Agentic AI: Everything that’s still missing to scale

Agentic AI is entering its next phase of hype as vendor conference season unfolds. Pick an enterprise vendor and you'll hear a keynote that revolves around AI agents.

It's AI agents everywhere. If we created a drinking game every time "agent" was uttered we'd be hammered. The big idea behind agentic AI will come to fruition, but there are more than a few missing elements that need to fall in place.

Here's what is missing from the agentic AI stack today.

Standards. If AI agents live in one platform and focused on one function such as CRM, HR, service, sales they can be useful. However, there are few workflows that live in one data store in control of one vendor. The reality is that these AI agents are going to have to communicate, negotiate, form workflows and execute tasks on their own.

That reality is why Anthropic created Model Context Protocol (MCP), an open standard for connecting AI assistants to systems where data lives. OpenAI and a bevy of others are backing MCP. The need for standards is why Google Cloud also launched Agent2Agent, a communications standard that also has some big backers. These efforts are a nice step toward connecting agents across the AI workflow chain, but more is needed.

Constellation Research CEO R "Ray" Wang noted that AI agent interoperability needs to model itself after HL7 (Health Level 7), which is a set of international standards for exchanging electronic health information.

Another question worth asking via Constellation Research analyst Holger Mueller: Will these AI agent communication and automation standards be based on natural language or API calls or both?

Multi-agentic cross platform agents. That requirement is a mouthful, but without standards in place and vendors focused on agentic AI within their platforms true agents working across platforms remain more about theory. If agentic AI is going to work they have to be horizontal.

There's a reason why early agentic AI use cases and development have thrived at integrators relative to vendors. Integrators core business is working across platforms. Vendors not so much.

- The Future of Agentic AI: Get Ready to Build Your Own Agents With Ease

- Cross-Platform Agentic AI: Infosys Topaz

- Constellation ShortList™ Cross-Platform Agentic AI

What we need to see is interoperability across MCP, Google Cloud's A2A and platforms from the likes of Boomi. In some ways agentic AI is like email back in the day--at first email only worked within a company. Once multiple companies could email new collaboration was opened up.

The end of agent washing. Vendors hopped on the agentic AI bullet train in a hurry. Everything is now agentic. But there's a downside to this marketing bonanza as surfaced by our BT150 CxOs. The downside? CxOs are glazing over at the AI agent claims. These BT150 veterans, who have seen cloud washing, followed by AI washing, followed by agentic AI washing, are noting that RPA may get the job done and note that there are a lot of APIs masquerading as AI agents these days.

- BT150 zeitgeist: Agentic AI has to be more than an 'API wearing an agent t-shirt'

- Enterprise AI: Here are the trends to know right now

- AI agents bring consumption models to SaaS: Goldilocks or headache?

- Agentic AI: Three themes to watch for 2025

Horizontal use cases that can go vertical. While vendors have focused on AI agents that revolve around their go-to-market efforts, the natural progression for enterprises may be horizontal use cases that can form and then deconstruct based on what needs to be done.

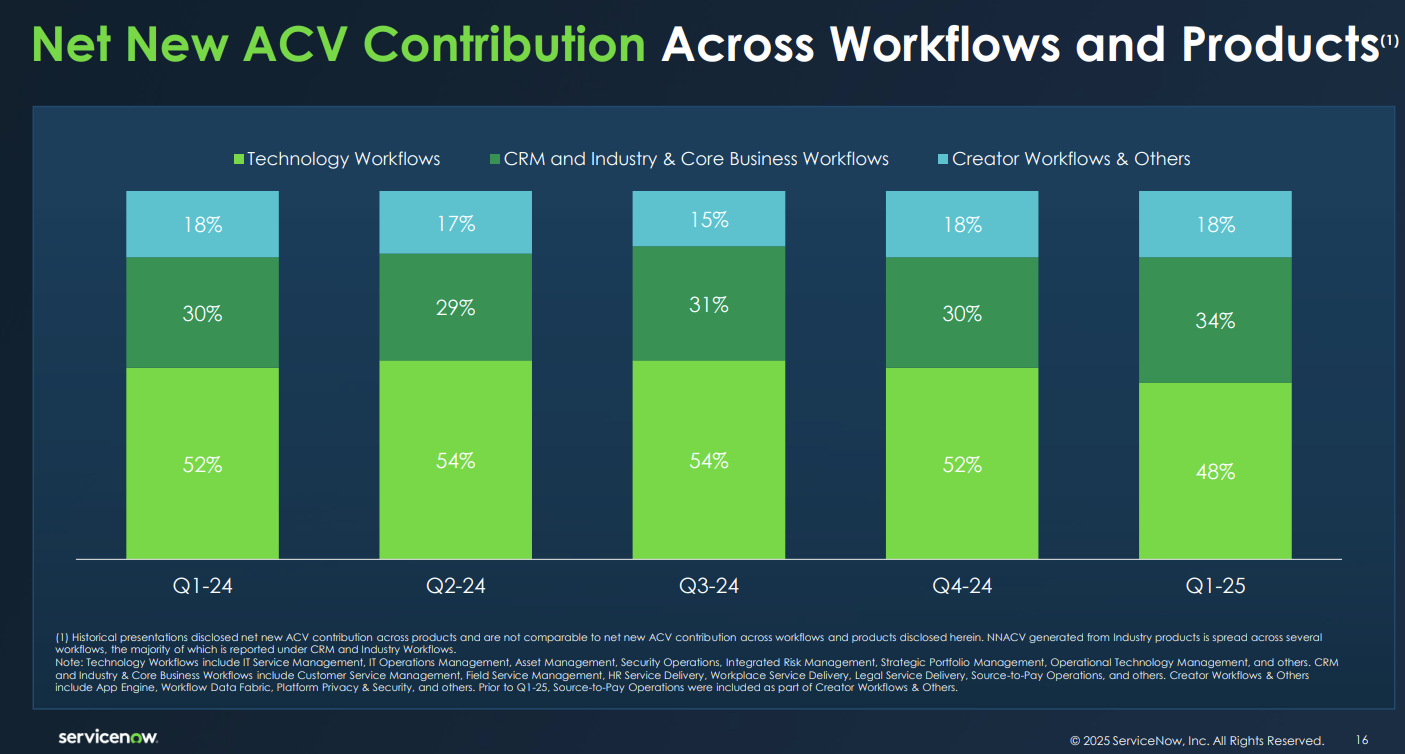

Minimized agent sprawl and lock-in risk. Those realities point to a horizontal approach and CxOs are likely to look to their hyperscale cloud providers as well as cross-system vendors like ServiceNow to orchestrate agents. The value will be in the orchestration layer and neutral vendors are going to be valued.

Data products that are autonomous and can work with agents. To date, the prerequisite of agentic AI is to get your data all in one place--or just a few places. Perhaps that means you'll have just one or two data lakehouses instead of the six you have now.

Here's the problem: Enterprises have been chasing the one data store to rule them all strategy and it hasn't worked. Constellation Research’s Mueller has said enterprises need to get down to a few primary data stores and it's likely you'll still have a data estate that includes SAP, Databricks, Salesforce Data Cloud, Snowflake and hyperscale cloud platforms. If that lineup still sounds like a lot consider that just having four data platforms is way better than the 10 you have now. Congrats!

NextData, a startup led by Zhamak Dehghani, who created the data mesh concept, launched the NextData OS, a platform for building and operating autonomous data products. The idea is that these data products are decentralized and enable you to scale with agents without uprooting your infrastructure. "I hope to change this paradigm and frame of thinking that we have to have the data in one place because the moment you get there it's out of date," said Dehghani. "We want to have one way of getting access to data in a standard way."

Dehghani's company is young, but an abstraction layer and operating system for data that works well with agents and multiple modes of access is on target. NextData's launch webinar featured Mars and Bristol Myers Squibb as customers.

An end to agentic AI storyline that obsesses about humans. To date, agentic AI has been pitched as a way to scale labor. These digital labor pools will complement humans, but also restrain hiring.

Microsoft's annual report on the state of work envisions management roles that emerge to coordinate human and digital labor. Under these constructs, AI agents are mapped to human roles.

That AI agent-as-human thinking may be misplaced. Wang argues that the focus for agentic AI has to revolve around decision trees and automated decision-making. Mapping AI agents to human roles just scales what enterprises do today.

Process knowhow. AI agents are a handy way to handle the process flows that drive ROI. Order-to-cash, procurement, supply chain and other core processes move the returns the most for enterprises.

What's lacking in a lot of these agentic AI pitches is process automation, process mining and intelligence. I've noted before that agentic AI is going to flop without a hefty dose of process.

The focus on process is needed because the biggest question facing enterprises is where do you insert the human in agentic AI workflows? That issue is what unlocks ROI. If you see AI agents as a human labor replacement, you're missing the big process picture.

In the end, enterprises are a collection of human and digital processes that can be optimized and continually improved. Flashy agentic AI marketing isn't going to change that fact.

Data to Decisions Future of Work Next-Generation Customer Experience Innovation & Product-led Growth Tech Optimization Digital Safety, Privacy & Cybersecurity ML Machine Learning LLMs Agentic AI Generative AI Robotics AI Analytics Automation Quantum Computing Cloud Digital Transformation Disruptive Technology Enterprise IT Enterprise Acceleration Enterprise Software Next Gen Apps IoT Blockchain Leadership VR GenerativeAI Chief Information Officer Chief Executive Officer Chief Technology Officer Chief AI Officer Chief Data Officer Chief Analytics Officer Chief Information Security Officer Chief Product Officer