Dreamforce 2016: Einstein to Power the Next Wave of Salesforce Sales and Marketing Advancements

Cindy Zhou is a practicing CMO.

Prviously, she was Vice President and Principal Analyst at Constellation Research covering Digital Marketing Transformation and Sales Effectiveness. With over 18 years of practitioner experience in corporate marketing, product marketing, product management, and sales operations, Zhou has spearheaded marketing transformation at multiple technology companies. She advised Constellation’s clients on strategies to light-up demand generation, prove revenue contribution, and maximize sales productivity.

Prior to joining Constellation, Zhou was Global Senior Vice President of Marketing and Sales Operations at BackOffice Associates, a global provider of data quality and information governance solutions to the Fortune 1000 and SAP SolEx partner. Before…...

Read more

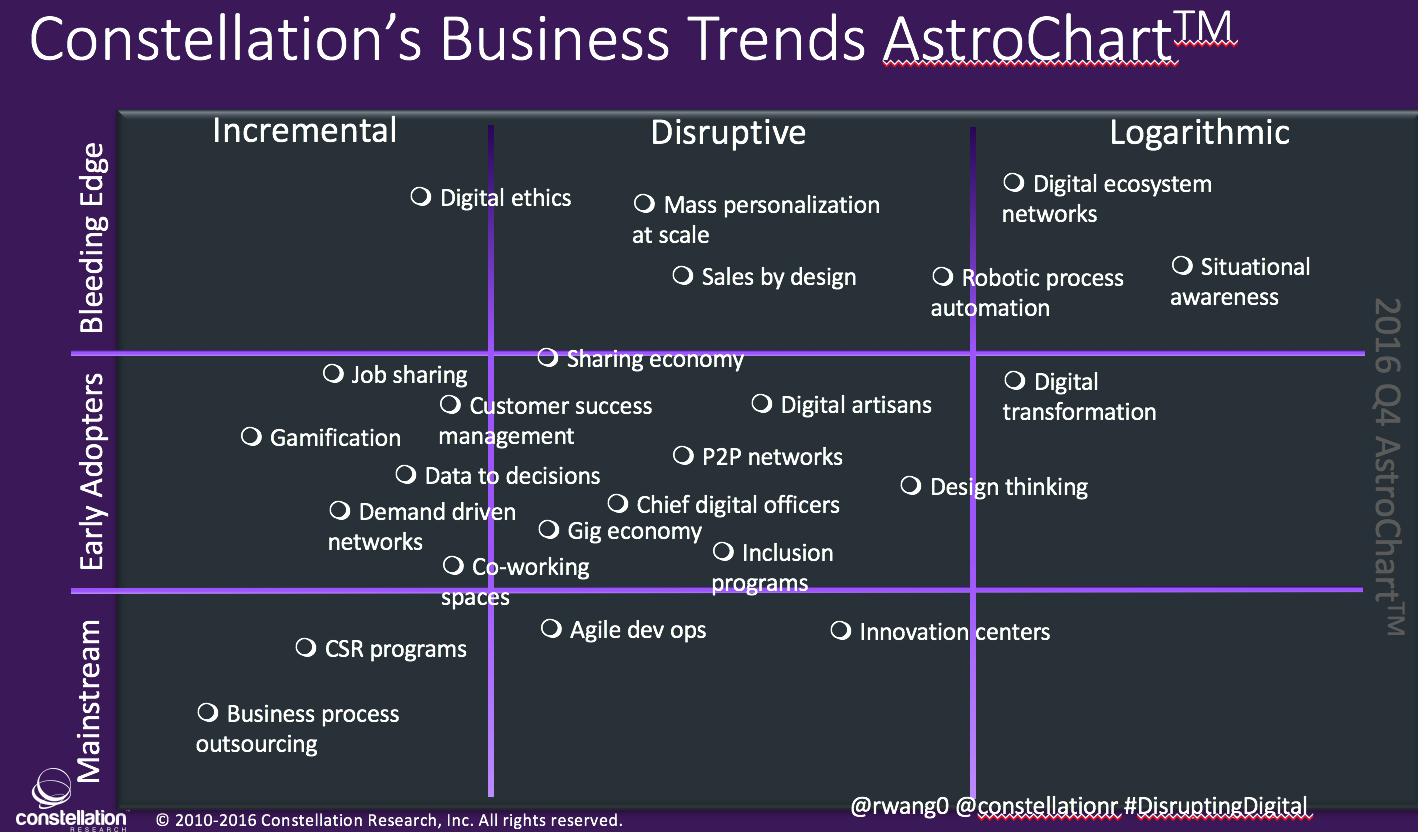

The Constellation Team spent last week in San Francisco for Dreamforce, also known as the largest technology conference with a reported 171,000 attendees this year. The buzz leading up to Dreamforce was a series of acquisitions including Quip, Krux, and of course, the star attraction - Salesforce Einstein, the Artificial Intelligence (AI) platform service that took center stage.

The Salesforce Einstein equation: Smart CRM = Customer Data + AI + Salesforce - With the tagline of “AI for Everyoneâ€, Salesforce’s goal is to democratize AI for the business user, and they don’t need to be a data scientist to configure and utilize Einstein. The initial set of capabilities are squarely in the Marketing and Sales capabilities with an initial emphasis on lead scoring (more on that below). Salesforce's Director of Data Science, Subha Nabar, demonstrated how to configure Einstein via Salesforce's Lightning process interface and from the demo I saw, it appears to be straightforward enough for business users to manage on their own.

Image Credit: Salesforce Einstein Configuration Panel

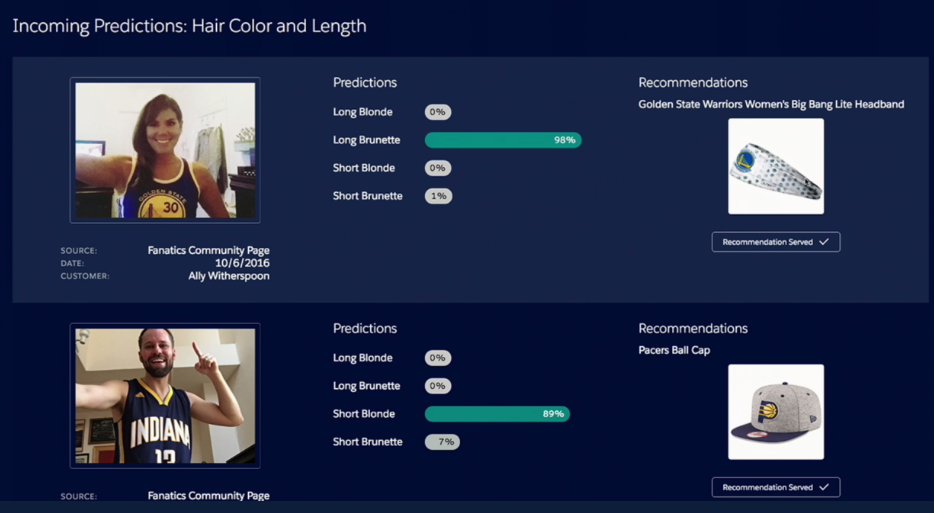

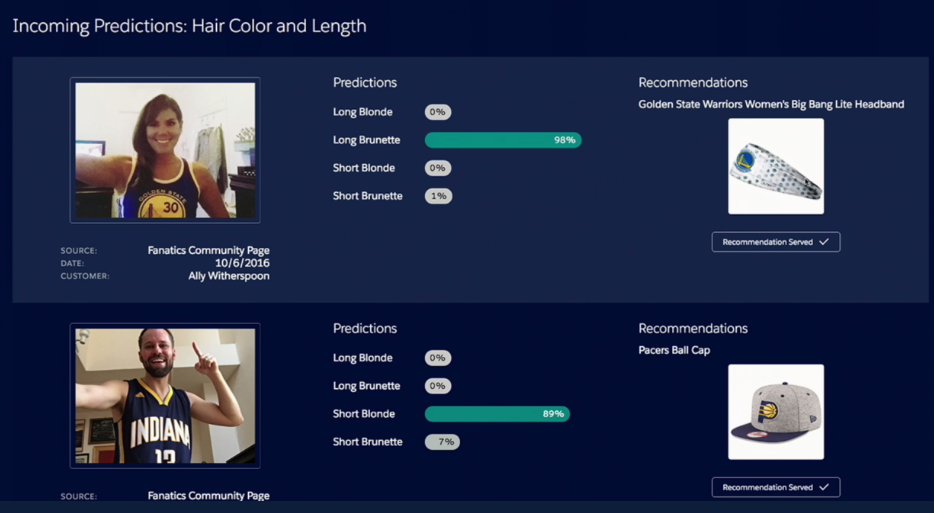

Einstein for B2C Marketers - Einstein's Marketing capabilities include an intelligent grouping of audience segments (likely to make a purchase vs. likely to unsubscribe, etc.) that can be pushed into Journey Builder where Einstein will make recommendations on distribution channel mixtures, such as email, mobile messaging, or ads to Facebook with send-time optimization. Salesforce demonstrated how their customer Fanatics, an online retailer of licensed sports apparel, uses Einstein's image processing capabilities to drive product recommendations. In the demonstration, Fanatics's customers were encouraged to upload selfies for a contest. These images were then processed via Einstein’s Predictive Vision Service to sort, classify, and label key attributes such as the customer's hair color and length, to recommend complementary products such as a light-colored headband. This product is particularly powerful for marketers and based on the technology from Salesforce's MetaMind acquisition.

Image Credit: Salesforce Einstein Predictive Vision Service

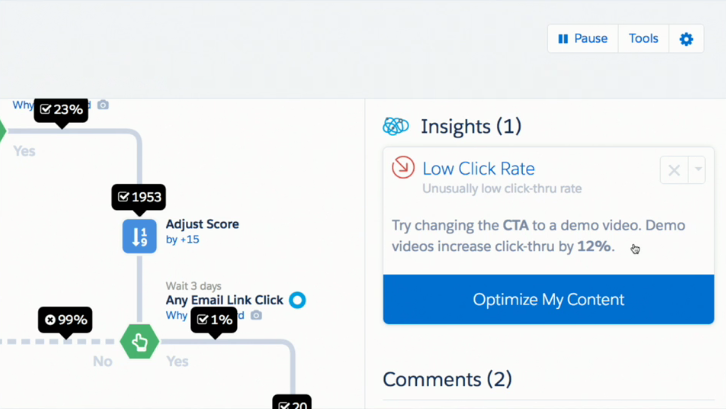

Einstein + Pardot for B2B Marketers - Pardot’s Engagement Studio went live over the summer providing B2B Marketers a way to visually design nurture tracks. The differentiator for Salesforce in this area goes back again to Einstein. In the past, Marketers fly blind when it comes to journey design. Sometimes the best intentions designing “if†and “then†process steps can go awry and lead to over-emailing or entire segments of customers missing from a campaign. Marketers often don’t even realize the issues until weeks later when the performance reports are generated. The insights on the Einstein panel of Pardot Engagement Studio helps guide Marketers during the design process and alert them to which campaign steps may run into problems or predict low performance. It can also provide suggestions on content that may perform better.

Image Credit: Salesforce Einstein Insights embedded in Pardot Engagement Studio

The potential of leveraging Einstein to manage the entire customer lifecycle from Journey Design to the Marketing offer, through to Commerce (the purchase) then back to Sales Cloud (track the entire journey) can enable the "one-to-one marketing†that is often discussed, but few can actually implement.

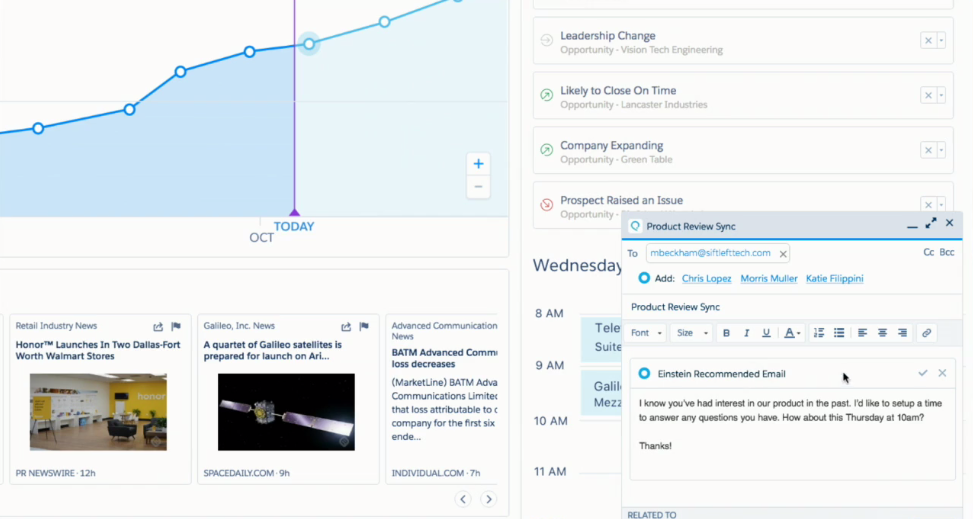

How Einstein Can Help Sales Representatives - The initial use cases of Einstein revolve around intelligent deal insight such as cross-referencing data to uncover who the competitor in the deal might be, and lead scoring for sales representatives to better sort their lead queue. Now, lead scoring isn’t new, Marketing Automation solutions have been able to provide demographic and behavior scoring for well over 12 years. What is interesting with Einstein is its' ability to aggregate custom objects and images into the scoring mix, then layer on social data and sentiment analysis to generate recommended next steps. In the demonstration, a pre-configured email can be populated and sent from Sales Cloud reducing the rep’s time to format a new message.

Image Credit: Salesforce Einstein Insights embedded in Sales Cloud

One point to consider, Einstein needs to ingest quality data in order to make accurate predictions. Companies looking to their own CRM data to fuel the scoring, segmentation, etc. need to pay particular attention to data quality. Suggest Salesforce customers look at data augmentation and cleansing solutions to get the house in order first.

Krux Acquisition + BeyondCore to power the Salesforce Data Management Platform (DMP) - Salesforce’s 11th acquisition this year announced the day before Dreamforce was Krux, a cross-device data management platform in the ad tech space. Krux combined with BeyondCore (machine-learning, data discovery engine) will be the basis of Salesforce’s Data Management Platform (DMP). For Einstein to offer the correct predictive actions the data has to be there and that’s where Krux comes into play. Krux will provide Salesforce Marketing Cloud customers the ability to perform audience segmentation and management. Salesforce needed to boost their DMP offering to better compete with competitors that have been building out their DMP offering for years and further along.

Quip - Quip is an exciting recent Salesforce acquisition and also announced a few weeks prior to Dreamforce. My colleague Alan Lepofsky was an early fan of Quip and covered them often. I saw the Quip demo and was impressed by how Salesforce fields can be pulled directly into the documents and spreadsheets, and when the field are updated in Salesforce, it will auto update in the document as well. Does the future include a Quip panel in Sales Cloud for teams to collaborate on let’s say, RFPs and RFI responses?

The Bottom Line: Customers are passionate about Salesforce as evidenced by the ever-growing number of Dreamforce attendees. Customers that I personally spoke with, including the co-founder of B-Lab, a Sales Cloud, Pardot, and Heroku customer, had nothing but praise for Salesforce. They’ve done a great job building the community of certified administrators, MVPs, the “trailblazers†that have encouraged each other through the Trailhead program for learning. The challenges that I heard from customers are on overall pricing and concerns about how long many of the previously promised enhancements, such as the Lightning UI, is taking. One new Salesforce enterprise customer I spoke with indicated that their integrator was reluctant to start them off with Lightning as it is “buggyâ€. With that said, the majority of the customers I spoke with are excited by the possibilities with Einstein, but remain cautiously optimistic on timing and pricing. If it’s a key value proposition for the next gen of Salesforce, is it included in the current subscription pricing? As the Constellation team has further conversations, we will update our clients on the pricing models.

As a marketer, I’ve always appreciated how Salesforce manages their brand and the colorful “Trailblazer†theme made for some fun imagery at Dreamforce. The plush Einstein mascot made an appearance at the Analyst reception and yes, even analysts wanted a selfie.

View a Storify collection of my tweets from Dreamforce #DF16 below:

Marketing Transformation

Chief Marketing Officer

Chief Digital Officer

Chief Revenue Officer