SAP TechEd: Inside Cloud For Analytics

Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers,…...

Read more

SAP’s new platform for BI, planning and predictive analytics promises simplicity and consistency, but it will require a fresh start for BusinessObjects or Lumira customers looking to move to this new cloud.

SAP can point to many benefits in building Cloud for Analytics, it’s new cloud-based BI, analytics and planning platform, from scratch, but one drawback is that BusinessObjects and Lumira customers won’t be able to bring dashboards or reports currently used on premises into this new cloud.

Before I get to this drawback, let’s review all there is to like about SAP Cloud For Analytics. For starters, it will include components for BI (meaning reporting, dashboarding, data-discovery and visualization), business planning, predictive analytics and, eventually, governance, risk and compliance (GRC). The starting point for Cloud for Analytics was Cloud for Planning, the budgeting and planning application introduced last year built on the HANA Cloud Platform. No surprise, then, that the planning component of Cloud for Analytics, renamed “SAP Cloud for Analytics for Planning,” is available immediately.

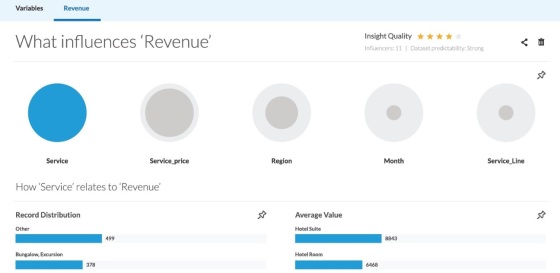

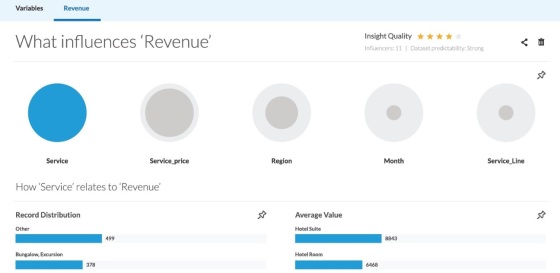

SAP Cloud for Analytics will include components for data-discovery and visualization, planning and predictive analytics.

As for the rest of the platform, the BI component, which draws on and replaces SAP Lumira Cloud, is expected to be available as soon as next month (and surely by year end). The Predictive Analytics component is expected to show up in the first half of next year (ideally by Sapphire). The GRC component isn’t on a hard timeline yet, so there’s talk of first introducing risk-analysis capabilities within the other components of the platform.

The benefits of Cloud for Analytics start with having BI, predictive analytics and planning all on a single platform – a unique combination in the cloud. SAP is also promising consistent and modern user interfaces that will be easy and intuitive for business users. Pricewise SAP is sticking with the Lumira Cloud freemium approach, starting with a free, basic BI service before graduating to more robust, paid levels of service starting at $25 per-user, per-month. Power-user licenses spanning multiple components and including the most advanced capabilities will top out at more than $1,000 per user, per month.

From what I’ve seen, the new platform delivers a clean design with lots of data-visualization elements. On speed and performance, Cloud for Analytics runs on the in-memory HANA Cloud Platform, so expect fast, in-memory performance.

At TechEd, SAP executives stressed that BusinessObjects and Lumira Server and Lumira Desktop are not going away. There’s a roadmap of new releases and planned innovations for all of these products. Anticipating hybrid deployment scenarios, SAP says Cloud for Analytics will be able to tap into existing BW, Lumira and BusinessObjects data and metadata as well as BusinessObjects Universes. There’s also bi-directional integration between Cloud for Analytics for Planning and SAP Budgeting, Planning and Consolidation (BPC). In another nice touch, Cloud for Analytics will be able to access on-premises S/4HANA and BW data without replication.

As for that one drawback, customers running BusinessObjects and Lumira on-premises will have to rebuild dashboards and reports they’ve accumulated in on-premises deployments if they want to run them on Cloud for Analytics. You can use the same data, metadata and Universes, but reports and dashboards won’t migrate to this HANA-based platform. As has long been the case, you still have the private-cloud option to migrate and run BusinessObjects and Lumira Server deployments as hosted, managed services. But that’s not the kind of agile, multi-tenant, always-current cloud service that many customers are looking for.

MyPOV on SAP Cloud for Analytics

SAP made a conscious choice to start with a clean sheet. We haven’t seen all of the components of the platform as yet, but it will be an attractive option if it lives up to expectations on consistency, ease of use and in-memory performance. It’s a good fit for customers if they’re fine leaving the legacy dashboards and reports on-premises while building out new reports, dashboards and applications in the cloud. And this approach also makes sense if you’re taking a day-forward approach, whereby new dashboards, reports and analytic uses center around new cloud-based apps and data sources.

If you have hundreds (or thousands) of dashboards and reports, as many SAP BusinessObjects customers do, and you want to take them into the cloud, managed services are the only practical option. Many BusinessObjects customers are ready to let go of the old content and start from scratch, but this limitation means that third-party cloud options may be as easy to embrace as Cloud for Analytics. Tapping existing data sets and metadata isn’t the hard part of changing BI tools and platforms.

The good news for customers is that there’s a world of new BI and analytics options in the cloud. Amazon announced two weeks ago that it’s jumping in with QuickSight. Salesforce has revamped and is putting a second push into Salesforce Wave. Microsoft is steadily adding options and capabilities to Power BI. Tableau and Qlik are moving more aggressively into the cloud. And next week we’ll see new analytics and BI cloud services from both IBM and Oracle. We’re clearly seeing plenty of innovation and the fresh competition, and that should help keep prices competitive.

RELATED POSTS:

SAP Highlights S/4 Hana Finance, Cloud For Analytics

AWS re:Invent: Five Takeaways On New Services

Data to Decisions

Future of Work

Chief Financial Officer

Chief Information Officer

Chief Digital Officer

Apttus, Booker, Lattice Engines, Segment and Tubular Labs are the five hottest cloud-based marketing startups of 2015.

Apttus, Booker, Lattice Engines, Segment and Tubular Labs are the five hottest cloud-based marketing startups of 2015.

![]()