Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

Asana projected decelerating growth and is starting a search to replace CEO Dustin Moscovitz, but sees strength for its AI work coordination platform, AI Studio, amid economic uncertainty.

The company is about to make its AI Studio generally available with the aim of coordinating human and digital labor and automating workflow. Moscovitz cited use cases such as using AI to model workflows of SAP process testing, cybersecurity coordination as well as multiple workflows across industries.

"Unlike standalone AI Chatbots or simple task automation, we provide a structured, intuitive framework that both humans and AI can navigate and evolve together. This enables us to deliver AI capabilities exactly where teams work, with the essential context and security controls that enterprises demand. And our power extends beyond our proverbial walls," said Moscovitz. "Our strategy is to be the essential coordination layer for humans and AI across all teams and tools."

Asana plans to build more autonomous capabilities in AI Studio to make work management more adaptive. Asana has integrated Amazon Q Business into its platform for more insights on work.

"Our competitive advantage doesn't depend on owning massive amounts of data," said Moscovitz. "We excel at orchestrating work across multiple AI agents and human teams, managing complex access controls and governance frameworks, and connecting cross-system workflows with enterprise-grade reliability."

The issue is that Asana's fourth quarter was largely in line. The company reported a net loss of 27 cents a share on revenue of $188.3 million, up 10% from a year ago. On a non-GAAP basis, Asana broke even. For fiscal 2025, Asana delivered revenue of $723.9 million, up 11% from a year ago.

As for the outlook, Asana said revenue growth will decelerate. Asana is projecting non-GAAP earnings of 2 cents a share on revenue of $184.5 million to $186.5 million, or growth of 7% to 8%. For fiscal 2026, Asana projected non-GAAP earnings of 19 cents a share to 20 cents a share on revenue of $782 million to $790 million, up 8% to 9%.

The deep dive on Asana is warranted for a few reasons. First, Asana has expanded into non-tech verticals and revenue from those customers were up 15% in the fourth quarter compared to a year ago. Asana's fastest growing verticals were manufacturing, energy, retail and media. That expansion also gives Asana a better view of the economy.

In addition, Asana's AI Studio is consumption-based, agentic AI-led and focused on "human AI coordination." Asana's goal is to have the "definitive platform for human AI coordination." said Moscovitz, who noted AI Studio is seeing strong demand. However, there are growing pains.

My hunch is what Asana is talking about is going to be repeated by other SaaS vendors in the quarter ahead. Customers are growing cautious, agentic AI will be consumption based and enterprises will wrestle with visibility and vendors are going to see lumpiness ahead.

The CEO search. Moskovitz's retirement means that there's a search underway that's just getting started. The search will be internal and external and Asana will be patient about finding the right person. Moscovitz said he's at the helm for the duration. "I really think of the fiscal year ‘26 plan as my plan. And my personal goal is to be able to build the fiscal year ‘27 plan together with the next person," said Moscovitz.

Takeaway: It's unclear whether Moscovitz's retirement will affect buying behavior from enterprises. It’s difficult to replace a long-tenured CEO.

The consumption model. A quarter ago, Moskovitz was very bullish on AI Studio and its uptake. He still is, but AI Studio could be "a solid base hit for the company or it could be a grand slam." He said it has been hard to narrow the range of expectations because Asana doesn't have enough data to forecast the uptake by customers.

Moskovitz said:

"When we've been forecasting internally, we repeatedly come to two specific variables that the model is incredibly sensitive to, but they're actually tiny percents with very large error margins.

So they create big swings in the outcome. The first is how many of our customers are going to adopt AI Studio at all? And generally, how many of our users are potential workflow builders? We've started by approaching our power users, the people who we think make great early adopters. That's going really well. I think we can forecast that now. But there's a much larger potential population of non-power users. And the difference between converting 1% or 3% or 5% of that population is just a massive swing in the model. And it's really going to depend on things like how effective our marketing is and how easy we make it to customize out-of-box workflows."

Asana is moving away from seat-based pricing and offering a credit-based consumption model focused on AI Studio Basic, which all customers have, and a Pro tier that includes credit. Most enterprise software vendors are moving to this seat-consumption hybrid model.

Takeaway: Asana is going to launch self-service for AI Studio and it will be able to tweak the experience and better model adoption. This refrain from Asana is likely to be a common theme from other SaaS vendors moving to consumption models.

Consumption models can be lumpy and customers and vendors will need to be able to model usage. Moscovitz noted that all consumption models are going to be tricky to model. The current approach is vendors and customers are trying to model and average level of consumption. Moscovitz said:

"There's going to be a stratification with a small portion of customers consuming the vast majority of credits, like an 80-20 rule or probably a power law distribution. And I've seen plenty enough to be fully confident we're going to have some of those, as we refer to them, whales. Individual customers paying six figures, maybe even seven figures for consumption by the end of the year. But I haven't seen enough to know whether there's going to be five of those or 50 or even 5,000. So again, massive swing on the model."

He added that Asana's channel network is another swing factor for AI Studio.

Takeaway: What's unclear for Asana, and other SaaS vendors, will be whether consumption whales spread the love to multiple vendors or prefer one or two.

The pricing environment is at an inflection point and enterprises are wary. Asana's Moscovitz talked repeatedly about product, pricing and packaging. Asana is looking for "a menu of options to align price to value." This menu "is specific to both regional and macro dynamics," he said.

"What I've observed in the macro cycle is just more cautious buying behavior and customers becoming more budget conscious. And that means the growth opportunity involved in getting those details right has dramatically increased. The previously inelastic patterns are now more elastic. Customers want a lot more agency in choosing how their budget is leveraged."

Takeaway: Enterprise customers may be able to customize contracts a bit more.

Tech customers vs. non-tech customers and a potential recession. Asana said it has made a lot of traffic with verticals such as manufacturing, but those customers are the ones that are most cautious about adopting something like Asana AI Studio. Non-tech customers will expand Asana's market reach but that cohort is also more cautious.

However, Asana noted that tech customers are also showing signs of caution.

Anne Raimondi, Chief Operating Officer and Head of Business, said:

"Tech is definitely continuing to adjust spend and decision timelines continue to be elongated. We have not seen customer sentiment degrade thus far, but we also appreciate there's just a lot of uncertainty right now and things can and will likely change quickly. We're paying close attention to that in all of our customer conversations. I do think our focus over the last year on diversification and investments in additional verticals like retail, manufacturing, financial services have helped us with kind of steady and consistent growth, especially outside the U.S. But again, we know things could change rapidly."

Takeaway: Note the talk about customers becoming more cautious. Enterprises can't plan with any confidence due to tariff whipsaws, uncertain economic moves and flagging consumer confidence.

Constellation Research's take

Liz Miller, analyst at Constellation Research, said:

"Work management has been a hot space for early interest and experiments with AI in the hope that agentic intervention and process automation could transform work itself. However, as we see from Asana and other players in the space, once the lowest hanging fruit of efficiency and operational effectiveness that can be achieved by, for example, automating the repeatable or mundane, or expanding beyond to address precision automation and decision velocity has been a slower road marked by caution from buyers.

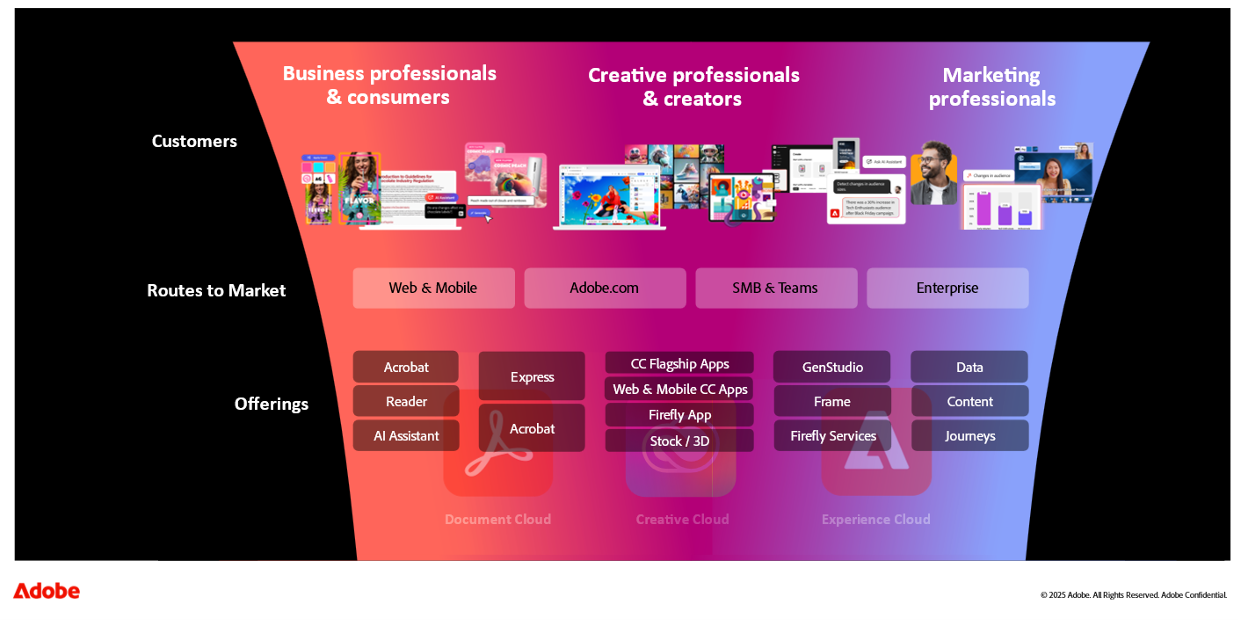

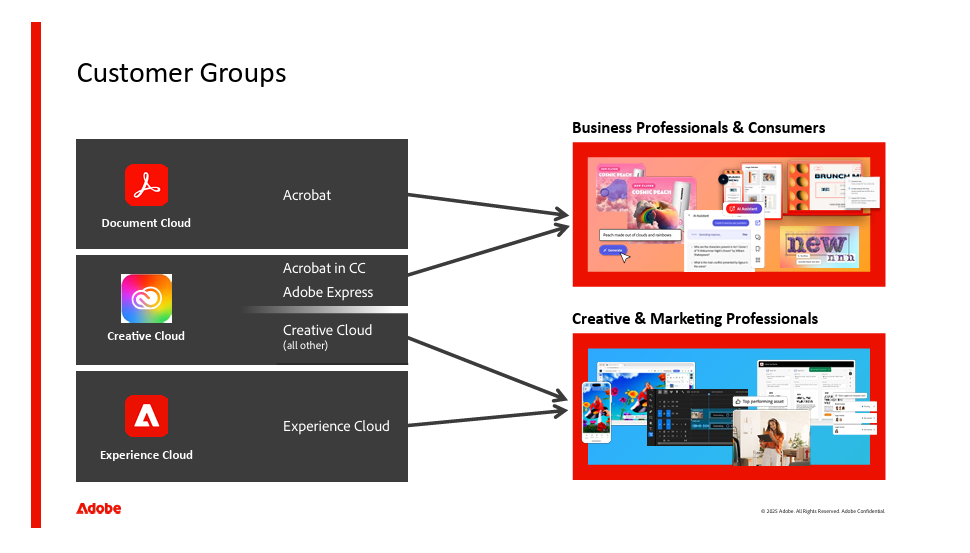

The space is also being challenged by platform players looking to integrate work management and project management into their overarching workflow and work management. For example, Asana is not just facing competition from the likes of Smartsheet that has capabilities across work and project management, but also includes the Brandfolder product for asset and brand asset management. There is also pressure from enterprise platforms like Adobe that arguably knows the work of specific use cases like Marketing just as well if not better than Asana. Work management is at risk of becoming a commodity and not a strategic differentiator…and that is exactly where Asana should be looking to advance the conversation."

Data to Decisions

Future of Work

Next-Generation Customer Experience

Innovation & Product-led Growth

Tech Optimization

Digital Safety, Privacy & Cybersecurity

ML

Machine Learning

LLMs

Agentic AI

Generative AI

AI

Analytics

Automation

business

Marketing

SaaS

PaaS

IaaS

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

finance

Healthcare

Customer Service

Content Management

Collaboration

Chief Information Officer

Chief Executive Officer

Chief Technology Officer

Chief AI Officer

Chief Data Officer

Chief Analytics Officer

Chief Information Security Officer

Chief Product Officer