ConstellationTV Episode 23

I was fortunate enough to be invited to attend and speak at the Refresh 2021 conference in Las Vegas earlier this month. For those who don't know Freshworks, they are a recently public company (Symbol: FRSH) that provides SaaS solutions in the Sales, Marketing, CRM, HR, and IT helpdesk/service areas

My first thought, for a change, Vegas has implemented a mask mandate policy in casinos (gasp!). Every conference venue now conducts vaccination validation and demands a negative Covid test onsite. While the town is back in demand and bustling with crowds, it is good to see these precautions as the covid doesn't seem to be going away any time soon.

At the conference itself, a few things stood out to me. Freshworks touted their ease of use, the total cost of ownership (TCO), return on investment (ROI), and scaling IT with business as their main differentiators. I am actually in the middle of reviewing the Incident Management, ITSM, ITOM vendors currently, and will let you know how they stack up against the competition. But, from what I saw at the conference, it is compelling enough to include them in your evaluation process.

Delivering on Delight

As with most technical conferences, this hybrid conference was well attended virtually with about 20k people joining globally, and with about 200+ in person. The theme of this conference was "delight." The entire line-up, keynotes, panels, and breakout sessions were all centered around how do you delight your customer.

The day started with Stanford Neuroscientist David Eagleman (a Pulitzer nominee) talking about the science of delight. He pointed out that the human brain has 86 billion neurons with 100s of trillions of connections between them. While the delight happens at the neuron level, you can’t control it, but you can feel it, live it, enjoy it! According to him, while it is the conscious brain that makes the decisions, the unconscious brain decides based on the delightfulness of something that is underlying whether it is selecting a partner, a job, a car or a house, etc. A lot of times, the conscious mind messes up by overriding proper decisions made by the unconscious mind according to him. In other words, overthinking at times will only mess things up. You want things to be automated for decision making, fixing, etc. as most times the decisions made and executed by unconscious or automated systems are better than what collaborative thinking can result in.

Everything that is happening in cognition is happening incognito. Decision making such as choosing Pepsi vs Coke, or other decisions of branding decisions are all done incognito. A compelling example is when a charger is priced at $19 vs $29 (a $10 diff) we would be willing to walk a mile to save that $10, but whereas when you buy an iPhone that is $567, we are not willing to walk a few steps to save that $10. The way we make decisions is not rational, but it is based on context – valuing things when they are in different valuation metrics is hard to choose according to him.

More than the price itself, the customer experience, and the context surrounding that sets the value of pricing are more important. The decisions are made based on delighting the customer, it is based on emotions. Total value is much more than just the price or a total cost of ownership, it is based on connected customer experience and the delight that goes with it, according to David.

Girish Carries Forward Humility in All He Does

After David spoke, Founder and CEO Girish took to the stage. I have always admired Girish as he came from humble beginnings. I had a chance to chat with him a little bit when he had a moment.

The thing Girish pointed out was that customer wants "easy." He went on to talk about his experience in dealing with a vendor about replacing a brand-new TV broken in transit and how long it took to replace it even though it was under warranty and the customer experience that went with it. Painful!

He boldly claimed that the first generation of SaaS providers failed. He claimed they focused on re-platforming and reducing technology debt but failed on delivering customer experience. I agree with this thought, though disagree that all of them have failed. He started FreshWorks with a "fresh" view to provide those customer experience and usability in mind. He said he wanted to build something that will be easy about using the software right away instead of waiting for 18 months – the art of delight. You can't argue that.

He said Freshworks was built on five core principles – Modern, Unified, Salable, Intuitive, and Cost-effective – as table stakes and that is MUSIC to customer's ears. I liked the wordplay there!

At the end of the day, it is not just customer satisfaction but the customer experience that goes with it that matters more. In other words, it is not just the end result that matters, but the path to reach it – products and services should delight the customers and not leave them with a painful experience. A real boost in loyalty comes from reducing overall effort or reducing friction in doing business with you.

Freshworks also showed a persona-based live demo on-stage that was compelling. A combination of bots, automation, the collaboration between customer service, IT, warranty, finance, returns to solve an issue in a short time frame was powerful. They chose to demo a fictitious shoe company with a manufacturing defect and how teams can collaboratively handle the issue and take the customer experience to the next level.

The burden on IT is higher than ever to run the business with the remote workforce. Especially with customers used to the delightful experience of consumerization experience of B2C companies, providing an old, clunky, outdated user experience will hurt more than help your business, particularly the online engagement with customers at the channel of their choice.

Girish also said, "Marketing is not about spamming millions of customers with a generic email anymore. It is about sending each customer a highly personalized, individualized offer based on their needs, desire, and timing, and the digital channel of their choice" which I completely agree with.

Amy Purdy Delivers Stories of Personal Triumph

It would be remiss of me if I failed to mention the most compelling closing keynote that I have ever seen. Amy Purdy, a 3x paralympic medalist, talks about how she went from an Olympic-level snowboarder to the brink of death and came back alive again. She talked about turning any challenge into an opportunity by defying all odds. If you are passionate, you can do it! I won't do justice by narrating her story. You can watch it in its entirety here. https://web.cvent.com/hub/events/52b42838-fdea-4731-b8fd-51c212b052b5/sessions/88c63436-e43c-4c1c-adef-35f7efc2b240

Freshworks Platform Delivers on New ITSM/ISOM Capabilities

And finally, my favorite segment – ITSM, ITOM capabilities. They demonstrated the platform on how a business can move instead of being reactive to incidents to being proactive. While they are getting into the crowded AIOps market (I track about 50+ vendors in this space), the correlation engine from multiple monitoring solutions, AI sensing a shopping cart problem and create an auto incident instead of customer/support initiated ticket, ML-powered ticket routing and assignment, figuring out the actual underlying issue, the urgency of it, escalating it to the right person to solve the issue, and thus enabling a faster time to resolution resulting in enhanced customer experience are all making sense in connecting business with IT.

The persona-based demo involved Freddy the AI sensing the customer Phoebe having difficulty in completing the order, and figuring out the underlying issue, creating an auto ticket, routing it, NOC agent Pollack sensing that issue, and collaborating with Ash the on-call full-stack engineer to roll back the updates, and Leslie the CSR finally updating the customer to buy it again. While of course it was staged, it was pretty compelling to see the business and technology come together to support each other. I would love to see that with my vendors, but it feels like the below

[Pic Courtesy: Mark Parisi]

And I can't close this without mentioning my talk at the conference. I went head-on with the legendary Ray Wang discussing ITSM vs DevOps. I have battle scars to prove it! I think it was a great discussion which can be viewed at the following link (registration required).

THE BOTTOM LINE: WHAT DOES THIS ALL MEAN?

I am currently reviewing 11 vendors for my market overview research on Incident Management and FreshWorks is one of them. More details on my research can be found at the following links:

For a Constellation ShortList on incident management, see: Andy Thurai, "Constellation ShortList Incident Management," August 18, 2021.

on incident management, see: Andy Thurai, "Constellation ShortList Incident Management," August 18, 2021.

For more on digital incident management, see: Andy Thurai, "Crisis/Incident Management in the Digital Era," Constellation Research, September 22, 2021.

Andy Thurai, "2022 Trends in Site Reliability Engineering," Constellation Research, October 2021.

Andy Thurai, "2022 Trends in Incident Management," Constellation Research, October 2021.

For a Constellation ShortList on AIOps, see: Andy Thurai, "Constellation ShortList AIOps," August 18, 2021.

on AIOps, see: Andy Thurai, "Constellation ShortList AIOps," August 18, 2021.

Data to Decisions Next-Generation Customer Experience Tech Optimization Innovation & Product-led Growth Future of Work Digital Safety, Privacy & Cybersecurity ML Machine Learning LLMs Agentic AI Generative AI Robotics AI Analytics Automation Quantum Computing Cloud Digital Transformation Disruptive Technology Enterprise IT Enterprise Acceleration Enterprise Software Next Gen Apps IoT Blockchain Leadership VR business Marketing SaaS PaaS IaaS CRM ERP finance Healthcare Customer Service Content Management Collaboration CCaaS UCaaS Enterprise Service Chief Information Officer Chief Digital Officer Chief Analytics Officer Chief Data Officer Chief Executive Officer Chief Technology Officer Chief AI Officer Chief Information Security Officer Chief Product Officer

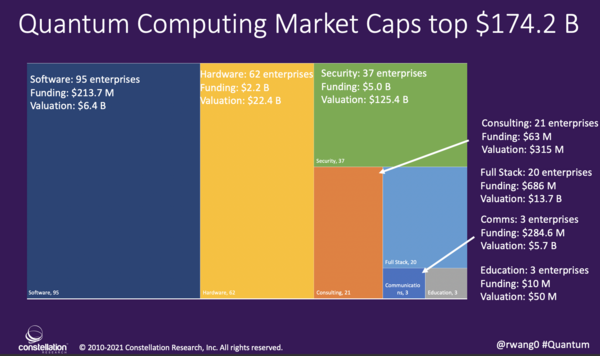

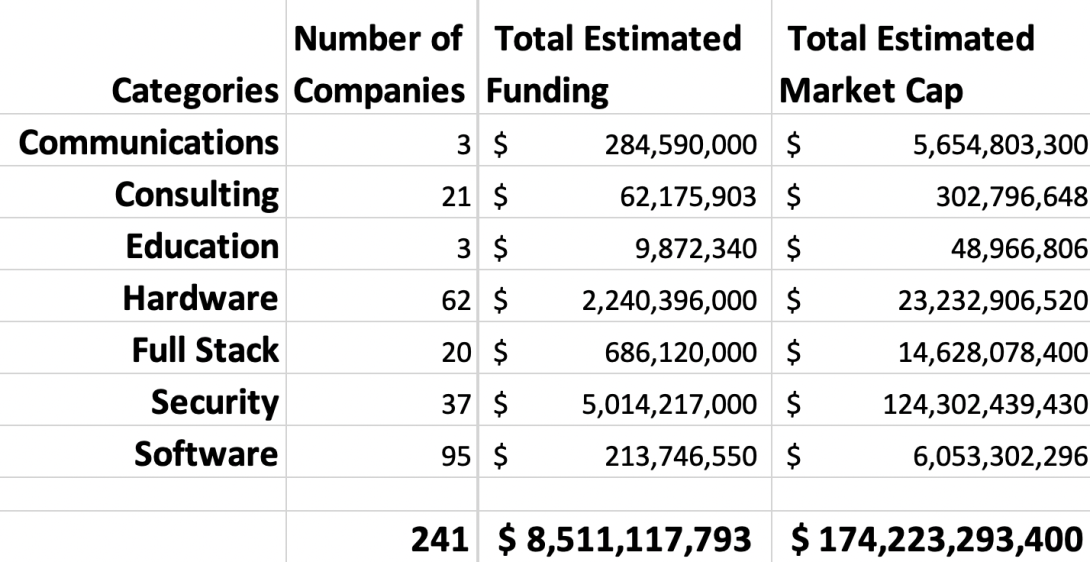

A recent analysis by Constellation Research found 241 companies in the Quantum Computing space in seven categories driving $8.512 billion in investment to date. A review of funding announcements, deals in pipe, and conversations with investors, demonstrated a tremendous appetite to fund all categories of the quantum ecosystem. The funding to date does not include investments from established digital giants such as Amazon, Google, IBM, Intel, Microsoft, and Nviidia.

Across the seven categories, security represented the highest estimated market cap at $124.3 B followed by hardware companies at $23.2B. Full stack vendors who deliver the complete quantum capabilities will drive $14.6 B in estimated market cap. Software came in at $6.1 billion and communications registered a $5.8 B estimated market cap (see Figure 1).

Figure 1. Investors Flock To The Quantum Landscape

Source; Constellation Research, Inc.

The Quantum revolution has begun. Early investors have seen the potential and the market is entering a period of consolidation to acquire talent, intellectual property, and product offering roadmaps. With over 241 startups in this space, Constellation expects at least a dozen full stack winners to emerge along with five to seven specialists in each category and emerging use case. Security will continue to receive the most funding and attention. New players will continue to attract funding as the quantum field advances. The early days of quantum are here and the winners will emerge in the next five years.

What quantum use cases drive your interest? Where do you see the quantum players win?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your strategy efforts. Here’s how we can assist:

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2021 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

Source: Apple

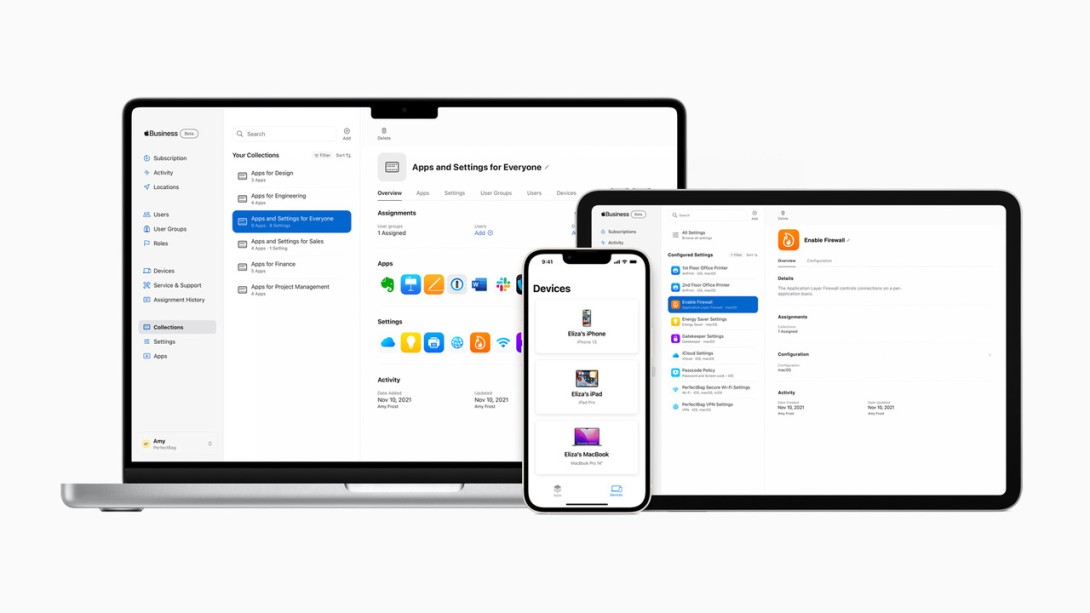

On Wednesday, November 10th, Apple introduced a new business service for companies up to 500 employees. Apple Business Essentials enables organizations to easily add users, onboard users, back up information, secure devices, receive 24/7 support, repair devices onsite, and manage the device lifecycle for deployment.

A new feature known as Collections enables easy configuration of settings and apps for the Individual user, group, and/or device level. Further, IT personnel can automatically push Wifi passwords, VPN settings, and make downloaded apps available to employees who sign in to a personally owned or corporate devices. As a result, this new service makes it possible for organizations to enforce security policies and critical security settings such full-disk encryption, privacy of personal and work data, and the ability to lock out lost or stolen devices. In conversations with technology executives with Apple shops, they are looking forward to the 4-hour or less onsite repair capabilities starting with the iPhone.

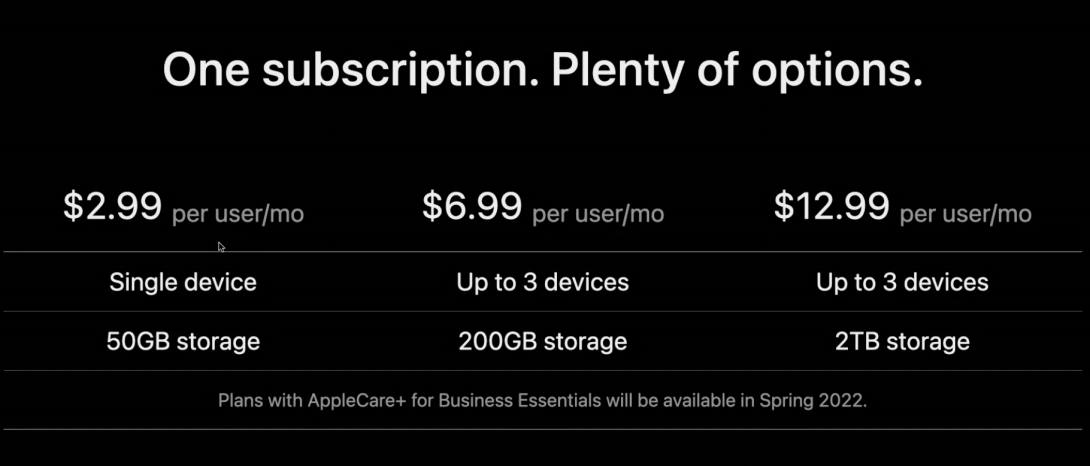

Apple is offering three Business Essentials plans that vary by number of devices and amount of storage (see Figure 1). Organizations can also add optional AppleCare+ to their existing plans.

Figure 1. Three Levels Of Apple Business Essentials Pricing Reflect Usage Based and User Based Pricing

Technology executives in the mid-market face constrained staffing and seek ease of use in adding and on-boarding users and devices; while enabling flexible technology choices amidst growing security threats. The Apple Business Essentials service offering makes it easy to allow SMBs to scale.

The time has come to recenter our attention and our intention when it comes to omnichannel. We’ve been chasing omnichannel for what feels like decades, repeating an exercise in pushing everywhere yet engaging nowhere. After such a long journey, the idea of even catching up with the expectations of the omnichannel customer can feel overwhelming.

To break this down into a more actionable conversation, I propose starting by admitting what omnichannel is not: Omnichannel is not a destination. It is less about the technical specifications of the various channels of engagement and more about the customers’ decisions about where to engage in their micromoments of need.

Conversely, what is omnichannel? Omnichannel is a promise and expectation. Omnichannel is bidirectional exchange of value. Omnichannel is an agreement between the buyers of services and the providers of those services on what, when, and how value will be exchanged—and that agreement is redefined and reimagined with every engagement.

It is also time to reset and even reimagine what omnichannel can be—and in some cases, already is. Let’s consider an example: the new face of commerce. The COVID-19 pandemic’s brute-force acceleration of digital commerce innovation catapulted consumers from pushing a shopping cart down the aisles of a grocery store to curb-side pickup and home delivery.

The lines that traditionally segmented B2B and B2C buying experiences into neat categories were upended, blurred, and in some cases completely redrawn, thanks to increased direct-to-consumer (D2C) interactions. Everyone started to rethink and reimagine how life around us actually operated, and then expected technology to bridge the gaps between need and possibility. Entire segments of retail, food service, and even grocery launched mobile and digital experiences enabling online shopping with a choice of curbside pickup, in-store pickup, or delivery.

We are also facing the reality that every day seems to breed a new business model or a new challenge to “normal” operations. Take the challenge facing airlines: Under normal circumstances, pricing models were based on historical data, leveraging years of “normal” to best predict and set pricing to achieve optimal revenue. But what happens when historical norms get thrown out the window? There was no historical data that could fit the new normal of pandemic travel. Pricing and the process for predicting pricing models needed to shift, and airlines leveraging platforms that could aggregate known behavioral and event data to predict and optimize price and promotions on the fly (no pun intended) won the trust of the business for optimizing revenue and the trust of the customer for optimizing value.

In B2B, the very concept of what an “experience” should be was quickly being replaced with expectations molded thanks to distinctly B2C experiences. It wasn’t just that the channels of how transactions unfolded were reimagined—entire business models were transformed, demanding new, flexible options for configuring, transacting, and deploying them.

If groceries could be ordered online and delivered, why couldn’t business materials and needs? If toilet paper could be purchased via subscription, why couldn’t training, service, or insurance? If the price of a first vacation could be optimized for both traveler and airlines, why couldn’t the price of software platform configurations similarly evolve?

The pandemic forever changed the expectations for how service and value could be delivered. It forever changed the speed at which business models could transform and shift. And once the pandemic fades into history, the expectations for value, service, and flexibility will remain. Thanks to the past year, key lessons were learned (often by “failing forward”) that should be carried into this new age of reimagined omnichannel commerce.

The time for questioning whether omnichannel is the right path has passed. The reality is that the customer is already well down that road, setting expectations and resetting buying norms. Once we rethink omnichannel, we can actually prepare for what comes next: the onset of the “metaverse”—that not-so-distant future of shared, connected, virtual spaces and persistent experiences across a self-defined and self-perceived virtual universe. And in the metaverse, customers won’t need to wait for organizations to get up to speed with their expectations. They will have already moved on to engage with an organization ready to meet their needs.

Data to Decisions Marketing Transformation Matrix Commerce Next-Generation Customer Experience Chief Customer Officer Chief Executive Officer Chief Marketing Officer Chief Digital Officer Chief Revenue OfficerIt’s official: The Monkeys ARE running the billion-dollar-zoo. Zendesk, a leading customer service and sales engagement solution, has announced plans to pick-up Momentive, the parent to the research and survey disruptor of the 2000’s, SurveyMonkey, for a cool $4.13 Billion. This after the other marketing-monkey, MailChimp, a company of no relation and in a totally different space, was picked up by Intuit for $12 Billion this past September.

While the two primate companies couldn’t be more different, the near-term value for Zendesk and Intuit feet the same: access to new customers to boost revenues. For Zendesk, this near-term motivation is laid bare in the second subhead of their press release: “Combination expected to be growth accretive by 2023 and accelerate Zendesk’s revenue plan to $3.5 billion in 2024.”

It doesn’t get spelled out much more clearly than that. But it’s the long-term vision that has me most intrigued. Zendesk intends to become a “Customer Intelligence” company, and I think they’ve got a pretty good shot.

From the start, Zendesk has been focused on capturing the moments that matter most to a customer—those moments when customers are in need of answers or in need of help. What started as tools for customer service agents to more easily engage with customers has evolved into a comprehensive and predictive platform to bring sales and service closer to the true need, and perhaps even voice, of the customer. For sales and service teams, the Zendesk platform can provide immediately actionable customer understanding in every engagement, including automating next best actions like relevant content delivery or sales follow-ups.

Over the past several years Zendesk has intentionally invested, be it through targeted acquisitions like Smooch (2019) and Cleverly.ai (2021) or through its own innovation and platform advances, in solutions and tools to help organizations be better at having focused, valued conversations with customers. Zendesk has worked to make an organization’s people more productive and effective at conversing with their customers, especially when that means empowering the end customer to help themselves.

So it isn’t that much of a leap to see why Zendesk would start shopping for a means to pull voice more directly into the conversation. With Momentive, Zendesk isn’t just picking up SurveyMonkey, but a slew of smaller pickups along the way that intentionally build broad feedback loops between organization, digital product and customer. This pick up allows an organization to amass a customer-voice-driven profile that is rich with behavioral intention and direct high-fidelity signal from customer feedback…now native (once integrated) to the platform their teams are using to actually engage in sales and service conversations.

And this, at least in my wild world of CX, is where Zendesk has a real opportunity: To connect the dots between a customer’s interaction with an organization and their feedback on how those experiences have landed in one aggregated pane of intelligence and understanding. Today, the intelligence about the customer has been segmented across moments of discovery (largely driven by marketing), moments of opportunity (largely driven by sales), and moments of requirement or need (largely driven by service and support).

These moments, and the rich intelligence they can deliver back to the organization, are too often relegated to the tools and systems they have been collected in. Zendesk has a chance to flip that script by intentionally collecting those signals and feed them back to the front line of customer experience delivery. Today, that front line impacted by Zendesk is largely a sales and service driven picture…but I doubt the company has any intention of limiting their scope there.

New C-Suite Marketing Transformation Next-Generation Customer Experience Chief Customer Officer Chief Information Officer Chief Marketing Officer Chief Digital Officer Chief Data Officer