data distribution will be similar to Computer Driven Data Transactions, as it would be directly fed through the Firewall to the internal Enterprise IT ERP system. As an example; linking a sensor based supply chain, or external sub contractor manufacturing line, to SAP Connected Manufacturing ERP system. This is data used for State-full purposes, an important point to be expanded later, other, indeed probably the majority of the data will be State-less and not used by internal IT applications or data at all.

An example of the alternative use of data would be that originating from Internet of Things sensing on a vending machines being fed to a Salesforce Service Hub via the Digital Business Platform to evoke responses from people. This data does not need to confirm to the State-Full rules of transacted traditional IT application data and the whole Inter Layer transfer would take place outside the Firewall as a State-less Interaction. In reality this wont be an either/or operation as both types of data will be flowing through the Inter-Layer Data Layer at the same time.

These two Internet of Things, or IoT, examples illustrate the challenge for a fully functional Digital Business Platform to handle both State-full responses through the Firewall and Statesless responses outside the Firewall.

To understand more about the new and unique challenges of IoT sensing data origination based on Industrial Technology, and its use in Information Technology it is recommended to read the IoT blog published alternative weeks on this web site; example relating to IoT services.

Ad-hoc People Interactions function is often thought of as Collaboration, but in practice it is a much wider topic that relates to the manner in which people navigate, access, use and create a wide variety of Interactions. Unlike the data from the Internet of Things, IoT, handled through the Inter-Layer Data Link there is little to no structure to these Interactions that rely on People to make the context. The challenge is to provide access to a wide range of Services, and Apps, that allow people to decide what, and how, to provision the technology capabilities they need to operate effectively in the Front Office.

The great difference between this ‘Consumer Technology’ environment where users have both knowledge and the access to choose, deploy and use a ‘Services’ environment and traditional IT is the subject of Part 1 of this series. It is a hugely important point to grasp and brings an understanding about the all too frequent ‘battles’ between conventional IT, and newer ‘Digital’ Officers roles.

The all important point is that Ad-Hoc People Interactions are one of the key creators of value in Digital Business delivering the exploitation of their experience, and tacit knowledge to recognize and optimize opportunities. Front Office work depends as much, or more, on the empowerment of people as opposed to the automation of Back Office processes which are usually made more efficient by their removal.

In reaching this point it must have become clear that the complexities of the fully functional Digital Business Platform flow from the many different sub functions it must perform, but at its heart there must be a crucial capability to orchestrate these activities into a recognizable Enterprise beneficial structured set of capabilities. This is what lies at the center of the final three functions; the successful management of State-full Big Data, plus the careful separation from State-less Smart Data, and the use of sophisticated Intelligent Integration Middleware.

Definitions of Big Data, or Smart Data, abound, but here the definition is provided by the functional use required in a Digital Business Platform; this in turn relates to the key characteristics of State-full close-coupled transactional processes versus State-less loose-coupled interactions.

The importance of State-full, and State-less, lies in their very different functionality in respect of the Digital Business Platform, and this relates to where, how, and with what aim in mind, the data is both used, and some is created.

Big Data (state-full) is part of deterministic processes that end with a transactional outcome in accordance with the principles of traditional Enterprise IT applications. To do so means that all elements of the process, and the data, are pre determined in Tight Coupled integration architecture, therefore allowing the Intelligent Integration function to act in a rule based manner recognizable to existing Middleware capabilities.

The Intelligent Integration function is very different in respect of how it handles the functionality required in respect of Smart Data (State-less). This more difficult role, indeed one that is still subject to different views from different Technology vendors, concerns providing linkage and context to Smart Data (State-less) which in turn is also unstructured. The huge pool of data accessible external, together with internal acquired data may be rightfully called Big Data, but the term Smart Data is intended to define a very different functional use from the conventions of Business Intelligence report generation. The blog turning Big Data Upside Down into Smart data provides more detail on this critical point.

Stateless Smart Data is used in, and maybe even created from, Loose-Coupled Architectures, which in turn are Orchestrated from Services in response to an event. This dynamic, contextual response is the prime goal for Front Office Business Intelligence and is radically different from the use made of State-Full Big data in predefined Close-Coupled Architecture and traditional BI reporting.

Currently the development of Technology Intelligence Integration Middleware to provide dynamic loose-coupled Orchestrations is just starting to emerge, some from startups, and others such as IBM Blue Max, or SAP S/4 HANA, are defined directions for products sets that are just starting to ship. It is however crucial to recognize that Big Data and Smart Data should be understood by functional use in loose, or tight, coupled systems and with, or without State when examining the deployment of any new Middleware.=

The integration of the various new defined business functions and associated technology alignments of a Digital Business as identified in Parts, 1, 2, and 3 of this series, and as described in this Blog which is Part 4, are an emerging capability, but one that is in the longer term probably the single most crucial aspect of a Digital Business with its transformed dynamic business model.

Not surprisingly the major technology vendors recognize this, and want to see their Enterprise Platform as at the heart of a Digital Business. The challenge for an Enterprise is to recognize the highly strategic nature of their choice from the beginning and not to become committed/locked-in through miss-assessing an immediate tactical requirement.

This series of four blog posts under the title ‘Understanding your Digital Business Model by its Business Functional Requirements for Operational Technology’ attempts to provide a strategic view of the ‘big picture’ of how the technologies will be used, and the manner in which they are provisioned to successfully deliver the Business Transformation agendas that Business Schools and Management Consultants have identified. In past Business Transformations many of the problems have been shown after the event to be the impact of poor ‘big picture’, or strategic understanding of the necessary reorganization of Technology in the Enterprise.

Nobody can predict the detailed future, but fortunately the direction and principles are clear, and it is hoped that this series will provide the thoughtful Enterprise Transformation Team with important input to their work.

Innovation & Product-led Growth

Tech Optimization

Future of Work

AI

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Analytics

Automation

B2B

B2C

CX

EX

Employee Experience

HR

HCM

business

Marketing

SaaS

PaaS

IaaS

Supply Chain

Growth

Cloud

Digital Transformation

Disruptive Technology

eCommerce

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

Leadership

finance

Customer Service

Content Management

Collaboration

M&A

Enterprise Service

Chief Information Officer

Chief Technology Officer

Chief Digital Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Executive Officer

Chief Operating Officer

![]()

My latest report,

My latest report,