Vice President and Principal Analyst

Constellation Research

Holger Mueller is VP and Principal Analyst for Constellation Research for the fundamental enablers of the cloud, IaaS, PaaS and next generation Applications, with forays up the tech stack into BigData and Analytics, HR Tech, and sometimes SaaS. Holger provides strategy and counsel to key clients, including Chief Information Officers, Chief Technology Officers, Chief Product Officers, Chief HR Officers, investment analysts, venture capitalists, sell-side firms, and technology buyers.

Coverage Areas:

Future of Work

Tech Optimization & Innovation

Background:

Before joining Constellation Research, Mueller was VP of Products for NorthgateArinso, a KKR company. There, he led the transformation of products to the cloud and laid the foundation for new Business Process as a…...

Read more

Late on a Friday night in Germany SAP issues a press release that Robert Enslin is leaving the company. The organizational consequence was that of Jennifer Morgan taking over the Cloud Business Group, Enslin's previous responsibility. Her go to market activities are no completely with Adaire Fox-Martin – who now solely owns go to market for SAP.

The late Friday night release always implies that SAP tried to 'hide' the new around the departure and re-organization ad the board level, especially since it is the 2nd one this year (read about Leukert's departure here). So let's start with dissecting the press release in our customary fashion, it can be found here.

WALLDORF — SAP SE (NYSE: SAP) today announced that Executive Board Member and President of the Cloud Business Group Robert Enslin has elected to resign from the company to pursue an external opportunity.

MyPOV - Short and sweet – Enslin looking for an external opportunity. The remarkable part is that he does that after a 27-year career with SAP. Usually that long tenured board members and SAP employees get the chance to retire (contrast and compare with for instance Kleinemeier). The Cloud Business group is in the midst of a transformation to move to the SAP technology stack (and in most cases off Oracle's database), but that effort seems well under way. Enslin got more responsibility during the tenure with the addition of Callidus Cloud in 2018 and recently Qualtrics. So, it needs to be something that has happened more recently to prompt him to look for external opportunities.

SAP Executive Board Member Jennifer Morgan will succeed Enslin as president of the Cloud Business Group (CBG). SAP Executive Board Member Adaire Fox-Martin will take sole responsibility of Global Customer Operations (GCO) as president. These leadership changes are effective immediately.

MyPOV - So Morgan is the 'new' Enslin – leaving sole revenue responsibility to Fox-Martin. Well not completely as all six 'sisters' of the Cloud Business Unit have a salesforce and revenue targets. This is taking it to the next level challenge wise for both executives. Fox-Martin must deliver the bulk of SAP's revenue, ironically a job that Enslin had for a long time. And Morgan needs to show she can deliver products to market, as she has not held product development responsibility in her career. Both executives have their work cut out in the next years.

Enslin, who first joined SAP in 1992, departs following a long and successful career at the company. He was named to the Executive Board in 2014, initially as president of Global Customer Operations. A respected technology leader with a unique global perspective on business and economic trends, he earned a highly favorable reputation with customers and industry analysts. His two-year stint as president of the company's Cloud Business Group resulted in an aggressive build-out of SAP's cloud portfolio, including the recently closed acquisition of Experience Management leader Qualtrics.

MyPOV - Sad to see such an SAP veteran go – but I guess it was time for the next level. Enslin has delivered sales results during challenging times for SAP, and more recently made sure that 4 of the 6 sisters (Ariba, Fieldglass, hybris and SuccessFactors) are moving to SAP's technology stack – most prominently SAP HANA, SAP Cloud platform and SAP analytics. Interesting that his 27-year retrospective of his SAP career speaks little about the sales success. Enslin emerged as the best sells person for SAP in North America, delivering regular performance and results, culminating in the world-wide sales responsibility. Most recently Enslin's impact is going to be to have moved Fieldglass and most likely SuccessFactors over to SAP's tech stack. Insight on Ariba is still out. Plans for Qualtrics are tbd, given the recent acquisition. Concur is free to leverage 100% AWS (HANA is out there).

Comments from Professor Hasso Plattner, Chairman of the Supervisory Board of SAP

"We are very grateful for the many significant contributions Robert Enslin has made to SAP. The Supervisory Board has immense confidence in Jennifer Morgan and Adaire Fox-Martin as they assume broader responsibilities on our Executive Board."

MyPOV - Good quote by Plattner, but what alternatives did SAP have? The alternatives would have been presidents inside of the cloud business unit. But they are all busy at delivering results while their product teams are re-platforming. At the same time, with Enslin leaving, the designate backup for McDermott is out of SAP as well. Time to groom a potential successor. And leading SAP you always need to have some product development responsibility (McDermott is the only exception, so was Apoteker). So, its timely for Morgan to get development responsibility. I wrote the same for new board member Klein earlier this year. Klein and Mueller would have been the other two alternatives, but they just got on the board, and need to show they can deliver first. And maybe mistakenly, SAP always had a business leaders on top of the SAP cloud business unit and each off the six sisters. That the technology transformation to SAP's technology, despite being postulate by Plattner on a yearly level – is not a surprise by now. But hindsight is always easy.

Comments from Bill McDermott, CEO of SAP

"Let me first congratulate Rob Enslin for everything he's done in his distinguished SAP career. He'll be a great champion for SAP in his new opportunity and a lifelong friend to me personally. With Jennifer Morgan and Adaire Fox-Martin moving up, we have two dynamic leaders who will help us take SAP to the next level. Our market-leading core ERP and high-growth cloud application portfolio make SAP a rarity in the enterprise software industry. This transition gives us a clear path to continue simplifying the company. SAP's leadership team will drive greater operational efficiency, faster time to market, higher product quality and superior market fit, all while significantly improving margins. 'The Best Run SAP' is our motto, our maxim and our strategy to run the company with greater discipline and focus. I could not be more optimistic about SAP's road map to create value for our customers, employees and shareholders – a true Best-Run SAP."

MyPOV – A long quote by McDermott. Nice to see him thank Enslin and sparking the curiosity where Enslin maybe going. SAP has a lot of partners – so the field is wide open. And agreed that with Fox-Martin solely in charge of almost all sales (the cloud business units sales leaders have a dotted line into her) – SAP certainly simplifies the sales organization and responsibility. Not so much though from a product development side, as the Morgan for Enslin replacement doesn't solve the challenges of a product development troika now between Klein, Morgan and Mueller. It changes the dynamics in the troika as Morgan is less senior than Enslin (who I joked, could have been a father age gap wise to Klein / Mueller). And certainly, the board has gotten much younger, it maybe (math pending) on record low average age – even before Kleinemeier retires.

Comments from Robert Enslin

"I am truly grateful to Hasso Plattner, Bill McDermott and all my SAP colleagues for the opportunity to be part of such a special company. As I leave SAP for a new journey, I do so with unrivaled respect for the company and its amazing customers around the world."

MyPOV – Nice quote. Always good to leave on a high note.

Comments from Jennifer Morgan

"I am very honored by this opportunity to work with the outstanding team in SAP's Cloud Business Group. I have never been stronger in my belief that SAP's best days are yet to come."

MyPOV – Good quote. Would have loved to see some of the Cloud Business group goals in here.

Comments from Adaire Fox-Martin

"For the entirety of my career at SAP I have focused on our customers and their success. I could not be more energized to continue this exciting journey as president of Global Customer Operations."

MyPOV – Good quote – focus on the customer. Strange though Fox-Martin trails Morgan in sequence. Alphabet can't be used as explanation. At least form an outside perspective and revenue responsibility (not functional diversity) her job eclipses Morgan's.

Overall MyPOV

SAP's board organization doesn't come to peace, and with that stability that is key for execution. Except for Finance, HR and Services – every board area has been changed, re-organized in the course of 6 months. I can't think of such a board level change happening at SAP … ever. And the next change is already announced, as Kleinemeier stayed an extra year to keep doing the work that Leukert was supposed to take over. Organization need stability on the top, and changes on the top have repercussions many levels down the organization, all the way to middle management changing. In a traditionally stable culture like SAP these changes are especially challenging, as networks have operated over decades, that are now changing. But change can be for the better, so we will have to see what happens.

The other aspect is of course SAP's questionable job of succession management. This is not an easy job at board level, and one only needs to think the issues e.g. Apple has had. But SAP needs to benchmark itself with the competition, and there the parallels of loosing Leukert are similar to Oracle losing Kurian, but Oracle absorbed that change much better (for now, blog post coming). If SAP did not have the double leadership in sales, a luxury and complexity, Morgan would not even have been available as a board member. The other potential successor(s) for Enslin had to come from the presidents of the cloud subsidiaries. But none of them made it, and not sure if any was ready for running all 6 sisters at this moment. As a side note: A mini consolidation occurred with moving Fieldglass under Barry Padgett who now runs Ariba and Fieldglass. And apparently no external candidates have been considered. But then SAP has a questionable record of bringing in outside board members, it has tried and failed twice for its people leader before Ries was installed.

So, except for Mucic, Kleinemeier and Ries, everybody has a new job on the SAP board – or is new to the board. The good news is, this board has worked together before. And SAP has reduced sales complexity whit handing the sales keys for (almost) all of SAP sales. One can argue McDermott's job hasn't changed, but I'd argue that he is the product developer in chief (see here), a new role for him.

For customers these changes simplify things on the sales side, where Fox-Martin is the last word – before reaching out to McDermott. Things remain as complex on the product side as before, with new relationships with Morgan having to be developed. Her background in sales is likely going to make the first phase of customer interaction easier, the potential challenge will be not to over extend product development commitments.

But at the end of the day, it is what it is: SAP's executive board is younger than ever before (or a very long time), and needs to get going asap as the challenges are massive and not getting smaller because SAP is reorganizing: Making the value proposition of the digital core real, getting S/4HANA right, adding new technologies across the products, operating on the new reality of SAP owned integration between its products and moving the six sisters to the SAP technology stack. All while delivering results to shareholder expectations. Time to roll up the sleeves for the SAP board.

[For additional reference checkout my analysis of SAP's last major board reorg, in April 2017, which created the cloud business group - here.]

Future of Work

Tech Optimization

Data to Decisions

Innovation & Product-led Growth

New C-Suite

Sales Marketing

Next-Generation Customer Experience

Digital Safety, Privacy & Cybersecurity

AI

Analytics

Automation

CX

EX

Employee Experience

HCM

Machine Learning

ML

SaaS

PaaS

Cloud

Digital Transformation

Enterprise Software

Enterprise IT

Leadership

HR

Chief Customer Officer

Chief People Officer

Chief Human Resources Officer

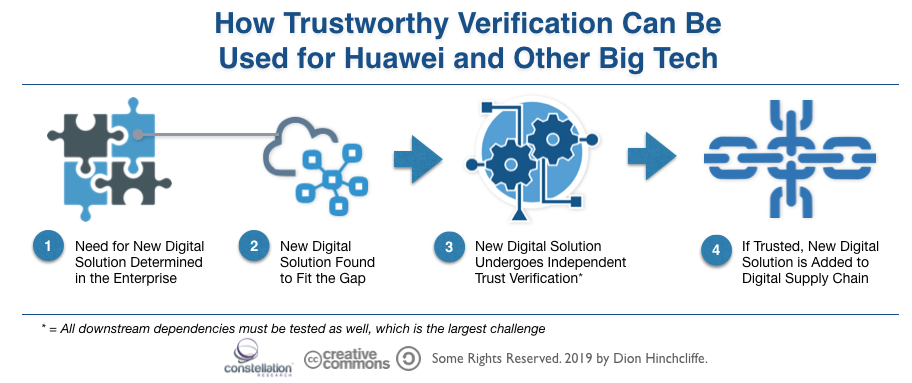

For Huawei, it's been a long journey from manufacturing back-office PBX switches back in the 1980s to besting Apple last year to

For Huawei, it's been a long journey from manufacturing back-office PBX switches back in the 1980s to besting Apple last year to