Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

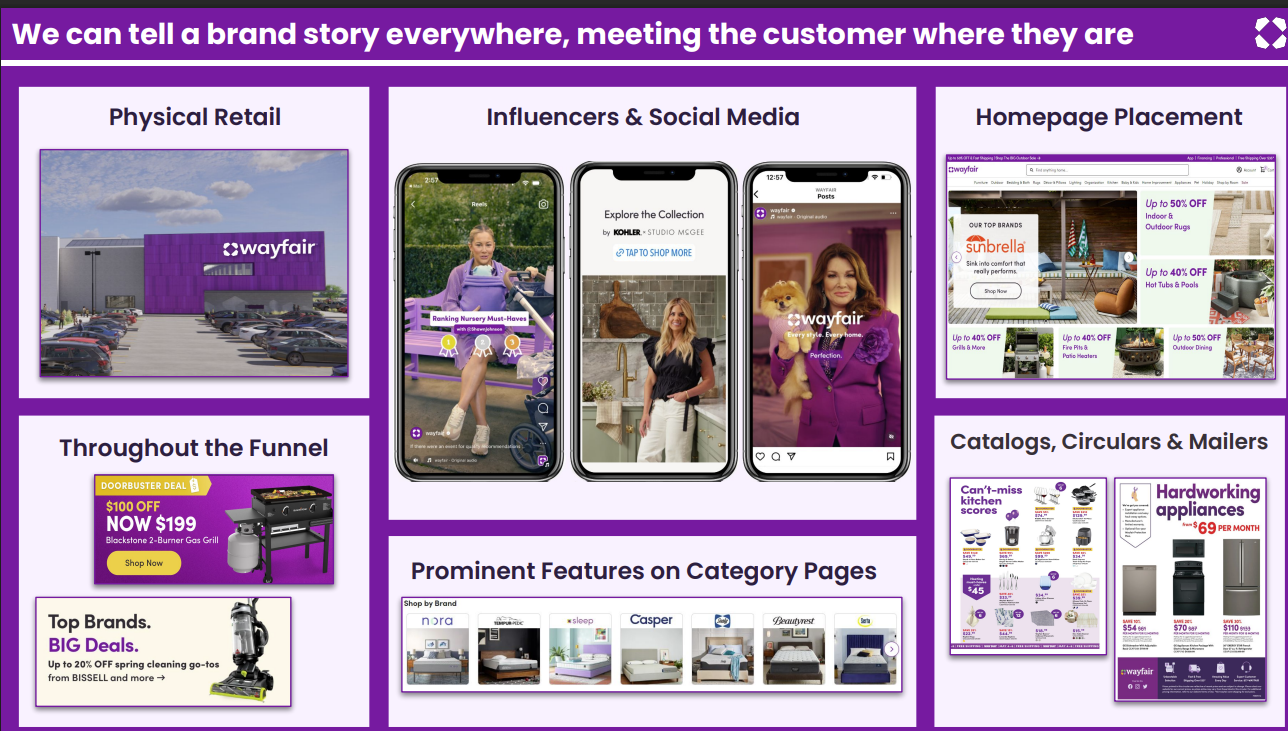

Wayfair plays in a rough neighborhood where it has to deal with tariffs, an anemic housing market and consumer purchasing patterns that were skewed by the Covid-19 pandemic. However, a technology replatforming during that volatility has made it more agile and able to position itself for AI.

The home goods retailer shined this week with third quarter results that handily topped estimates. Wayfair delivered a third quarter net loss of $99 million on revenue of $3.1 billion, up 8% from a year ago. Non-GAAP earnings in the quarter were 70 cents a share, 26 cents a share ahead of Wall Street estimates.

Wayfair had 21.2 million active customers in the third quarter, down 2.3% from a year ago, but was able to increase net revenue per active customers. A big reason Wayfair was able to increase revenue per active customer was that it used technology to help people design and buy easier. Repeat orders were up 6.8% from a year ago.

Niraj Shah, CEO of Wayfair, said the company has benefited from "the groundwork we've laid over multiple years directly driving share capture and profitability despite a category that remains stubbornly sluggish."

Shah added:

"We completed the bulk of our replatforming earlier this year and the timing couldn't have been better as we are in the early innings of a new phase in how customers shop online. While AI has certainly become the buzzword of late, we've been on the forefront of machine learning for a long time, leveraging algorithms to drive everything from pricing decisions to marketing investments. Today, there is new ground being broken with the proliferation and sophistication of generative AI, and Wayfair is a leader in the application of AI in retail."

Simply put, Wayfair doesn’t necessarily need a housing market recovery to thrive.

On the earnings call, Wayfair CTO Fiona Tan, a BT150 member, laid out the company's AI plans. Here's a look at the strategy.

AI as growth engine

Tan said generative AI and agentic AI is central to Wayfair’s next growth phase. The company is leveraging its long history with machine learning (pricing, cataloging, marketing) and is now scaling generative AI capabilities across the customer journey, operations, and supplier ecosystem.

“Our investments in AI are pragmatic and results-oriented centered on three key strategic outcomes: reinventing the customer journey, supercharging our operations and teams, and powering our platform and ecosystem,†she said.

Reinventing the customer journey

Wayfair is transforming the shopping experience into an AI-powered growth flywheel—inspire, engage, learn, personalize—to move beyond traditional personalization.

Key initiatives include:

- Muse: A proprietary AI-powered inspiration engine that generates photorealistic, shoppable room scenes to attract low-intent shoppers.

- Discover Tab: Integrates insights from Muse to create a looping shopping experience that drives longer visits and higher conversion.

- Interest-Based Carousels: Personalize product recommendations based on lifestyle, with future context signals like weather and location.

- LLM-Powered Search & Visual Search: Moves beyond keywords—customers can upload a photo and find similar products instantly.

- AI Assistant & Designer-Quality Recommendations: Combines Wayfair’s designer expertise with LLMs to produce curated, personalized design matches—customers shown these are 33% more likely to add to cart or purchase.

- “Complete the Look†(in testing): Generates full AI-styled rooms using real shoppable items from the catalog.

Operations

AI is being embedded across operations to boost efficiency and accuracy. Here’s a look at the moving parts:

- Catalog Enrichment: Generative AI improves product data quality and consistency, driving higher add-to-cart rates.

- Duplicate Detection: AI identifies redundant listings, cutting manual review costs by 75%.

- AI Customer Service Agents: 24/7 fully autonomous bots handle common inquiries, while human agents use AI copilots with intent-based routing and reasoning models for complex issues.

- Trust & Safety: Multimodal AI detects fraudulent imagery in real time.

- AI for All Employees: Every employee has access to a generative AI license; company-wide Gen AI Innovation Challenge encourages practical AI adoption across departments.

“We’re making AI experimentation part of our everyday culture. Our teams are learning with the same urgency and curiosity we expect of the technology itself,†said Tan.

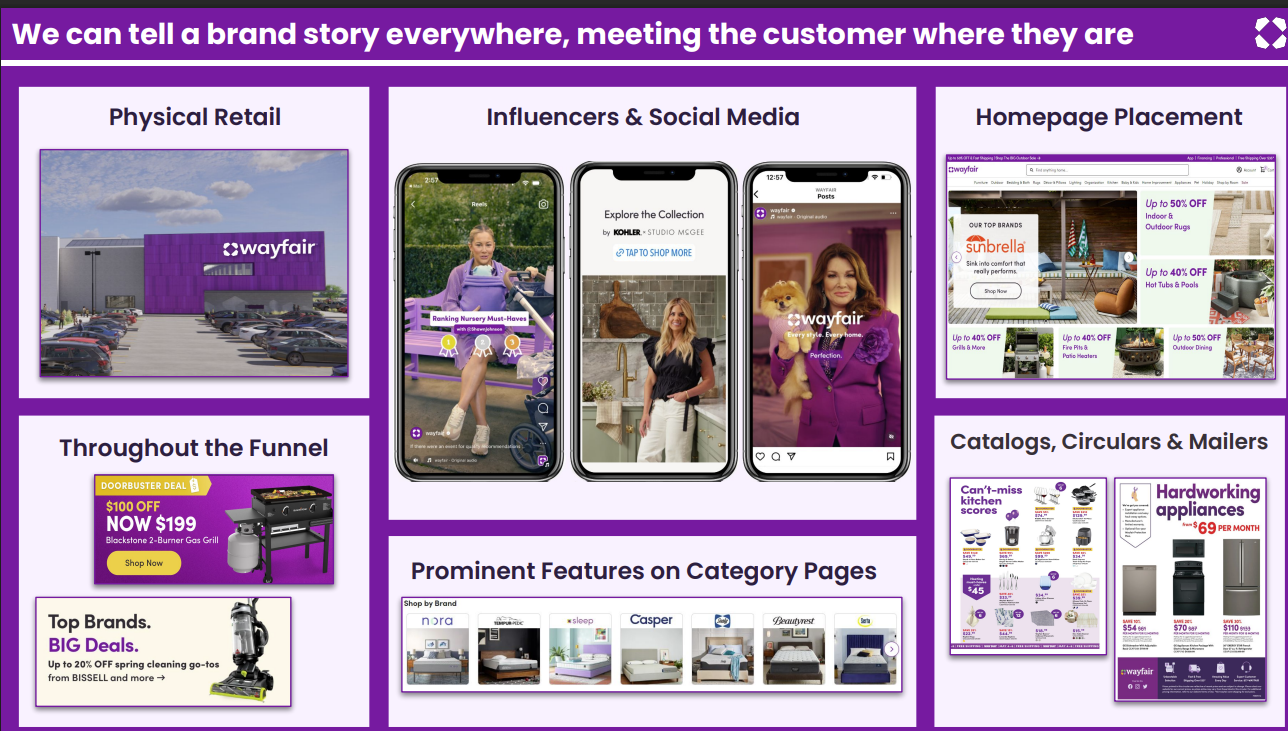

Platform and ecosystem

Tan said the supplier side of the Wayfair marketplace will leverage a series of AI agents as well as generative AI tools. Here’s a look:

- AI Agents for Suppliers: Automate ticket classification and resolution, reducing manual work.

- Generative AI for SEO & Ads: LLMs optimize product titles and ad copy—boosting Google visibility, free traffic, and ad performance.

- Generative Engine Optimization: Ensures Wayfair products are surfaced in AI-driven search and chat platforms.

“We believe customer attention will flow to the most trustworthy API, not the loudest ad,†said Tan.

Agentic commerce

Tan said Wayfair is building a dual-pronged agentic AI strategy that revolves around the following.

- Integrate with AI Platforms (e.g., Google, OpenAI, Perplexity) — ensuring its vast catalog is verifiable, discoverable, and fully transactable within AI environments.

- Strengthen Wayfair’s Own Moats — emphasizing proprietary data, curated catalog, verified supply chains, and delivery reliability.

“Our plan is to make our catalog fully transactable on leading AI platforms, allowing customers to shop with confidence wherever their journey begins,†she said.

If successful, Tan said that AI-driven commerce will serve as a moat for Wayfair. “In a world of AI-driven commerce, retailers with a large, well-detailed catalog, verified supply chains, and deep technology capabilities are advantaged,†she said.

Data to Decisions

Innovation & Product-led Growth

Marketing Transformation

Matrix Commerce

Next-Generation Customer Experience

Sales Marketing

Revenue & Growth Effectiveness

B2B

B2C

CX

Customer Experience

EX

Employee Experience

business

Marketing

eCommerce

Supply Chain

Growth

Cloud

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

Leadership

finance

Social

Customer Service

Content Management

Collaboration

M&A

Enterprise Service

AI

Analytics

Automation

Machine Learning

Generative AI

Chief Information Officer

Chief Marketing Officer

Chief Customer Officer

Chief Data Officer

Chief Digital Officer

Chief Executive Officer

Chief Financial Officer

Chief Growth Officer

Chief Product Officer

Chief Revenue Officer

Chief Technology Officer

Chief Supply Chain Officer

"I know that for so many of you in this room, and not in this room, our federal agency customers, leaders, dedicated public servants and the entire contracting community, this government shutdown is creating profound uncertainty and difficulty," said Dahut. "Your missions are critical. The work you do matters."

"I know that for so many of you in this room, and not in this room, our federal agency customers, leaders, dedicated public servants and the entire contracting community, this government shutdown is creating profound uncertainty and difficulty," said Dahut. "Your missions are critical. The work you do matters."