IoT is the key technology element that will drive the full transformation of Digital Business into the next generation of Business.

Vice President and Principal Analyst, Constellation Research

Constellation Research

Andy Mulholland is Vice President and Principal Analyst focusing on cloud business models. Formerly the Global Chief Technology Officer for the Capgemini Group from 2001 to 2011, Mulholland successfully led the organization through a period of mass disruption. Mulholland brings this experience to Constellation’s clients seeking to understand how Digital Business models will be built and deployed in conjunction with existing IT systems.

Coverage Areas

Consumerization of IT & The New C-Suite: BYOD,

Internet of Things, IoT, technology and business use

Previous experience:

Mulholland co authored four major books that chronicled the change and its impact on Enterprises starting in 2006 with the well-recognised book ‘Mashup Corporations’ with Chris Thomas of Intel. This was followed in…...

Read more

A deliberately bold statement, however it is a logical prediction, particularly so if you have been following this winter series of Blog posts. The currently the transformation to Digital Business is driven by the capability to increase sales and market share by using ubiquitous Internet connectivity to reach potential and existing customers. The connectivity coupled with the use of social tools extends the level of understanding of the relationships and requirements into new insights that allow a seller to be ‘smarter’ in their interpretation of opportunities.

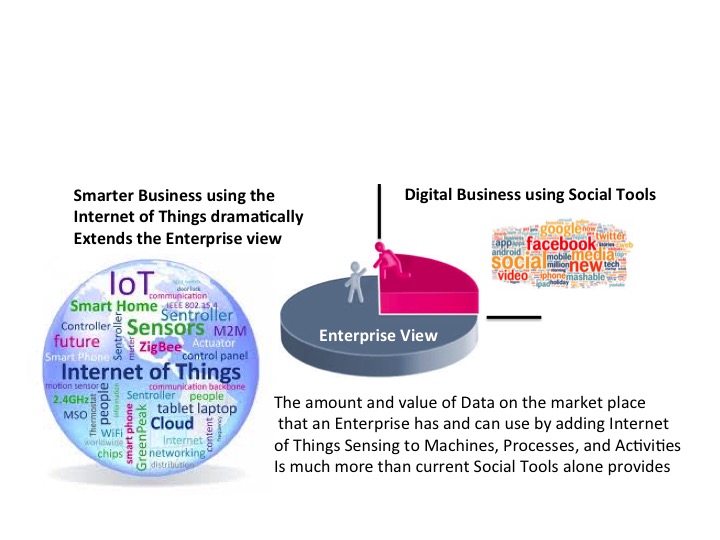

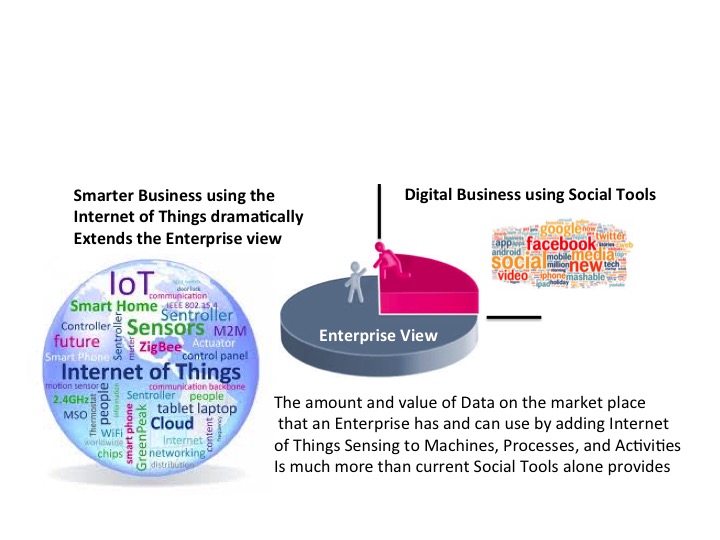

Internet of Things, IoT, extends the same the ubiquitous connectivity of People through the use of Social Tools to include Machines, Processes, Objects, and yes, even further data on People activities. Visualize this as moving from the limited view of your enterprises customers via Social Tools, to a full 360-degree view of everything that affects your market, or each individual opportunity.

Upon grasping this point it becomes easy to understand the reason for the predicted massive growth in the use of IoT as it the real transformation force behind Digital Business. Internet of Things sensors are rapidly moving beyond the simple measurements of initial products, and fast becoming sophisticated, multi capability monitoring devices; think what the Apple Watch Health app tells those who have authorized access about the wearers health and daily activities as an example.

The enterprise that can maximize its IoT connectivity across the market truly has the power to out smart its competitors by the use of its 360-degree view of the market and opportunities. Many describe this as ‘Big Data’ stating scale and rates of data creation are far beyond what can be managed beneficially with todays analytic tools, and compute power.

This hyper connected, massive real time data flow driven environment is both a real challenge in how data is utilized, and a huge business competitive opportunity. No longer is the challenge not having enough data, or enough analytical power to comb through our precious accumulated data for new insights. Now the challenge is spotting the immediately relevant data from the continuous flows of data created by monitoring a huge number of IoT sensors covering all aspects of the market place.

To win in this fast moving, dynamic new connected environment means immediately understanding events as they are happening, including competitors’ actions that affect the market, and be able to influence the outcomes with smarter responses. This transformation to real-time business is more than using Digital Technology with Social Tools to connect in a new manner to people. This is shift in the entire basis of competition driven by new capabilities in Technology.

‘Digital Business’ as we practice it today is the interim step to ‘Smart Business’ conducted in the transformed Smart Markets and Industries of tomorrow. A World where everything is connected to produce a mesh of cross-related data flows that periodically relate to each other and ‘merge’ to trigger real time insights.

The winners, whether buying or selling, successfully tap into the World of IoT data flows using the new generation of tools that spot and trigger the kind of ‘Insights’ that have the power to simply out smart competitors.

This is not the IT, or Data Analytics, environment we know today, with data mostly delivered by either the historic transactions of Enterprise Applications, or through exercises to identify, and collate, for data entry after the event. Big Data in this model describes an over whelming amount of stored data that defies most efforts to analyze for even short term opportunistic outcomes, let alone making real-time ‘Smart’ decisions.

Smart data is the real time alignment of multiple data sources flows at a mutually significant, or relevant moment, by an advanced analytical engine using a rules structure to provide Smart Insights. As the number of IoT sensing points increase so does the number of data flows, increasing expediential the capability to trigger new and unsuspected smart Insights.

This is a difficult capability to understand, just as Relational Databases were to a previous generation, and was covered in more detail in the previous blog; the science of getting real value from IoT data. As indeed were all the elements that make up the complete picture of the Smart Enterprise competing through real time sense and respond to the global market place.

We have now arrived at the concluding Blog in the entire series that started in October 2014 and presented on alternative weeks through till April 2015; a journey on the implications for an Enterprise on business transformation under the title of Digital Business; and a primer of how IoT with its associated Technologies is developing and being deployed to change capabilities for business. More than a few people commented that, as the series progressed, it become increasingly clear that the two topics with their developing narratives were clearly linked. In the last two months for many readers it has become clear, that as it was intended to demonstrate there is more than a more link.

The Internet of Things, IoT, is actually the key additional to Digital Technology that transforms Industries, Markets, and Enterprises, into a whole new generation of Business models supported by competitive activities.

The popular separation of the business transformation implications of Digital Business taken to mean sales and marketing activities online; from the introduction of the wide range of new Technologies that are driving the Internet of Things is an artificial and dangerous misunderstanding. It stems from inadequate appreciation and grasp by Business managers of technology, and by Technologists of Business, resulting in neither party full grasping the full scale of the current changes.

We should be more aware as the history of Technology with its impact on Business, and in particular, the more recent transformation in the period of the late 1980s into the 1990s, generally goes through the same pattern. There is a period when a slew of new technologies appear, usually individually offering business value, then value is increased through the integration of the technologies finally leading to a Business Transformation to new competitive capabilities.

In the 1980s to 1990s, the PC with personal Applications, linked into Networks, which in turn led to Client-Server applications, growing into ERP suites that delivered Business Process Re-Engineering of Enterprise Business models. At each stage many enterprises congratulated themselves on the value of new deployments in isolation, before having the expense of re working into the final cohesive mature change.

Recent years have led through Clouds, Mobility Devices, Apps into Browser Web Services, leading to Social Tools and Digital Business. Now IoT extends the principles of external social connectivity into full market connectivity, and awareness, by drawing on all of these technologies in a maturing integrated manner to transform competitive capabilities and costs of deployment.

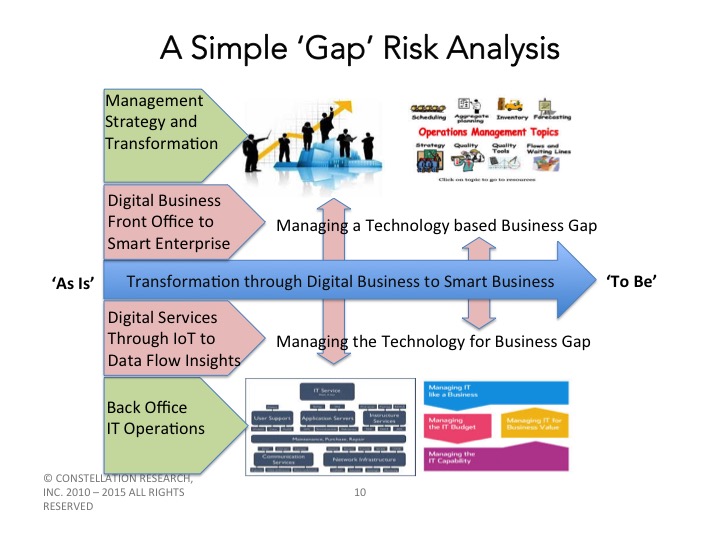

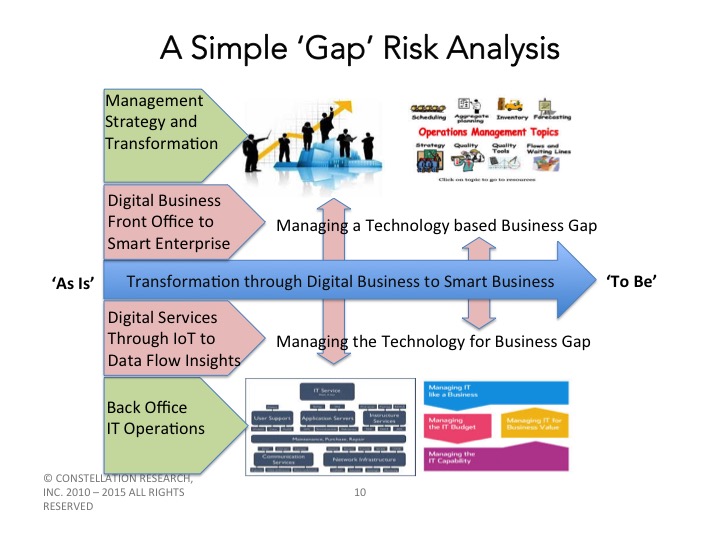

Whilst Digital Business and IoT should not be considered in isolation from each other, it is necessary to fully understand each individually in depth to draw up roadmaps for the successful, and necessary, full enterprise transformation. See the diagram below with the highlighting of the two capability gaps;

Summary; This winters blog series has been focused on examining in full the nature of the business led challenge under the title of Digital Business; and the Technology deployment challenge under the title of IoT. This final blog in the joint series finally summarizes the combined situation. With this conclusion it is recommended to consider re-reading some of the previous blogs to put the full context in place. The summary list of all the posts can be found here.

Speaking as the author; I will be taking a break for some of the summer months in the form of a Sabbatical therefore the frequency of posts will reduce for a few months. I will however remain actively engaged in these topics through out the period of my summer sabbatical, albeit at a reduced activity level in blog publishing. I will be appearing and presenting on these topics at the Constellation Research European Digital Disruption Tour. Specific dates and locations are London on 17th June and Amsterdam 22nd June.

Innovation & Product-led Growth

Tech Optimization

Future of Work

AI

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Analytics

Automation

B2B

B2C

CX

EX

Employee Experience

HR

HCM

business

Marketing

SaaS

PaaS

IaaS

Supply Chain

Growth

Cloud

Digital Transformation

Disruptive Technology

eCommerce

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

Leadership

finance

Customer Service

Content Management

Collaboration

M&A

Enterprise Service

Chief Information Officer

Chief Technology Officer

Chief Digital Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Executive Officer

Chief Operating Officer

usage of water. It will be interesting to see if this supply chain starts employing tactics that we are seeing in manufacturing – near shoring. When states like California supply 80% of the global almond supply, yet that crop consumes 10% of California’s water – or 1.1 gallons per almond. Granted it is easier said than done since crops require much more than just water – soil and weather play major factors in crop growth. But moving crops to different location is not that easy.

usage of water. It will be interesting to see if this supply chain starts employing tactics that we are seeing in manufacturing – near shoring. When states like California supply 80% of the global almond supply, yet that crop consumes 10% of California’s water – or 1.1 gallons per almond. Granted it is easier said than done since crops require much more than just water – soil and weather play major factors in crop growth. But moving crops to different location is not that easy.![]()

If you follow the news you know that GetSatisfaction was acquired by Sprinklr last week (

If you follow the news you know that GetSatisfaction was acquired by Sprinklr last week (