Observability stands out in enterprise software wreckage

Observability companies, initially thrown out with the SaaS bath water, still matter given strong earnings results from Datadog and Dynatrace. The upshot: AI workloads are only becoming more complicated and that means observability matters.

In fact, executives at the publicly available observability companies are noting that the case for their platforms is stronger with AI. Nevertheless, Wall Street analysts were still asking whether enterprises are going to vibe code their way to observability suites.

- SaaS under the microscope: How to evaluate your vendor

- BT150 CxO zeitgeist: AI agent growing pains abound

- SaaS death knell storyline illogical, but margin compression is here

- Yes, Software is Still Eating the World

Other key players in the observability space such as Splunk and New Relic are part of a much larger technology company in Cisco or now private, respectively.

Datadog reported strong fourth quarter results and provided a solid outlook for its first quarter and fiscal year ahead. The company will outline more of its strategy at an investor day Thursday.

The company reported fourth quarter earnings of 13 cents a share on revenue of $953 million, up 29% from a year ago. Non-GAAP earnings were 59 cents a share. Wall Street was looking for earnings of 55 cents a share.

As for the outlook, Datadog projected revenue between $951 million and $961 million with non-GAAP earnings of 49 cents a share and 51 cents a share. Fiscal 2026 revenue will be between $4.06 billion and $4.1 billion with non-GAAP earnings of $2.08 a share and $2.16 a share.

Oliver Pomel, CEO of Datadog, said the company has launched more than 400 new features including an AI site reliability engineer, storage management and data observability. Pomel said the company is focused on helping customers deploy next-gen AI applications. "Looking forward to 2026, we are excited about our plans to deliver more AI-powered innovation and help our customers with their complex challenges in modern Observability, Security, Software Delivery, Service Management, and Product Analytics," said Pomel.

Pomel said on Datadog's earnings call:

- "We saw a continued acceleration of our revenue growth. This acceleration was driven in large part by the inflection of our broad-based business outside of the AI-native group of customers we discussed in the past. And we also continue to see very high growth within this AI-native customer group as they go into production and grow in users, tokens and new products."

- "We continue to see strong growth dynamics with our core 3 pillars of observability: infrastructure monitoring, APM and log management as customers are adopting the cloud, AI and modern technologies."

- "We continue to see increased interest among our customers in next-gen AI. Today, about 5,500 customers use one or more Datadog AI integrations to send us data about their machine learning, AI and LLM usage."

- "There's going to be many more applications than there were before. Like people are building much more and they are building much faster.

Dynatrace's fiscal third quarter results also topped expectations. The company reported third quarter earnings of 13 cents a share on revenue of $515 million, up 18% from a year ago. The company closed 12 deals worth more than $1 million in ARR in the quarter.

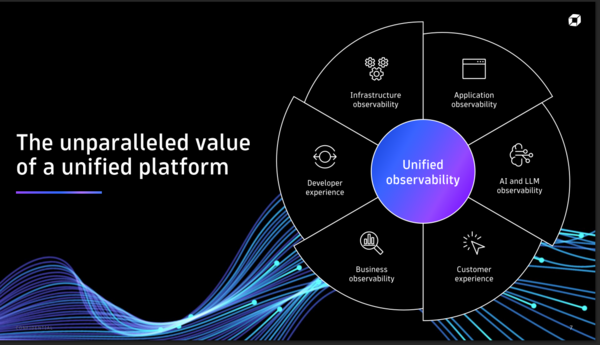

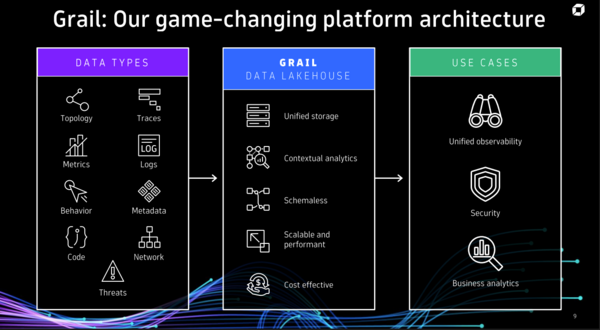

The company recently launched Dynatrace Intelligence, an agentic AI operations system, agents for site reliability engineers, cloud native integrations and real user monitoring tools. The company data lakehouse, Grail, serves as the hub for Dynatrace's platform.

Rick McConnell, CEO of Dynatrace, said "as organizations broadly deploy AI, observability is mission critical to managing the reliability and performance of those workloads."

As for the outlook, Dynatrace projected fiscal 2026 revenue of $2.005 billion to $2.02 billion, up 18% or so. Non-GAAP earnings will be between $1.67 a share to $1.67 a share. That guidance was ahead of projections.

On Dynatrace's earnings call, McConnell was asked about LLM's and their impact on SaaS and his company. Key quotes from him include:

- "Number one, we view there to be a very sizable difference between enterprise software with standard workflows and infrastructure software like ours with highly dynamic workflows requiring variable evaluation of billions of interconnected data points.”

- "Secondly, we really do see observability as the control plane for enterprise AI. We don't believe that you can easily replace observability through vibe coding or an LLM instantiation that can do the same thing that we do. Third, we really see our focus and our moat really is being architectural and not code based."

McConnell added that AI deployments are only getting more complex across LLMs and agentic systems. And that means observability and a deterministic and explainable system to complement probabilistic models.