Salesforce sets $60B revenue target: Will unlimited Agentforce plans drive growth?

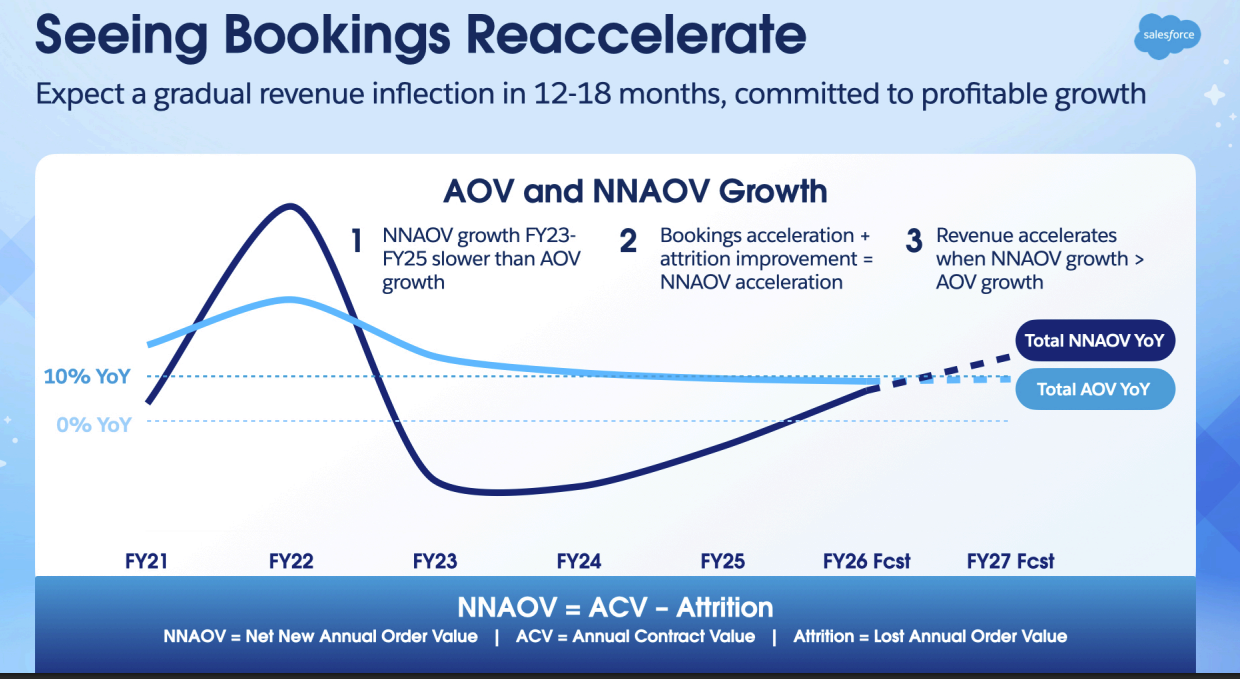

Salesforce executives said that growth is reaccelerating due to Agentforce deployments and it is projecting a long-term revenue target of $60 billion by fiscal 2030 excluding the Informatica purchase. The big question is whether new pricing plans designed to meet customers where they are will drive the growth.

The revenue target assumes more than 10% of organic compound annual revenue growth from fiscal 2026 to fiscal 2030. Salesforce also said it aims to have the sum of subscription and support constant currency growth rate and non-GAAP operating margin total 50 by the end of fiscal 2030. Software vendors have typically made the "Rule of 40" as a key metric.

"We are confident in our ability to reach $60-plus billion by FY '30. In addition to that, as you know, we are very focused on profitable growth. One of my key goals as CFO is to deliver Salesforce is not only an agentic enterprise, but a lean agentic enterprise," said Salesforce CFO Robin Washington.

- Salesforce CEO Benioff: Context is king

- Salesforce makes its Agentforce 360 case to be your AI agent platform

- Salesforce's acquisition of Apromore highlights how process intelligence, agentic AI converging

- Salesforce expands OpenAI, Anthropic partnerships, eyes Agentforce everywhere

During the Wall Street analyst session, Salesforce executives, notably Chief Revenue Officer Miquel Milano, walked through the pricing and packaging of Agentforce. "We are meeting customers where they are," said Washington, who noted Salesforce is focusing on industries and segments as well as geographies.

Salesforce CEO Marc Benioff said "what we've seen in the last 3 years is that the speed of innovation has outpaced the speed of customer adoption." That situation is changing though.

Benioff said:

"There's only two things that we do. One is building that product. The second thing is now selling it. So now on a global stage, across every geography, every language and across all six of those segments, we have to deliver the goods, and we have to deliver the growth. And we have to get to those -- the numbers are off the screen, but then we're trying to get to these very high numbers."

Pricing matters

Milano outlined an Agentforce pricing strategy that appears to be more flexible to entice enterprises to bet on Agentforce 360 as a platform play. The unlimited plans for Agentforce and Data 360 may give CFOs and CIOs more predictable costs.

“Customers don’t want to count tokens. They want predictability. The Agentic ELA gives them unlimited use for two or three years,†said Milano.

New monetization models to “meet customers where they are†include:

- Seat-based editions (e.g., Agentforce for Service/Sales): upgrades existing licenses.

- Consumption-based credits for flexible AI use.

- Flex Agreements: reallocate seat spend toward AI consumption.

- Agentic Enterprise License Agreements (ELAs): flat-fee, unlimited use of Data 360 and Agentforce for predictable costs — already a dozen signed and more than 150 accounts in negotiation.

Milano said:

“CEOs for the most part, they're tired. They're saying I just want to transform. I just want to use AI everywhere. We are clear that there are very few technology vendors that can do this for us. We want Salesforce to do it, but we are worried about the pricing. Predictability of cost was very important for CEOs. So we put together something very simple: Flat fee, unlimited usage of Data Cloud and Agentforce for our customers. They can deploy any use case they want for 2, 3 years. They can ingest as much data as they need for those Agentic use cases.â€