Cisco reports strong Q2, sees networking, AI infrastructure surge

Cisco's fiscal second quarter results were better-than-expected with revenue growth of 10% and strength in AI infrastructure and networking.

The company reported second quarter earnings of $4.1 billion, or 80 cents a share on revenue of $15.3 billion, up 10% from a year ago. Non-GAAP earnings were $1.04 a share. Wall Street was expecting Cisco to report non-GAAP earnings of $1.02 a share on revenue of $15.12 billion.

CEO Chuck Robbins said: "We believe Cisco is uniquely positioned to deliver the trusted infrastructure needed to securely and confidently power the AI-era."

Key second quarter figures include:

- Product orders were up 18% from a year ago with networking orders up more than 20% from a year ago.

- AI infrastructure orders from hyperscalers were $2.1 billion.

- Americas revenue was up 8%, EMEA was up 15% and for Asia Pacific was up 8%.

- Networking revenue was up 21%.

- Collaboration was up 6%.

- Security was down 4% and observability was flat.

- Remaining performance obligations (RPO) in the second quarter was $43.4 billion.

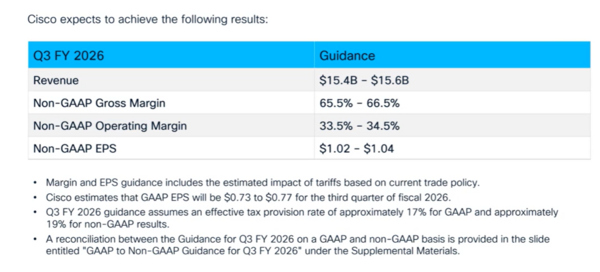

As for the outlook, Cisco projected third quarter revenue of $15.4 billion to $15.6 billion with non-GAAP earnings of $1.02 a share to $1.04 a share. For fiscal 2026, Cisco projected revenue of $61.2 billion to $61.7 billion with non-GAAP earnings of $4.13 a share to $4.17 a share.

- Cisco launches Silicon One G300, new Nexus switches, AI ops tools

- IBM, Cisco aim to scale, network quantum systems

- Cisco tunes network portfolio, gear for AI agents, introduces AgenticOps

Speaking on the earnings call, Robbins said:

- "While it was clear that expectations for adoption and execution are high, one major challenge still exists: legacy infrastructure was not designed for the performance, speed and security needs of AI. Our strong first half of FY 26 demonstrates both the power of our portfolio and the fundamental role we play in this once in a generation transition."

- "I'd also like to address the recent significant increases in memory prices across the market, leveraging our industry leading supply chain team, we are proactively implementing three key strategies. First, we have already announced price increases and will continue to monitor market trends and make additional adjustments as necessary. Second, we are revising contractual terms with channel partners and customers to address evolving component prices. Third, Cisco's operating scale and industry leading position help us negotiate favorable terms and secure supply to fulfill current and future demand."

- "We continue to see strong demand for our industrial IoT portfolio, which has now grown double digits for seven consecutive quarters. This demand is driven by onshoring of manufacturing to the United States, the increase of AI workloads at the network edge and the emergence of physical AI."

- "With Splunk we saw a similar trend in q2 and seen in q1 with continued acceleration to cloud subscriptions and fewer on premise deals. While this shift is creating a drag on revenue growth, which we expect to continue in the second half of fiscal year 26, cloud subscriptions enable greater adoption expansion and faster delivery of innovation to customers. So overall, we are pleased with this transition."

Cisco recently held its AI Summit. Here are dispatches from that meetup.

- Cisco AI Summit 2026 Key Takeaways | With R "Ray" Wang & Chirag Mehta

- SaaS under the microscope: How to evaluate your vendor

- OpenAI's Altman on fully AI companies, open source, infrastructure

- AWS CEO Garman said space data centers likely to take longer

- Intel to make GPUs; CEO Tan riffs on AI adoption