Workday spends $1.1 billion on Sana, aims to be front door to work

Workday has acquired Sana, an AI agent startup that surfaces knowledge in enterprise systems, for $1.1 billion in a bet that the HCM and finance software provider can become "the front door to work."

The news, announced at Workday Rising 2025, touches on a few themes worth noting.

- Workday's Sana acquisition pairs with other announcements such as Workday Data Cloud to telegraph a platform play for the company. Workday's argument that its data on people and money can power a broader AI agent platform.

- There's a healthy debate about how AI agents could upend software. Workday's Sana's purchase gives the company a hedge.

- It's quite possible that AI agents are the new user interface of choice. Sana puts Workday in good position if AI agents are the de facto interface.

Gerrit Kazmaier, president, product and technology at Workday, said Sana's AI-native approach and design chops will help Workday revamp work. "(Sana) will make Workday the new front door for work, delivering a proactive, personalized, and intelligent experience that unlocks unmatched AI capabilities for the workplace," said Kazmaier.

- LLM giants need to build apps, ecosystems to go with the models

- Pondering the future of enterprise software

- Agentic AI: Is it really just about UX disruption for now?

The Workday-Sana vision of work revolves around bringing enterprise knowledge, data and workflows in one place. This front door for work will find answers from various data stores including Workday, Google Drive, SharePoint and Office365, integrate actions, create content and automate workflows.

In addition, Sana has more than 100 connectors to various repositories ranging from Box to Snowflake to SAP and Salesforce. See: AI agents, automation, process mining starting to converge

The big theme with Sana is that Workday is trying to make AI easier, more practical and useful. Workday Executive Chair Aneel Bhusri said:

"People thought AI was going to solve everything, and vendors were out there marketing way ahead of what they had product wise. Vendors have gotten more realistic about delivering solutions to their customers, and, frankly, smarter about what works and what doesn't work. What you'll see from workday and others over the next 12 to 18 months will be real solutions that really help you run your business better and really leverage the power of AI, not just quick fixes."

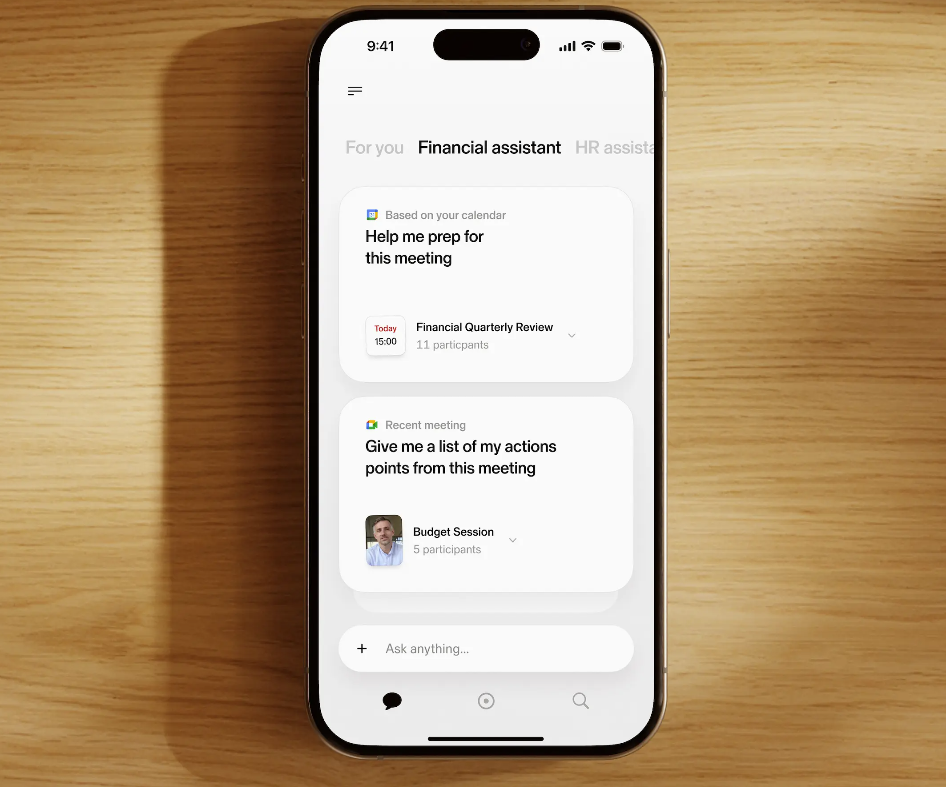

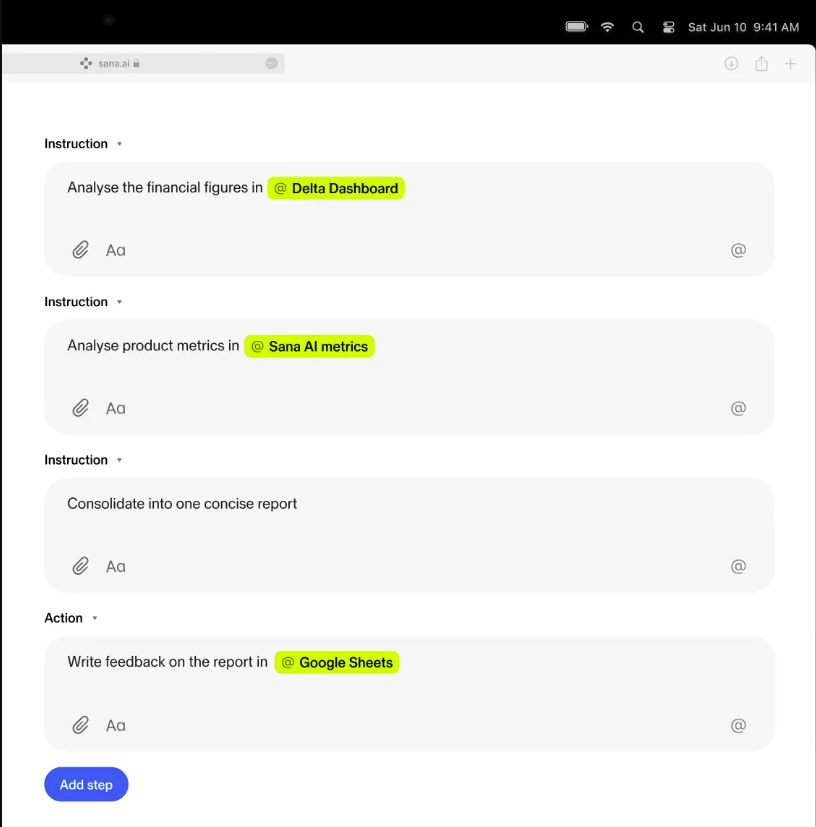

Here's a look at Sana's UI.

Sana Agents feature search and chat as well as coding tools and automation. Sana also has a learning platform, Sana Learn, that combines learning management, content creation and course generation. Sana Learn will complement Workday Learning with AI tools and personalization.

Kazmaier said during Workday's investor day:

"We think about Sana like the iOS for enterprise in the future. And we see it being like a power combination with Workday because we have incredible distribution. We have 75 million users already. And you can ask 100% expect us to leverage that to bring Sana as an experience to every one of them.

Now the beautiful thing about Sana is that it's not just an incredible enterprise search and enterprise action experience. It also gives us the opportunity to encompass many, many more workflows that people are not doing in Workday today. People engage with Sana today on average 7 times a day in the current form. If we bring this to all of our customers and we open up that AI extensibility for them many things that they are doing today with legacy ticket-based automation, programmed exits, DIY AI systems, they will just naturally fall into this."

Workday has been on a bit of a buying spree of late. In the last 18 months, Workday has acquired the following:

- Sana.

- Paradox.

- Flowise.

- Evisort.

- HiredScore.

Holger Mueller, an analyst at Constellation Research, said:

"Workday is on a record acquisition spree, Sana the latest one. At the same time, Workday is radically changing it's data and AI architecture. Here's the question: How will Workday integrate the last three acquisitions? Customers want and need AI asap and Workday needs to deliver fast, while addressing architectural debt and not creating too much new debt."