SAP strikes again - this time it is Concur - and the push into spend management

Vice President and Principal Analyst

Constellation Research

Holger Mueller is VP and Principal Analyst for Constellation Research for the fundamental enablers of the cloud, IaaS, PaaS and next generation Applications, with forays up the tech stack into BigData and Analytics, HR Tech, and sometimes SaaS. Holger provides strategy and counsel to key clients, including Chief Information Officers, Chief Technology Officers, Chief Product Officers, Chief HR Officers, investment analysts, venture capitalists, sell-side firms, and technology buyers.

Coverage Areas:

Future of Work

Tech Optimization & Innovation

Background:

Before joining Constellation Research, Mueller was VP of Products for NorthgateArinso, a KKR company. There, he led the transformation of products to the cloud and laid the foundation for new Business Process as a…...

Read more

It was rumored for quite a while, that SAP may acquire Concur. After SAP acquired Ariba a few years back and Fieldglass this year (we covered earlier

here) - it was only a matter of time till the company would likely acquire again. Earlier this week board member Bern Leukert talked about how SAP is #1 in users and #2 in revenue for cloud based applications. The 700M US$ that Concur has as cloud revenue run rate will certainly bring SAP closer to #1 Salesforce.com. And pushing it's user base to 50M creates certainly a nice cushion, should anybody try to go for SAP's crown of having the most cloud users.

So let's dissect in our unique new analysis stile the press release (you can find it

here):

SAP SE (NYSE: SAP) and Concur Technologies, Inc. (NSDQ: CNQR) today announced that SAP’s subsidiary, SAP America, Inc., has entered into an agreement to acquire Concur. With more than 23,000 customers, 4,200 employees and 25 million active users in over 150 countries, Concur is the leader in the multi-billion market for travel and expense (T&E) management software. With Concur, SAP’s business network – the world’s largest – will transact more than US$600 billion annually, deliver frictionless commerce across more than 25 different industries and address annual corporate travel spend of US$1.2 trillion worldwide.

MyPOV - An impressive increase of market share for SAP in the corporate spend management market. But if you consider that with Ariba and Fieldglass and now Concur, SAP only addresses in total half of the corporate travel market, you realize it is early days in this market category. But SAP certainly is in the pool position now.

The Concur board of directors has unanimously approved the transaction, which is expected to close in the fourth quarter 2014 or the first quarter 2015, subject to Concur stockholder approval, clearances by the relevant regulatory authorities and other customary closing conditions. The per-share purchase price of US$129 represents a 20% premium over the September 17 closing price, a 21% premium over the one month volume weighted average price per share and an enterprise value of approximately US$8.3 billion. The transaction will be funded from a credit facility agreement of up to €7 billion to cover the purchase price, target debt refinancing and acquisition-related costs. The company has undergone an external credit rating process with two agencies. The results of this process will be published shortly.

MyPOV - SAP paid a significant but not hefty premium (Fieldglass wasn't disclosed and Ariba was 20%, too - but 'cheap' at only 4.3B US$) - and let's not even calculate how long it could / would take to earn that amount back... but the real value of Concur is in its established interfaces to the many travel industry providers. If SAP wanted to compete in this space without Concur it would have had to spend a lot of time and money, and the former is in short supply for SAP in regards of moving to the cloud.

“The acquisition of Concur is consistent with our relentless focus on the business network,” said Bill McDermott, CEO of SAP. “We are making a bold move to innovate the future of business within and between companies. With Ariba, Fieldglass and Concur, SAP is the undisputed business network company. We are redefining how businesses conduct commerce across goods and services, contingent workforces, travel and entertainment. With the SAP HANA platform, the possibilities to innovate new business models around Concur and the network are limitless.”

MyPOV - McDermott puts it perfectly. I'd debate the relentless focus with the cumbersome presentation of the Ariba keynote at Sapphire in 2013 (read

here) - but recently the focus has certainly gone up. As spend management has a number of 'higher ground' argument that are attractive to SAP:

- Large user base - As SAP wants (and probably needs) to be a leader in cloud - spend management apps deliver the users. SAP would not have been #1 in users even before Concur if it had not acquired Ariba.

- Stable revenue - SAP wants (and needs) cloud revenues. Spend revenue are stable and have less of a need to keep a salesforce around immediately as other SaaS software categories.

- Little competition - The other SaaS player - including Oracle have little interest in the category - for now. So SAP can acquire avoiding bidding wars (remember Retek?).

- Up sell - Spend management applications are an easy up sell / cross-sell item for the SAP salesforce. Same buyers, more SAP install at the customers.

- Synergies - What companies spend needs to get funded and updated in an enterprises 's Financial and Purchasing systems. SAP owns many of these, so getting rid of an interface and let SAP own it is an intuitive synergy to decision. makers.

“Concur shares SAP’s vision to help our customers ‘Run simple.’,” added McDermott. “Concur cloud solutions are network-based and enable context-aware applications for travelers to use on any mobile device. With Concur, people are given the professional courtesy and ultimate flexibility to make the choices that are right for them. No longer does cost control for companies have to come at the expense of people.”

MyPOV - This fits nicely with McDermott new mantra of 'simple'. And there is a lot of potential to reduce the administrative hassle of travel and expenses. If SAP can really late this simple - very good news. And I like the new People focus in the quote. Note, not employees, but people.

But it is also proof that to create simple application a lot of complexity needs to be handled in the background. To get that right is the 'do or die' for the delivery of simple applications.

“We have always been focused on making solutions for real customer problems, and with SAP we have a great opportunity to advance that mission,” said Steve Singh, CEO of Concur. “We are constantly seeking innovative ways to deliver the best customer experience and we’re excited about leveraging SAP technology, including SAP HANA as we scale globally.”

MyPOV - Nice and wow - already aligned with HANA, that was fast. But does HANA make sense for expense reports? We will see.

Scaling the Business Network

Concur will expand SAP’s business network to reach into the US$1.2 trillion corporate travel spectrum.

Concur has developed an open platform to connect the corporate travel ecosystem, such as airlines, hotels and car rental companies in new and innovative ways.

MyPOV - We need to dig a little deeper here, tough to assess how much work has to be done here.

With the addition of the corporate travel ecosystem to the Ariba and Fieldglass networks, SAP’s business network will have an opportunity to power transactions that drive more than US$10 trillion of global spend annually.

MyPOV - Staggering numbers. But then if SAP could make 1% of transactions (The Apple Pay few, just to throw that out) - it would make only 1B p.a. But there's is more money to be made than process / transaction costs, to be fair.

With SAP HANA, Concur anticipates real-time network collaboration that will reshape the travel value chain, create new business models and eliminate needless complexity confronting millions of business travelers worldwide.

MyPOV - That's a nice vision - but much of travel operated through interfaces of highly proprietary systems. Try to book an airline ticket between 1 and 4 AM for a local airline and you may often be turned away. Maintenance time.

SAP applications touch two-thirds of global commerce; combined with the power of SAP HANA, SAP is uniquely positioned to make the “real-time networked economy” a reality.

MyPOV - A lot has to happen for a real time networks economy. Start with software agents to transact business. Something - at least publicly - of the enterprise software vendors is working.on. And sometimes enterprises need to get comfortable with first.

Achieving Significant Business Synergies

Together the two companies will have more than 50 million users in the cloud — more than any enterprise cloud company — and will be the second largest cloud company by measure of revenue.

MyPOV - Here we go. Has the SAP board incentives in that direction - similar like the 1B user ambition of the past?

Concur has a revenue run rate of more than US$700 million. With its global reach in every country around the world, SAP will provide a global platform to scale.

The majority of SAP customers do not run Concur, presenting a clear opportunity to scale as part of the SAP franchise.

MyPOV - I am sure there are some hefty returns on these two categories in the acquisition cost model.

Only 30% of Concur customers currently run SAP, presenting a dynamic opportunity to introduce SAP innovations to the Concur install base.

MyPOV - That's a little tougher sale, SAP will have to create substantial synergies and can't at the same time risk the openness of Concur for non SAP back ends, unless jeopardizing potential future revenue.

With one of the richest T&E data sets in the industry and the potential of the SAP HANA platform, Concur will deliver unique insight and analytics to business expense wherever it occurs.

MyPOV - Certainly some Data-as-a-Service plans and benchmarking ambitions get new spring in their legs.

With the dominance of the mobile device in travel and entertainment, Concur will collaborate with SAP’s innovation leadership to build network-based, context-aware mobile applications.

MyPOV - Good synergies and the chance to sell a lot of mobile apps. And Apple is a 30% winner. Oh well.

SAP will migrate all its corporate travel and expense management to Concur’s integrated solutions. [...]

MyPOV - This is a key and probably right decision. SAP is well advised not to have the situation it had for HCM products again. But a decision for SAP T&E customers to keep an eye on. Remember a year ago Expenses was SAP's showcase for cloud apps. Time flies in the cloud age.

Implications, Implications.

Let's look at the implications of this market move :

Implications for SAP customers

There key scenarios are in play here:

- SAP customer how don't use SAP T&E and ConcurGood news if they don't use competitor products. Wait and see what SAP will come up with and look at the ROI of a travel spend management and T&E project. If a competitor product(s) is used - then stay where you are. Monitor SAP process and announcements though.

- SAP customers who use Concur Generally good news. Check what contacts say for material change in control. Ensure support and call SAP asap in case there are roadmap dependencies.

- SAP customers who use SAP spend management and T&E appsTime to call SAP asap and get reassurances in operation. Secure potential roadmap items contractually. Monitor carefully what SAP ans to do and be proactive. Use ASUG and other user groups as a forum.

Implications for Concur customers

You have become a SAP customer now. See what SAP will do to reach out to you and chart your course. If unfamiliar with SAP time to join user groups and get familiar. If you have a Concur roadmap dependency secure it asap - best contractually. Better now than when the transaction has close.

Implications for Partners

For implementation partners the market has certainly become larger, so good news. But standing with the respective vendor may change and it's key to come to a strategic decision on the prospects of of this acquisition on your business.

If you are a fulfillment partner check your contracts. Keep or improve conditions. It is unlikely that SAP will try to change the economics immediately - but ultimately they may well try. Be prepared for both cases and balance your provide portfolio.

Implications for competitors

With Ariba and now with Concur, SAP has a jump start in spend management. It's a too large spend of your customers not to have a strategy. Of you had contracts and partnerships with Concur, and you want to maintain that status - then secure contracts. Check Material Control Change clauses. Look for early signals of SAP in regards of heterogeneity plans and ambitions.

MyPOV

A good acquisition for SAP that further builds it's lead in spend management and T&E with the Concur acquisition. I went over above why this is an attractive area for SAP. On the flip side many of these arguments are also the reason why competitors don't want to get in the game (yet). Margins are things. The question is where is a the best return of billions. There it is interesting that SAP finances the deal. No direct rancor for SAP customers asking for a return on maintenance. Good for investors as a 20+ growth in SaaS revenue for SAP is 'baked in' through Concur. Did Concur have a dominating position in the market? I leave this to others.

A good first acquisition for sole CEO McDermott that gives breathing room for product development and quarter end pressure to make year over year SaaS revenue comparisons.

---------

And more on overall SAP strategy and products:

- Event Report - SAP SuccessFactors picks up speed - but there remains work to be done - read here

- First Take - SAP SuccessFactors SuccessConnect - Top 3 Takeaways Day 1 Keynote - read here.

- Event Report - Sapphire - SAP finds its (unique) path to cloud - read here

- What I would like SAP to address this Sapphire - read here

- News Analysis - SAP becomes more about applications - again - read here

- Market Move - SAP acquires Fieldglass - off to the contingent workforce - early move or reaction? Read here.

- SAP's startup program keep rolling – read here.

- Why SAP acquired KXEN? Getting serious about Analytics – read here.

- SAP steamlines organization further – the Danes are leaving – read here.

- Reading between the lines… SAP Q2 Earnings – cloudy with potential structural changes – read here.

- SAP wants to be a technology company, really – read here

- Why SAP acquired hybris software – read here.

- SAP gets serious about the cloud – organizationally – read here.

- Taking stock – what SAP answered and it didn’t answer this Sapphire [2013] – read here.

- Act III & Final Day – A tale of two conference – Sapphire & SuiteWorld13 – read here.

- The middle day – 2 keynotes and press releases – Sapphire & SuiteWorld – read here.

- A tale of 2 keynotes and press releases – Sapphire & SuiteWorld – read here.

- What I would like SAP to address this Sapphire – read here.

- Why 3rd party maintenance is key to SAP’s and Oracle’s success – read here.

- Why SAP acquired Camillion – read here.

- Why SAP acquired SmartOps – read here.

- Next in your mall – SAP and Oracle? Read here.

And more about SAP technology:

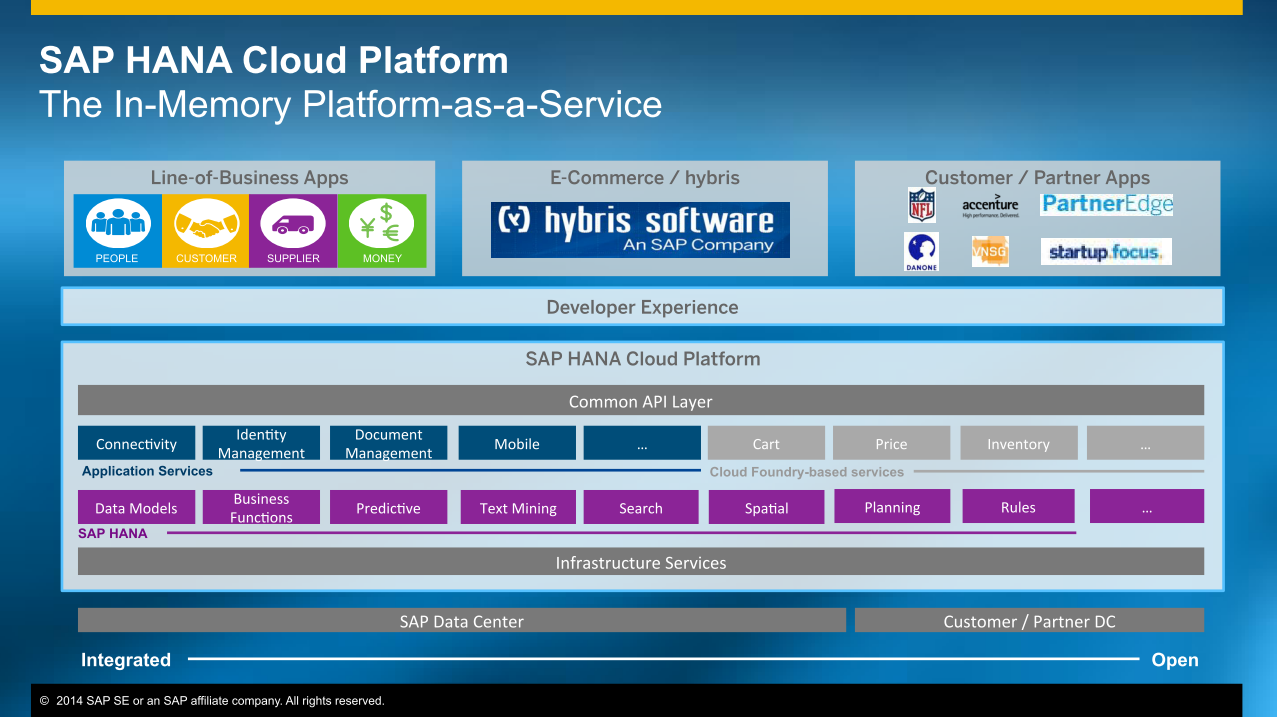

- HANA Cloud Platform - Revisited - Improvements ahead and turning into a real PaaS - read here

- News Analysis - SAP commits to CloudFoundry and OpenSource - key steps - but what is the direction? - Read here.

- News Analysis - SAP moves Ariba Spend Visibility to HANA - Interesting first step in a long journey - read here

- Launch Report - When BW 7.4 meets HANA it is like 2 + 2 = 5 - but is 5 enough - read here

- Event Report - BI 2014 and HANA 2014 takeaways - it is all about HANA and Lumira - but is that enough? Read here.

- News Analysis – SAP slices and dices into more Cloud, and of course more HANA – read here.

- SAP gets serious about open source and courts developers – about time – read here.

- My top 3 takeaways from the SAP TechEd keynote – read here.

- SAP discovers elasticity for HANA – kind of – read here.

- Can HANA Cloud be elastic? Tough – read here.

- SAP’s Cloud plans get more cloudy – read here.

- HANA Enterprise Cloud helps SAP discover the cloud (benefits) – read here.

Find more coverage on the Constellation Research website

here.

2012, 2013 & 2014 (C) Holger Mueller - All Rights Reserved

Tech Optimization

Data to Decisions

Digital Safety, Privacy & Cybersecurity

Innovation & Product-led Growth

Future of Work

infor

workday

IBM

SAP

Oracle

Microsoft

Chief Information Officer

Chief Technology Officer

Chief Information Security Officer

Chief Data Officer