SAP Q1 solid amid uncertainty

SAP in the first quarter delivered cloud revenue growth of 27% from a year ago with total revenue growth of 12%.

The company reported first quarter earnings of €1.796 billion, or €1.52 a share, on revenue of €9.01 billion. Cloud revenue was €4.99 billion, up 27% from a year ago. Cloud ERP revenue was €4.25 billion, up 34% from a year ago.

CEO Christian Klein said the first quarter results show that its "success formula is working." Current cloud backlog was up 29% at constant currencies. CFO Dominik Asam said the first quarter was "a solid start to the year in a highly volatile environment."

SAP maintained its 2025 outlook, but Asam noted that the company remains "mindful of the broader environment and are approaching the rest of the year with vigilance, continuing to safeguard both profit and cash flow."

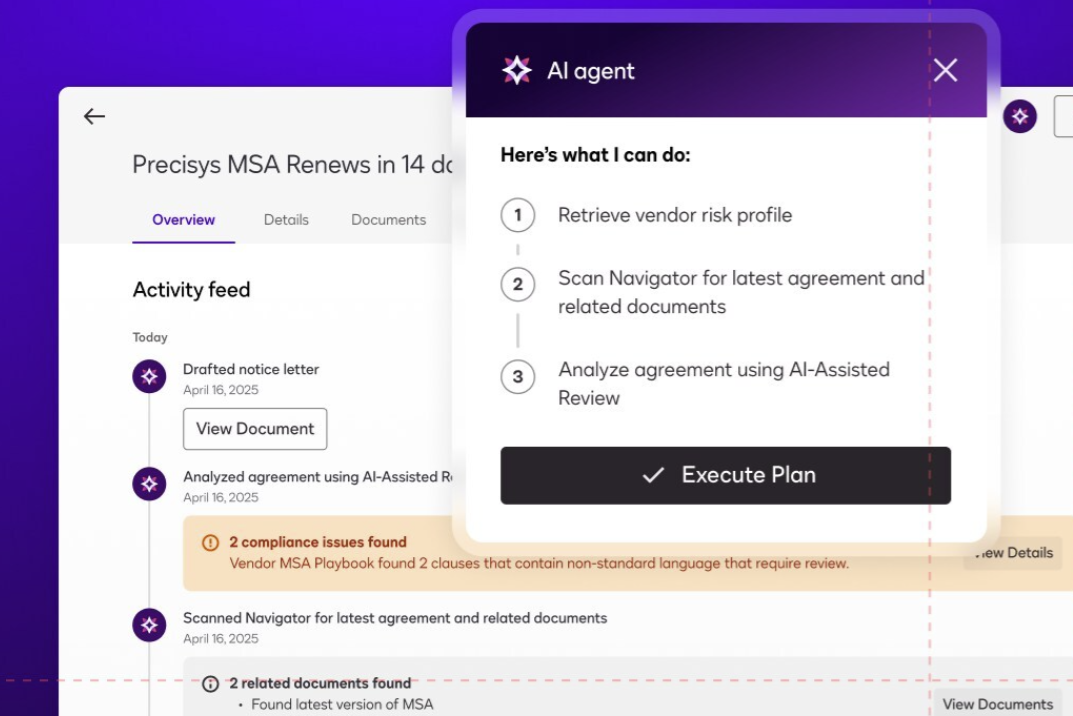

The enterprise software giant added that it is adding customers to its RISE with SAP program including Hyundai and Kia, Mazda, Molson Coors and Tyson Foods to name a few. The company recently outlined the SAP Business Cloud via a partnership with Databricks and a stack designed for agentic AI.

- Hershey finishes SAP S/4HANA implementation: Is it sweet or suite?

- SAP launches SAP ERP, private edition, transition option: What you need to know

- SAP launches Business Data Cloud, partnership with Databricks: Here's what it means

- Infosys sees 'good traction' with SAP S/4HANA migrations

"No one can really predict how the global economy will develop throughout 2025 without any doubt, uncertainty in the market remains high," said Klein, who said SAP's business model is resilient and the pipeline looks strong. "Our globalization team localizes SAP portfolio, including solutions like global trade services management that enables our customers to manage every single global transaction in real time steer their companies in uncertain times. Our customers can run real time financial simulations based on internal and external data."

Other items from the call:

- Klein said Sapphire will include deep dives into agents and core areas as well as "the next chapters of the SAP growth story."

- SAP customers are building use cases around supply chain, productivity and AI and processes such as order-to-cash. Those use cases haven't diminished amid geopolitical risks, said Klein.

- The promise of the SAP Business Cloud partnership with Databricks revolves around customers match SAP data with other system. "This is a real 360 that doesn't require an arm

SAP is also using its own software to highlight returns for customers.

As for the outlook, SAP projected cloud revenue at constant currency of €21.6 billion to €21.9 billion in cloud revenue, up 26% to 28%. Cloud and software revenue at constant currencies will be up 11% to 13% for 2025. SAP projected operating profit excluding items of €10.3 billion to €10.6 billion in 2025. SAP said the outlook will vary depending on currency fluctuations.

Constellation Research analyst Holger Mueller said:

"It looks like SAP is starting to pick up speed convincing its customers to move to the cloud and S/4HANA. AI has come to the rescue for SAP, with customers realizing that with AI they need to run SAP, data and automation in the cloud. The launch of the SAP Business Data Cloud should invigorate the trend. Now SAP of course has to show in Q2 that Q1 was no fluke."

eme.

eme.