Rimini Street CEO Ravin: CxOs have to lower costs, preserve autonomy over tech stack

The AI-driven disruption in software as a service and ERP is a case of CIOs wrestling control over their tech stacks from vendors, according to Rimini Street CEO Seth Ravin.

Speaking on DisrupTV, Ravin said "you should never give up your ability to make decisions about your own infrastructure." "Moving forward with upgrades and migrations is what the vendor wants. They're not based on an analysis of what the client needs," said Ravin. "It's a vendor-led program."

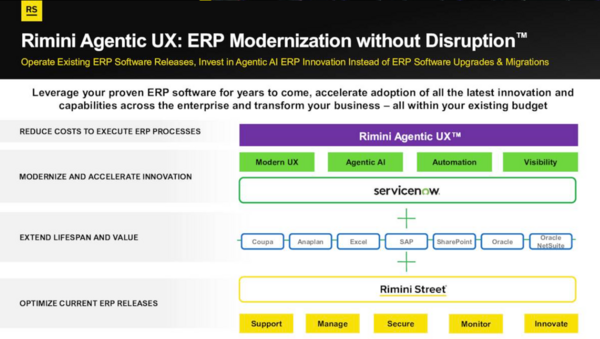

Ravin's appearance followed a better-than-expected fourth quarter and outlook. Just like Rimini Street disrupted enterprise software with its third-party maintenance, the company is looking to upend ERP with a layer of AI agents focused on business processes via a partnership with ServiceNow.

See: Rimini Street’s second act will include heavy dose of agentic AI, UX (PDF)

The strategy for Rimini Street is to put an AI layer above core ERP systems to help businesses save money and move faster. Ravin added that enterprises don't have the bandwidth to upgrade multiple platforms from dozens of vendors in the name of AI.

Ravin said ERP is so complex and unwieldy that it can't be changed quickly enough in the AI age. Rimini Street is adding agentic AI on the top of the ERP layer to be nimbler. "You might call it Band-Aids. You might call it a supplement," said Ravin. "But we're doing the work in the AI layer and we're able to do things faster."

Ravin said the transition to an agentic AI labor will take time, but there's no choice.

"We watched big ERP break apart and decompose into pieces, and now those pieces are finding competitors," said Ravin. "CFOs are much more comfortable as are CIOs in mixing and matching pieces. The software vendors used to have control of the customer. That's all changing. They're losing control because choice is entering at different levels."

Indeed, Anthropic's moves in the enterprise with Claude Code and Claude Cowork have forced companies to re-evaluate their vendors just as Wall Street has revalued software stocks.

- Zoho just delivered the best SaaS defense vs. AI

- How CEOs are answering the dreaded LLM disruption question

- SaaS under the microscope: How to evaluate your vendor

- SaaS death knell storyline illogical, but margin compression is here

- Observability stands out in enterprise software wreckage

Choice in the enterprise software layer and AI will "allow us to do things faster, better and cheaper with faster speed to market," said Ravin. "The only way a company is going to win in the future is to have the lowest cost to serve. That's why you're watching the software stocks. Nobody knows how to value them," he said. "Imagine every one of these vendors telling you to move to my new product to deploy my agents. You can't do it all. CIOs for the first time can no longer defer to the roadmap because there's too many roadmaps."

Constellation Research CEO R "Ray" Wang said enterprises are all looking at margin compression. "People are working 10 times harder to stay still, and this is why people are looking at automation," said Wang. "We're trying to get more innovation into play. How do you pay for that innovation? Find the cost savings to pay for that innovation."

Rimini Street’s fourth quarter

Rimini Street reported a fourth quarter profit of $724,000, or a penny a share, on revenue of $109.8 million, down 3.9% from a year ago. Non-GAAP earnings for the fourth quarter were 6 cents a share.

The revenue decline was due to Rimini Street phasing out its PeopleSoft support offerings.

As for the outlook, Rimini Street projected first quarter revenue between $101.5 million and $103.5 million. The company reiterated revenue growth for 2026 in the 4% to 6% range.

In January, Rimini Street released its first 20 Rimini Agentic UX Solutions powered by ServiceNow. The 20 Rimini Agentic UX Solutions were built by process experts focused on sales and go-to-market, procurement and supplier, material and master data, logistics and fulfillment, order and shipment exceptions, maintenance operations, finance and expense management and quality and compliance.

Ravin said on the earnings call that its agentic ERP offerings with ServiceNow are garnering strong interest. He said:

"We're positioning Rimini Street as the bridge between existing traditional ERP software infrastructure and the capability and benefits of modern AI innovation, and we expect growing subscriptions for both Rimini Support as our core service offering and our new AI for the real-world service offerings to fuel top and bottom-line growth in 2026."