Walmart expects AI efforts to drive sales growth

Walmart's AI strategy is evolving as the company plans four "superagents" that will run across the retailer's operations, but one big theme is that CEO Doug McMillon expects revenue growth as well as productivity.

Each quarter, Walmart has divulged a bit more about its AI plans and the big takeaway this go round is that revenue growth is an expectation. Typically, enterprises have seen AI as a way to drive productivity and efficiency.

Walmart’s adjusted second quarter earnings of 68 cents per share missed expectations, but revenue of $177.4 billion was topped estimates. Walmart maintained its outlook for fiscal 2026.

Here’s a look at Walmart’s AI progression over the last year:

- A look at Walmart’s platform approach to data, AI, optimization

- Walmart's tech bets improve resilience as it reaffirms Q1 outlook

- Walmart’s fiscal 2026 bets: Supply chain optimization, AI, automation

McMillion said:

"As it relates to AI, I don't think it's lifting our top line sales yet. I think this is very early days. But I am excited about the road map, as I mentioned. I think what lies ahead is really exciting for us, given how our assortment has grown and our capabilities today as it relates to tech."

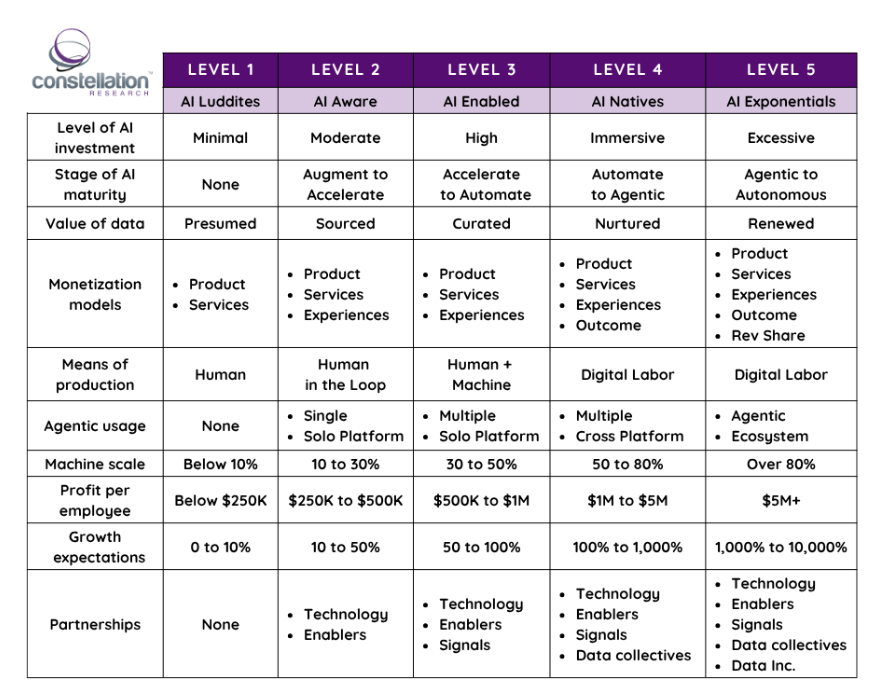

Walmart likely sits somewhere between AI Aware and AI Enabled today, but based on what executives have said the retailing giant clearly plans to become AI Native with faster growth rates. Constellation Research CEO Ray Wang outlined an AI maturity model that ranges from AI Luddites to AI Exponentials.

Also see: The road to AI Exponential will be bumpy

McMillon added that Walmart recently created a new position reporting to him. Walmart hired Daniel Dankers, who was previously at Instacart and Uber, to lead AI acceleration, product management, design, tech prioritization and AI-related change management. Dankers will report to McMillon. Walmart also created a new role focused on AI platforms and increasing speed, productivity and architecture. That role will report CTO Suresh Kumar.

"We're biased towards growth as it relates to AI. It's exciting to think about the productivity opportunities. But when we wake up in the morning, we're thinking about how we can serve customers better using AI," said McMillon.

For now, most of Walmart's AI plans seem to generate returns that revolve around productivity. It'll be interesting to see how long it takes for Walmart's AI plans to be credited for sales gains.

McMillon said that plan now is for Walmart to create its superagents. These superagents will govern a bevy of underlying AI agents.

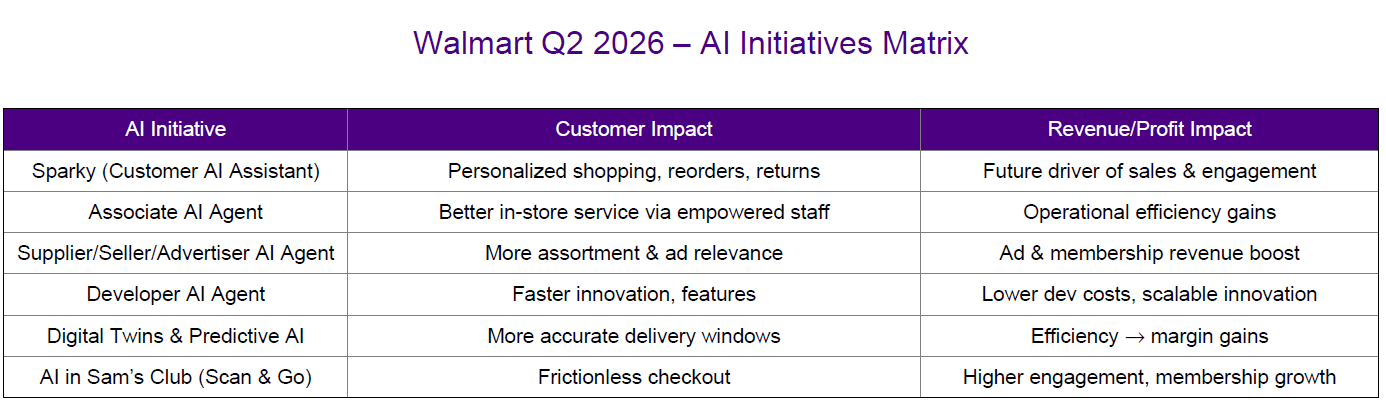

Walmart's superagents are focused on the following:

- A customer-facing assistant called Sparky that resides in Walmart's app. Over time, Sparky will become agentic, but for now it's focused on search and assistance.

- A superagent for associates that will bring scheduling, sales data and other need-to-know items in one place.

- A superagent focused on suppliers, sellers and advertisers to manage onboarding orders and campaigns.

- A developer agent to speed up new product delivery.

"We see lots of opportunities, whether that's with digital twins of our facilities, which can help predict or prevent issues before they happen or the accuracy of dynamic delivery windows, which will provide to 95% of U.S. households by the end of this year," said McMillon.

Should Walmart leverage AI to deliver sales growth it will be a big win. Vendors have talked about AI driving revenue growth, but enterprises are often struggling to get from pilot to production.

Takeaways from Walmart's second quarter and technology strategy include:

Walmart is funding its investments with high-growth, high-margin businesses. Walmart--via Sam's Club--delivered membership growth of 16% in the second quarter with advertising up 50% from a year ago and e-commerce was up 26%. These businesses are giving Walmart flexibility to navigate tariffs, absorbing pricing hits and investing in new initiatives.

Walmart CFO John David Rainey noted the company is "fortunate to have opportunities to invest in ourselves in things like technology, AI, supply chain automation to drive returns in some cases, in the 20% range."

The data flywheel. McMillon said:

"We've obviously got is a ton of data and it's not just product catalog data these days, it's delivery data. It's real-time data. And the way that we can put that to work to understand the context in which someone's shopping is really exciting to think about.

I think it's compelling. There are times when you want to replenish your home with the things you buy all the time. There are other times when you're browsing for fun, and I think we're going to do a better job of understanding what the moment calls for and being able to meet the need, whether it's delivery speed or it's the breadth of the assortment."

Physical technology improvements. McMillon added that Walmart can differentiate its digital abilities with physical supply chain and in-person customer service.

Sam's Club CEO Christopher Nicholas said more than 40% of weekend shoppers are using Scan & Go and Just Go arches. Physical AI such as computer vision can drive customer experience. See: Sam's Club CEO Nicholas on AI, frictionless commerce, focus on members