Agentic AI: Is it really just about UX disruption for now?

Are AI agents going to reinvent workflows, processes, the future of work and enterprise efficiency? Or are AI agents just a better user experience and another excuse to sell you a different flavor of the "suite always wins?" Your answer depends on time frame.

We've detailed how it's early in the agentic AI journey and there are a few requirements needed to scale. It appears 2025 is about standards, protocols, improving AI models and orchestrating agents within the same silo-ed platforms you're currently stuck in. If AI agents go production and drive ROI, it's a 2025 story.

- Lessons from early AI agent efforts so far

- Every vendor wants to be your AI agent orchestrator: Here's how you pick

- Agentic AI: Everything that’s still missing to scale

- BT150 zeitgeist: Agentic AI has to be more than an 'API wearing an agent t-shirt'

The disruption of the minute with AI agents is likely to be about the user experience. When you purchase from your friendly neighborhood SaaS vendor you're buying a data store and often a UI. The enterprise software vendors see this oncoming AI trainwreck and are quickly positioning themselves as platforms with consumption models.

Boomi CEO Steve Lucas said: “I think SAP will always exist. Workday will always exist; Oracle will always exist. Here's the real question. The real question is, how much of that exists in the future? I believe is their UI will go away entirely.”

How would SaaS vendors be valued if they were actually headless systems where enterprises used AI agents to create the user experience? Consider the following developments:

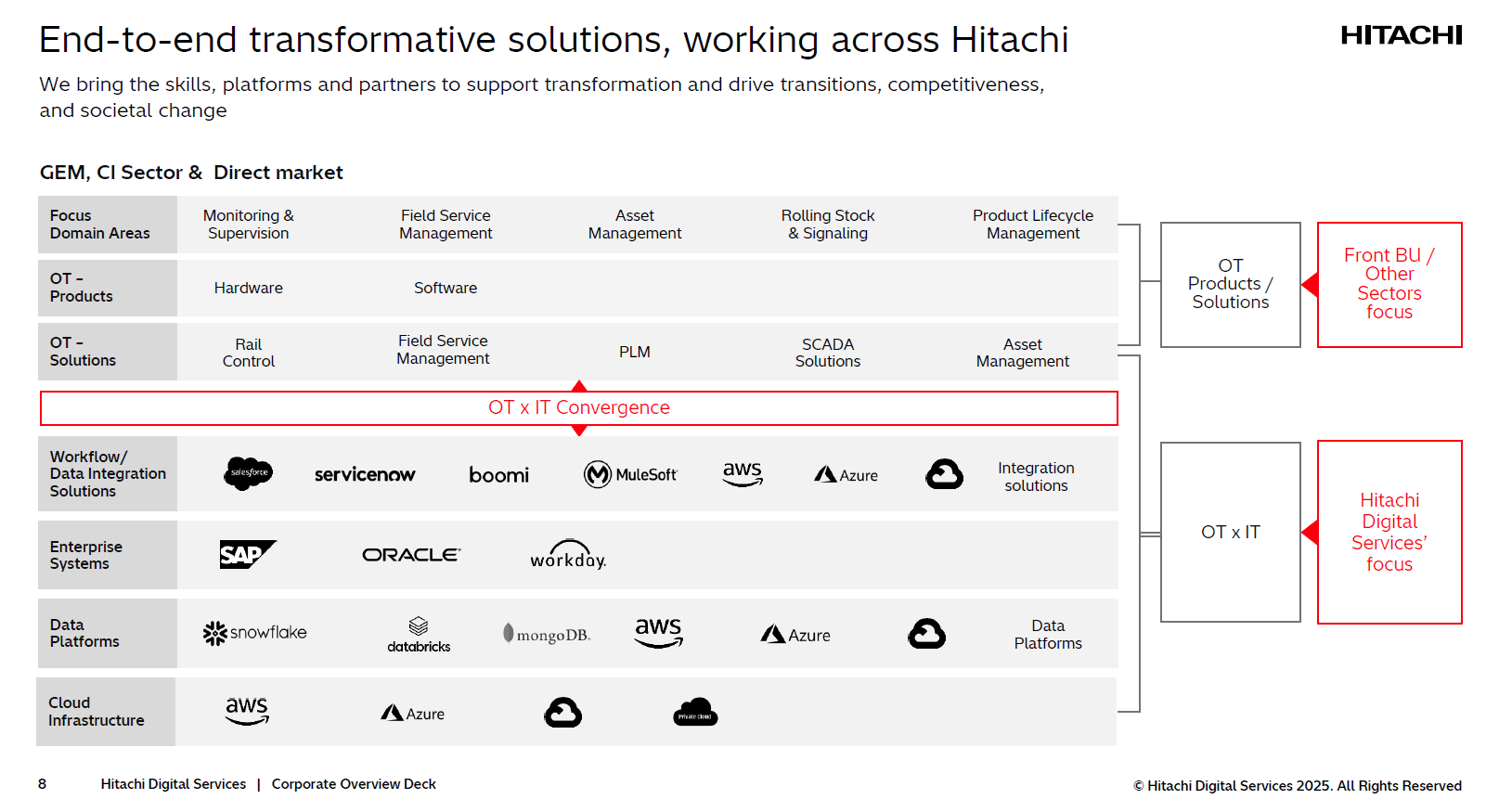

- Salesforce is using Agentforce to become more of a platform and break down its various cloud silos--Service, Sales, Data, Commerce etc. The UI becomes Agentforce over time with a credit model.

- Google outlined at Google I/O how the dream is about being a universal AI assistant that would traverse various services and devices. That's a consumer dream, but those customer experiences and the tools behind them (Gemini, Agentspace and data and AI platforms) appear on Google Cloud.

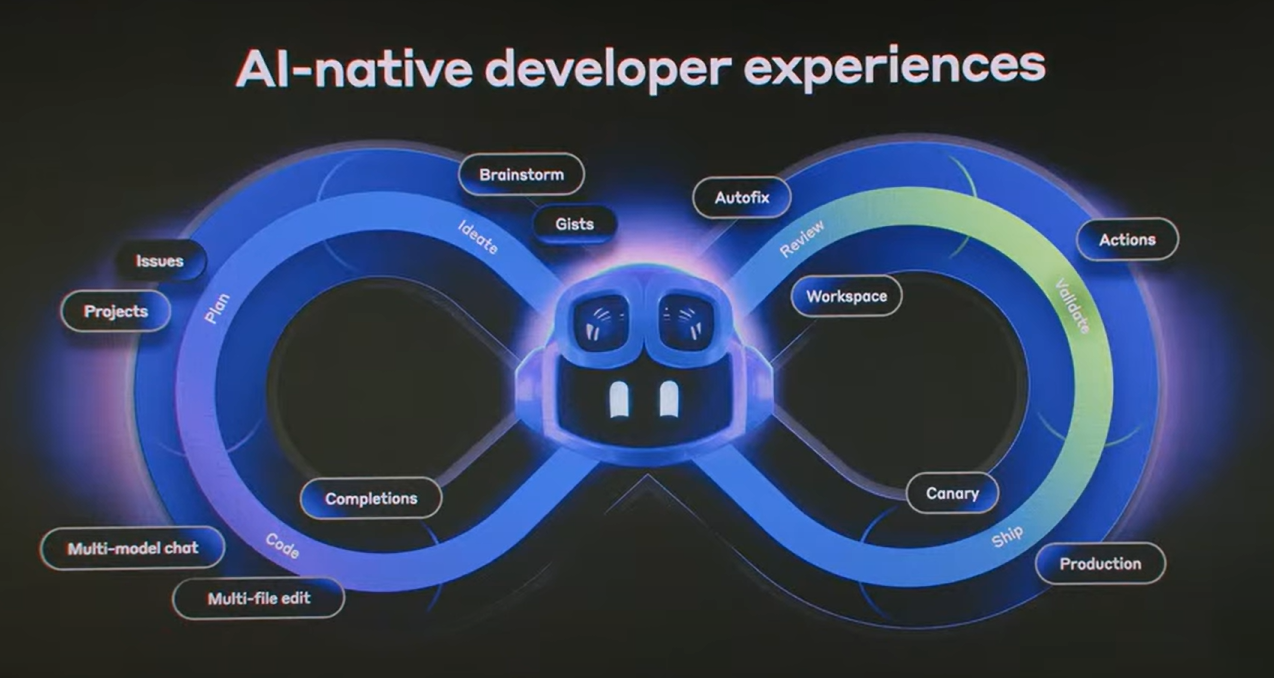

- Microsoft CEO Satya Nadella has repeated referred to Copilot as a user interface to AI-based applications that are delivered via agents. Nadella said at Build that Microsoft "is bringing together agents, notebooks, search and create into a new scaffolding for work." "Beyond horizontal knowledge work, we are introducing agents for every role and business process," he added.

- SAP executives argued that Joule will be an always-on AI assistant to optimize processes and drive returns. Via Liz Miller, Muhammad Alam, member of the SAP Executive Board, said enterprises should standardize on Joule as their agent of choice. "You can either further complicate your landscape by adding yet another layer of tech, whether from workflow providers or from platform providers, where you knowingly or unknowingly, shift more towards the iceberg," said Alam, who leads the SAP Product & Engineering Board area and has global responsibility for all business software applications. Alam noted that the idea of best of breed AI agent systems doesn't work (as if he'd say anything else). He acknowledged that the enterprise suites didn't innovate fast enough even as he through a few jabs at ServiceNow.

- ServiceNow also is a big AI agent play and is all about platform. As a result, it doesn't seem hamstrung by UI issues.

Add it up and you have a bunch of vendors talking AI agents that may merely be defending their cross-selling models and interfaces that put a face on their software.

Data to Decisions Future of Work Next-Generation Customer Experience Innovation & Product-led Growth Tech Optimization Digital Safety, Privacy & Cybersecurity ML Machine Learning LLMs Agentic AI Generative AI Robotics AI Analytics Automation Quantum Computing Cloud Digital Transformation Disruptive Technology Enterprise IT Enterprise Acceleration Enterprise Software Next Gen Apps IoT Blockchain Leadership VR B2C CX Chief Information Officer Chief Executive Officer Chief Technology Officer Chief AI Officer Chief Data Officer Chief Analytics Officer Chief Information Security Officer Chief Product Officer Chief Customer Officer Chief People Officer Chief Human Resources Officer

"With agentic AI, you're going to see a significant movement towards modernization in a green field type of manner. I think you're going to see a lot of reinvention of processes and applications from scratch because of the new approaches. I think that will come about a year from now."

"With agentic AI, you're going to see a significant movement towards modernization in a green field type of manner. I think you're going to see a lot of reinvention of processes and applications from scratch because of the new approaches. I think that will come about a year from now."