Unit4 Analyst Summit - New Architecture and Deep Verticals

Here is the 1-2 slide condensation (if the slide doesn’t show up, check here):

Want to read on? Here you go:

Always tough to pick the takeaways – but here are my Top 3:

The People Architecture is Real – Two years ago Unit4 shared its vision of self-driving ERP and a people oriented architecture. The platform is reality since a year, built on top of Azure and passionately using the Microsoft technology stack (e.g. Luis for the Assistant Wanda). Unit4 has almost finished moving its ERP product – Business World On to the new platform – with a goal to be done by fall (which I read by end of the year). With that Unit4 is on the most modern ERP platforms, when it comes to adopting a modern tech stack, running on a public cloud IaaS (Azure) and taking aggressively advantage of platform capabilities, e.g. shipping Wanda on the Microsoft platform before Microsoft has an assistant in its Dynamics product suite. It’s seldom partners outpace their technology stack providers.

|

| CEO Sieber |

|

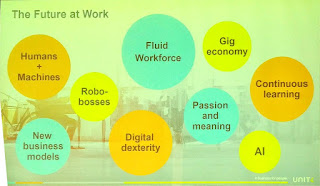

| The Future at Work Vision |

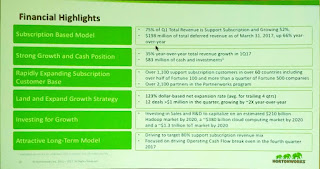

Prevero is an ace up Unit4’s sleeve – Almost a year ago Unit4 acquired German CPM / BI vendor Prevero. Integration is advanced and most importantly Prevero has now more developers than ever, helping to build out the product. The beauty about CPM / BI is that Prevero not only creates value for the install base of Unit4 – but also is a value proposition that Unit4 can take to complete new prospects. Provero e.g. still supports interfaces into SAP. The product is (surprise) in memory based, has an attractive UX and enough customer proof points to be taken more than seriously by prospective customers.

|

| The Platform |

MyPOV

Unit4 has made good progress. Creating a new platform is never easy – and to keep the revenue stream up, during the transition is never easy. The common best practice is to acquire new companies that can create revenue growth during that time and that’s what Unit4 has done with Three Rivers, Command Software and Prevero. Surprisingly the vendor chooses not to address its progress and status of its ERP product – Business World On – but we asked for it (see above). CEO Siebert made the point that ERP is getting commoditized and that the differentiation happens in the Front Office. A fair point certainly, but end to end replacements happen as well. Unit4 customers should ask actively for the status of Business World On.

On the concern side Unit4 has its hands full. New platform, Business World On almost completely on it, new acquisitions to integrate and a new value proposition for customers. The good news for customers is that Unit4 is almost out the tunnel… It would be well advised to find a more aggressive go to market in North America in regards of its ERP products. More competition is good for customers and markets. And modern offerings are only modern … for so long.

But for now, good times are comong for Unit4 customers, the vendor is over the mountain in regards of platform and the benefits should be visible to customers soon: Modern ERP software for services industries. Stay tuned.

.