Understanding your Digital Business Model by its Business Functional Requirements for Operational Technology

Understanding your Digital Business Model by its Business Functional Requirements for Operational Technology

Part 2; The role of existing business functions and technology provisioning when Digital Business adds new business functions and technology provisioning Digital Business models stress agile, dynamic, and responsive to external opportunities using sense and respond. Is this just adding a new technology operation to the Front Office? Its difficult to see how the Back Office IT model built for optimization of internal operations can support such a flexible business-operating model without some changes at least. Its time to re-examine and identify the business functions and what and how technologies provide them.

Slowly but surely all enterprises have become dependent on technology to operate their internal processes, but now with new externally oriented market processes bringing a new dependency on even more technologies its time for a serious review of the integrated Digital enterprises functions

Part I ended with a diagram that identified just how different the operational environments of the Front and Back Office are, and why it’s not only the technologies that are different but also the provisioning. In Part 2 the starting point is to identify the core Business functions and from this examine how they should be provisioned to align with the Business requirement for that function.

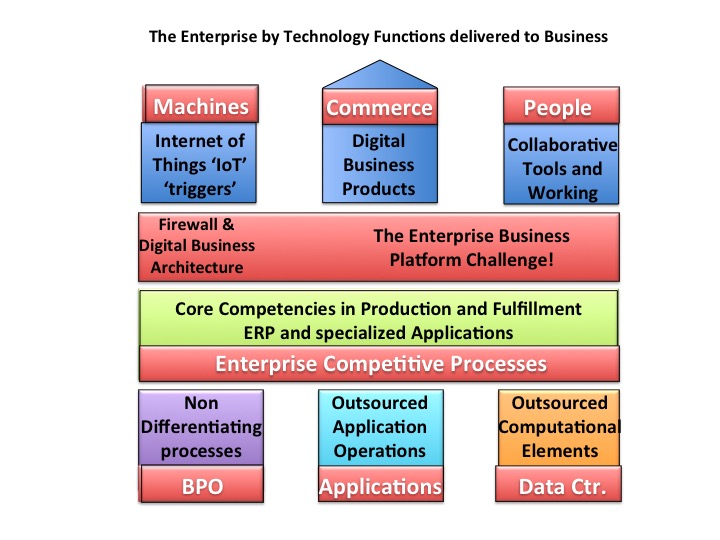

The diagram below outlines eight core functional operating areas each with different business requirements leading to different technologies operations.

In explaining the principle behind this type of functional analysis it is perhaps easiest to start with the three functions in the bottom layer of the diagram working from left to right.

Non-Differentiating Business Processes are those that have to be performed, usually for compliance reasons, but do not provide any competitive differentiation other than by the cost and efficiency with which they are carried out. Invoicing and HR are two common examples where the entire business operation is outsourced with payment based on a business metric such as per invoice, or per employee.

Interestingly Business Process Outsource, or BPO, is an existing example of shifting from CapEx overhead to OpEx operational expenditure and therefore totally aligned to the Digital Business goals of attributable cost, agility and flexibility. New Cloud based service capabilities are widening the range and types of Business Operations that can be outsourced on an OpEx business.

It makes sense to re consider exactly what could or should be moved to Business Process Outsourcing and in particular to think through the whole book to bill cycle and its relationship to your enterprises external digital business. Before doing this it helps to firmly identify exactly what makes up the functional block of ‘Core Competencies in Production and Fulfillment’

These are the activities that actually create the products that make up the enterprises business to sell with associated activities that fulfill orders, and as such are the basic competitive activities that keep an enterprise in business. Whether orders come from existing ‘traditional’ channels, or as part of new ‘digital business’ models.

Some two decades of applying IT expertise to ‘Core Competencies in Production and Fulfillment’ to optimizing processes and integrating data, etc. lie behind the original mission statement of IT, and ERP, in producing Competitive Differentiation. But for many enterprise mission creep’ has led to this vital activity becoming almost obscured behind a morass of other IT services. Hence the need to rethink competitive focus versus distracting operations better outsourced!

Returning to Business Process Outsourcing functions and re considering what to outsource by function against this criteria should result in fresh critical analysis. Add to this a further checklist of questions; should it be directly cost attributable to their activities and volume; is this now competitively available through Cloud based Services; and most significantly, who uses the function defined by where in the Business and Technology model there activities are primarily located.

Digital Business is usually seen in terms of using technology outside the enterprise IT systems and firewall to do business in new ways with Clouds, Mobility, and Services at the heart of the new capabilities. It makes sense to question if non-differentiating activities in support such as Book to Bill, and others, should not be provided in a similar manner as Cloud based BPO functions.

The usual arguments will of course be made as to preservation of the statue quo, and there are of course functions and activities where this is the right action. Here the two traditional outsource functionalities illustrated in the diagram provide the answers, but as the topic of traditional outsourcing has been argued in full in many places it does not necessary to provide a further airing here.

Its tempting to accept the continuation of the current status, but its difficult to see how without some really careful and strategic thinking a transformed Front Office using new technologies and deployment models can be made to work in a new, and reset, competitive market places with out some impacts in the rest of the enterprise and its business functions.

Digital Business Transformation must, by definition, mean a wider consideration of exactly how an enterprise does functional operate when its business model becomes based not only on Technology, but also on external Technology and Services provided by new deployment models.

This is not an argument for the chaos of Enterprise wide transformation in response to the introduction of IT, and PCs and ERP technologies as in the past. Instead it is an argument for managing a graceful change by letting go of non-core activities and re focusing on what will increase competitive differentiation in support of Digital Business.

Part 3 of this series; will focus on examining the functions of the Front Office and its aligned technology model. Part 1 can be found here

Innovation & Product-led Growth Tech Optimization Future of Work AI ML Machine Learning LLMs Agentic AI Generative AI Analytics Automation B2B B2C CX EX Employee Experience HR HCM business Marketing SaaS PaaS IaaS Supply Chain Growth Cloud Digital Transformation Disruptive Technology eCommerce Enterprise IT Enterprise Acceleration Enterprise Software Next Gen Apps IoT Blockchain CRM ERP Leadership finance Customer Service Content Management Collaboration M&A Enterprise Service Chief Information Officer Chief Technology Officer Chief Digital Officer Chief Data Officer Chief Analytics Officer Chief Information Security Officer Chief Executive Officer Chief Operating Officer

Originally published on December 13, 2011. Updated for relevancy January 14, 2014.

Originally published on December 13, 2011. Updated for relevancy January 14, 2014.