Market Move - Red Hat snaps up CoreOS - The Kubernetes ecosystem heats up

Few open source standard have won faster than Kubernetes, and that also means the ecosystem consolidation is moving faster than almost any market in enterprise software. So it came as no surprise that Red Hat announced it acquired CoreOS.

So let's dissect the press release in our customary style – it can be found here:

Red Hat, Inc. (NYSE: RHT), the world's leading provider of open source solutions, today announced that it has signed a definitive agreement to acquire CoreOS, Inc., an innovator and leader in Kubernetes and container-native solutions, for a purchase price of $250 million, subject to certain adjustments at closing that are not expected to be material. Red Hat's acquisition of CoreOS will further its vision of enabling customers to build any application and deploy them in any environment with the flexibility afforded by open source. By combining CoreOS's complementary capabilities with Red Hat's already broad Kubernetes and container-based portfolio, including Red Hat OpenShift, Red Hat aims to further accelerate adoption and development of the industry's leading hybrid cloud platform for modern application workloads.

MyPOV – Good intro, shares the motivation (applications / containers everywhere), the prices (250 M) and where the new home is (Red Hat OpenShift) and the prize (hybrid cloud deployment). Kudos to the press release authors.

We believe this acquisition cements Red Hat as a cornerstone of hybrid cloud and modern app deployments.

PAUL CORMIER PRESIDENT, PRODUCTS AND TECHNOLOGIES, RED HAT

MyPOV – Ok good to have a quote, with the usual optimistic to grandiose outlook today woth Paul Cormier.

As applications move to hybrid and multicloud environments, a growing number of organizations are using containers to more easily build, deploy and move applications to, from, and across clouds. […]

MyPOV – No question containers are popular for load portability. Nice would have been a statement e.g. how many containers are run by Red Hat / CoreOS.

Founded in 2013, CoreOS was created with a goal of building and delivering infrastructure for organizations of all sizes that mirrored that of large-scale software companies, automatically updating and patching servers and helping to solve pain points like downtime, security and resilience. Since its early work to popularize lightweight Linux operating systems optimized for containers, CoreOS has become well-regarded as a leader behind award-winning technologies that are enabling the broad adoption of scalable and resilient containerized applications.

MyPOV – Fair history of CoreOS… but not sharing the Google investment, and plan to make Kubernetes more popular for on premises.. that master plan has pretty much paid off by now… and the market leader for Linux (Red Hat) gives CoreOS the biggest reach for on premises deployments.

CoreOS is the creator of CoreOS Tectonic, an enterprise-ready Kubernetes platform that provides automated operations, enables portability across private and public cloud providers, and is based on open source software. It also offers CoreOS Quay, an enterprise-ready container registry. CoreOS is also well-known for helping to drive many of the open source innovations that are at the heart of containerized applications, including Kubernetes, where it is a leading contributor; Container Linux, a lightweight Linux distribution created and maintained by CoreOS that automates software updates and is streamlined for running containers; etcd, the distributed data store for Kubernetes; and rkt, an application container engine, donated to the Cloud Native Computing Foundation (CNCF), that helped drive the current Open Container Initiative (OCI) standard.

MyPOV – Good summary of what CoreOS does and has achieved in remarkably short time. Red Hat now needs to explain and share what it plans to do with the products in the next months.

Red Hat was early to embrace containers and container orchestration and has contributed deeply to related open source communities, including Kubernetes, where it is the second-leading contributor behind only Google. Red Hat is also a leader in enabling organizations around the world to embrace container-based applications, including its work on Red Hat OpenShift, the industry's most comprehensive enterprise Kubernetes platform. Now with the combination of Red Hat and CoreOS, Red Hat amplifies its leadership in both upstream community and enterprise container-based solutions.

MyPOV – Everybody likes to claim to be an early adopter of a winning standard, but in this case RedHat has the chops to prove it, based on the Kubernetes distribution it has delivered… of course partnering with Google since a year on many levels never hurt that effort.

The transaction is expected to have no material impact to Red Hat's guidance for its fourth fiscal quarter or fiscal year ending Feb. 28, 2018.

The transaction is expected to close in January 2018, subject to customary closing conditions.

MyPOV – Things move fast in the open source and container world.

Paul Cormier, president, Products and Technologies, Red Hat

"The next era of technology is being driven by container-based applications that span multi- and hybrid cloud environments, including physical, virtual, private cloud and public cloud platforms. Kubernetes, containers and Linux are at the heart of this transformation, and, like Red Hat, CoreOS has been a leader in both the upstream open source communities that are fueling these innovations and its work to bring enterprise-grade Kubernetes to customers. We believe this acquisition cements Red Hat as a cornerstone of hybrid cloud and modern app deployments."

MyPOV – Good quote from Cormier on why Red Hat acquired CoreOS.

Alex Polvi, CEO, CoreOS

"Red Hat and CoreOS's relationship began many years ago as open source collaborators developing some of the key innovations in containers and distributed systems, helping to make automated operations a reality. This announcement marks a new stage in our shared aim to make these important technologies ubiquitous in business and the world. Thank you to the CoreOS family, our customers, partners, and most of all, the free software community for supporting us in our mission to make the internet more secure through automated operations."

MyPOV – Ok quote from Polvi, indeed a new phase for CoreOS. Good to thank all that got the vendor to this point.

Overall MyPOV

Containers have quickly become the deployment form of choice for enterprises, mainly because of their portability. And Kubernetes has practically won that game, being supported on all major clouds. But enterprises for a variety of reasons (security, performance, data residency being the most prominent ones) still deploy on premises. There the OS of choice is Linux, and Red Hat is the market leader. So adding more support for Kubernetes makes sense for Red Hat. It also has the upside to convert some CoreOS customers to on premises with Red Hat.On the concern side, this acquisition removes one of the key promoters of Kubernetes, funded by Google with the intention to help its propagation… but Kubernetes growth and foot print are likely robust enough to not be damaged from the market move.

But for now, congrats to Red Hat on a key acquisition and good luck to the CoreOS team and customers being part of the Red Hat ecosystem, likely going to be all good news.

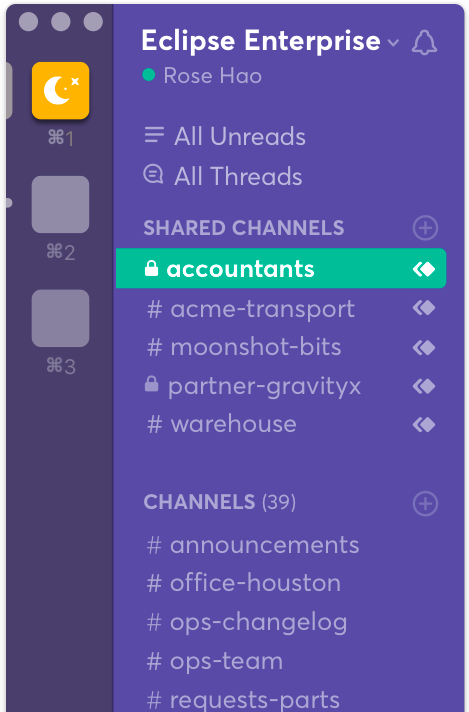

improve this situation using what they called Shared Channels. This feature allows two companies (who are both already paying for Slack) to communicate with each other using a channel that spans across the two different companies. So say Company A uses Slack and they want to connect with their customer Company B (who has to also be using Slack), they can create a shared channel that employees in both companies can use. This is much better than Company A having to create, manage and pay for IDs and PWs on their system for Company B's employees.

improve this situation using what they called Shared Channels. This feature allows two companies (who are both already paying for Slack) to communicate with each other using a channel that spans across the two different companies. So say Company A uses Slack and they want to connect with their customer Company B (who has to also be using Slack), they can create a shared channel that employees in both companies can use. This is much better than Company A having to create, manage and pay for IDs and PWs on their system for Company B's employees.