Broadcom reports strong Q3, but Q4 revenue outlook light

Broadcom reported better-than-expected third quarter results as revenue growth was driven by Ethernet networking and custom accelerators for AI data centers. The fourth quarter outlook, however, was a bit light.

The company reported a third-quarter net loss of $1.87 billion, or 40 cents a share, on revenue of $13.07 billion, up 47%. Non-GAAP earnings in the third quarter were $1.24 a share.

Wall Street as expecting Broadcom to report earnings of $1.21 a share on revenue of $12.96 billion.

CEO Hock Tan said the quarter reflected “continued strength in our AI semiconductor solutions and VMware.” Revenue from AI will be $12 billion for the fiscal year due to networking and custom AI accelerators. “The integration of VMware is driving adjusted EBITDA margin to 64% of revenue as we exit fiscal year 2024,” said Tan.

Going into the results, analysts were mostly interested in Broadcom as an AI play. However, AI infrastructure players such as Nvidia and chipmakers like AMD have tailed off of late. VMware integration was also a hot topic as Tan addressed VMware customers directly. “You're telling us you want our products to work better and be more user friendly. You want them to work together. You're asking us--me particularly--to roll up your sleeves and do the hard work. That's exactly what we've done,” said Tan.

VMware is facing the heat from customers and competitors such as Nutanix. Rajiv Ramaswami, CEO of Nutanix, said: "The VMware acquisition continues to be positive for Broadcom shareholders, but at what expense to VMware customers? Higher prices, support changes, lack of innovation - it all adds up to a genuinely frustrating experience for customers, and in the end, effectively cutting VMware –a one-time enterprise leader–out at the knees."

- Broadcom CEO Hock Tan aims to woo VMware customers with private cloud, simplification pitch

- Nutanix lands larger deals in Q4, ups outlook, plays long game vs. VMware

- Broadcom delivers strong fiscal Q2 on AI demand, splits stock 10-for-1

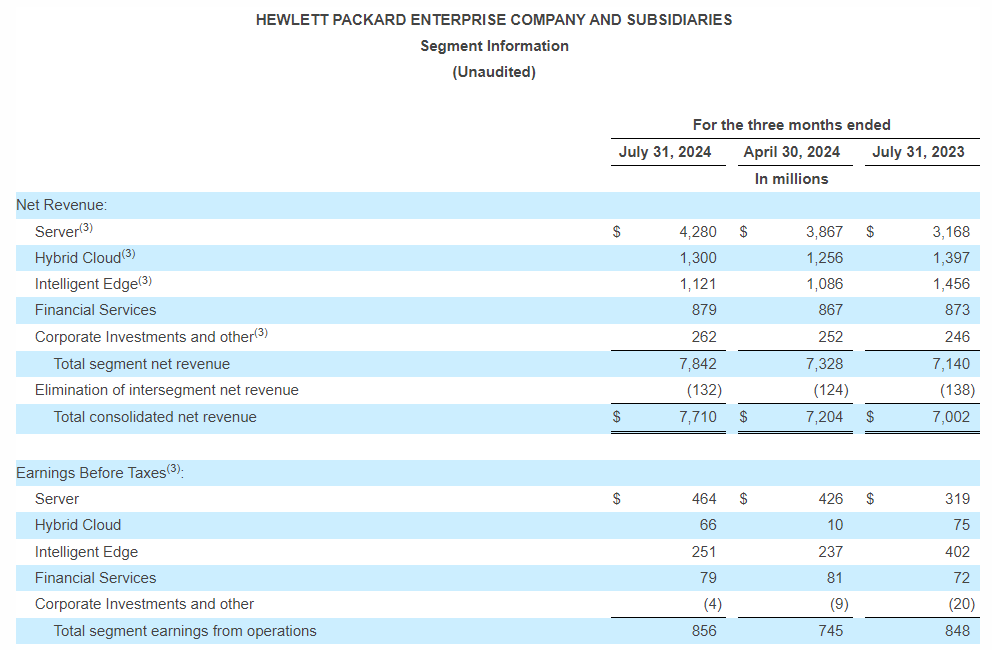

By unit, Broadcom semiconductor revenue was $7.27 billion, up 56% from a year ago. Infrastructure software revenue was $5.8 billion, up 200% from a year ago due to the VMware purchase. In the third quarter, software revenue was 44% of the total pie, up from 22% a year ago.

As for the outlook, Broadcom projected fourth-quarter revenue of $14 billion with adjusted EBITDA of about 64%. Wall Street was expecting revenue of $14.13 billion in the fourth quarter.

Here's what Tan said on Broadcom's earnings conference call:

- "We booked more than 15 million CPU costs of VCF (VMware Cloud Foundation), representing over 80% of the total VMware products we booked during the quarter. And this translates into an annualized booking value, or ABV as I had described before, of $2.5 billion during Q3, up 32% from the preceding quarter. Meanwhile, we continue to drive down costs in VMware. We brought VMware spending down to $1.3 million in Q3 from $1.6 million in Q2."

- "Our hyperscale customers continue to scale up and scale out their AI clusters. Custom AI accelerators grew 3.5 times year-on-year."

- "We do not focus very much on enterprise AI market as you know well. Our products in AI are largely, very much largely focused, especially on the AI accelerator or XPU side, but even -- also just as much on networking side, on hyperscalers, on cloud, those three large platform and some digital natives, what you call, big guys. We don’t deal very much on AI with enterprise."

- "The VMware business continues to book very well, as we convert our customers very much in two ways, one, from perpetual to a subscription license, but also those subscription license for the full stack of VCF. And that has been very successful."

Scotts Miracle-Gro: How CX and UserTesting Drive Omnichannel Revenue

Scotts Miracle-Gro: How CX and UserTesting Drive Omnichannel Revenue