Quantum computing pure plays duel with giants, rivals

Quantum computing's pure plays have bulked up balance sheets and continue to bet they can upend larger rivals backed by big corporations including Alphabet, IBM and Honeywell.

In recent weeks, Google, IBM and Quantinuum have outlined roadmaps and quantum computing milestones. Meanwhile, the pure play quantum companies have surged on Wall Street (and given a big chunk of those gains back) with more going public. For instance, Infleqtion, which is focused on neutral atom architecture, will go public via a merger with special purpose acquisition company Churchill Capital Corp X.

The results from the quantum computing pure plays land after Google outlined advances in its Willow processor and Quantinuum launched its next-gen Helios system. Toss in IBM's quantum computing efforts and it's pretty clear that the pure plays in quantum computing are Davids trying to slay Goliath (or a series of them). Those aforementioned giants are all focused on superconductors to drive quantum systems.

- IBM, Cisco aim to scale, network quantum systems

- IBM launches IBM Quantum Nighthawk processor

- Quantinuum launches Helios quantum computer, touts fidelity, enterprise customers

- Google claims quantum advantage with Willow breakthrough

- 2025 is the year of quantum computing

Rigetti is also aligned with superconducting, but D-Wave is focused on annealing and IonQ plays in the trapped ion space. Simply put, there's a VHS-Betamax moment ahead, but it remains to be seen how long until a clear winner is declared.

What is clear is that the pure play quantum providers have floated shares to raise capital. IonQ has $1.5 billion in cash and equivalents as of Sept. 30 and $3.5 billion following a $2 billion equity offering in October. D-Wave had a cash balance of $836.2 million and Rigetti checked in with $600 million in cash and equivalents. In other words, there's enough funding to surf the quantum computing technology shifts.

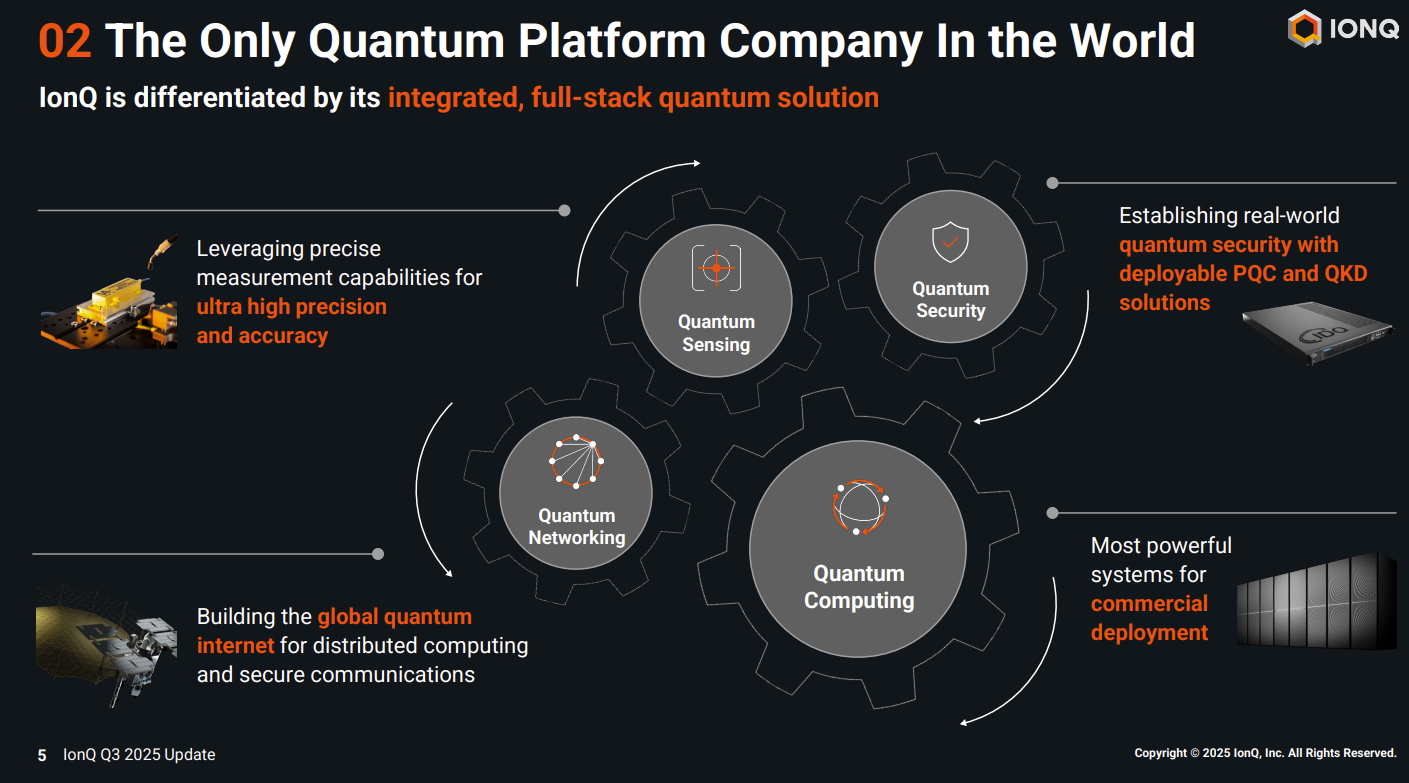

Nevertheless, it's also clear the market is immature. Rigetti reported third quarter revenue of $1.9 million. D-Wave had third quarter sales of $3.7 million. IonQ, the largest of the publicly traded pure plays in quantum, had third quarter revenue of $39.9 million and projected more than $100 million in revenue. IonQ has bulked up via acquisitions and aims to offer an integrated stack of quantum compute, networking, sensing and security.

Constellation Research analyst Holger Mueller said:

"The quantum space is in an interesting phase, as we see both the giants and the Davids. The interesting thing is that the Davids often are older than the giants, so they have adapted to the new competitive landscape and state of quantum. Usually though we should see a new generation of Davids pop up - but it looks like the hardware window is closed for now. Davids will likely show up on the algorithm and software side. A further challenge to first generation Davids is quantum advantage will be achieved by a combination of AI / HPC and quantum. Smaller quantum players will need to partner for the former two. The good news is that there are "Ggiants" in HPC that do not have a quantum play (like HPE) and AI (like Nvidia) that will be eager to partner. The biggest challenge: CxOs cannot pick the winners for their initial quantum workloads yet - but it is getting closer and closer to make that call."

Here's what you need to know about the latest round of quantum computing results.

IonQ (trapped ion)

IonQ CEO Niccolo de Masi said the third quarter was transformative because it saw a "tremendous symphony of technical progress, talent attraction and successful expansion of our vision to lead globally in the business of quantum."

de Masi's take aligned with what he said on IonQ's investor day. The big picture: IonQ is the leader in quantum computing and will become the next Nvidia.

IonQ's #AQ 64 Tempo system launched ahead of schedule and de Masi is focused on use cases that deliver value today. IonQ is also betting heavily on quantum networking.

"IonQ has a truly unique ability to land and expand quantum computing, quantum networking, quantum sensing and quantum cybersecurity. Our strategy is to expand our technical lead in each quantum product family and connect our products together to provide unique solutions to allied sovereigns and major multinationals alike," said de Masi, who noted IonQ has more than 1,100 patents pending and granted.

de Masi also touted 99.99% fidelity for 2-qubit gates. IonQ is also taking aim at incumbents focused on superconducting as the company has outlined use cases with Ansys for engineering and AstraZeneca for drug discovery. "Our newest system, which we unveiled at our Analyst Day on September 12 is called Tempo. Public benchmarks show Tempo has a compute space 36 quadrillion times larger than the leading commercial superconducting system in the market. We are proud that Tempo is scheduled to ship in 2026 and has a computational space approximately 260 million times larger than our current fully commercialized Forte system," said de Masi.

The IonQ CEO added:

"While numerous companies, public and private, have added the word quantum to their corporate name for decades, we can confidently state that in almost every case beyond IonQ, this is just a branding attempt. Terms like quantum-inspired, quantum annealing or analog quantum simulators all represent toy machines compared to the real deal, which is universal fully entangled gate-based quantum computing."

Things to know:

- IonQ is targeting 1,600 logical qubits in 2028 and 80,000 in 2030.

- For 2025, IonQ is projecting revenue of $106 million to $110 million.

- The company reported a third quarter net loss of $1.1 billion on revenue of $39.9 million, up 37% from a year ago.

- IonQ advanced to Stage B of DARPA's Quantum Benchmarking Initiative (QBI).

- IonQ is available on AWS Braket, Microsoft Azure, and Google Cloud Platform.

Rigetti Computing (superconducting)

Rigetti Computing reported a third quarter net loss of $201 million on revenue of $1.9 million and had $600 million in cash and equivalents as of Nov. 6.

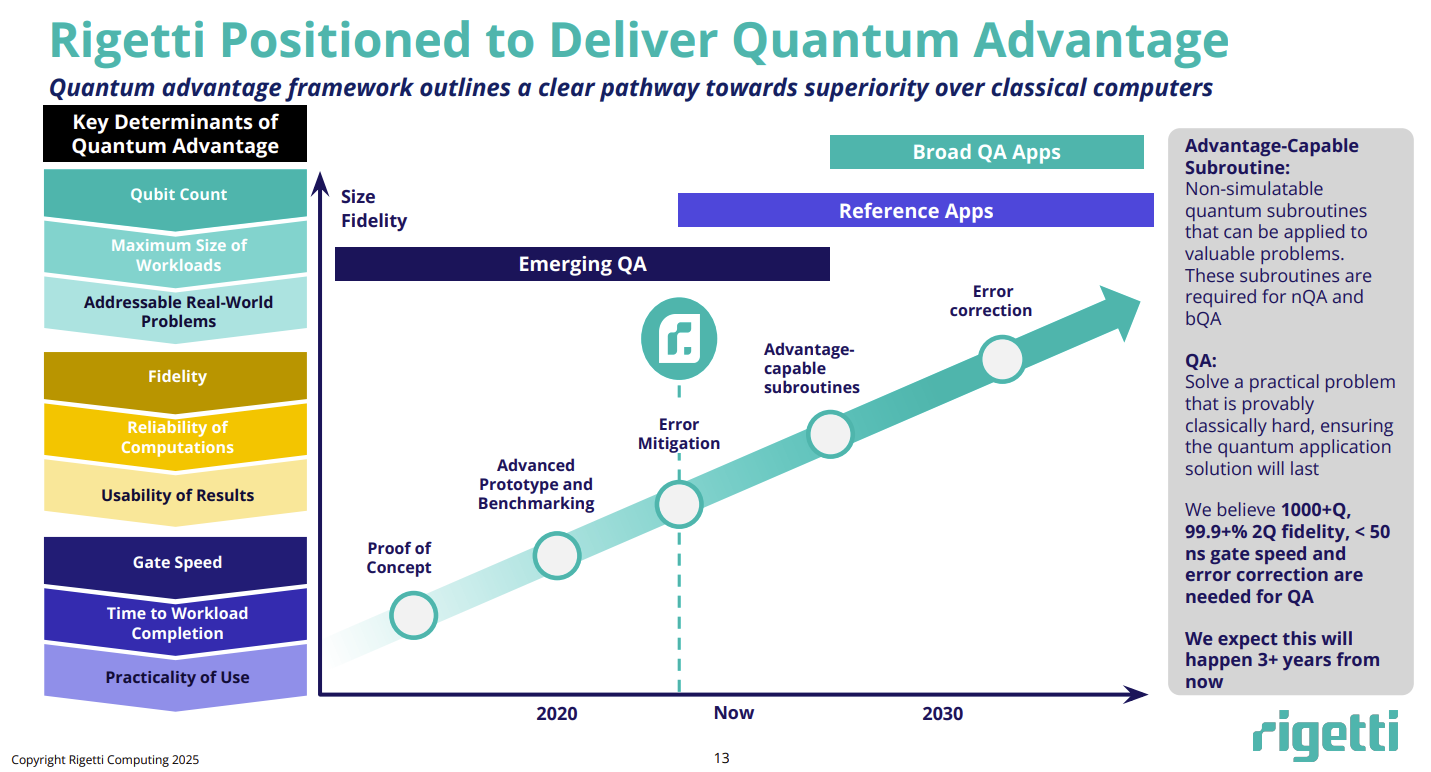

Dr. Subodh Kulkarni, Rigetti CEO, said the company will deliver its chiplet-based quantum system with more than 100 qubits by the end of 2025. The system has a 99.5% median two-qubit gate fidelity.

Rigetti is aiming for a quantum system with more than 150 qubits by the end of 2026 with a 99.7% median two-qubit gate fidelity and top 1,000 qubits by the end of 2027 with a media two-qubit gate fidelity of 99.8%.

The company stands out in the pure play quantum space since it has decidedly less bravado. Kulkarni said quantum computing is a challenging space and the company plans to grow organically even though it has enough cash to make acquisitions.

Rigetti Computing CEO: Quantum advantage 4 years away

"For quantum advantage, we still think we need a 99.9% 2-qubit gate fidelity, as well as some form of error correction. So between '27 and '29, which is when we still believe we accomplish quantum advantage, is getting the fidelity to that 99.9% and also error correction up," said Kulkarni.

Rigetti said it sold two quantum systems for $5.7 million for two 9-qubit Novera systems, which can be upgraded to increase the qubit count. The systems will be delivered in the first half of 2026 to an Asian technology manufacturing company and an applied physics and AI startup in California.

Kulkarni said the two systems include everything from the dilution refrigerator to control systems. The complete systems can be upgraded to and drive additional revenue.

Things to know:

- The company has a 3-year $5.8 million contract from the Air Force Research Laboratory to advance superconducting quantum computer networking with QphoX, a Dutch quantum startup.

- Rigetti wasn't selected for Stage B of DARPA's QBI, but received constructive input. The company said it is optimistic that it will be chosen for Stage B in the coming months.

- DARPA's feedback for Rigetti revolved around error corrections and some areas of long-rang coupling.

Rigetti sees a big opportunity for hybrid supercomputing that bridges high performance computing and quantum as well as Nvidia's NVQLink effort. "We believe superconducting quantum computing is most amenable for hybrid computing compared to other modalities which are 1,000 times slower, like trapped ion or pure atom modalities," said Kulkarni.

Kulkarni said the company was feeling good about the roadmap, its ability to execute and a partnership with Quanta Computer to build systems.

D-Wave (annealing)

D-Wave reported third quarter revenue of $3.7 million, up 100% from a year ago, with a net loss of $140 million. The net loss includes a non-cash charge due to the company's warrants. The company has $836.2 million in cash and equivalents.

The company, which is focused on the annealing approach to quantum computing, recently launched its Advantage2 system. Quantum annealing is designed for optimization and probabilistic sampling problems in areas like logistics, finance and machine learning. This specialized approach isn't general purpose.

CEO Alan Baratz said on the company's earnings call:

"As other quantum companies remain in R&D mode, we are laser-focused on a path to profitability built on customer value. We signed a number of new and renewing customer engagements in the third quarter for both commercial and research applications. These engagements include one of the largest U.S.-based international airlines, SkyWater, the nation's largest pure-play semiconductor foundry. Japan Tobacco's Pharmaceutical division, which is exploring new Quantum AI applications in drug discovery, Yapi Kredi, one of the leading banks in Turkey and Korea Quantum Computing, a company specializing in quantum computing R&D, quantum security solutions and AI infrastructure in Korea."

Baratz's added that D-Wave is focusing on hybrid workloads with supercomputers. Baratz said the company's approach is to deliver value today with optionality in the future based on whatever quantum computing approach wins. Baratz said D-Wave is using superconducting gates for its annealing and emphasized the point.

On D-Wave's second quarter and first quarter earnings calls, Baratz didn't go into details about how much aligned it was with superconducting. It's possible that D-Wave's cryogenic control system it uses for its annealing would be critical to any superconducting gate model quantum company.

The D-Wave CEO said, "we believe that one will clearly emerge victorious in the long run and that approach is superconducting." Baratz, who said ion trap and neutral atom approaches have some advantages today, also took aim at IonQ's investor pitch.

"We recently heard an ion trap company spent hours discussing their technology advantages at an analyst event, but not once did they mention gate speed. With a potential performance disadvantage of up to 10,000x, I can see why they might have forgotten to discuss that key metric," said Baratz.

Much of Baratz's time on D-Wave's most recent earnings call was defending its annealing approach. "We recently had a fair amount of chest pounding from quantum leaders. Let me be clear. Anyone who characterizes quantum annealing as not real quantum is either intellectually incapable of understanding the physics and science or has chosen to put their head in the sand because they are worried about the competitive threat," said Baratz.

D-Wave's Advantage2 quantum computer generally available

Things to know:

- D-Wave has more than 100 revenue-generating customers over the last four quarters.

- For the nine months ended Sept. 30, D-Wave had revenue of $21.8 million. Of that total, $4.2 million was quantum computing as a service (QCaaS) and $2.1 million was professional services.

- The company has 100 QCaaS customers and 48% of them are commercial. D-Wave offers its systems through its Leap cloud service.

- D-Wave's business strategy is to focus on commercial customers not government funded R&D.

- Baratz said the company is "laser-focused on quantum computing" not ancillary revenue streams like networking, sensing and quantum key distribution.