Infor, a leading provider of business application software serving more than 70,000 customers, today announced Infor CloudSuiteTM, the first group of industry-specific application suites available on Amazon Web Services' (AWS) cloud. Infor CloudSuite provides beautiful software with deep industry functionality and a flexible, subscription-based delivery model that significantly reduces upfront IT expenditure.

MyPOV – This makes Infor the first enterprise application vendor of size to rely for overall core processes on a public cloud, here AWS. While development and test systems have been available for a long time (e.g. SAP, Oracle, Workday etc.) only very narrow application scopes have been brought to the public cloud (e.g. Infor with its analytical offering on based on AWS Redshift) for production purposes, or their scope has not been too broadly advertised (e.g. Saleforce.com’s Heroku runs on AWS) or it has been only used in very selected scenarios (running SAP, Oracle or Microsoft enterprise apps in production on AWS).

Each industry suite within Infor CloudSuite is built by unifying multiple applications that historically were deployed independently to holistically support core business functions by industry. This core, along with fast and simple provisioning and a SaaS pricing model will enable Infor CloudSuite to change the way enterprise software is delivered to and consumed by customers.

MyPOV – Deep vertical automation is one of the leitmotivs of Infor's products and the company is investing heavily in this area. What Infor is doing is pretty much best practice for anyone out there facing the challenge of building and delivering next generation applications on a public cloud infrastructure. The remarkable part is that Infor is the first - and so far the only - enterprise application vendor to deploy complete transactional application in production on a public cloud (here AWS).

"SaaS today refers primarily to HCM, CRM or another edge application, never to mission-critical business operations," said Charles Phillips, CEO of Infor. "Infor CloudSuite redefines cloud for the enterprise, delivering the first full suite of business applications purpose-built by industry running in a public cloud through Amazon Web Services."

"Customers want help figuring out how to move more of their operations into the AWS Cloud. They want to shift their resources to focus on what they do best, rather than on the undifferentiated heavy lifting of managing IT and complex software," said Andy Jassy, SVP, Amazon Web Services, Inc. "We are excited that Infor is addressing these needs using the AWS platform. Infor CloudSuite on AWS delivers a simplified and enhanced user experience, across a multitude of industries, and provides all the agility, elasticity, and cost benefits of the AWS Cloud to enterprise customers around the world."

MyPOV – No surprise – both Philips and Jassy are excited about this. And the excitement is deserved as Infor becomes the first mover across the large enterprise software vendors to deploy productions systems on a public IaaS like AWS, and AWS gets a lot of enterprise load into their cloud. Enterprise load has been something that AWS wants (and needs to) aggressively ramp up inside of enterprises to not let traditional enterprise vendors (that now have cloud offerings) like IBM, Oracle, Microsoft, HP etc. gather this lucrative business.

Infor will leverage the AWS cloud infrastructure to allow customers to take advantage of Amazon's expertise and economies of scale to access resources when they need them, on demand and with auto-scaling built into the Infor applications. Infor is in the process of consolidating existing subscribers and transitioning current internal infrastructure to the AWS platform. AWS provides services in 10 Regions, with 25 Availability Zones and 51 Amazon CloudFront Edge locations globally.

MyPOV – This is a key paragraph that documents, that Infor has tried to build out its own datacenter infrastructure – but has obviously realized that moving to a public IaaS provider like AWS is better for Infor. And it makes sense – instead of putting CAPEX into data centers, Infor gains critical capital to pore into R&D or acquisitions. From a technology stack perspective that is relatively easy to do for Infor, as it is standardizing around JBoss, PostgreSQL and Linux. All platforms that AWS offers. The argument of ‘no one can run our tech stack better than us’ is no argument for a generic and open source based technology stack that Infor has opted to build its next generation applications on. Experience and scale matter much more here.

"AWS has the best and most advanced cloud infrastructure in the world, providing a delivery model, cost structure, and focus on operational excellence that perfectly complements and enhances our products," said Phillips. "Moreover, the tie between Infor and AWS is strengthened through a common focus on customer experience, rapid-pace of innovation, and standards-based architecture."

MyPOV – Well I am sure other public cloud IaaS may have given Infor a similar overlap – but as Philips mentioned in his presentation at AWS Summit – none of them was as easy and fast to do business with like AWS. And the JBoss, PostgreSQL and Linux stack eliminated many of the other public cloud IaaS providers. And PostgreSQL was also new to AWS, which announced PostgreSQL support at their re:invent conference only last November as beta (and with that it is available to all customers).

The other emphasis needs to be on standards based which is key for Infor’s technology direction – but also for AWS. As long as standards are popular – they are key winners for AWS and enterprise software vendors like Infor.

Infor plans to roll out industry suites, delivered on AWS, throughout 2014, beginning this spring with Infor CloudSuite Automotive, Infor CloudSuite Aerospace & Defense, and Infor CloudSuite Hospitality. Early this summer Infor expects to deliver Infor CloudSuite Corporate, with a core of best-in-class financials and Infor's complete human capital management suite. [..]

MyPOV – Interesting that Infor is delivering Aerospace and Defense offerings so early, an industry ruled by very high security requirements. It could well be thought that using AWS’ cloud offerings was the faster – and potentially even only way for Infor to get a Defense vertical offering out in the first half of 2014.. The true landmark will be CloudSuite Corporate (Financials and HCM automation) – which will appeal to all of Infor’s customers and is slotted to be available mid-2014..

Massive CAPEX Savings

There can be no question that Infor is gaining significant CAPEX savings from the move. Instead of having to build out a global data center and network infrastructure, it can now piggy back on AWS. To a large extent Infor’s move is like Netflix’s move, which opted years ago to use AWS for its streaming (and more) services. Infor’s COO Pam Murphy even looked relieved to a certain point to not have to deal with the compliance and certification anymore (see here interview with John Furrier and team here).

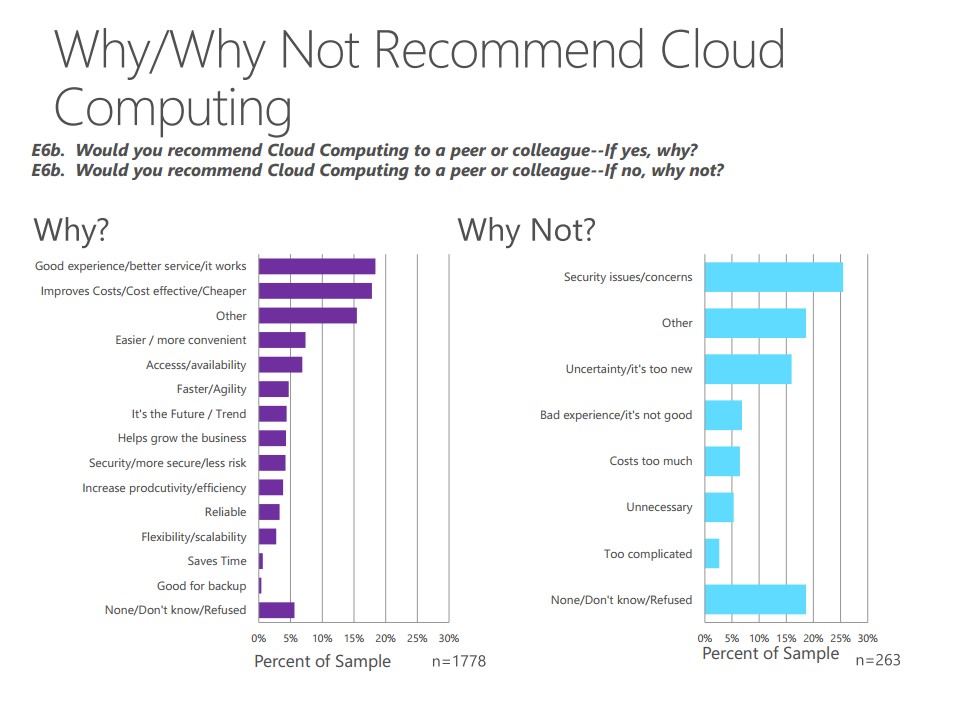

The Security concerns

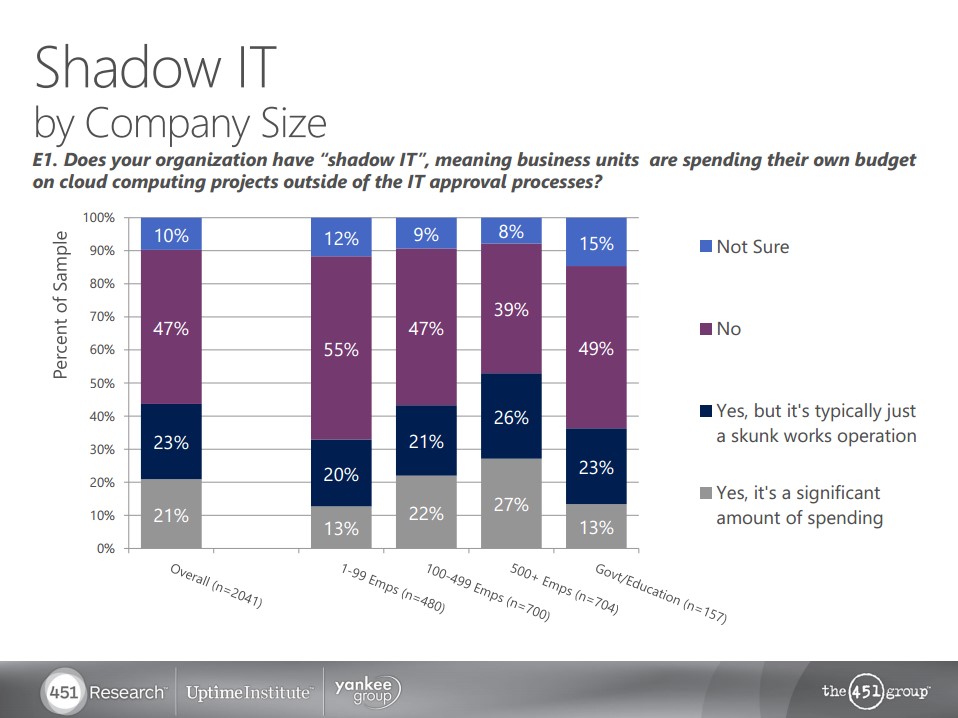

Needless to say when you move core enterprise data in the public cloud, there will be security concerns. Infor has done a good job addressing these heads on with almost a quarter of the information of the CloudSuite website centering on security. Infor even went so far to put the email address of their Information Security Officer, Jim Hoover on the website. Kudos for accessibility. But to a certain point Infor hedges here – as it offers it applications as well on premises, so it’s really the customer who decides at the end of the day. And letting the customer decide is never a bad strategy at the end of the day.

Holistic approach is key

The Infor management team around Philips has plenty of sales execution experience – so no surprise that Infor is equally changing sales compensation plans to motivate its salesforce to move to CloudSuite. A key more to create revenue traction.

Moreover, Infor has involved its substantial 3000+ member partner network that is key to help move install base customer over to the new offering.

And lastly Infor offers a standardized upgrade program with UpgradeX to its customers. For a fixed price Infor will value engineer the move to the cloud, transfer data, train and support customers moving to Infor 10x.

Market Implications

Smaller ISVs with cloud offerings need to take a hard look at the cost of their datacenters and their build out, especially with a global customer base and / or global ambition. Even larger enterprise software vendors like SAP and Oracle will probably need to take a fresh look at their cost calculations.

On the IaaS side AWS has the largest enterprise software vendor on the hook, as Oracle for sure and SAP most likely will go down the path of running their own cloud infrastructure. But as the MDM offering from SAP has already shown, AWS is certainly an attractive option for certain SAP offerings, too. AWS competitors have missed out on one of the largest enterprise software loads out there

Customer Implications

For Infor customers – These customers should take a good look at the CloudSuite offering, as long as functional coverage of CloudSuite vs their existing offering is attractive. Then it comes to security considerations, upgrade costs and overall risk appetite to decide for CloudSuite on premises – or on top of AWS.

For non Infor customers – This is an area to watch. Wait for the offering to mature but then certainly have a look at it. Use the intelligence around the pricing and licensing to ask for similar numbers from your existing enterprise application vendor. If they can be more or less matched, good news, if they cannot be matched – time to look at vendors that can match them, including Infor.

Implications for Infor

Infor has been planning this move for a while, so we can expect that Philips and team know what they are doing. The holistic approach is a key validation point for this. Now it comes back for Infor to execute by delivering what it announced and to create the customer momentum to make this a successful move on the revenue side.

MyPOV

A very good move by Infor, ridding itself of high CAPEX and worries around a global datacenter and network rollout. Infor's commitment to an open source stack is another key piece of its strategy to disrupt its main competitors (SAP, Oracle), reducing and challenging their steady technology license streams.

And a key win for AWS on the enterprise side. If both Infor and AWS deliver, not only SaaS by accident, but SaaS on AWS by accident (customers buying CloudSuite and with that run on AWS) will happen – nothing better can occur for AWS. So definitively an inflection point – not a hot air balloon – as long as Infor can create the commercial success and execute on its ambitious product roadmap.

- Inforum 2013 – Takeaways from the Keynote – Day 2 – read here.

- Infor’s bet on microverticals – the good, the bad the ugly – read here.

More about AWS: - Event Report – AWS Summit in San Fr.ancisco – AWS keeps doing what has been working since 8 years – read here

- AWS moves the yardstick - Day 2 reinvent takeaways - read here.

- AWS powers on, into new markets - Day 1 reinvent takeaways - read here.

- The Cloud is growing up - three signs in the News - read here.

- Amazon AWS powers on - read here.

The next generation of Enterprise Software Applications (

The next generation of Enterprise Software Applications (