There's nothing precise about Precision Medicine

There's nothing precise about Precision Medicine

The media gets excited about gene therapy. With the sequencing of genomes becoming ever cheaper and accessible, a grand vision of gene therapy is now being put about all too casually by futurists in which defective genetic codes are simply edited out and replaced by working ones. At the same time there is broader idea of "Precision Medicine" which envisages doctors scanning your entire DNA blueprint, instantly spotting the defects that ail you, and ordering up a set of customized pharmaceuticals precisely fitted to your biochemical idiosyncrasies.

There is more to gene therapy - genetic engineering of live patients - than the futurists let on.

A big question for mine is this: How, precisely, will the DNA repairs will be made? Lay people might be left to presume it's like patching your operating system, which is not a bad metaphor, until you think about how and where patches are made to a computer.

A computer has one copy of any given software, stored in long term memory. And operating systems come with library functions for making updates. Patching software involves arriving with a set of corrections in a file, and requesting via APIs that the corrections be slotted into the right place, replacing the defective code.

But DNA doesn't work like this. While the genome is indeed something of an operating system, that's not the whole story. Sub-systems for making changes to the genome are not naturally built into an organism, because genes are only supposed to change at the time the software is installed. Our genomes are carved up en masse when germ cells (eggs and sperm) are made, and the genomes are put back together when we have sex, and then passed into our children. There is no part of the genetic operating system that allows selected parts of the genetic source code to be edited later, and -- this is the crucial bit -- spread through a living organism.

Genetic engineering, such as it is today, involves editing the genomes of embryos at a very early stage of their lifecycle, so the changes propagate as the embryo grows. Thus we have tomatoes fitted with arctic fish genes to stave off cold, and canola that resists pesticides. But the idea that's presented of gene therapy is very different; it has to impose changes to the genome in all the trillions of copies of the code in every cell in a fully developed organism. You see, there's another crucial thing about the DNA-is-software metaphor: there is no central long term program memory for our genes. Instead the DNA program is instantiated in every single cell of the body.

To change the DNA in a mature cell, geneticists have to edit it by means other than sexual reproduction. As I noted, there is no natural "API" for doing this, so they've invented a clever trick, co-opting viruses - nature's DNA hackers. Viruses work by squeezing their minuscule bodies through the cell walls of a host organism, latching onto DNA strands inside, and crudely adding their own code fragments, pretty much at random, into the host's genome. Viruses are designed (via evolution) to inject arbitrary genes into another organism's DNA (arbitrary relative to the purpose of the host DNA's that is). Viruses are just what gene therapists need to edit faulty DNA in situ.

I know a bit about cystic fibrosis and the visions for a genetic cure. The faulty gene that causes CF was identified decades ago and its effect on chlorine chemistry is well understood. By disrupting the way chlorine ions are handled in cells, CF ruins mucus membranes, with particularly bad results for the lungs and digestive system. From the 1980s, it was thought that repairs to the CF gene could be delivered to cells in the lung lining by an engineered virus carried in an aerosol. Because only a small fraction of cells exposed to the virus could have their genes so updated, scientists expected that the repairs would be both temporary and partial, and that fresh viruses would need to be delivered every few weeks, a period determined by the rate at which lung cells die and get replaced.

Now please think about the tacit promises of gene therapy today. The story we hear is essentially all about the wondrous informatics and the IT. Within a few years we're told doctors will be able to sequence a patient's entire genome for a few dollars in a few minutes, using a desk top machine in the office. It's all down to Moore's Law and computer technology. There's an assumption that as the power goes up and the costs go down, geneticists will in parallel work out what all the genes mean, including how they interact, and develop a catalog of known faults and logical repairs.

Let's run with that optimism (despite the fact that just a few years ago they found that "Junk DNA" turns out be active in ways that were not predicted; it's a lot like Dark Matter - important, ubiquitous and mysterious). The critical missing piece of the gene therapy story is how the patches are going to be made. Some reports imply that a whole clean new genome can be synthesised and somehow installed in the patient. Sorry, but how?

For thirty years they've tried and failed to rectify the one cystic fibrosis gene in readily accessible lung cells. Now we're supposed to believe that whole stretches of DNA are going to swapped out in all the cells of the body? It's vastly harder than the CF problem, on at least three dimensions: (1) the numbers and complexity of the genes involved, (2) the numbers of cells and tissue systems that need to be patched all at once, and (3) the delivery mechanism for getting modified viruses (I guess) where they need to do their stuff.

It's so easy being a futurist. People adore your vision, and you don't need to worry about details. The march of technology, filtered through 20:20 hindsight, appears to make all dreams come true. Practicalities are left to sort themselves out.

But I think it takes more courage to say, of gene therapy, it's not going to happen.

New C-Suite Future of Work Chief People Officer

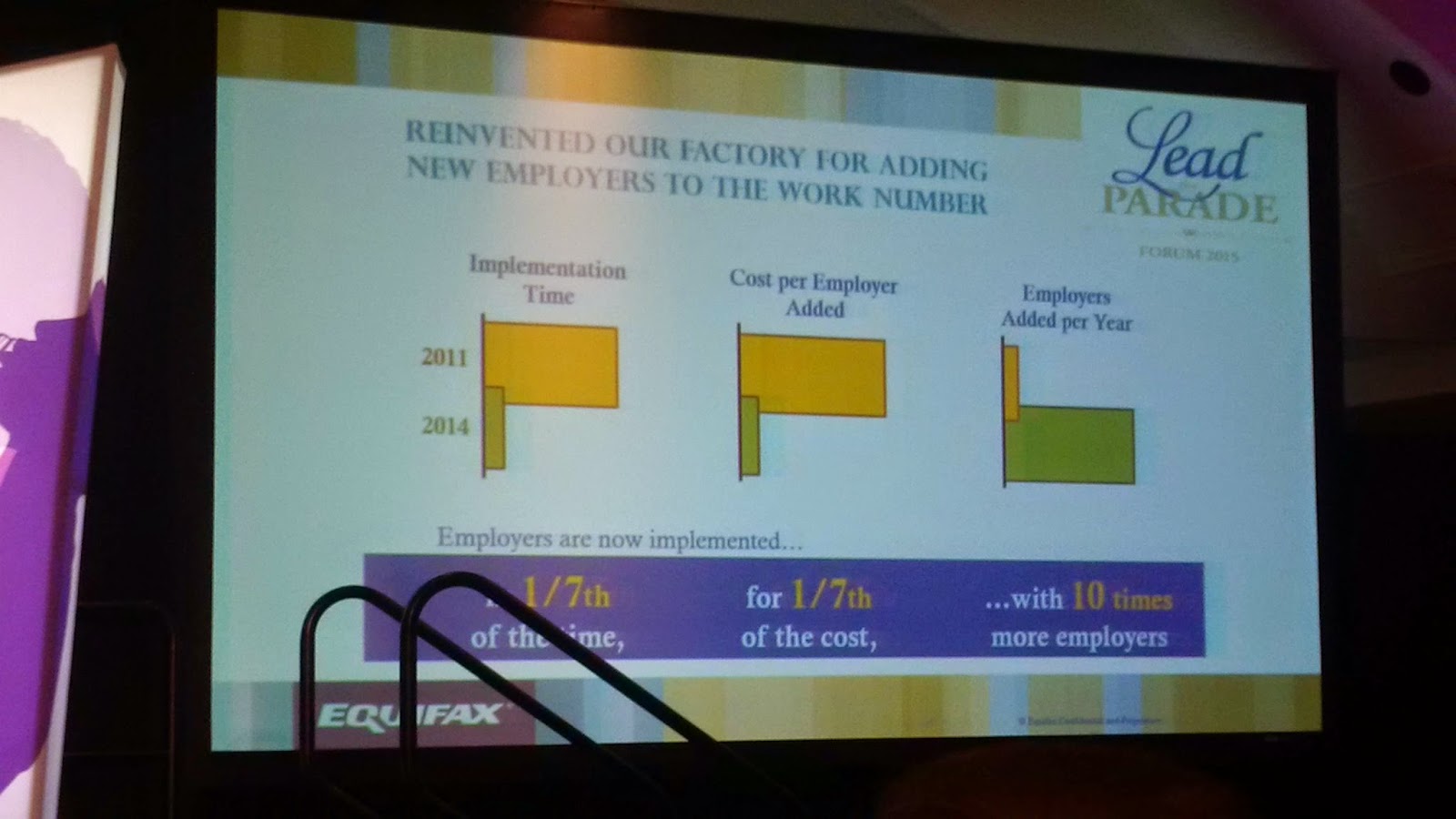

That’s an example of an information-driven company waking up to unrealized value in data. Among governance-and-risk-minded companies,

That’s an example of an information-driven company waking up to unrealized value in data. Among governance-and-risk-minded companies,