Dell Q4 powered by AI servers

Dell Technologies delivered better-than-expected fourth quarter earnings as it continues to see strong demand for AI servers. Shipments for AI servers will hit $15 billion in fiscal 2026, according to the company.

The company reported fourth quarter earnings of $2.15 a share on revenue of $23.9 billion, up 7% from a year ago. Non-GAAP earnings were $2.68 a share.

Wall Street was looking for earnings of $2.53 a share on revenue of $24.57 billion.

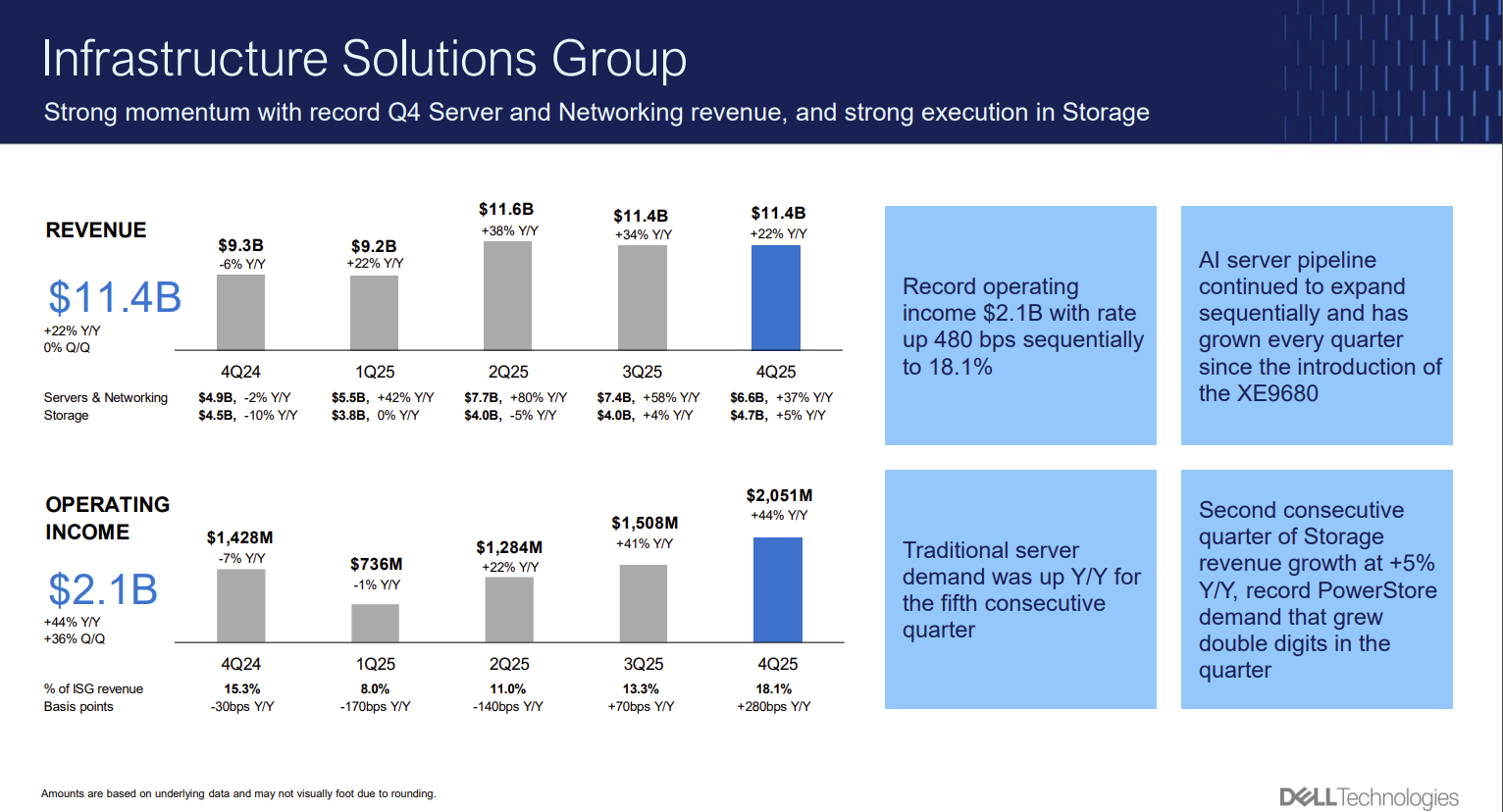

Dell Technologies' Infrastructure Solutions Group delivered revenue growth of 22%. Jeff Clarke, chief operating officer, said:

"Our prospects for AI are strong, as we extend AI from the largest cloud service providers, into the enterprise at-scale, and out to the edge with the PC. The deals we’ve booked with xAI and others puts our AI server backlog at roughly $9 billion as of today."

Dell also raised its annual dividend by 18%.

For fiscal 2025, Dell reported earnings of $6.38 a share on revenue of $95.6 billion, up 8% a year ago.

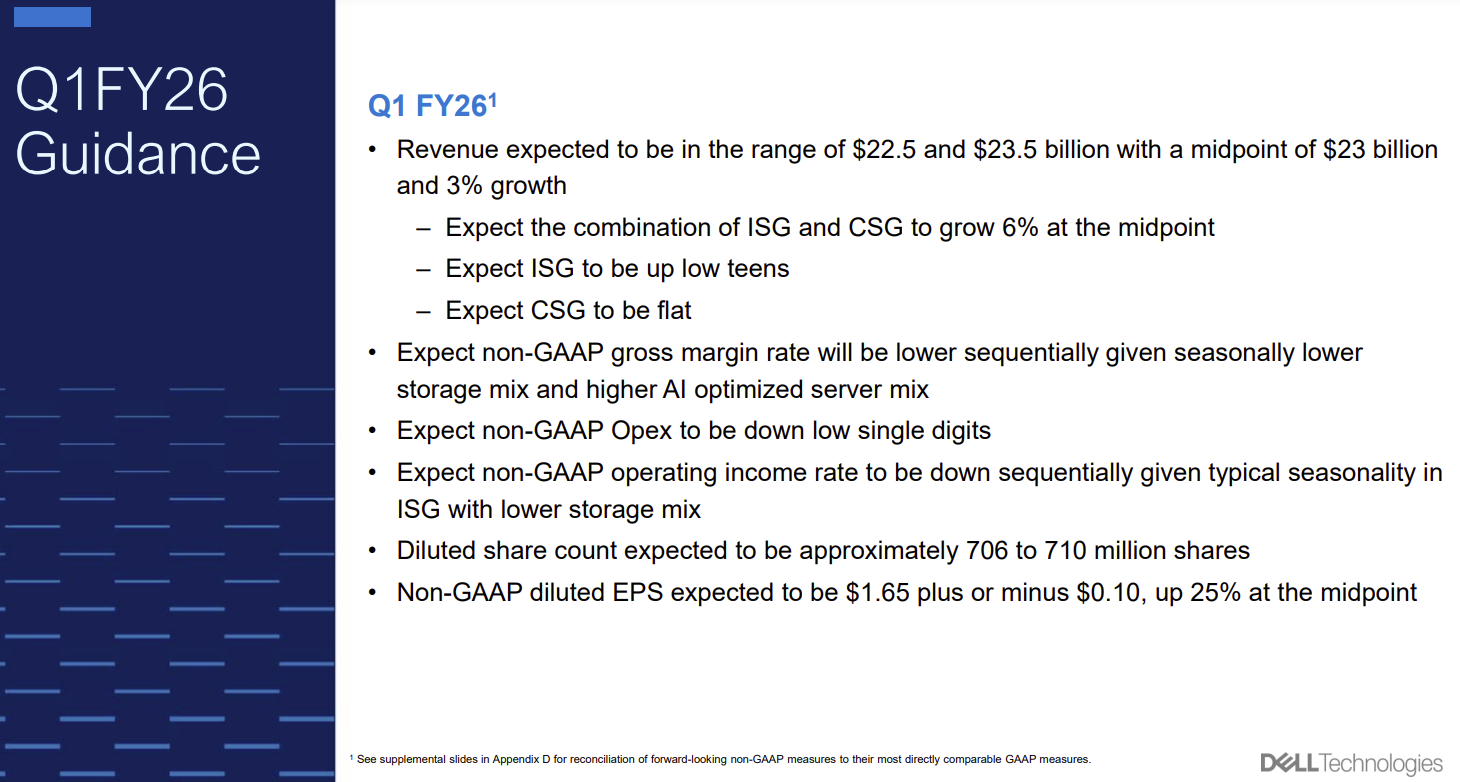

As for the outlook, Dell projected fiscal 2026 revenue growth of 8% to between $101 billion and $105 billion and non-GAAP earnings per share growth of 23%.

Speaking on an earnings conference call, Clarke said:

"We booked deals putting our AI backlog at roughly $9 billion as of today. Our pipeline expanded sequentially and has grown every quarter since the introduction of the 9680. We are seeing continued progress in AI from enterprise customers, albeit still earlier in their journey with sequential growth in both orders and customers. And our engineering services, financing and ability to optimize density and performance per watt are important differentiators for the largest at-scale CSPs and provide very efficient enterprise solutions. In traditional servers, the growth trajectory continues, up double digits in Q4. We've now seen 5 quarters of year-over-year demand."

As for the outlook, Dell CFO Yvonne McGill said:

"IT spending is expected to grow with 3 underlying trends that we see. First, businesses are leveraging AI to enable competitive advantages, and we are seeing that in our opportunity pipeline that continues to expand. Second, data center modernization is well underway with a focus on consolidation and power efficiency. Third, customers are planning to refresh their PC installed base with AI-enabled devices."

By the numbers:

- Infrastructure Solutions Group (ISG) fourth quarter revenue was $11.4 billion, up 22% from a year ago. Annual revenue was $43.6 billion, up 29%.

- Servers and networking revenue in the fourth quarter was $6.6 billion, up 37% due to AI servers.

- AI backlog was $4.1 billion exiting the fourth quarter.

- Storage revenue was up $4.7 billion, up 5%.

- Operating income for ISG in the fourth quarter was $2.1 billion.

- Dell's PC unit revenue in the fourth quarter was $11.9 billion, up 2% from a year ago, with operating income of $631 million. Commercial client revenue was up 5% in the fourth quarter and consumer revenue fell 12%.

Other Dell items worth noting:

US government exposure. "We've had numerous times in our history where a country or a particular segment demand was suppressed for various reasons. We've been able to navigate the cycles, I think, pretty successfully," said Clarke. "Our underlying belief is United States government will need technology. AI plays a pretty significant role in our nation. And I think the demand will materialize. We'll get through whatever is happening today."

Tariffs. Clarke said:

"This is a pretty darn dynamic environment as represented what we heard this morning. It's fluid. We built an industry-leading supply chain that's globally diverse, agile, resilient that helps us minimize the impacts of these trade regulations, tariffs to our customers and shareholders. We've been monitoring this for some time. We've taken our digital supply chain, our digital twins actually using some AI modelling to look at every possible scenario that you might imagine of this country, that country, and restrictions to help us understand how we optimize our network and how we that in the least amount of time at the speed of Dell. And whatever tariff we cannot mitigate, we view that as an input cost. And as our input costs go up, it may require us to adjust prices."

Nvidia Blackwell margins. Clarke said Blackwell margins remain lower than Hopper. "We're still early. The deals are very large upfront. There's more competitors, so it's a more competitive landscape," said Clarke. He added:

"This is system design and architecture work. There's an ability to really distinguish our engineering and value add in that step, which is an opportunity for us to extract value and opportunity for us to reduce cost. These aren't reference designs or as we would affectionately call in the engineering community, they're not cookie-cutter designs. We're designing a unique rack, a unique power distribution unit. Our cooling, our manifold, the cold plate, the ability to engineer that and to drive that through the scale of our supply chain are opportunities for us, helping our customers attach with our networking with our storage or opportunities."

Constellation Research analyst Holger Mueller said it remains to be seen how on-premises AI can boost demand. "Dell manages to beat inflation, but not by much, as its client solutions business is still dragging, with even the commercial business barely clocking in at inflation rate," he said. "If Dell’s ISG business keeps growing as it did in the last fiscal, ISG will pass CSG, a milestone for Dell. Dell became more profitable, with EPS up by almost 40%. AI demand keeps being the main driver. The big question is: How strong will the on-premises AI bonanza be in 2025?"

Data to Decisions Tech Optimization dell Big Data Chief Information Officer Chief Technology Officer Chief Information Security Officer Chief Data Officer

Alexa+ will work with most of the 600 million Alexa devices in the field. Amazon will charge $19.99 a month, but

Alexa+ will work with most of the 600 million Alexa devices in the field. Amazon will charge $19.99 a month, but