Salesforce Einstein: Dream Versus Reality

Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers,…...

Read more

Salesforce has introduced Einstein as a set of platform services, but for now it seems more like a collection of acquired parts. Here’s a look at what’s real and what’s coming.

“There’s a reason they call it Dreamforce,” quipped one Salesforce partner executive at the company’s big October 4-7 event in San Francisco. “They’re great marketers, but who knows when any of this AI stuff will be real?”

There’s good reason for skepticism, given Salesforce’s habit of announcing capabilities at Dreamforce well ahead of availability, yet several Einstein “artificial intelligence” (AI) services are actually already available. The capabilities available immediately are mostly those that Salesforce picked up through its many AI-related acquisitions over the last year to 18 months. Several Einstein capabilities coming soon to the Marketing and Sales Cloud were developed organically, according to Salesforce, relying on machine learning and other technologies evolved out of the ExactTarget and Heroku acquisitions.

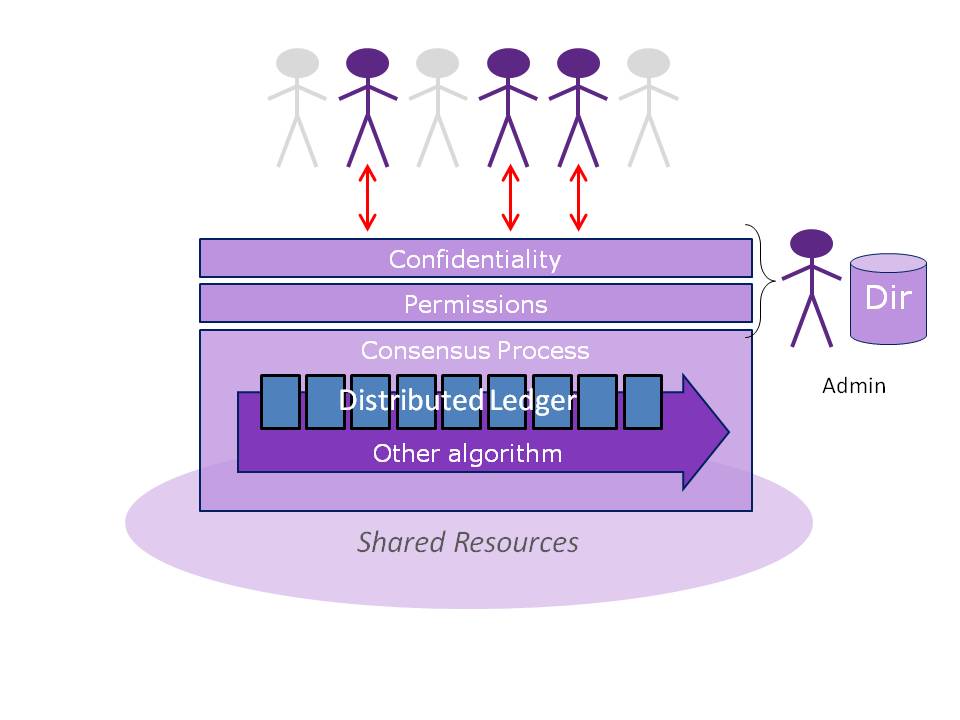

What’s not yet real, in my view, is the Einstein “platform services” layer depicted in the marchitecture diagram that Salesforce flashed up during several keynotes last week (see below). Salesforce insists that it’s not just a vision, but incorporating all those acquisitions will require a bit of integration work before Salesforce can deliver a consistent set of services and APIs. And only then will Salesforce be able to deliver some of the blended Einstein capabilities described at Dreamforce. Based on executive interviews and time spent at the Dreamforce “Einstein Discovery Center,” here’s a closer look at what to expect and when.

‘Discover Smarter Insights’ with Analytics Cloud Einstein

It quickly became clear at Dreamforce that BeyondCore, one of Salesforce’s most recent AI acquisitions, is expected to be among the most significant of the dozen or so deals driving Einstein – at least where machine-learning based data-discovery and analysis are concerned. BeyondCore is the engine behind the “discover smarter insights” capability in Analytics Cloud Einstein, and it’s already available.

Purchased in September, BeyondCore is a cloud-based data-discovery and analysis platform that takes in data and statistical summaries of big data and then uses machine learning to automatically spot correlations and patterns in that data. Rather than starting with hypotheses developed by data scientists, BeyondCore is designed to let business analyst select measures to investigate, such as cost, profitability or customer lifetime value. The engine then identifies and explains the drivers of a measure or combination of measures.

BeyondCore analyses and explanations are delivered in the form of text-based “stories” that are generated automatically and that answer four questions: What Happened? Why did it happen? What will happen? And how can I improve? The answers to the last two questions are predictive and prescriptive insights, respectively. BeyondCore stories can be exported as Word documents or PowerPoint presentations and the engine also generates supporting data visualizations.

To gain insights, BeyondCore connects to data sources including popular relational databases and Hadoop. When data sets are too large to load into the cloud the engine can create and rely upon statistical summaries of larger data sets. Soon after BeyondCore was acquired, a data connector was added for Salesforce CRM data, and a data output was added for Salesforce Wave, so predictive and prescriptive insights can be exported to the Analytics Cloud. Beyond Core was sold based on per-user pricing, and Salesforce executives tell me it will continue to be offered that way as an extra-cost option of Analytics Cloud Einstein.

MyPOV on BeyondCore. This is a powerful engine, and it’s no surprise it will play a prominent role in the Analytics Cloud as well as other Einstein capabilities. As for the limitations of the technology, I’d like to hear more about how quickly the engine can create statistical summaries of big data and how quickly it generates analyses. I’m told the engine can spot complex correlations and patterns across as many as 100 columns of data, but it also requires at least 10,000 rows of data to deliver statistically reliable results. You need a lot of data to make smart, automated decisions, so this capability may not be applicable to small and midsized customers that have fewer than 10,000 customers in key categories.

Recommend Products with Commerce Cloud Einstein

Several Einstein capabilities tied to the Commerce Cloud are either already available or will soon be available because they were developed or in the works at Demandware. Acquired in June, Demandware had a machine-learning based ability to automatically recommend best-fit products for customers based on their individual histories and the history of like customers. It’s a recommendation engine, and it’s a built-in and immediately available part of Commerce Cloud Einstein.

The same recommendation technology also powers an optional (extra-cost) Predictive Email service than can serve up personalized content, offers and product recommendations. Per-month pricing is based on the size of the mail list, but you can send as many personalized messages as you want. Demandware also had two other capabilities in the works that will soon be part of Commerce Cloud Einstein. Commerce Insights, a market-basket-analysis dashboard for merchandizers, is expected to be a built-in capability available before the end of 2016. Predictive Sort, a personalized product search and sorting capability, will be an optional feature, and it’s expected in the first quarter of 2017.

MyPOV on Commerce Cloud Einstein. This sort of recommendation technology has been available for quite some time. It’s table stakes for e-commerce, but it rightly belongs in the Einstein feature set, as machine learning is used to look at customer behavior data, catalog data and online and offline order histories.

Developer Cloud Einstein

Predictive Vision and Predictive Sentiment services are now available in Developer Cloud Einstein, and they’re based on the technology of MetaMind, which Salesforce acquired in April. Demonstrated at Dreamforce by Dr. Richard Socher, formerly MetaMind’s CEO and now Salesforce chief scientist, the vision engine was shown to be easily trainable by business-user types by dragging and dropping collections of images. The ease of training and implementing MetaMind’s sentiment engine was less apparent, but it’s clearly geared to straightforward natural language interaction and use by business users.

MyPOV on vision and sentiment AI. Usually you see mundane demos of such capabilities in marketing use case. (And, yes, these and other services will be available in Marketing Cloud Einstein to foster responsive and personalized customer interactions.) I was far more inspired by the example of MetaMind customer vRad (Virtual Radioligist), which is using vision services to save lives by reviewing thousands of brain scans within seconds to spot and help doctors prioritize cases of life-threatening inter-cranial bleeding. Inspirational!

What’s Coming

The list of Einstein capabilities not yet available is longer, and it includes many of the AI capabilities coming to the Sales, Service, Marketing and Community clouds. There are exceptions, such Predictive Lead Scoring and Opportunity Insights capability announced at Dreamforce. These organically developed features are currently in pilot and will be generally available as part of Sales Cloud Einstein by February. Similarly, Marketing Cloud Einstein scoring capabilities developed out of the Exact Target acquisition will be available this December. Finally, certain SalesforceIQ capabilities derived from RelateIQ are now part of Einstein.

MyPOV on the State of Einstein. It’s no surprise that integration work lies ahead before Einstein capabilities will be available across the Salesforce platform. After all, really important components such as BeyondCore have been a part of the company for just one month. Indeed, we’re at the very beginning of the company’s AI push. Salesforce not only has to turn these, and perhaps other, acquisitions into services that are consistent with its existing machine learning, deep learning and natural language processing work, it also has to embed many of these services into its various clouds and introduce feedback loops so that Einstein services can learn as new data is generated.

Will it take six months, eight months or a year or more to deliver all the Einstein services described at Dreamforce 2016? That’s unclear, and aspirations may well shift along the way. I, for one, hope that Salesforce will also introduce plenty of options for human oversight, such as rejecting recommendations or insights that subject-matter-experts deem to be off base so the technology can learn from mistakes. I didn’t see any examples of that in the demos at Dreamforce, but we have to assume that Einstein (and other early examples of AI) will be less than brilliant at launch. If humans are to gain trust in AI services, we have to design apps that place their ultimate faith in the wisdom of humans.

Related Reading:

Inside Oracle Adaptive Intelligent Apps

Oracle Vs. Salesforce on AI: What to Expect When

Strata + Hadoop World Highlights Long-Term Bets on Cloud

Data to Decisions

Future of Work

Tech Optimization

Chief Customer Officer

Chief Information Officer

Chief Marketing Officer

Chief Digital Officer