Microsoft Q2 strong, Azure growth of 39%, OpenAI is 45% of RPO

Microsoft said its second quarter cloud revenue topped $50 billion as the company handily topped expectations. Microsoft also posted a big investment gain on OpenAI.

The company, which said AI demand was strong, reported second quarter net income of $38.5 billion, or $5.16 a share, on revenue of $81.3 billion, up 17% from a year ago. Non-GAAP earnings were $4.14 a share. Microsoft noted that non-GAAP earnings exclude the impact of the company's investment in OpenAI.

Wall Street was looking for Microsoft second quarter adjusted earnings of $3.92 a share on $80.27 billion.

Microsoft said the impact from its OpenAI investment was a net gain of $7.58 billion, or $1.02 a share. The company said its other income and expense in the second quarter was $10 billion driven by a gain due to the OpenAI recapitalization. Look for OpenAI accounting to be a big topic for Microsoft going forward.

- Microsoft launches Maia 200 as custom AI silicon accelerates

- Microsoft outlines Quantum OS, Quantum Development Kit

- Microsoft's big idea: Be a good AI neighbor as NIMBY scales

- Microsoft launches Agent 365, a parade of AI agents at Ignite 2025

- Anthropic, Microsoft Azure, Nvidia ink $30 billion compute pact

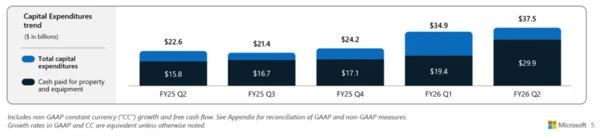

In addition, Microsoft said its capital expenditures were $37.5 billion in the second quarter, up 66% from a year ago.

CEO Satya Nadella said "we are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises." CFO Amy Hood added that results exceeded expectations with strong Microsoft Cloud growth.

By the numbers:

- Remaining performance obligations in the second quarter was $625 billion, up 110%. The company said about 45% of its RPO is attributed to OpenAI and the remaining balance got a boost from Anthropic.

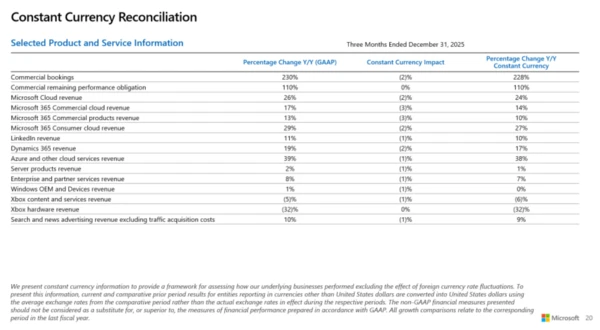

- Microsoft Cloud revenue in the second quarter was $51.5 billion, up 26% from a year ago.

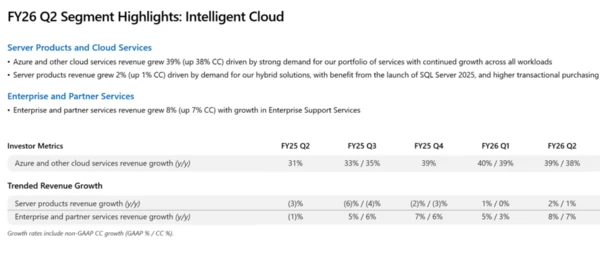

- Azure and other cloud services revenue was up 39%.

- Revenue for the Productivity and Business Processes unit was $34.1 billion, up 16% from a year ago.

- Microsoft 365 Commercial cloud revenue was up 17% and consumer revenue was up 29%.

- Dynamics 365 revenue was up 19%.

- LinkedIn revenue was up 11%.

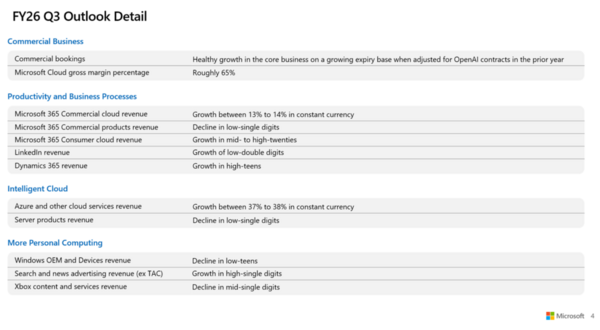

As for the outlook, Microsoft's third quarter will bring revenue between $80.65 billion to $81.75 billion. Here's the breakdown.

Nadella said the following on the earnings conference call and made it clear that Microsoft was optimizing AI price and performance as well as diversifying its models with its own.

- "We are building this infrastructure out for the heterogeneous and distributed nature of these workloads, ensuring the right fit with the geographic and segment specific needs for all customers, including the long tail. The key metric we are optimizing for is tokens per watt per dollar, which comes down to increasing utilization and decreasing TCO using silicon systems and software."

- "Sovereignty is increasingly top of mind for customers, and we are expanding our solutions and global footprint to match. We announced data center investments in seven countries this quarter alone, supporting local data residency needs."

- "Our customers expect to use multiple models as part of any workload so they can fine tune and optimize based on cost, latency and performance requirements. We offer the broadest selection of models of any hyperscaler. Already over 1,500 customers have used both Anthropic and OpenAI models on Foundry. We are seeing increasing demand for region specific models, including Mistral and Cohere, as more customers look for sovereign AI choices."

- "As agents proliferate, every customer will need new ways to deploy, manage and protect them. We believe this creates a major new category and significant growth opportunity for us. This quarter, we introduced Agent 365 which makes it easy for organizations to extend their existing governance, identity, security and management to agents. That means the same controls they already use across Microsoft 365 and Azure now extend to agents they build and deploy on our cloud or any other cloud, and partners."

- "We are entering an age of macro delegation and micro steering across domains intelligence using multiple models is built into multiple form factors."