The state of IoT at the end of 2016; Is the lack of uniformity in solution provision deterring buyers?

Vice President and Principal Analyst, Constellation Research

Constellation Research

Andy Mulholland is Vice President and Principal Analyst focusing on cloud business models. Formerly the Global Chief Technology Officer for the Capgemini Group from 2001 to 2011, Mulholland successfully led the organization through a period of mass disruption. Mulholland brings this experience to Constellation’s clients seeking to understand how Digital Business models will be built and deployed in conjunction with existing IT systems.

Coverage Areas

Consumerization of IT & The New C-Suite: BYOD,

Internet of Things, IoT, technology and business use

Previous experience:

Mulholland co authored four major books that chronicled the change and its impact on Enterprises starting in 2006 with the well-recognised book ‘Mashup Corporations’ with Chris Thomas of Intel. This was followed in…...

Read more

2016 has seen IoT make most of its Business impact as either extensions of existing IT based cost reduction moves, or extending the experience of Industrial Automation deployment. These early IoT adopters all use sensors and sensing to boost their existing operational management capabilities because they can recognize value in this context. But how will the IoT market develop in 2017?

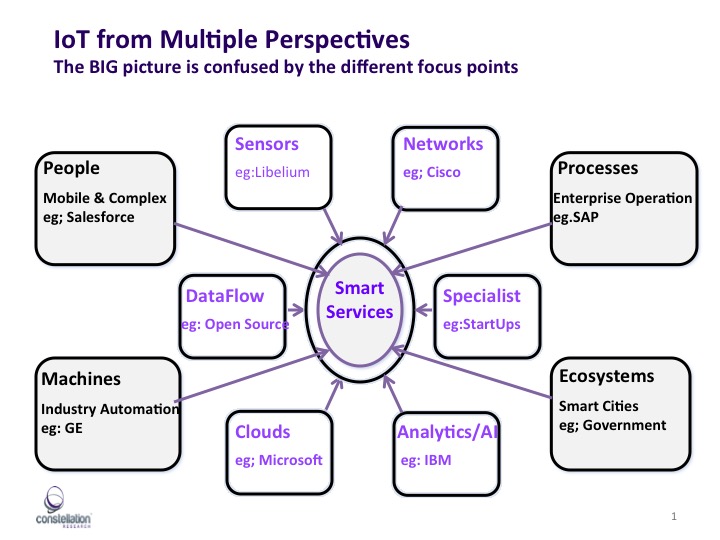

The level of interest in IoT is high with a great deal of events and online content devoted to the topic, but even so levels of recognition and understanding remain very low. Much of what is presented is fragmented around a particular product set, rather than a Business requirement, preventing CxO level management from acquiring a strategic view of the role of IoT in the Digital Services economy.

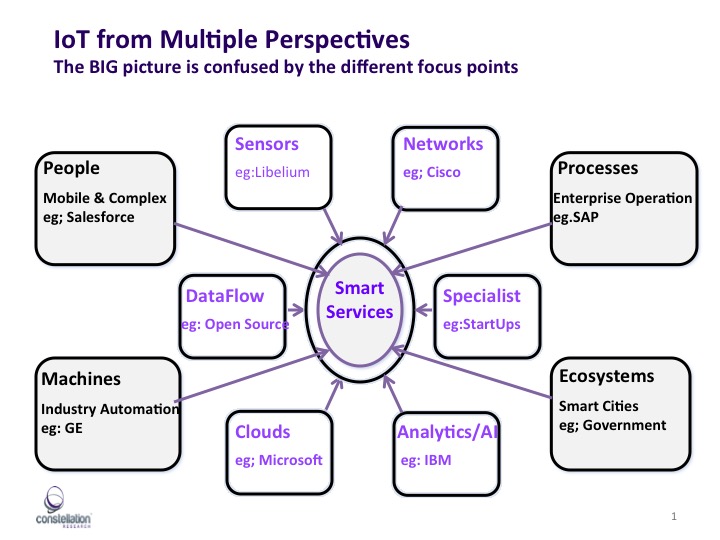

Perhaps even worse it seems as potential buyers are being deterred by the lack of recognizable uniformity in the approach to the same given Business requirement. The diagram below represents the most commonly held understanding by Constellation clients of the various Technology vendors positioning. Black text indicate areas where it was felt IoT business solutions were easier to understand, against purple text indicating a technology that needed to be integrated into a solution.

Widespread Business Adoption requires recognizable Business and Technology models that support clear value at low strategic risk combined with an ongoing incremental adoption path delivering an upward curve of increasing value. Where ever these basic conditions are met then adoption flourishes and the IoT market exhibits this just as much as any other technology market.

Currently Business and Management Consultants identify the future state of Business whilst Technology vendors present the elements, with little to connect the two. Hybrid Management to address the three principle questions is, from either side, in very short supply. The result is that it still early days in the growth curve with the Internet of Things Institute reporting that 19% of Business Professionals had still not heard the term in mid 2016.

In 2014 87% of consumers hadn’t heard of IoT, yet consumer adoption for Smart Homes has been a success story. Almost certainly the answer is products on offer delivered both recognizable ‘value’ propositions as well as integrated low risk home wide extensions. There was no sale of IoT technology, but there was and is some immediately recognizable consumer attractions. So what’s the problem in defining good IoT Business propositions?

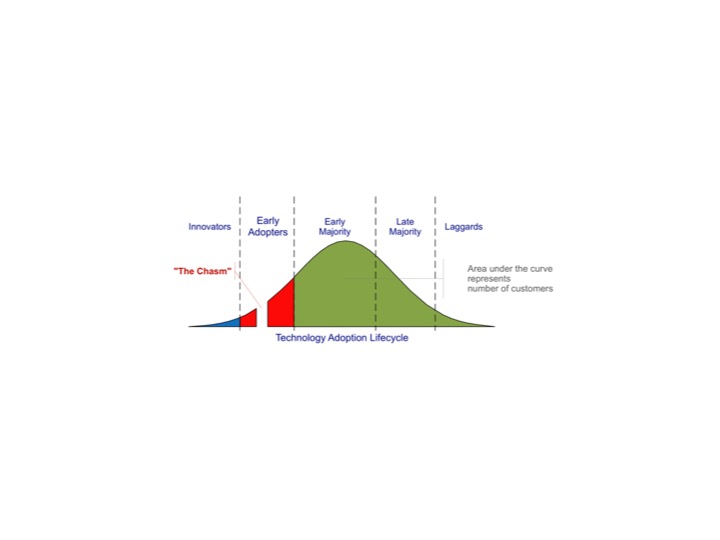

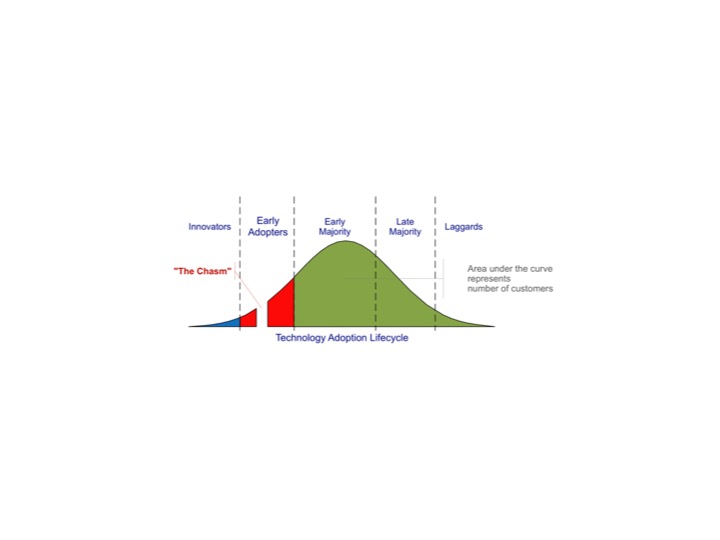

The Business adoption curve of IoT has striking differences, plus one point of similarity, with the previous Internet and Technology waves. The similarity is that consumer take-up around Smart Homes has occurred earlier and faster than Business take-up; think Smart Phones, Web, even the Internet itself. The manner of Technology adoption is usually explained by reference to the classic Crossing the Chasm model to define the stages of adoption by Business.

The initial stage of ‘Innovators’ sets the stage for all later success as enthusiastic start-ups collaborate with technology enthusiastic buyers to establish what works, and how that creates real Business value. The ‘Innovators’ stage ends when consensus has been formed on how to use the new technology for business competitive advantage and the identification of the leading products/startups. This critical stage prepares the adoption case for ‘Early Adopters’, those Enterprises whose culture and business model is driven by gaining ‘first mover’ advantage.

The ‘Chasm is Crossed’ at the stage when the market has become recognized and is growing at increasing speed, usually with one, possibly two, of the initial startups recognized as the low risk vendors. By this point established Technology venders will be starting to enter the market with their versions of the new product, sometimes based on acquiring startups with good technology that have failed for commercial reasons.

The large established IT vendors with their need to train sales and support staff on a global basis need the new market with its business benefits to be clearly defined in order to operate successfully.

IoT simply doesn’t seem to have followed this curve, as the established IT vendors seem to have entered the market at the Innovators stage before the market became clearly defined. Sophisticated products that require large investments are being offered before the Business case is widely understood, and low risk approaches are clear. As the sums involved are larger than innovative Startup projects would have required Early Adopter buyers are wary!

The book ‘Crossing the Chasm’ has much more to offer than its well known Technology Adoption bell curve being a concise handbook on marketing and selling high tech solutions. One of its messages states; “there must be a group of aligned, mutually supportive, technology subsets and products that together constitute the ability to create solutionsâ€. This condition is certainly met, as the first diagram above proves, but the critical point also being made is that the solutions required must have been defined. This is all too often conspicuously absence due to the by passing on the usual ‘Innovators’ phase.

It may be that the sheer size and scale of IoT with its countless ways of impacting business to create value is simply too big to follow a single recognizable adoption path. Certainly there is no doubt that a number of sub markets can be identified and in each there is a dominant player with a recognized value proposition. Does that clarify adoption rates, not always as the following example illustrates.

In the Smart Cities and associated Utilities sub category, Libelium an early innovator in IoT Sensors and Sensing who are now a recognized leader with a global ecosystem of partners and developers. Libelium is a perfect example of a ‘Crossing the Chasm’ startup in the Smart City market that has become a dominant Global player in what is now an early adopter Smart City market. As such it has a fully developed set of solution offerings, even low cost pilot ‘Innovators’ kits.

Some of the Libelium solutions, such as Parking Utilization Management, are now well recognized for their benefits, so mainstream IT players are also offering the same solution as a part of their Smart City transformation. Each vendor suggests that how it is deployed is a consideration of an entire Smart City strategy, and each vendor approaches the key principles of a Smart City in a different technology model.

Consider the offerings of IBM Smart City Solutions majoring on Watson based advanced analytics, Cisco Networking the Smart City, and SAP making Smart Cities Smarter. In each link the technology vendor references Parking Management as a case study, but careful reading indicates that what each believes is the core technology required is, not unexpectedly, different with alignment to their current technology leadership.

All the solutions undoubtedly work well, and have case studies to prove their capabilities. (Interestingly none of the IT technology vendors actually provides the important element of the actual sensors and sensing). The effect on a potential buyer is the confusion of four, (including Libelium), completely different approaches to providing an answer to their apparently straightforward requirement to improve parking space utilization in their Smart City strategy.

Crossing the Chasm takes care to identify this problem confronting buyers and markets stating; "the notion that part of what defines a high-tech market is the tendency of its members to reference each other when making buying decisions-- is absolutely key to successful high-tech marketing."

It is hard not to believe that many potential buyers of Smart City Parking solutions are deterred by the multiplicity of the solutions on offer. Especially when at this early adopter stage of the market there is no general understanding of the technology involved, and the abilities to write a requirement definition are less then fully developed.

Directly similar scenarios can be identified in other sub markets, and in some markets there are additional Technology vendors not coming from the IT market, but from the actual industry sectors. Their proposition is direct and frankly appealing; Trust us as we really understand this Business and our solutions are based directly on experience.

2017 looks to be the start of a new phase in the IoT market as the Industrial Technology vendors start to pit their Business Knowledge solutions against the IT vendors Technology knowledge. Expect to see the new IoT vendors from Industrial Technology making use of their installed customer bases, extensive sales, support and financial capabilities to redefine the Business case for IoT, and very possibly various sub sector market places too.

Perhaps the actions of SAP in announcing a new round of new IT and Industrial Technology vendors partnerships , and GE in signing IT System Integrators to deliver its Industrial Technology are both illustrations of how the IoT market in 2017 will develop!

Got a few minutes? Take Constellation's 2017 Digital Transformation Survey and see how your organization stacks up against others pursuing digital transformation. Constellation will send you a copy of the results.

New C-Suite

Data to Decisions

Future of Work

Innovation & Product-led Growth

Tech Optimization

New C-Suite

Data to Decisions

Future of Work

Innovation & Product-led Growth

Tech Optimization