Vice President and Principal Analyst

Constellation Research

Holger Mueller is VP and Principal Analyst for Constellation Research for the fundamental enablers of the cloud, IaaS, PaaS and next generation Applications, with forays up the tech stack into BigData and Analytics, HR Tech, and sometimes SaaS. Holger provides strategy and counsel to key clients, including Chief Information Officers, Chief Technology Officers, Chief Product Officers, Chief HR Officers, investment analysts, venture capitalists, sell-side firms, and technology buyers.<br>

Coverage Areas:

Future of Work

Tech Optimization & Innovation<br>

Background:

Before joining Constellation Research, Mueller was VP of Products for NorthgateArinso, a KKR company. There, he led the transformation of products to the cloud and laid the foundation for new Business…

Read more

NGA (NorthgateArinso) had their analyst day on July 16th, and it was well attended and provided an update where the company is standing and where it plans to go in the coming years.

Corporate and Executive Changes

It was a good opportunity to get to know the new CEO, Adel Al-Saleh, who previously was the Group CEO of Northgate. After the divestiture of the Northgate the Managed Services divisions, Al-Saleh took over for Mike Ettling as the NGA CEO. Al-Saleh has a long tenured background with IBM and IMS Health.

Good FY13

NGA comes out of a good financial year, growing on the sales side and increasing TCV by 36%. With the launch of a Japan office, NGA is now present in this key economy. The company keeps evolving its strategic partnerships with Workday and SuccessFactors and has an opportunity in South Africa / Africa with a joint venture with local SI powerhouse BCX, just named NGA Africa (and not discusses on the call, happened a day later).

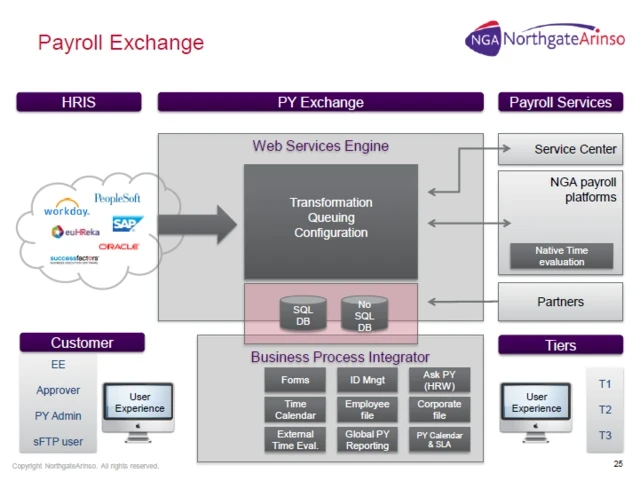

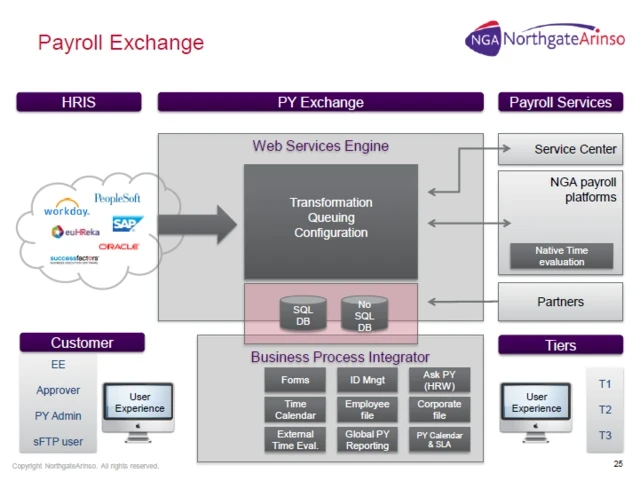

On the operations side NGA keeps improving service readiness and focuses on scaling up in what it has designated its strategic delivery centers. On the products side the euHReka releases 12 & 13 have centered on deeper localization functionality and customer driven enhancements. The MoorepayHR launch for SMB companies in the UK seems to be going well and the company delivered the connectors to run payroll for Workday and Successfactors clients. These connectors and more have been bundled to the new offering the company named Payroll Exchange.

Recently NGA was named by Gartner (with ADP, Ceridian and Talent2) a member of the leader's quadrant of the 2013 Magic Quadrant for Payroll BPO Services.

NGA's Strategic Agenda

The company describes itself as a IP led HR services company, with its core business being the automation of administrative HR processes encompassing the employee life cycle, with a focus on global enterprises - all running on the euHReka product / platform. Talent Management (NGA calls it Administration) is an Add-on the company equally offers, but depends on the sales scenario and partnerships that are in play.

Where NGA has a SMB offering with products like ResourceLink and Preceda, it plays in the these markets additionally, which are the UK and Ireland, South Africa (with BCX) and Australia / New Zealand.

And NGA believes it can differentiate itself by its exclusive focus on HR, it's flexible service delivery portfolio and it's advanced technology platforms and applications. The company takes an opportunistic view in the cloud religious wars, offering its products both on premise and in the cloud.

NGA FY 14 Priorities

In the upcoming financial year NGA will focus on the further evolution of its client centric coverage model, drive more maturity into global delivery capability and further investment into the key products (euHReka, Preceda, ResourceLink and Moorepay), the new Payroll Exchange and service center tools and utilities.

Obviously the company will focus to extend its partnership with Oracle - next to the existing partnerships with Workday and SAP / SuccessFactors.

Still doing BPO? Yes...

To my surprise the company never used the term BPO - Business Process Outsourcing, something that NGA provides for their customers and does pretty well. That's where key internal initiatives of standardizing support centers and making not only the service side of the business, but the overall company more customer centric. With no doubt both initiatives will be beneficial for existing and future NGA customers.

The company now operates over 3000 agents in 8 key strategic delivery centers that are spread over Europe, Brazil, India, Philippines and China.

Product direction

Not surprisingly NGA plans to expand payroll capabilities further, and since the company does a large part of the implementation work in house, there is a focus to reduce implementation times and with that the related service costs.

NGA's flagship product euHReka has its release 14 right now in testing and release 15 will focus on learning and recruitment capabilities.

The big ambition on the product side is to standardize APIs internally to work with the new Payroll Exchange product - and to enable this product to automate extensive employee life cycle services not only for the NGA products but equally for other vendor's products.

|

Screenshot from Webcast |

With a lack of industry standards and an industry wide interest to keep these APIs close to each vendor's chest, coupled with NGA's iterative approach to the challenge, Constellation Research foresees this to be quite a challenge going forward, but the company merits respect and encouragement for having embarked in the effort.

NGA and Talent Management - multifaceted

At this point NGA has a unique strategy in regards talent management functionality- while it de-emphasizes talent management in meetings like the analyst meeting, focusing on what it calls employee life cycle services and payroll, NGA is at the same time adding learning and recruitment capabilities to upcoming euHReka releases. And we expect this effort to continue at least for the near future.

In case NGA may decide to end work on talent management - it will find itself in a unique position - as all competitors providing HRMS / payroll and talent management products are scrambling to build offerings in all three markets.

But that decision has not been made as we learnt and so NGA keeps both options open - partner for talent management or build some themselves.

The positioning challenge

NGA has a unique combination of services and product IP that does not fit the mold that is usually applied by both financial and industry analysts. Being KKR owned there is no financial analyst scrutiny at this point, but as the the question of my esteemed colleague Brian Sommer showed - it's tough to make out NGA. Take a look at the blog post of my former colleague Amy Wilson from the NGA analyst summit in April 2011 - and the challenge for the analyst community is clear.

But the onus should not be on the company - but on the analyst community to better understand NGA's unique capabilities and the accompanying challenges.

The problem we see with the IP led services positioning is, that today all services business are trying to differentiate themselves through differently functional and capable IP offerings - and NGA has more with software IP assets and a global BPO delivery organization. Together with ADP, NGA is the only player for large enterprise to run their multi country payroll and HR systems.

Advice for partners

Make sure your service offering is in a stable area that NGA has no interest to cover. If you are partnering with NGA for international payroll services that NGA is not covering, you are probably in good hands, as you can expect NGA to be more flexible than ADP - for better or worse.

Advice for customers

We see four scenarios where euHReka customers and prospects may find themselves these days:

You are most likely using and or planning to use NGA for multi country payroll services, maybe a international HR system, potentially a BPO play. NGA is well positioned to aid you with both, make sure you exercise the customary best practice provisions on the SLAs and penalties side.

If you are looking for NGA's talent management for the unified user experience, make sure you keep NGA committed to provide and strive for best practices (or at least good enough support) of future talent management trends that matter to your enterprise.

If you are having a 3rd party talent management system but want to use NGA's HR system and payroll offerings, make sure to get commitments to keep supporting your talent management system through robust interfaces for the usage time frame you see.

Finally - if you use one of the talent management vendors that NGA partners with (as of today Workday and Successfactors) then make sure that both vendors reassure you to support the interface for the lifetime you expect to use them or the maximum you can negotiate. You will need to not only understand NGA's road map - but equally Workday's or Successfactor's road map and realize where they may encroach on each other and how to insulate your enterprise against that possible event.

MyPOV

NGA is making good progress on many good housekeeping initiatives. Rationalizing products, consolidating centers, standardizing services, making employees more customer centric are all good initiatives - but other vendors are doing the same or at least similar initiatives. The winner will be who out-executes the others.

What I missed was some visionary and leadership pieces, something NGA showed in the recent past with the idea of a BPaaS (Business Process as a Service) idea and plan.

The other key aspect will be for the executive team to position NGA's unique product and services capabilities in an easy understandable manner that reflects these capabilities of NGA and at the same time allows analysts and influencers to apprehend and correctly position these capabilities.

Not only execution, but also positioning will be key for NGA in the next 12 months.

-----

You can find NGA's Storify here and mine here.

[Disclosure: I had the honor and pleasure to run Products for NGA from Summer 2010 till Spring 2012]

Future of Work

Tech Optimization

Data to Decisions

Innovation & Product-led Growth

New C-Suite

Sales Marketing

Next-Generation Customer Experience

Digital Safety, Privacy & Cybersecurity

SuccessFactors

workday

SAP

AI

Analytics

Automation

CX

EX

Employee Experience

HCM

Machine Learning

ML

SaaS

PaaS

Cloud

Digital Transformation

Enterprise Software

Enterprise IT

Leadership

HR

LLMs

Agentic AI

Generative AI

Robotics

IaaS

Quantum Computing

Disruptive Technology

Enterprise Acceleration

Next Gen Apps

IoT

Blockchain

CRM

ERP

CCaaS

UCaaS

Collaboration

Enterprise Service

developer

Metaverse

VR

Healthcare

Supply Chain

Chief Executive Officer

Chief People Officer

Chief Information Officer

Chief Technology Officer

Chief Customer Officer

Chief Human Resources Officer

Chief Digital Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Operating Officer

Future of Work

Tech Optimization

Data to Decisions

Innovation & Product-led Growth

New C-Suite

Sales Marketing

Next-Generation Customer Experience

Digital Safety, Privacy & Cybersecurity

SuccessFactors

workday

SAP

AI

Analytics

Automation

CX

EX

Employee Experience

HCM

Machine Learning

ML

SaaS

PaaS

Cloud

Digital Transformation

Enterprise Software

Enterprise IT

Leadership

HR

LLMs

Agentic AI

Generative AI

Robotics

IaaS

Quantum Computing

Disruptive Technology

Enterprise Acceleration

Next Gen Apps

IoT

Blockchain

CRM

ERP

CCaaS

UCaaS

Collaboration

Enterprise Service

developer

Metaverse

VR

Healthcare

Supply Chain

Chief Executive Officer

Chief People Officer

Chief Information Officer

Chief Technology Officer

Chief Customer Officer

Chief Human Resources Officer

Chief Digital Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Operating Officer

![]() Kevin Dooley via Compfight

Kevin Dooley via Compfight

Constellation Research, Inc. the research and advisory firm focused how disruptive technologies transform business models announced the publication of ”

Constellation Research, Inc. the research and advisory firm focused how disruptive technologies transform business models announced the publication of ”