Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers,…...

Read more

Application-integrated cloud analytics offerings were announced by Oracle, SAP and Workday this fall. Here’s a closer look at when they’re a good fit.

Applications and analytics have complemented each other for decades, but this fall we’ve seen a fresh wave of announcements about offerings built for the cloud.

The announcements, by Oracle, SAP and Workday, build on larger analytics initiatives they’ve each had in the works for years. At Oracle it’s the company’s next-generation Oracle Analytics (OA) platform, anchored by the Oracle Analytics Cloud. The SAP Analytics Cloud has evolved since its 2015 introduction to become the company’s next-generation product for BI, augmented analytics and planning. Now it’s complemented by the broader SAP Cloud Services platform and a new data warehouse service. At Workday, data and analytics investments have steadily increased from a partnership with Datameer to the 2016 acquisition of Platfora to Workday Rising announcements around its Prism Analytics platform.

Here’s a deeper dive into the announcements along with my take on how to size up the fit you’re your organization.

Analytics for Applications

Reporting capabilities have been tied to applications since the earliest days of the mainframe. Today’s demands for insight are far more sophisticated and, in the latest wrinkle, they must be built for the cloud. Tight integration with applications and cloud deployment are what these three announcements have in common:

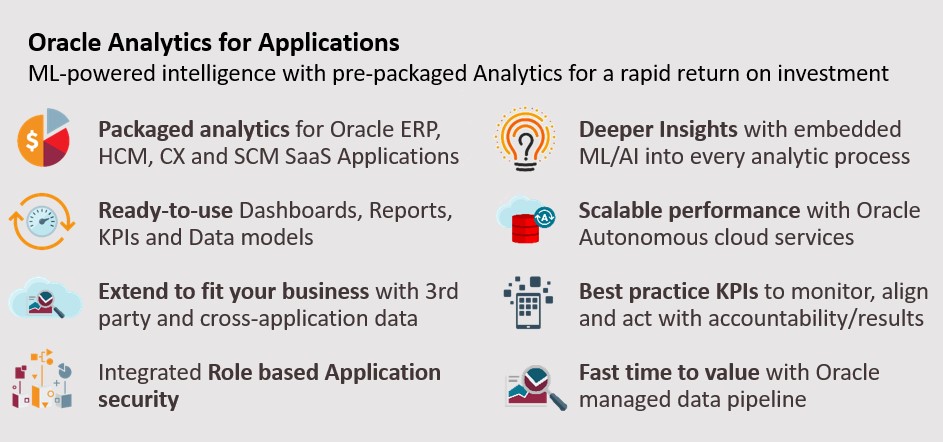

Oracle introduces Analytics for Applications. Announced at Oracle Open World 2019 in September, Oracle Analytics for Applications are SaaS apps designed to complement Oracle Fusion cloud applications. First up is Oracle Analytics for Fusion ERP, which is now generally available. Oracle Analytics for Fusion HCM is expected in Q1 2020 and Fusion SCM and CX and NetSuite are on the roadmap. Under the hood, the the SaaS apps will combine Oracle Analytics Cloud with a bundled instance of the two-year-old Oracle Autonomous Data Warehouse service as well as supporting data models, dashboards and key performance indicators. The data pipeline from Oracle Cloud apps to the Autonomous Data Warehouse is managed by Oracle, and Oracle’s Integration Platform as a Service is also available to move data from third-party apps.

Oracle Analytics for Applications offerings will include instances of the Autonomous Data Warehouse and supporting data integration services.

The minimum per-user, per-month licensing level of OA for Fusion ERP required to get the bundled Autonomous Data Warehouse instance is 20 users. At this entry level the data warehouse instance includes 2 OCPUs (Oracle Cloud Processing Units) and 1 Terabyte of storage. Oracle says this is more than enough capacity for Oracle Cloud ERP deployments of that size. Oracle would, of course, be only too happy to add more users, storage and compute capacity as required, and data-integration services are available to bring in data from third-party sources batch ETL style.

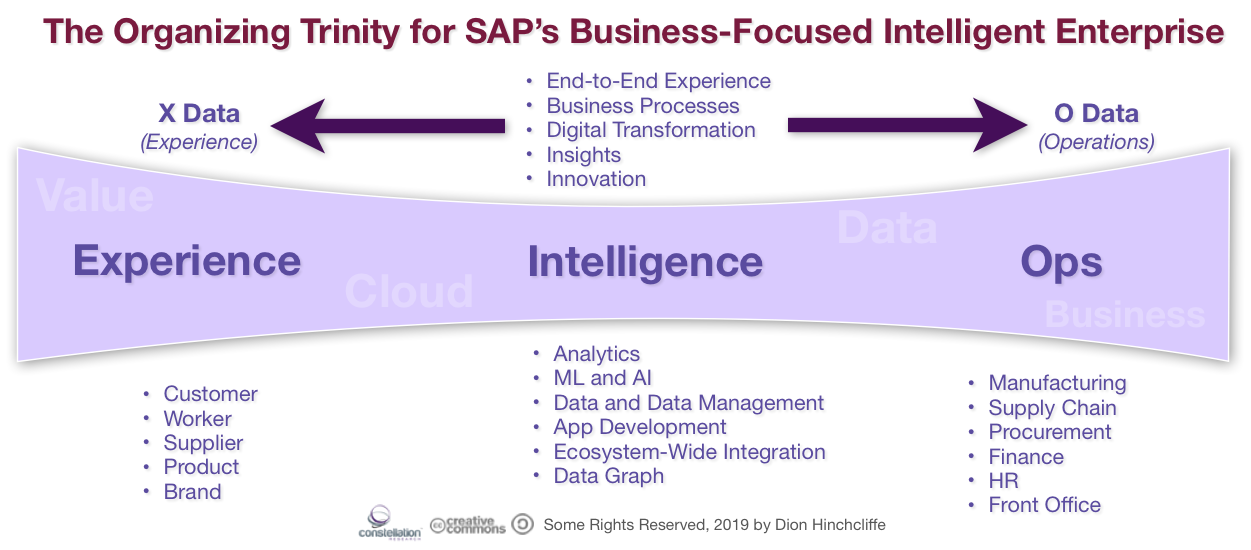

SAP extends its analytics cloud. SAP and Oracle seem to be squaring off with similar offerings and even similar names: SAP Analytics Cloud (SAC) and Oracle Analytics Cloud (OAC). SAP embedded SAC into the user interface and user experience of S4/HANA ERP last year, and it’s currently working on embedding SAC into SuccessFactors. Oracle answered with its OA for Fusion ERP release in September and expects its OA for Fusion HCM release early next year. (One notable difference between SAC and OAC is that planning is an integrated aspect of SAC whereas Oracle offers planning through separate cloud services.)

SAP touts the elastic scalability and hybrid- and multi-cloud-friendly virtual data access of its new SAP Data Warehouse Cloud.

At the October 8-10 TechEd event in Barcelona, SAP announced the general availability of SAP Data Warehouse Cloud, a part of its broader SAP HANA Cloud Services platform, which also includes SAP Analytics Cloud and SAP HANA Cloud. The data warehouse service, which is based on HANA, of course, parallels Oracle’s “for Analytics†combinations with its Autonomous Data Warehouse service. Departing from traditional ETL, SAP Data Warehouse Cloud uses data virtualization and a customer-managed semantic layer approach touted as improving reporting flexibility and virtualized querying across hybrid and multi-cloud deployments without always requiring data movement.

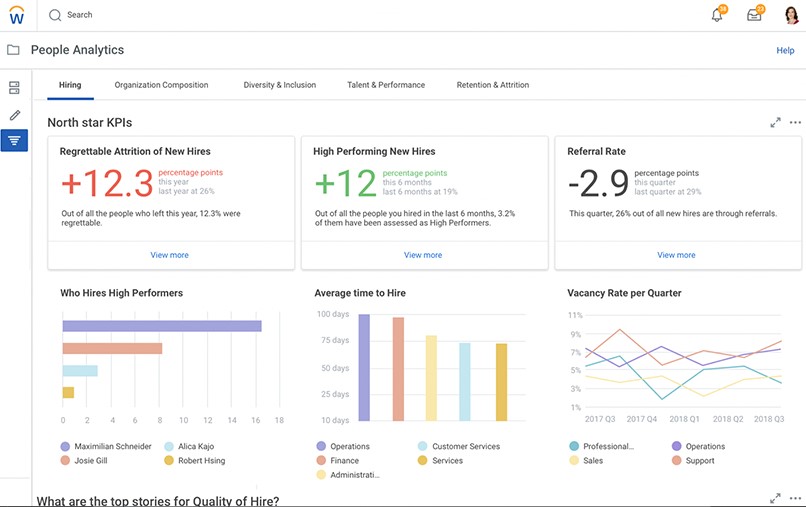

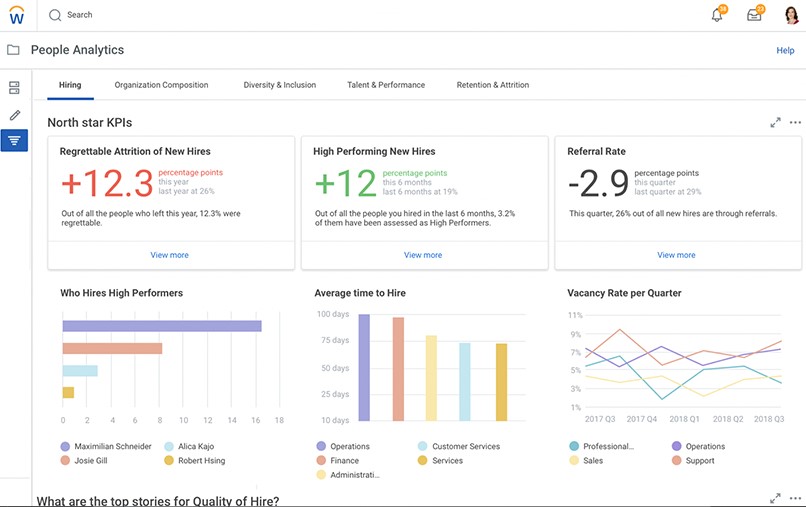

Workday bundles dashboards, adds apps. Workday is taking a different approach, bundling a drag-and-drop, analytic Discovery Board tool with its Human Capital Management and Financial Management applications at no extra charge. The optional, extra-cost offering, announced in October at Workday Rising, will be augmented analytic applications, starting with Workday People Analytics. Part of the appeal is keeping potentially sensitive HR data and (once a finance app is available) financial data within the confines of the security and access-control framework of the related applications.

Workday People Analytics is an augmented analytic app that complements Workday HCM.

Workday’s included Discovery Boards and optional applications are all built on Workday’s Prism Analytics platform, which is a cloud-based data hub. This hub is built on Workday application data, but you can also load third-party data. Prism has big data (non-relational) roots (by way of the 2016 Platfora acquisition), but Workday is adding fast relational querying capabilities by way of columnar Parquet data storage.

My Take on Analytics for Apps

Should your application choices determine your analytics strategy, or are these choices best made independently? In my view it all depends the recency of your investments in analytical tools and platforms and the diversity of your applications and data management infrastructure.

Oracle and SAP both have long histories in data management and business intelligence, and with their respective announcements they’re clearly looking to expand from their beachheads in the cloud. The challenge is that many Oracle Business Intelligence Enterprise Edition and SAP Business Objects customers have already moved on to third-party alternatives. If a customer made the switch some time ago (as in, four or five years ago or more), those deployments may now be aging and vulnerable to replacement. Companies that have invested in rival analytics platforms more recently are far less likely to change course and start fresh on a new platform or split investments on two or more platforms.

The two other factors that might sway analytic investments are commitments to apps and investments in data management infrastructure. All-Oracle and all-SAP shops are less common than they used to be, but the more committed the organization is to Oracle or SAP apps and Oracle or SAP data management options, the more open they will be to OAC or SAC and related application content and warehouse services. If it’s an organization that went cloud years ago and is deep into using RedShift, Snowflake or other cloud-based data management options, I don’t see them going back.

This brings us to Workday, which, in contrast to Oracle and SAP, has a modest heritage in data management and analytics. Thus, it’s taking the sensible approach of giving away its app-integrated Discovery Board capabilities. That will give Workday customers – and particularly their analytics and data management teams — a start on using Prism Analytics. The hope is that these folks will gain familiarity and a comfort level with using Prism and will use it more broadly, perhaps even adding data from external sources. Meanwhile, Workday will be selling CHROs and CFOs on the integrated analytic applications it’s developing, starting with Workday People Analytics. These ancillary applications are designed around business questions and processes (reminding me of Siebel Analytic Apps, for those who remember those).

The Oracle and SAP offerings also have business appeal, too, with the inclusion of application-specific schema, key metrics and dashboards and the availability of industry content. But it’s a stack commitment verses an ancillary app offering. I see the Oracle and SAP offerings as a best fit for companies that are heavily invested in these vendors, and that will use these analytical platforms to meet most if not all of their analytical needs, not just those tied to ERP or HCM. Workday’s is a co-existence strategy with existing data management and analytics investments. What’s available and coming will complement HCM and financials, and it’s not built or intended to serve as broad BI, analytics and data management foundation.

Related Reading:

Oracle Reasserts Itself in BI and Analytics

Workday Unifies Its Approach to Machine Learning, Analytics and Planning

Augmented Analytics: How Smart Features are Changing Business Intelligence

Data to Decisions

Tech Optimization

Digital Safety, Privacy & Cybersecurity

Innovation & Product-led Growth

Future of Work

workday

SAP

Oracle

ML

Machine Learning

LLMs

Agentic AI

Generative AI

AI

Analytics

Automation

business

Marketing

SaaS

PaaS

IaaS

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

finance

Healthcare

Customer Service

Content Management

Collaboration

Chief People Officer

Chief Information Officer

Chief Procurement Officer

Chief Supply Chain Officer

Chief Analytics Officer

Chief Data Officer

Chief Technology Officer

Chief Information Security Officer