Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers,…...

Read more

Workday roadmap reveals what’s ahead on machine augmentation, reporting and Adaptive Insights-powered planning. Here’s what’s next.

The tenth annual Workday Innovation Summit, held April 22-24 in Sausalito, CA, brought more than the sweeping San Francisco skyline into focus. Workday shared its vision for providing machine learning (ML) and analytics across its platform while also broadening planning capabilities accelerated by last year’s acquisition of Adaptive Insights.

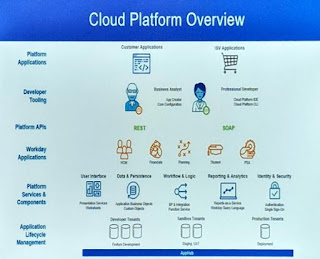

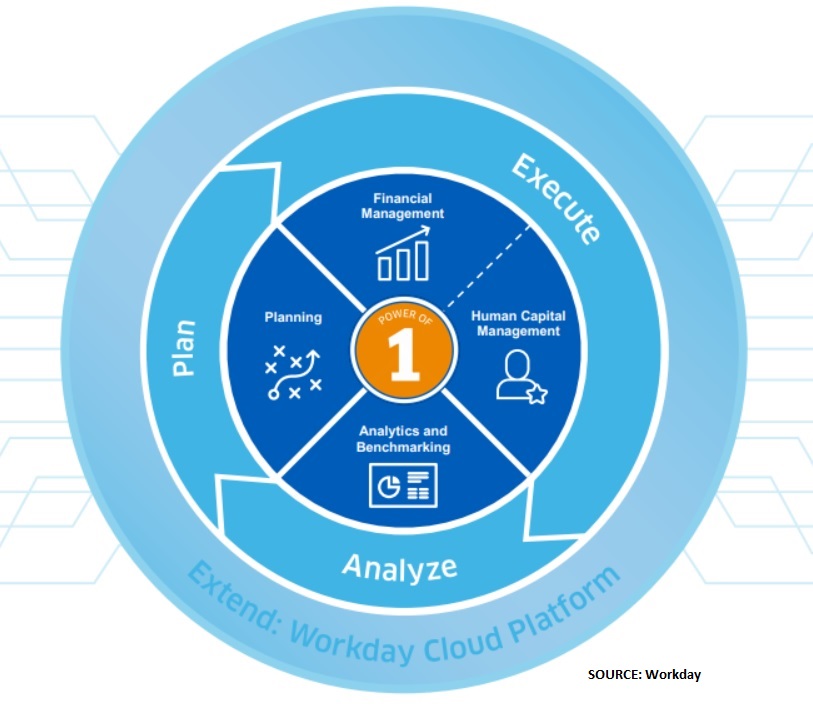

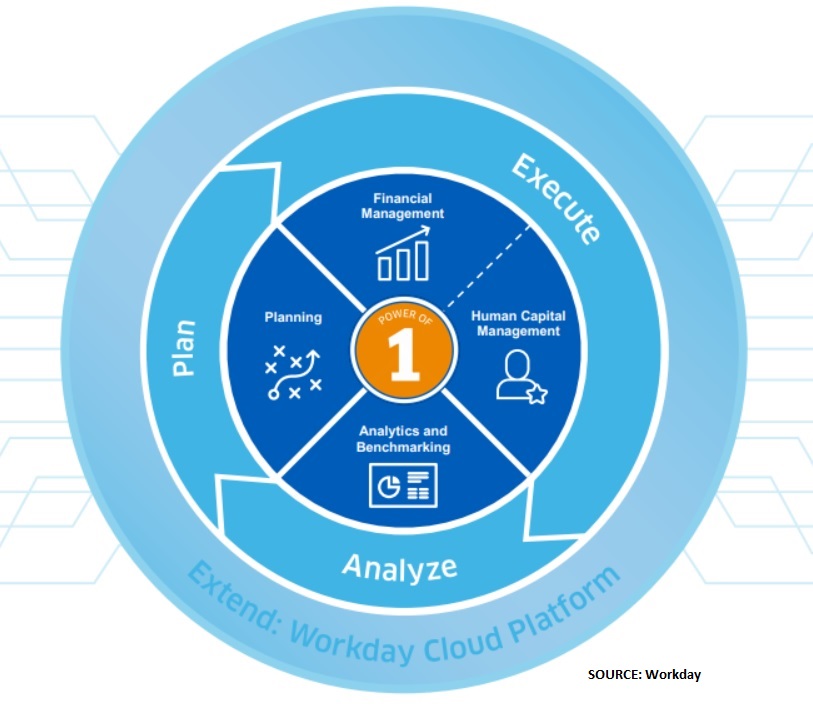

Workday is known first and foremost for its human capital management (HCM) and financial management ERP applications, but at the Innovation Summit, Workday gave equal attention to the analyze and plan aspects of what it described as its execute/ analyze/ plan platform. Workday’s advanced analytics capabilities are built on Prism, which is a data-access layer and analytics engine derived largely from the company’s 2016 acquisition of big data vendor Platfora. Next came Workday’s largest acquisition ever, last summer’s $1.55 billion acquisition of Adaptive Insights just days before that company was set to launch an initial public offering.

Here’s what’s in store on the machine learning, analytics and planning fronts along with my take on Workday’s vision.

ML, Graph and Analytics Unified

Workday is developing ML and graph processing capabilities that can be harnessed across the company’s applications. Echoing the spin I hear from most vendors, Workday execs vowed that the goal is to augment, rather than replace, human decision makers.

Don’t expect novel or esoteric ML-based applications out of left field: Workday said it will focus on concrete use cases and challenges that are already apparent to Workday customers. The first application-specific use of ML and graph analysis is the newly available Skills Cloud, which powers a Skills Insight feature that will discern team, employee and candidate skills and offer related recommendations on hiring, training, team building and project planning.

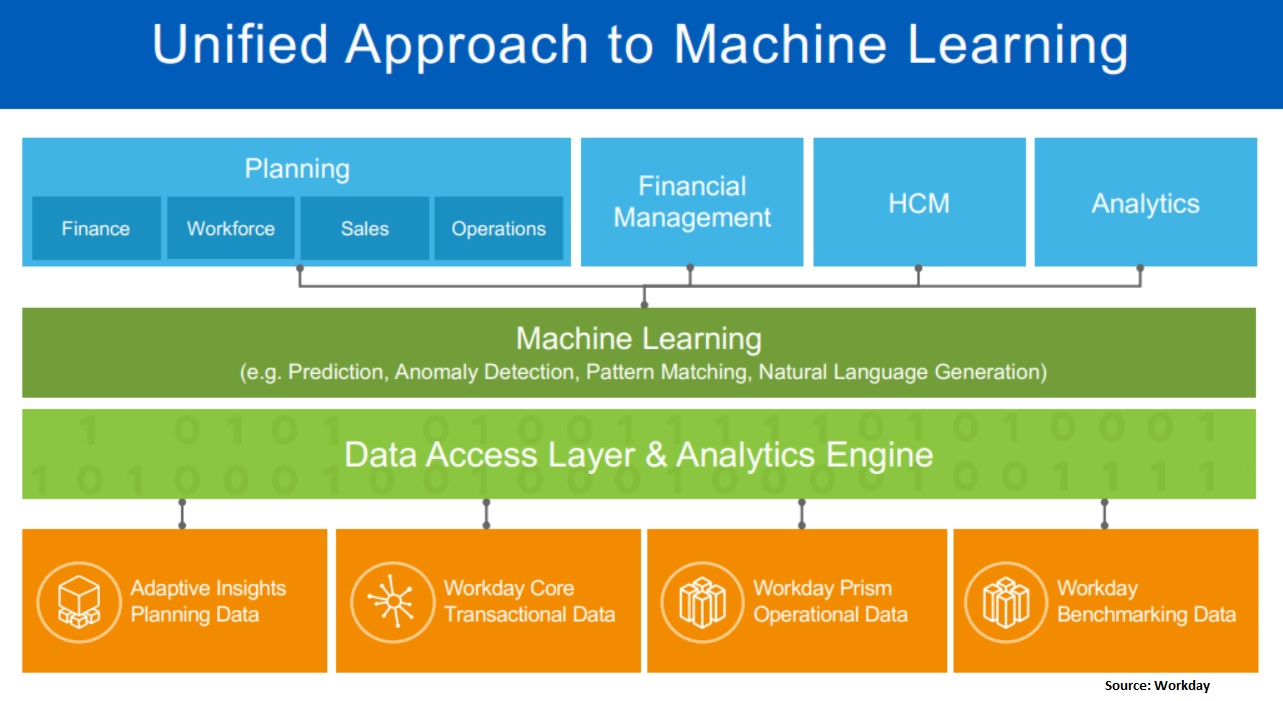

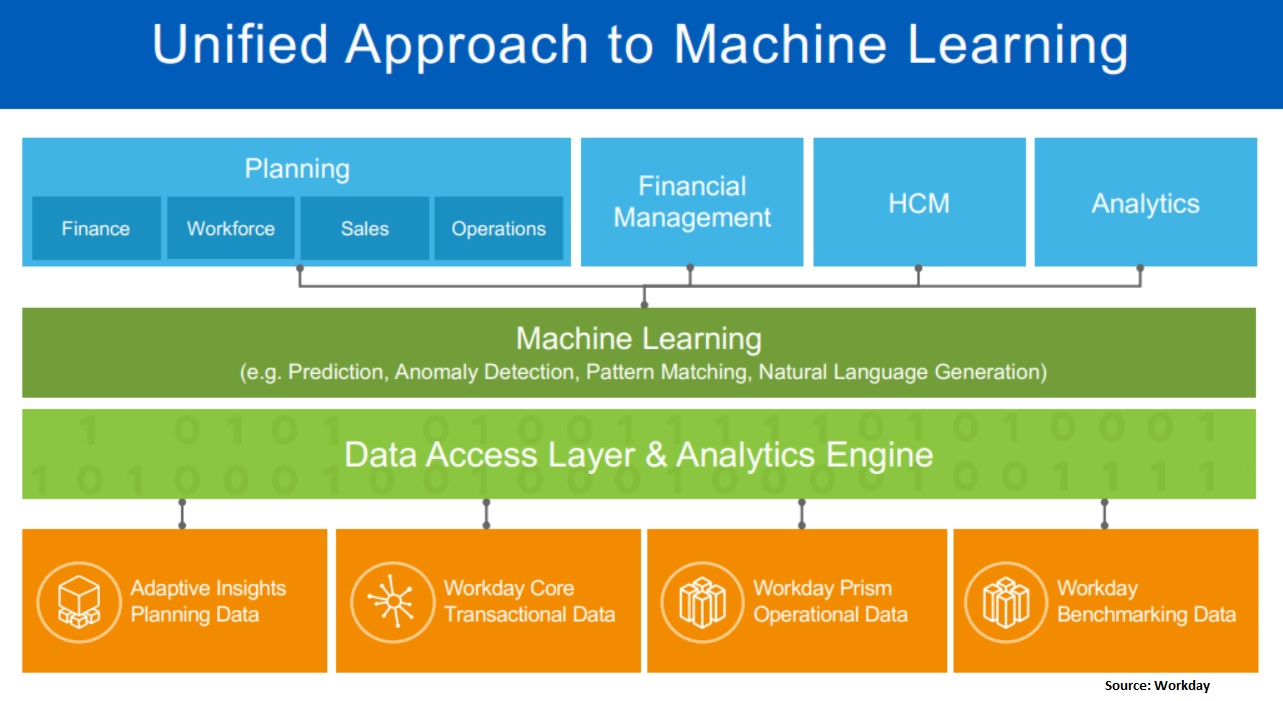

Workday’s ML capabilities are being built on open-source technology wherever possible, said Sayan Chakraborty, senior VP of tools and technology, including ensembles of open source and, in some cases, Workday-developed algorithms. These platform-level ML capabilities will also power augmented analytics and planning capabilities, sensibly leveraging one investment and unifying the ML/augmented analytics approach across the platform.

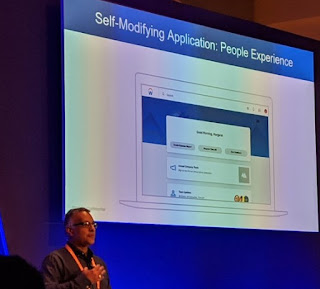

On the analytics front, Workday unveiled a “Discovery Board universal analytic canvas†that will provide a unified reporting architecture for all Workday users (including Adaptive Insights users -- but read more on that below). The analytics team said it will take advantage not only of the shared ML, graph and pattern-detection capabilities available from the platform, it’s also harnessing natural-language generation (NLG) capabilities from Workday's 2018 acquisition of stories.bi. That vendor's Storyteller Engine generates textual descriptions and explanations of the patterns and insights gleaned from analysis of Workday transactions coupled with external data inputs.

Think of the analytic, reporting and Storyteller capabilities as another unified platform upon which Workday plans to introduce multiple augmented analytics applications, starting with a Workday People Analytics app, which has been released to design partners. The ML, graph and NLG-powered insights and recommendations generated by this app will focus on hiring, workforce composition, diversity and inclusion, talent and performance, and retention and attrition. While the Discovery Board canvas will provide self-service discovery and reporting capabilities, Workday is counting on the appeal of the augmented analytic applications and the need to blend external data to spark customer investments in Workday Prism Analytics data management and analytic capabilities that are not included with core Workday apps.

MyPOV on Workday’s ML and Analytics Plans: Machine learning and AI capabilities are still in their infancy, but enterprise software vendors are now expected to have a strategy and a roadmap at a minimum. Workday rival Oracle has been developing its Adaptive Intelligent Apps for at least three years, but most of the applications and capabilities delivered to date have been focused in the sales and marketing arena, where its rival Salesforce has been aggressively developing and delivering its Einstein and Einstein Analytics ML/AI capabilities. SAP is ramping up investment and augmented analytics capabilities on the SAP Analytics Cloud (SAC), which includes planning, but its sweep of capabilities remains somewhat bifurcated between on-premises apps and SAC.

I see Workday’s plan as cogent and sensible, and it’s just now delivering its initial applications. There’s also a clear roadmap to extend the augmented capabilities across HCM, finance, analytics and planning over the next 18 months and beyond. While Workday has not been the pioneer on the ML/AI front, I see it as a fast follower with a unified and focused plan.

Adaptive Insights, Integrated

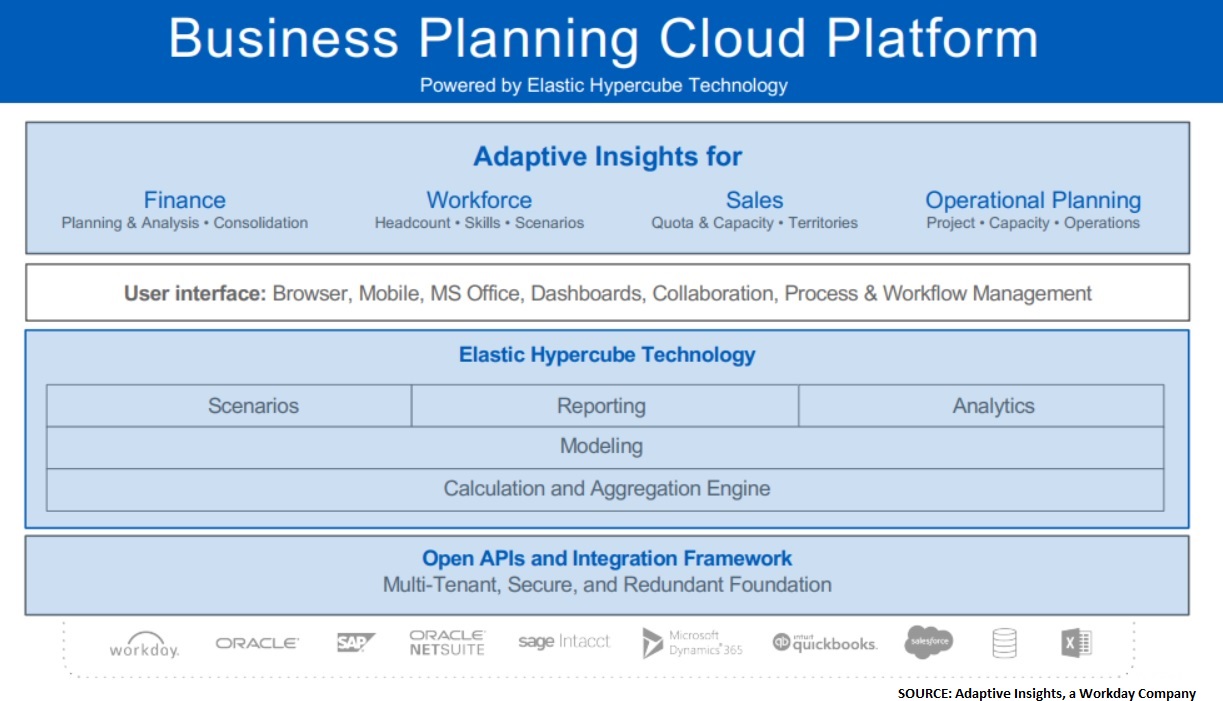

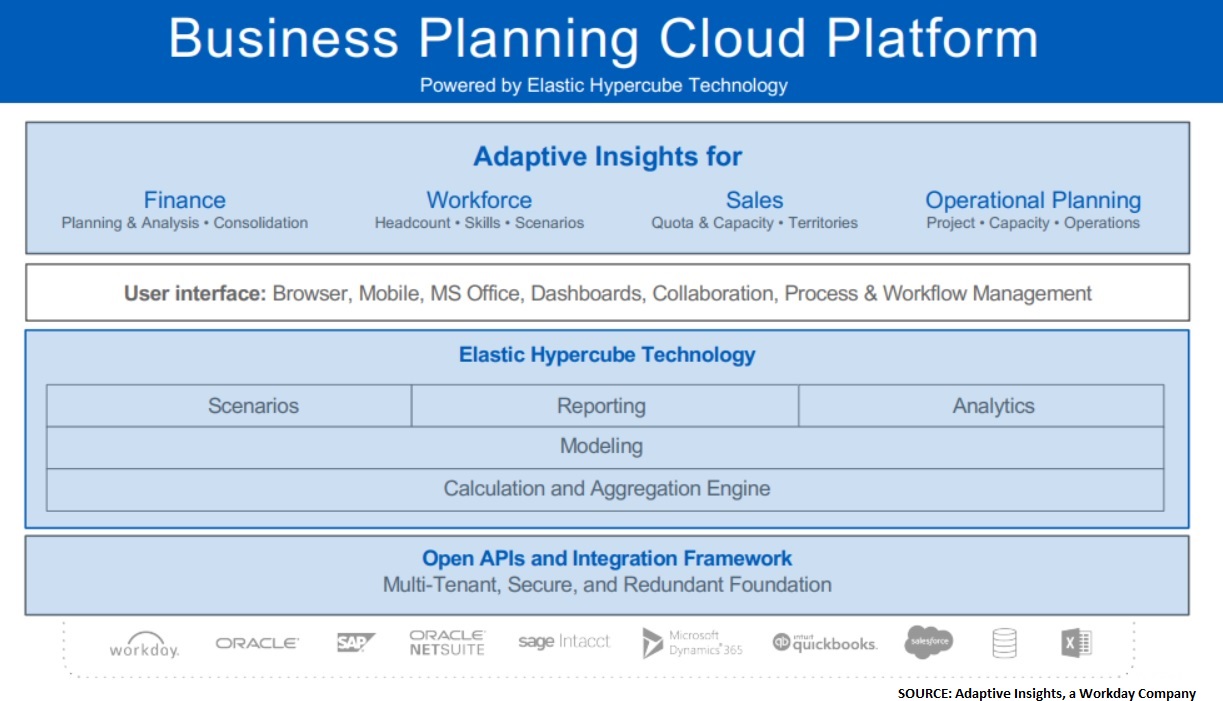

The first thing to know about Adaptive Insights is that it’s keeping its name, although it’s now “Adaptive Insights, a Workday company.†The stand-alone identity recognizes the fact that Adaptive Insights was a thriving, cloud-based planning company with more than 4,200 customers.

Workday had its own, fledging planning application, introduced in 2016, but it acquired Adaptive Insights because it knew it needed to step up its capabilities. In fact, during a question and answer session at the Innovation Summit, Workday co-founder and CEO Aneel Bhusri confessed that if he had it to do over again, he would have introduced planning capabilities ahead of the Workday Financial Management application introduced in 2008.

Bhursi’s comment speaks volumes about the importance of planning and analysis capabilities. Driven by the need for agility amid disruptive business conditions, the leading planning systems have moved beyond finance and are powering HR, sales, and operational planning with finance. Planning and analysis gives companies a clearer picture of where they stand and whether they’re on target to meet their financial and operational goals. When there are exceptions, planning systems help companies quickly replan and reallocate resources to get results back on track. Most importantly, planning solutions do all this much more quickly, broadly and accurately than companies can manage with scores if not hundreds of disconnected spreadsheets.

Adaptive Insights has more of a small- and midsize-business (SMB) base than does enterprise-focused Workday, but the company was already moving upmarket with investments in scalability and enterprise-focused features introduced last year. In the wake of the acquisition, both companies decided to replace Workday’s workforce planning application with Adaptive Insights' to gain its modeling capabilities. More than 100 of the roughly 300 customers using the original Workday Planning application are already switching over to Adaptive Insights.

MyPOV on Workday’s Adaptive Insights plans: As described above, Adaptive Insights will benefit from the investments Workday is making in unified ML, graph and analytic capabilities, and the integrations will show up first in workforce planning, where data obtained from the Skills Cloud will drive skills-gap planning and talent restructuring with financial modeling.

It remains to be seen how effectively Adaptive Insights can balance the needs of SMB and enterprise customers over the long term, but it was encouraging to me to see the entire executive team still in place, including CEO Tom Bogan, CMO Connie DeWitt, and chief product officer Bhaskar Himatsingka. Continuity counts with customers, and Adaptive Insights will also (presumably) be leaning on Workday’s team (as well as its unified platform capabilities) to bolster its sales, support and delivery capabilities for demanding enterprise-level customers.

Related Resources:

Why the Digital Era Demands Agile Planning

Constellation ShortListâ„¢ Cloud-Based Performance Management

Host Analytics Simplifies Collaboration Between Finance and Business Users

Data to Decisions

Tech Optimization

workday

Chief Executive Officer

Chief Financial Officer

Chief Information Officer

Chief Digital Officer

Chief Analytics Officer

Chief Data Officer