‘Free Your Data’ says SAP, perhaps in IoT World it should be ‘Data for Free’? (An overview on SAP TechEd Barcelona 7-10th Nov 2016)

‘Free Your Data’ says SAP, perhaps in IoT World it should be ‘Data for Free’? (An overview on SAP TechEd Barcelona 7-10th Nov 2016)

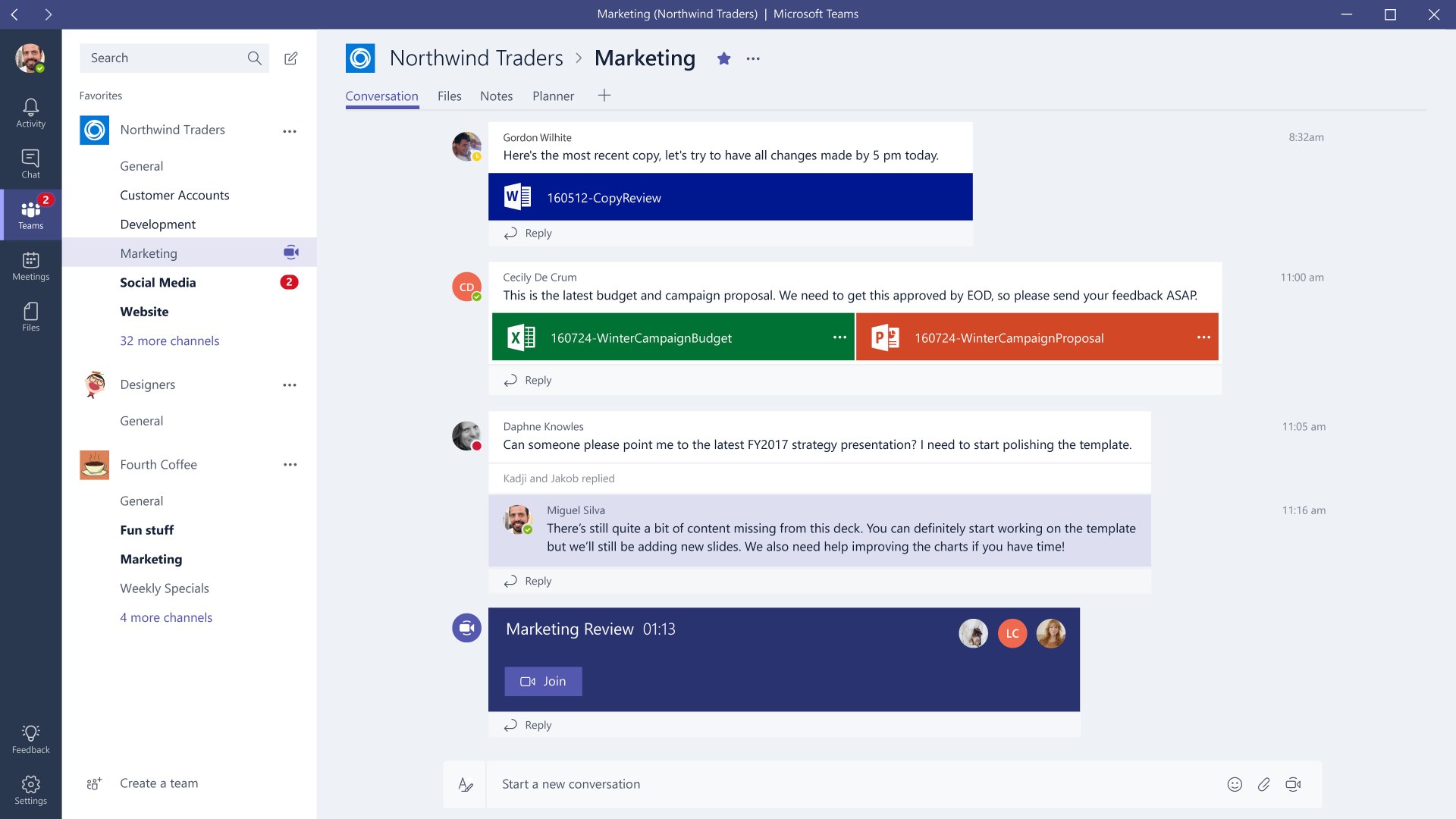

The 20th SAP TechEd gave Bernard Leukert, SAP Head of Products and Innovation, and Tanja Rueckert SAP Head of IoT, the opportunity to present SAP’s overall vision and direction with the linkage to IoT. A key message concerned Enterprises future with almost unlimited data that transforms the requirements and definition of Business value. Possibly because TechEd is a technology centric event the depth and coherence of the message was more focused and stronger than at the SAP Sapphire event earlier in the year.

Messers Leukert and Rueckert choice of phrases also gave interesting ‘insights’ into how SAP views the role of IoT and its contributing to Business. Quote; “Not the ‘Internet of Things but the Internet of Outcomes” aligned with the announced SAP intention to be “the Platform of choice for processing data into actions”.

To deliver the IoT element there was the announcement of HANA 2, offering a range of new capabilities for IoT, integrated with the recent acquisition of Plat.One as well as the ongoing strategic investment of Euro 2.0 Billion of funding. Adding all of this to the detailed work on reference architecture and integration guides makes it clear that SAP intends to be a strong contender in the IoT market place.

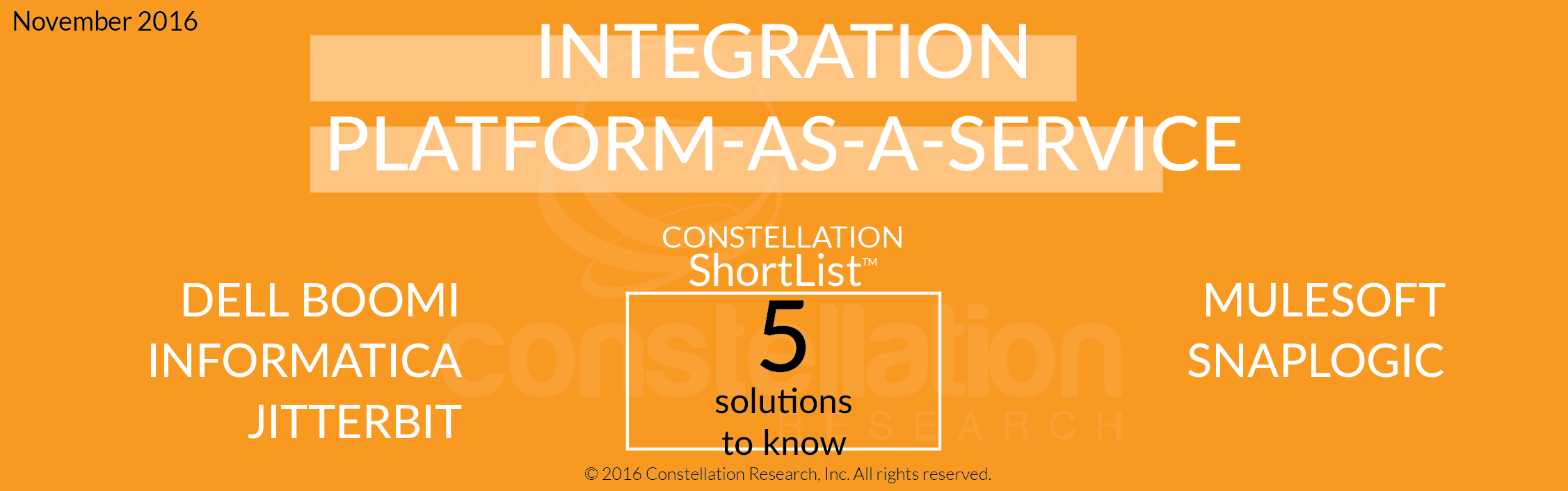

In the breadth of the technology market where all the major IT players, and more than a few Industrial and Telecom players, are all strategically committed to leadership in the IoT market differentiating positioning is vital. SAP has more experience in adding IoT sensing technology to its current Enterprise Applications, and indeed rolling out in their customer base, than is widely realized. Unfortunately for SAP when the rest of their customers chose words to describe them, thoroughness, and quality, dominate rather than innovation.

Given that back in the late eighties and early nineties SAP were one of the first to bet their future on Client-Server rather than Mini Computer technology; then the work on in-memory computing leading to the launch of HANA in 2010; it’s a little unfair to regard SAP as lacking in innovation leadership. So how does the ‘quiet’, but effective innovator in business efficiency use experience to create a differentiated position in IoT?

SAP believes that Enterprises will need to integrate all IoT inputs, both external and internal, into real time memory for the rapid processing required to create direct Business Intelligence outputs that to deliver operational excellent. If that sounds like the current HANA and BI capability reiterated, then it is certainly built on the experience obtained from this combination, which is no bad thing.

Now SAP has redesigned, everything to take Enterprise Operations to a wholly new and differentiated level. Think of the COO managing operations not on data that is 30 to 45 days old, but 3 to 4 minutes old, aided by a massive ‘real time’ Business Intelligence, to grasp the value SAP IoT plan to bring to Enterprises. (My words not an SAP quote)

To power this is HANA 2, (think of it as a 2nd Generation of HANA, but entirely consistent with the original HANA), combined with a technology architecture to fully exploit Clouds, bring in Machine Learning and the Plat.One acquisition, plus further updating across the board in Business Objects, and Fiori. In short same names, but a distinctly next generation set of updates to enable a new integrated capability to transform the data from the ‘Internet of Things’ into the Business promise of the ‘Internet of Outcomes’ featured in the keynotes.

More, better, and faster insights are the standard benefits attributed to IoT so where does SAP bring a competitively differentiated capability? There are two sides to the answer; one, dramatic improvement in User Interfaces to to bring make much high amounts of data understandable and usable; and two, and much more complex, supporting the shift from todays CapEx business models to the OpEx business models that can under pin the Business Transformation to Agility and Smart Services.

Years of experience in BI have helped SAP to master Design Led thinking to introduce User Interfaces that hide complexity and offer graphical clarity coupled with intuitively driven actions. A look at SAP Fiori introduced a couple of years ago, shows the benefits, and, Fiori also gains additional integration plus full user device portability covering Watches, Tablets, Phones together with a new partnership with Apple.

Whilst much has been said about the the transformational ‘outcome’ of the move to the ‘Digital Services’ economy, much less has been said about the ‘things’ that have to happen in business and technology models to enable this. Naming the technology elements involved; IoT Connectivity, with Cloud Processing and increased Intelligence, (machine learning or AI etc.), that are combining to create ‘change’, doesn’t answer the key questions of ‘how’ enterprises will be apply to achieve this ability.

At the heart of the concept of ‘Agile’ and ‘Smart Services’ business models is the shift from CapEx,; writing off overheads in the relatively unallocated manner possible in volume business models, towards OpEx. To create an Agile Business able to continuously adjust to optimum responsiveness to market opportunities requires the ability to de construct a business into the key assets. Detailed information of the status of each together with its direct cost of use is essential. An Agile response is a orchestration of some, or all of the Assets, to deliver a market response.

The resulting ‘unbundling’ of a Business into its elements* puts a whole new definition on what ‘real time’ Business Intelligence using the huge amounts of data available from IoT sources actually means. Grasping this hugely important, and frequently overlooked, point turns the SAP IoT proposition around integration of Data with ‘real-time’ Business Intelligence to operate an Agile Services based Enterprise at the required levels of efficiency into sharp focus

And of course it also clarifies the SAP market positioning, and ability to build on and incorporate the existing Enterprise Applications, though it is not necessary for them to be all from SAP. For senior executives the approach, coupled with the concept of a Middle Office, offers an a low risk strategic path reutilizing existing investments and maximizing enterprise stability, and delivering value quickly.

In addition to the product sets SAP have also invested in creating reference architecture, integration guides and training of partners to improve time, costs and quality of deployments. Taken together it’s a comprehensive and cohesive approach to making IoT, Clouds, BI/AI work to deliver a real transformation in competitive Smart Service offerings, without the prospect of Enterprise Transformation disruption.

Addendum;

1) Warning! This blog is not intended to provide an over view of the whole SAP TechEd event, and product announcements, merely those elements that are associated with the development and deployment of IoT solutions.

2) * The concept of an ‘Atomic Corporation’ defined as operating an Enterprise made up of individual capabilities/assets (atoms) to achieve a new operating model was first discussed in a book of this name authored by Roger Camrass and Martin Farncombe. Published in 2004 the book was somewhat ahead of its time, (though it has been updated in a later revision), nevertheless it has turned out to be an accurate prophetic view. One reviewer at the time wrote equally accurately; “A radical view of the business future … If the authors are right, we’re on the edge of a revolution

New C-Suite