SAS Takes Next Steps to Cloud Analytics

Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers,…...

Read more

SAS Viya is now available as the cloud-friendly platform for SAS Visual apps and, soon, SAS 9. Next up should be more cloud-based services options.

SAS, like many well-established tech vendors, has to keep one eye on the future and one eye on the past. At the April 2-5 SAS Global Forum in Orlando, FL, the company did its best to reassure the 5,500-plus attendees that it can take them into the future without obsoleting past investments in SAS technologies and training.

To the tens of thousands of companies running SAS 9 (there are some 77,000 site licenses for the software), the message was “SAS 9 is here to stay.” And to the thousands of customers running SAS’s newer Visual products (there are more than 6,000 site licenses for SAS Visual Analytics and north of 1,800 for SAS Visual Statistics), the message was “everything in the portfolio can now run on SAS Viya.”

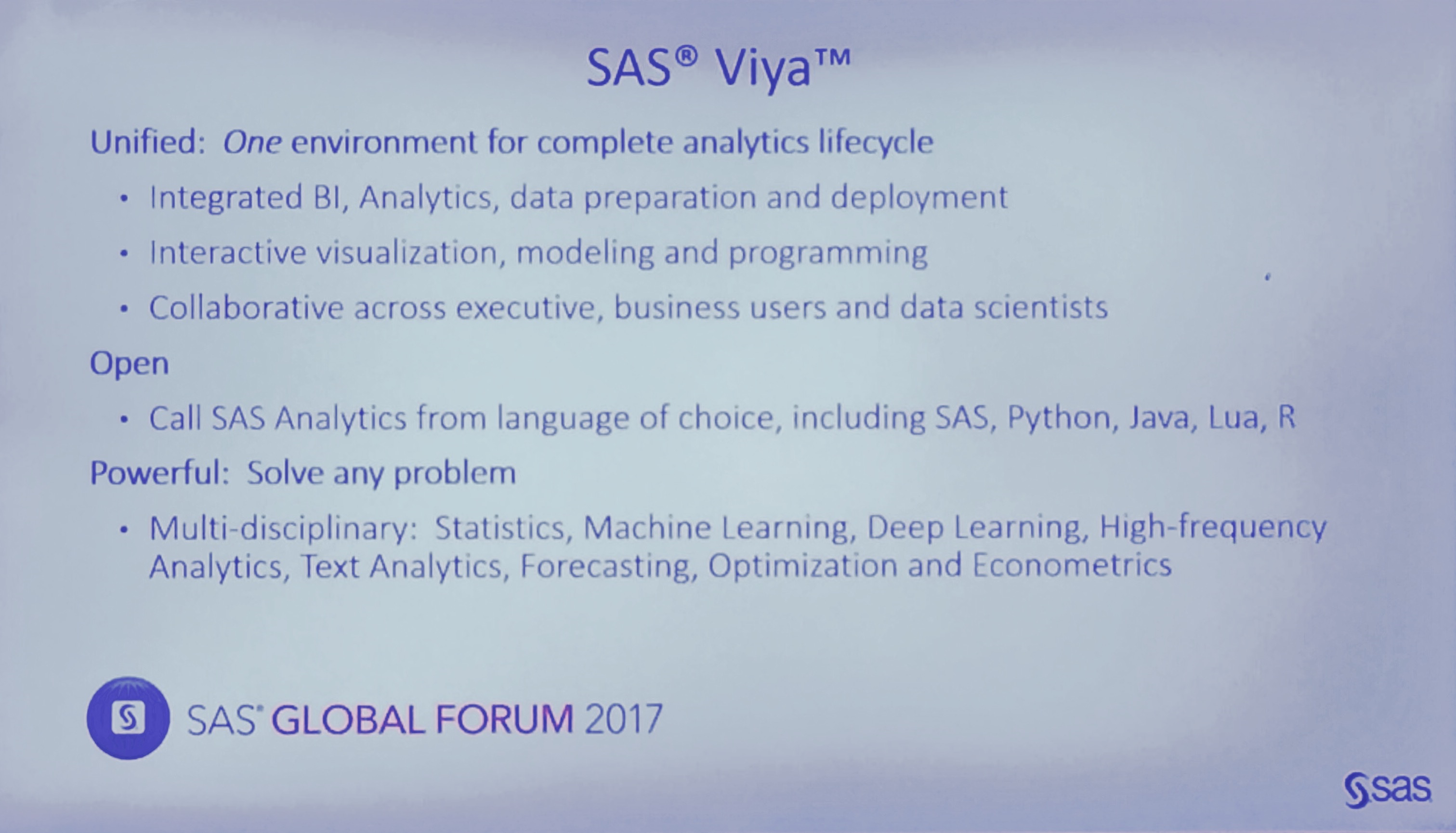

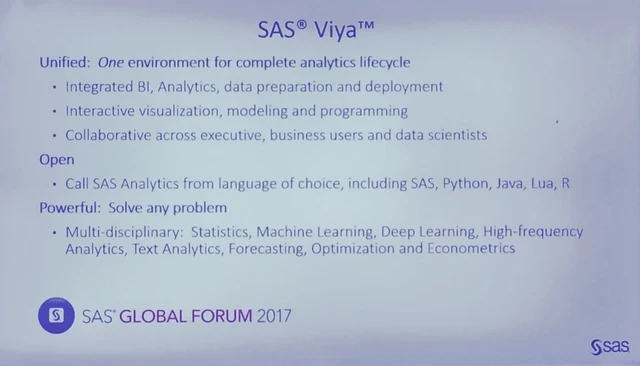

SAS Viya is the lynchpin of the company’s future. Introduced at SAS Global Forum 2016, Viya is the company’s virtualization and container-ready, Hadoop-compatible, next-generation back-end architecture. It supports in-memory, distributed processing at scale as well as lifecycle management for data and models. Microservices and REST APIs support services-oriented embedding of analytic services. Viya also extends language support beyond SAS to Python, Lua and, coming, R, Java and Scala.

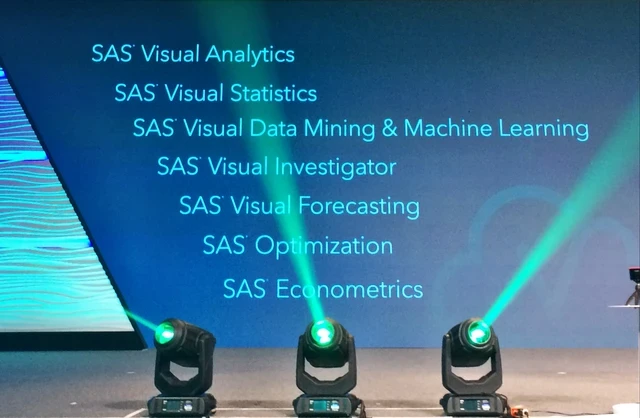

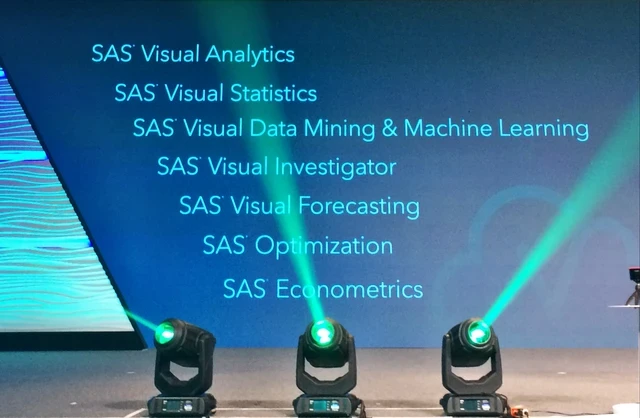

At SAS Global Forum the company announced that the entire Visual suite -- Visual Analytics, Visual Statistics, Visual Data Mining & Machine Learning, Visual Investigator, Visual Forecasting, Optimization and Econometrics – can now run on Viya. Heretofore these products ran on the SAS LASR Server, which will continue to be available and supported. But if you want the combination of scalability, virtualization and multi-cloud, container-based portability and flexibility, you’ll want Viya.

As for SAS 9, connectivity to Viya will be introduced in the third quarter, opening up big-data and machine-learning capabilities. These jobs will be sent to Viya while more routine workloads and procedures will continue to run on SAS 9.

“If you’re processing all your jobs in less than one or two minutes, you’re fine and you don’t need to move [to Viya],” said SAS co-founder and CEO Jim Goodnight during a keynote discussion. If you need big-data or modern machine learning capabilities, “…think of Viya as an extension of SAS 9.”

The plan is to add the more routine analytical capabilities to Viya over time, but some analyses and workloads, including mainframe (zOS) and AIX workloads, will remain tied to SAS 9 (currently on release 9.4).

The SAS Visual portfolio can now run on the Viya architecture. I'm hoping to see software-

as-a-service options that would appeal to new customers.

Other important announcements at SAS Global Forum included:

- SAS Visual Investigator 10.2: This analytic application was released in 2016, but 10.2 update offers improved search and discovery, scorecarding, alerting, entity analytics, workflow and administrative capabilities. SAS is also developing and delivering pre-built content for more than 14 investigative use cases, including child welfare, anti-money-laundering, power and energy monitoring, insider threat detection, and prescription drug abuse.

- Current Expected Credit Loss (CECL): This SAS content helps banks deal with what’s formally known as ASU 2016-13, a new U.S. GAAP standard for credit loss accounting. CECL replaces today’s “incurred loss” approach and will become effective for SEC filers in 2020. The rules establish a lifetime loss for every loan, require point-in-time loss estimates and increased public disclosure requirements.

- SAS-Cisco IoT Partnership: The companies have been working together for 18 months to create the Cisco SAS Edge-to-Enterprise IoT Analytics Platform. The platform includes SAS Event Stream Processing, now certified to run on CISCO UCS servers, and was launched with proof-of-concept content for the energy and mining industries.

- SAS Results-as-a-Service: A combination of strategy and consulting services wherein SAS professionals deliver analytical solutions within weeks or months. Once a solution is approved, SAS can deploy it in the cloud or on-premises, with supporting managed services or, if desired, training and hand offs to customer teams. The service is aimed at companies that don’t have available staff or infrastructure to tackle new analytic challenges.

MyTake on SAS Global Forum Announcements

As I commented after last year’s Global Forum, Viya is SAS’s modern architecture as well as its answer to multiple open-source and cloud threats. The biggest threat by far is Apache Spark, which is gaining adoption quickly and is now widely available as a service on multiple public clouds. Spark software is also distributed and supported for on-premises deployment by multiple vendors, including IBM and the big-three Hadoop vendors, Cloudera, Hortonworks and MapR.

Many SAS customers are, indeed, very conservative and more concerned about continued SAS 9 support than big-data analysis or cloud-deployment options. But with an eye to the future, SAS Viya is crucial. It can’t get here soon enough, in my book, because Apache Spark, as a scalable, in-memory platform and as an elastic, pay-for-what-you-use cloud service, has been steadily gathering steam.

In an one-on-one conversation, SAS Executive VP and CTO Oliver Schabenberger asserted that open-source alternatives lack the data-governance and model-management capabilities that many SAS customers, particularly regulated companies, insist upon. That may be, but dark warnings about governance failed to keep many BI practitioners from embracing self-service data-discovery and data-visualization products -- even before those products gained governance capabilities.

On the topic of open source machine learning and algorithms, Schabenberger said “SAS won’t take a back seat to anybody on analytics.” But there’s no denying that the cost advantages and ecosystem strengths of the open-source model are driving huge adoption. That’s precisely why SAS opened up Viya to Python. SAS has had a lot to say, in recent years, about making free SAS software available to colleges and universities. But to a fault, customers in the sessions I attended at the Forum said their new hires tend to use open-source languages such as Python.

If SAS governance and lifecycle-management capabilities and its analytic depth and breadth are truly superior, they’ll stand up to open-source competition. It’s clearly a topic of debate within SAS. Some executives pointed out that it’s long been possible to invoke open-source algorithms from within SAS, though they’d like to see more explicit support for Spark and other emerging options. And now that Viya is here, several execs hinted that SAS will be much more aggressive about offering SAS analytics and software as ready-to-run cloud services. These would be welcome, future-minded steps that might attract a next-generation of SAS customers, but they’re not on the official roadmap for now. I’m hoping to see more openness and more cloud services options at next year’s SAS Global Forum.

Data to Decisions

AI

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Robotics

Analytics

Automation

Cloud

SaaS

PaaS

IaaS

Quantum Computing

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

CCaaS

UCaaS

Collaboration

Enterprise Service

developer

Metaverse

VR

Healthcare

Supply Chain

Leadership

business

Marketing

finance

Customer Service

Content Management

Chief Customer Officer

Chief Information Officer

Chief Marketing Officer

Chief Digital Officer

Chief Technology Officer

Chief Information Security Officer

Chief Data Officer

Data to Decisions

AI

ML

Machine Learning

LLMs

Agentic AI

Generative AI

Robotics

Analytics

Automation

Cloud

SaaS

PaaS

IaaS

Quantum Computing

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

CCaaS

UCaaS

Collaboration

Enterprise Service

developer

Metaverse

VR

Healthcare

Supply Chain

Leadership

business

Marketing

finance

Customer Service

Content Management

Chief Customer Officer

Chief Information Officer

Chief Marketing Officer

Chief Digital Officer

Chief Technology Officer

Chief Information Security Officer

Chief Data Officer