Paychex is betting that its proprietary data sets in human capital management and adjacent markets will make it a winner in AI via productivity and new products.

The company reported better-than-expected second quarter earnings driven by its acquisition of Paycor, announced a year ago, and AI-driven efficiencies. Paychex reported second quarter earnings of $1.10 a share on revenue of $1.56 billion, up 18% from a year ago. Non-GAAP earnings were $1.26 a share.

- Paychex acquires Paycor in $4.1 billion deal

- Constellation Research Shortlist vendors for payroll for North American SMBs and HCM suites focused on North America.

For fiscal 2026, Paychex is projecting revenue growth of 16.5% to 18.5%. Paychex CEO John Gibson said the company now expects to save $100 million in expenses via the Paycor integration.

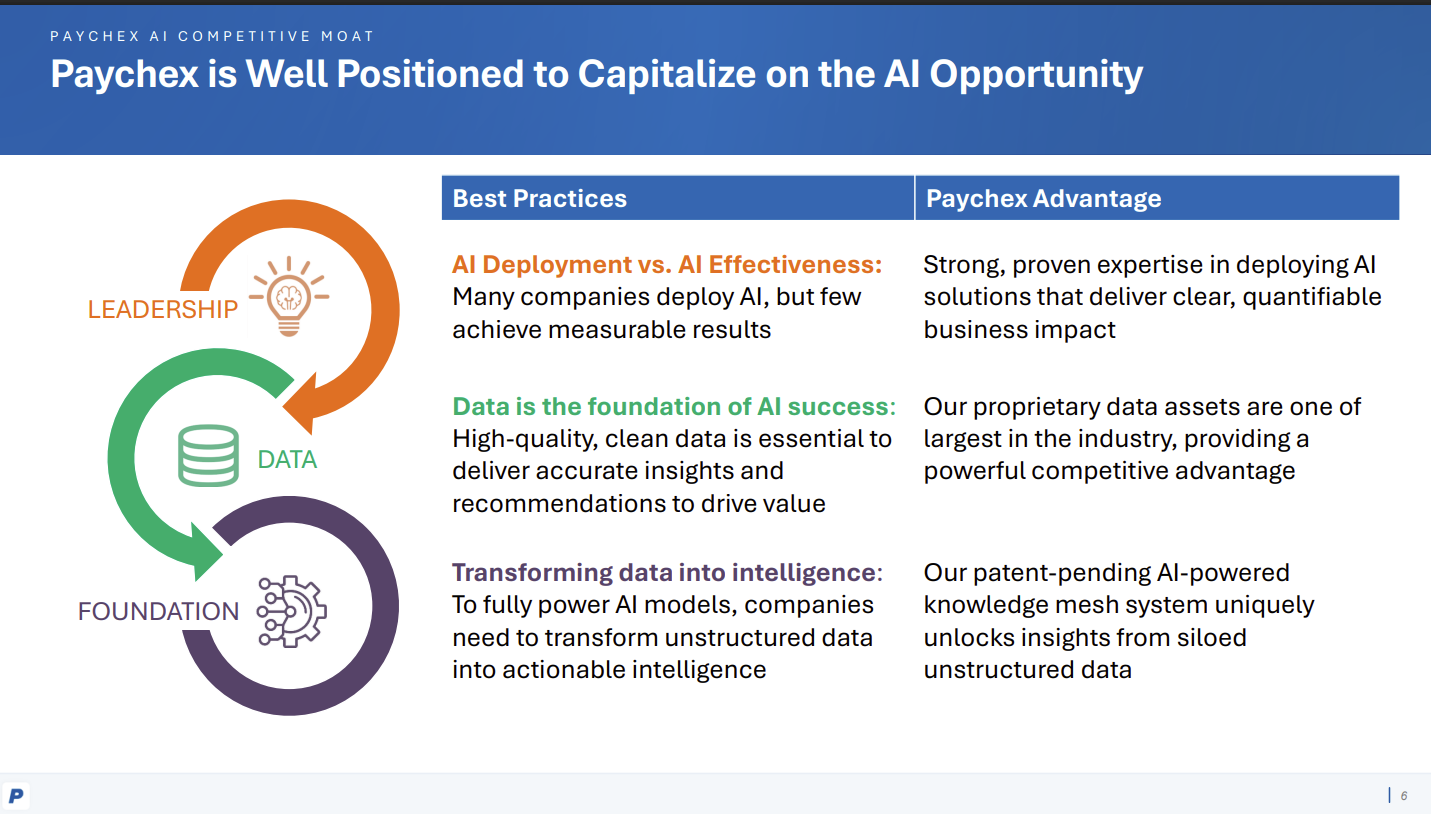

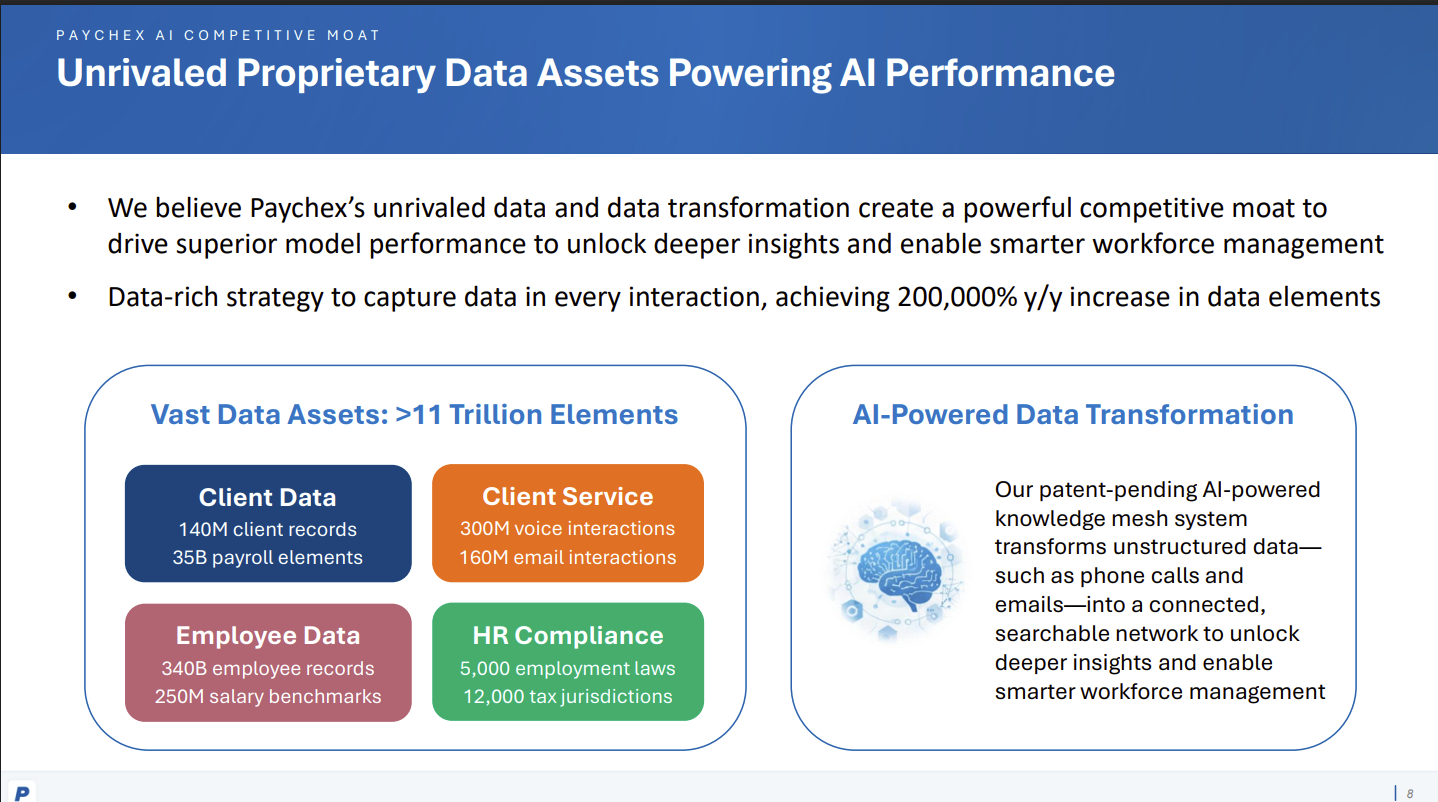

Along with the earnings results, Paychex outlined its AI plans and its positioning. The company recently launched agentic AI tools to automate payroll processing, created a knowledge mesh system that organizes unstructured data such as calls and emails into a searchable network and layered generative AI throughout its platform.

Here's a look at the takeaways from Gibson on Paychex earnings call and cover multiple AI disruption points.

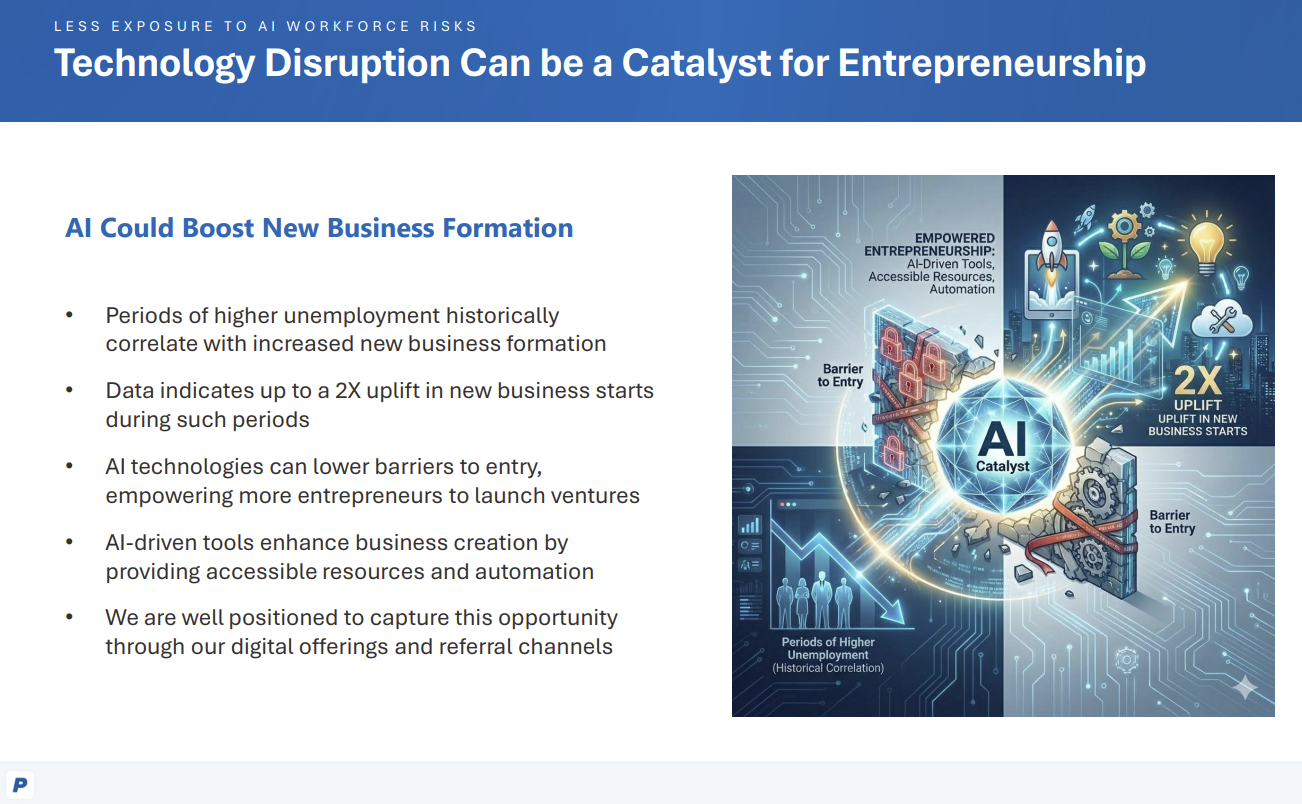

AI employment disruption. Paychex business depends on employees and there's a risk that AI will mean less employment and revenue for the company. Gibson said more than 70% of its customers employees work in "blue and gray-collar industries" that are harder to displace. In addition, the Paychex customer base skews SMB where staff where multiple hats. Those roles are harder to replace with AI.

"If AI disrupts large firms disproportionately, talent may shift to smaller businesses, benefiting our clients. Meanwhile, our clients continue to face talent shortages and AI can help improve efficiencies to address those gaps," said Gibson.

Simply put, there’s a valid case that AI disruption at large companies is going to mean that reskilling efforts will need to go well beyond AI and into entrepreneurship.

The Paychex revenue model. Gibson said that Paychex has a revenue model that has a significant fixed base fee component and that historically has insulated it from employment fluctuations. Paychex also HR experts to go along with the technology platform.

Proprietary data. Gibson said: "In terms of our differentiation, AI success hinges on data quality and data scale. With one of the largest proprietary datasets in the industry, we believe we have a powerful competitive advantage to drive superior AI performance."

This first-party data argument is something you're going to hear across multiple enterprises in technology and beyond. The game is going to be leveraging that data to spin off new products and services, becoming more efficient and building a moat around the business model.

"I think AI is going to be very interesting as we try to productize it. We're going to try to improve the customer experience. We're going to try to add more value to our product to differentiate ourselves because there are very few players that have the depth of insights and information from our data that we can provide inside the technology," said Gibson.

Pragmatic AI applications. Paychex plays in a crowded market where it can compete with ADP, Rippling, Intuit, Trinet, Dayforce and a bevy of others depending on the market. The acquisition of Paycor enabled Paychex to cater to more mid-sized businesses.

Gibson said Paychex is focused on "delivering pragmatic AI solutions focused on measurable outcomes such as time saved and friction removed from everyday processes." An AI-driven employment law and compliance platform would be an example. The company is piloting its first agentic AI tools now.

Holger Mueller, an analyst at Constellation Research, said:

"Paychex is playing with its two offerings Paychex at the lower end and Paycor for enterprises. Being able to serve both markets is attractive and investors are seeing a few more quarters of favorable comparisons thanks to the Paycor acquisition. To position itself for the new set of AI startups, Paychex will have to do more though. Fast growing startups in the past would buy large enterprise systems - larger than needed in many cases - to signal to investors they were ready for massive growth. Paychex will need to continue to appeal to those new companies."