Did Microsoft buy LinkedIn for the contacts?

Former Vice President and Principal Analyst

Constellation Research

Steve Wilson is former VP and Principal Analyst at Constellation Research, leading the business theme Digital Safety and Privacy. His coverage includes digital identity, data protection, data privacy, cryptography, and trust. His advisory services to CIOs, CISOs, CPOs and IT architects include identity product strategy, security practice benchmarking, Privacy by Design (PbD), privacy engineering and Privacy [or Data Protection] Impact Assessments (PIA, DPIA).

Coverage Areas:

- Identity management, frameworks & governance- Digital identity technologies- Privacy by Design

- Big Data; “Big Privacy”- Identity & privacy innovation

Previous experience:

Wilson has worked in ICT innovation, research, development and analysis for over 25 years. With double…...

Read more

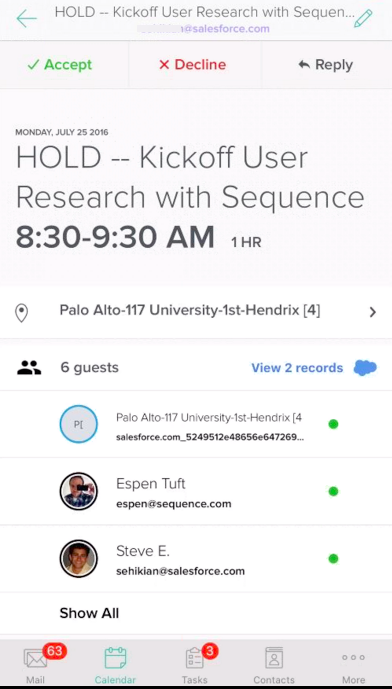

Microsoft turned heads in June when it announced its most expensive acquisition to date, the US$26 billion purchase of LinkedIn. Executives from both companies explained that the deal will lead to richer user experiences in Microsoft’s Office 365 and Dynamics products. Commentators framed the takeover interms of integrating LinkedIn's social graphs into the Microsoft product UX – for example, helping users better prepare for meetings by having Outlook display details of the people you're going to be meeting with.

But that didn't make sense to me. Would Microsoft really spend $26 billon to enhance meeting invitations? And it's not like the privacy-conscious Microsoft is going to try and exploit the contact details, even subtly. So I started to think about how the deep history of massed professionals' career growth could be valuable to a workplace automation leader.

At first glance, LinkedIn is a huge library of career snapshots. For hundreds of millions of professionals around the world, LinkedIn hosts their living resumes, but it’s so much more. For years now, members have curated their LinkedIn profiles, adding new positions, courses, publications and connections. They have given and received endorsements, and shared news and views that matter to their jobs and careers, acting as friendly amateur coaches for each other. LinkedIn has traced all this information in time. Within this dataset are the detailed histories of professionals that do well and others that don’t. The data can reveal characteristics of individuals – their backgrounds, skills, geographies, and associations – which correlate with their career growth. Over time, the graphs can reveal how professional activities, qualifications, and combinations of these affect career trajectories, not just of the individual but of the groups they belong to - their peers, college cohorts, teams, employers, professions and industries.

Imagine being able to track, model and predict which ways of working will do better in the future. Imagine knowing which professional traits confer fitness to survive in different niches in the business ecosystem, and at the different levels of individual, groupm sectors, and regions.

In the old management joke, a worried CFO asks the CEO, What if we spend all this money on training our employees, and they leave? to which the CEO responds, What if we don’t … and they stay? Human resources wisdom runs deep, but so little of it is actually tested. Microsoft can now start to rigorously answer perennial HR questions like:

- What experience and training correlates with sustainable company growth?

- What is the optimum mix of breadth of experience and specialization?

- How does workplace diversity affect business success?

- Does diversity correlate with ideation and innovation?

- How important is proximity to resources, capital, personnel, universities?

- What are the real differences between Gen X/Y/Z?

It remains to be seen how Microsoft will monetize all this intelligence.

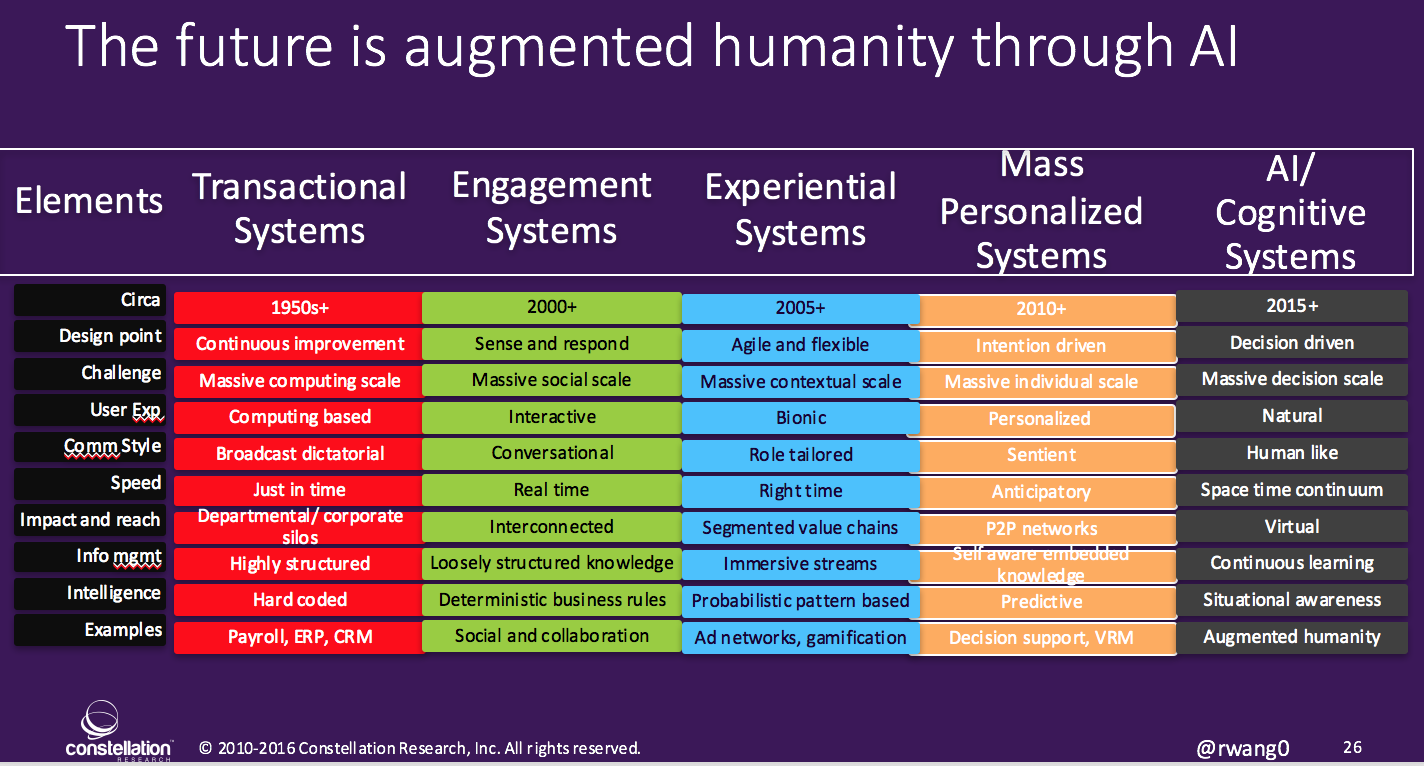

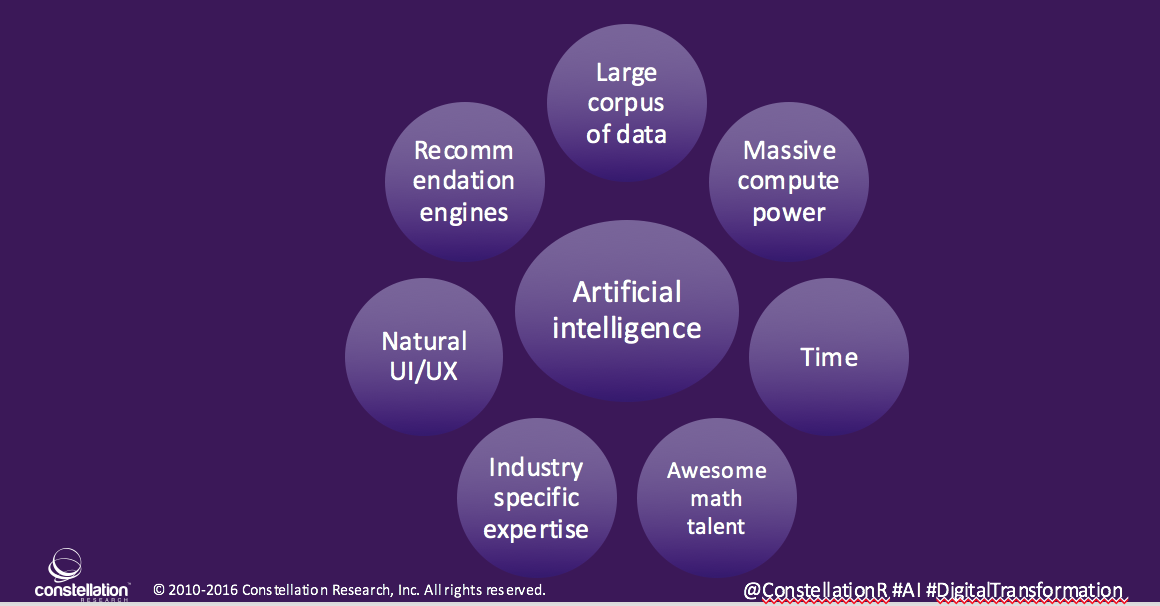

A big idea is that LinkedIn can help Microsoft’s AI projects. One of the great challenges in AI is imbuing algorithms with human sensibilities. Conversation and assistive technologies are key to Microsoft's future, and they can benefit enormously from insights into what makes humans tick in the workplace.

With my terrific Constellation Research colleagues Alan Lepofksy and Cindy Zhou, I've written a new report on the Microsoft-LinkedIn deal. We explore the many benefits for the Microsoft product and service line, and what it means for the future or work.

The report Microsoft Acquires LinkedIn, Shaping the Future of Work is available now.