BT150 zeitgeist: CxOs weigh in on SaaS consumption models for genAI, agentic AI

CxOs say that software-as-a-service business models that include consumption are going to require a learning curve as well as a few surprise bills. Nevertheless, there may be benefits to consumption-based models even with drawbacks.

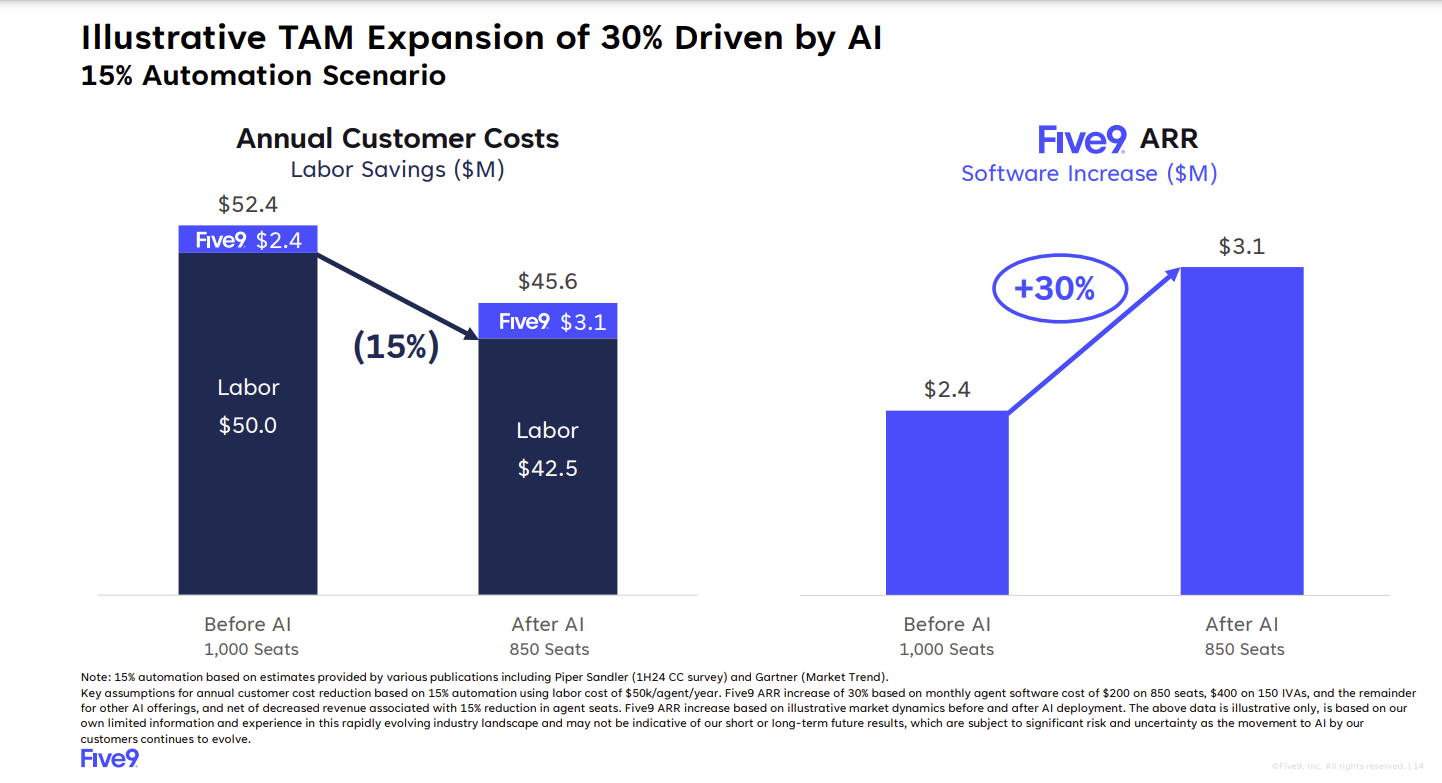

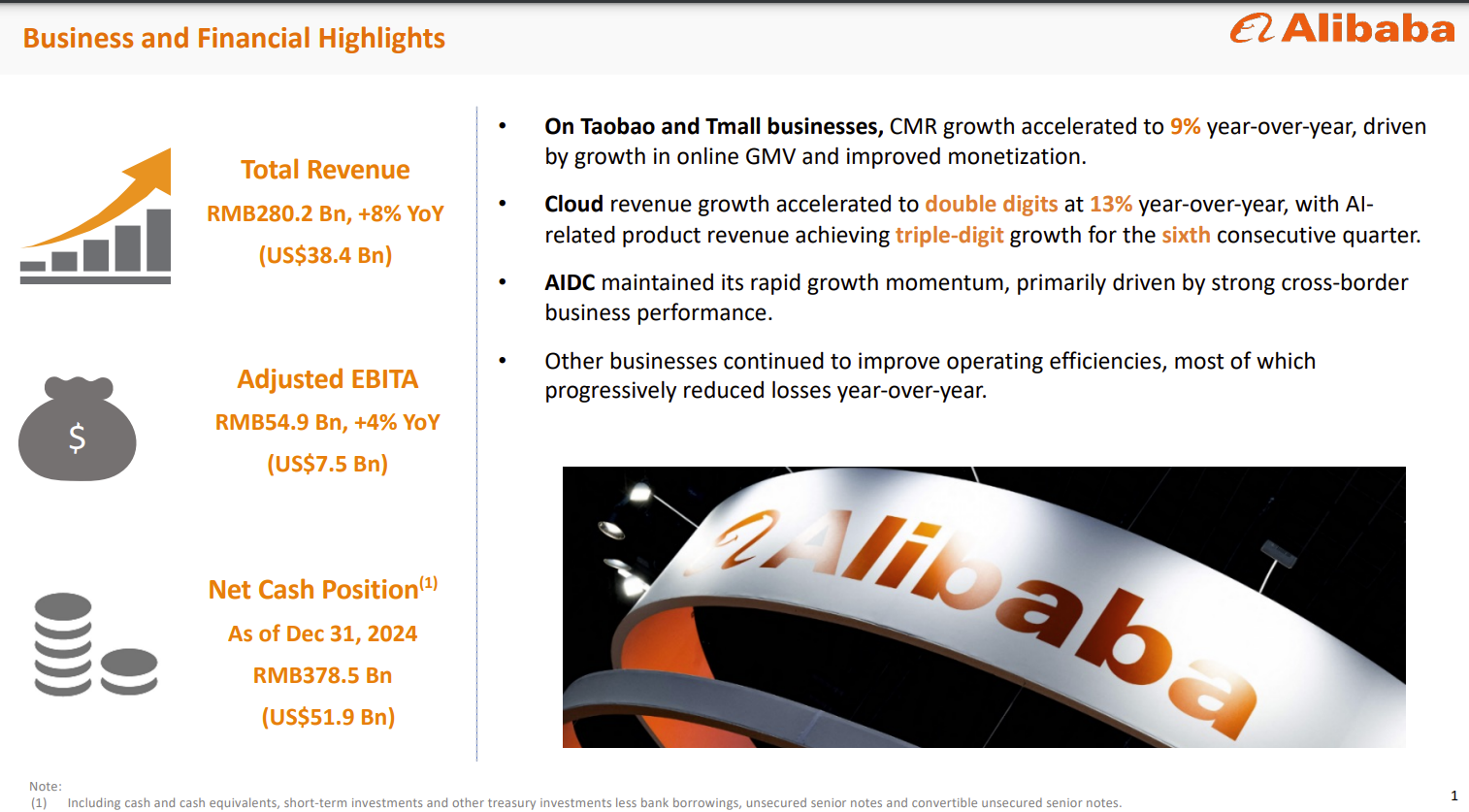

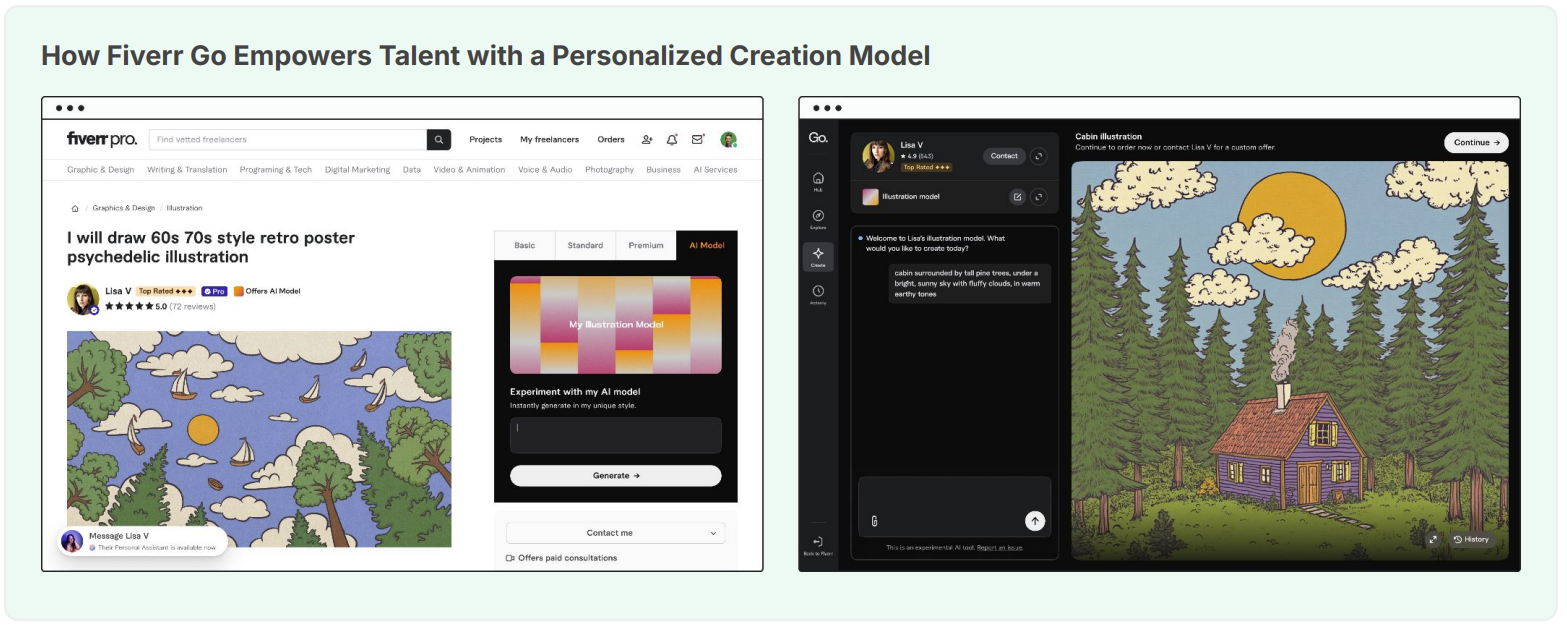

As previously detailed, SaaS vendors are all-in on consumption-based models for generative AI and agentic AI. Vendors are keeping seat and subscription models, but pricing AI usage based on consumption pricing.

With our monthly meeting of BT150 CxOs, consumption models were a key topic. Our CxO call, which is operated under Chatham House rules, highlighted a bevy of puts and takes about SaaS consumption models. Here's the breakdown:

Potential benefits

- Cost efficiency and scalability. A few CxOs noted that consumption models force enterprises to get savvy about only paying for what they do. As a result, these companies can avoid overprovisioning. Consumption models can be more cost-effective in unpredictable usage scenarios.

- Forced efficiency. If you don’t want nastygrams from your CFO, CIOs are likely to monitor and optimize usage. Consumption models force efficiency relative to three-year contracts.

- Price and performance alignment. With consumption models, IT costs can be better aligned with business success. When usage is high, costs increase and in downturns you’ll get a break. A consumption model allows software pricing to mirror utilities like water and electricity.

- Consumption models enable AI and genAI adoption. As AI usage varies significantly, consumption models enable dynamic scaling rather than committing to rigid, high-cost contracts that would restrict usage. Also see: BT150 zeitgeist: AI, efficiency, vendor angst and finding the right IT structure | AI agents bring consumption models to SaaS: Goldilocks or headache?

Challenges of consumption-based models

- Unpredictable budgets. Many enterprises struggle to predict costs, leading to surprise bills. Unpredictable costs were common in the early days of cloud computing adoption. Today, there are far more controls available. CIOs are likely to initially resist consumption pricing due to budgeting norms.

- Unpleasant conversations. CFOs favor fixed pricing to ensure budget certainty. In the early going of AI agent adoption, enterprises may over-budget for consumption, leading to "use it or lose it" spending behaviors. How leaders need to think about AI, genAI | Enterprise software 2025: Three big shifts to watch

- Governance and control issues. Consumption models requires strong cost tracking and governance to prevent runaway expenses. These controls will be even more critical with SaaS vendors because they lack the cost management tools that are common with cloud hyperscalers such as AWS, Microsoft Azure and Google Cloud

- Behavioral and cultural impact on users. One CxO noted that a paradox with consumption models may be that employees avoid using AI due to cost concerns. This defeats the purpose of AI and creates inefficiencies as well as shadow IT. In addition, encouraging consumption may clash with cost-control strategies within enterprises.

- Pricing confusion. GenAI and agentic AI with consumption models may introduce new costs that are difficult to quantify. Vendors are going to shift from seat-based pricing to AI-driven consumption, but customers lack the reference points to evaluate costs. There was healthy debate among CxOs about the likelihood of a cost-plus model (base cost and margin) because it torpedoes traditional software margins. Agentic AI: Three themes to watch for 2025 | Agentic AI without process optimization, orchestration will flop

- Justifying AI returns on investment as well as total cost of ownership. CxOs said enterprises will push to justify returns and it’s unclear whether vendors or customers have the maturity to model returns.

What’s next?

- Standardization of consumption models across SaaS vendors. There is no universal consumption pricing framework that exists and enterprises will struggle to evaluate AI and cloud service costs.

- ROI-based pricing. Vendors are shifting toward outcome-based pricing, forcing companies to justify AI investments.

- CFOs and CIOs need to align. Finance teams need better forecasting tools to integrate consumption models into enterprise budgets.

- Market pushback. Excessive consumption-based pricing may face customer resistance, especially for AI tools without clear ROI.

More from the BT150 calls:

- 2024 in review: What we learned from our BT150 CxOs

- BT150 zeitgeist: AI agent questions, SaaS ate the opex and job woes

- BT150 Zeitgeist: GenAI projects and culture, performance management

- BT150 zeitgeist: Dear SaaS vendors: Your customers are pissed

- BT15O CXO zeitgeist: Vendor procurement, cool projects and margin compression

- BT150 CXO zeitgeist: Data lakehouses, large models vs. small, genAI hype vs. reality

- BT150 CXO zeitgeist: Low marks for SAP RISE, process automation, change management, AI risk

- BT150 CXO zeitgeist: AI trust, AI pilots to projects, VMware angst, projects ahead

- BT150 nominations | 2024-2025 class