Palantir US commercial revenue jumps 121% in Q3, ups outlook

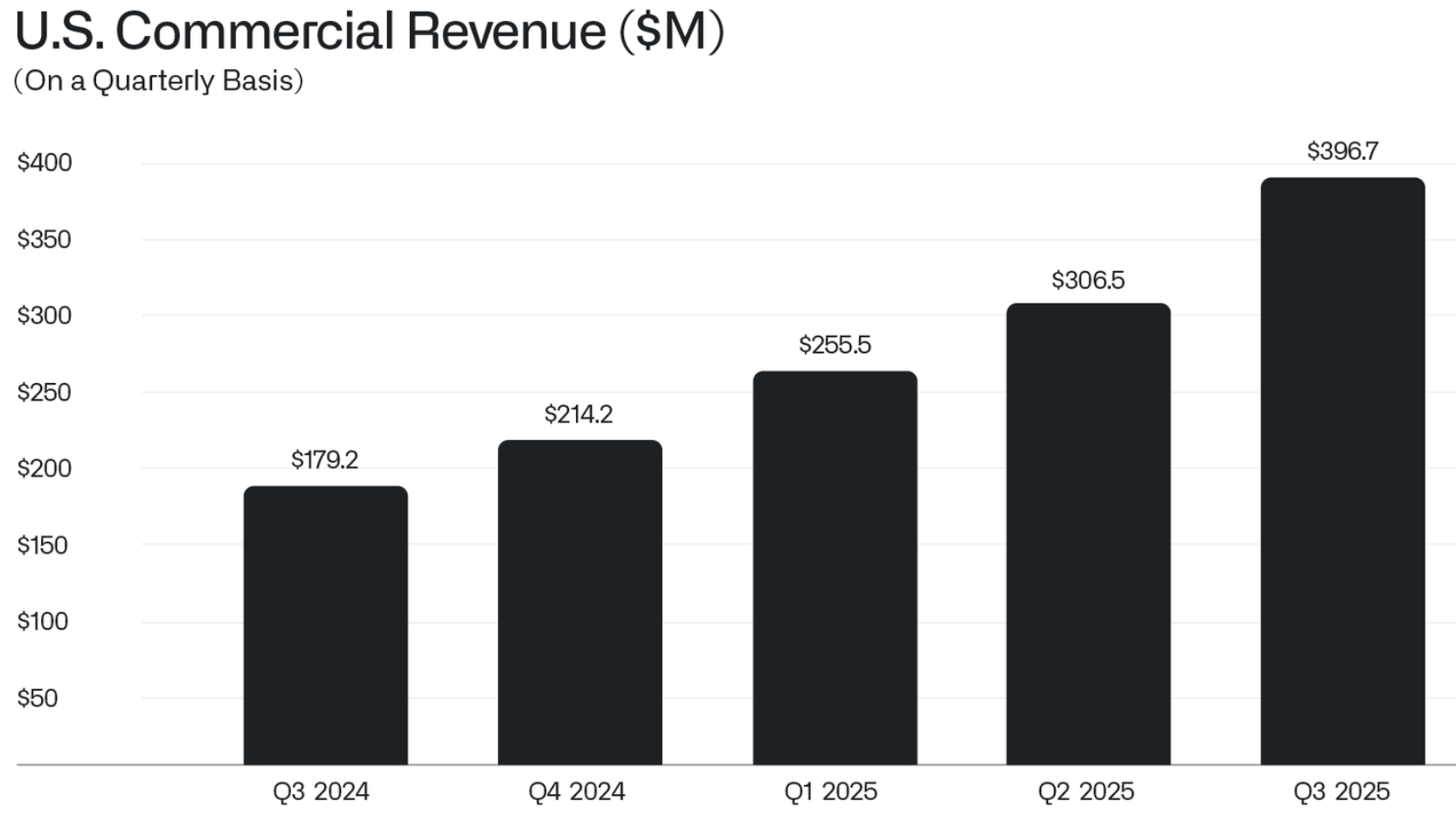

Palantir continued to land commercial accounts as its third quarter results handily topped expectations. The company’s US commercial revenue was up 121% from a year ago.

The company reported third quarter earnings of $476 million, or 18 cents a share. Non-GAAP earnings were 21 cents a share on revenue of $1.18 billion, up 63% from a year ago.

Wall Street was expecting Palantir to report earnings of 11 cents a share (17 cents a share non-GAAP) on revenue of $1.09 billion.

During the quarter, Palantir announced partnerships with Hadean, Lear, Lumen Technologies and SOMPO. Palantir has increasingly been competing with more traditional enterprise software vendors and winning accounts via its data ontology and ability to deploy AI.

- Snowflake, Palantir forge data integration partnership

- Palantir's software revolution: Forget salespeople, let value do the talking

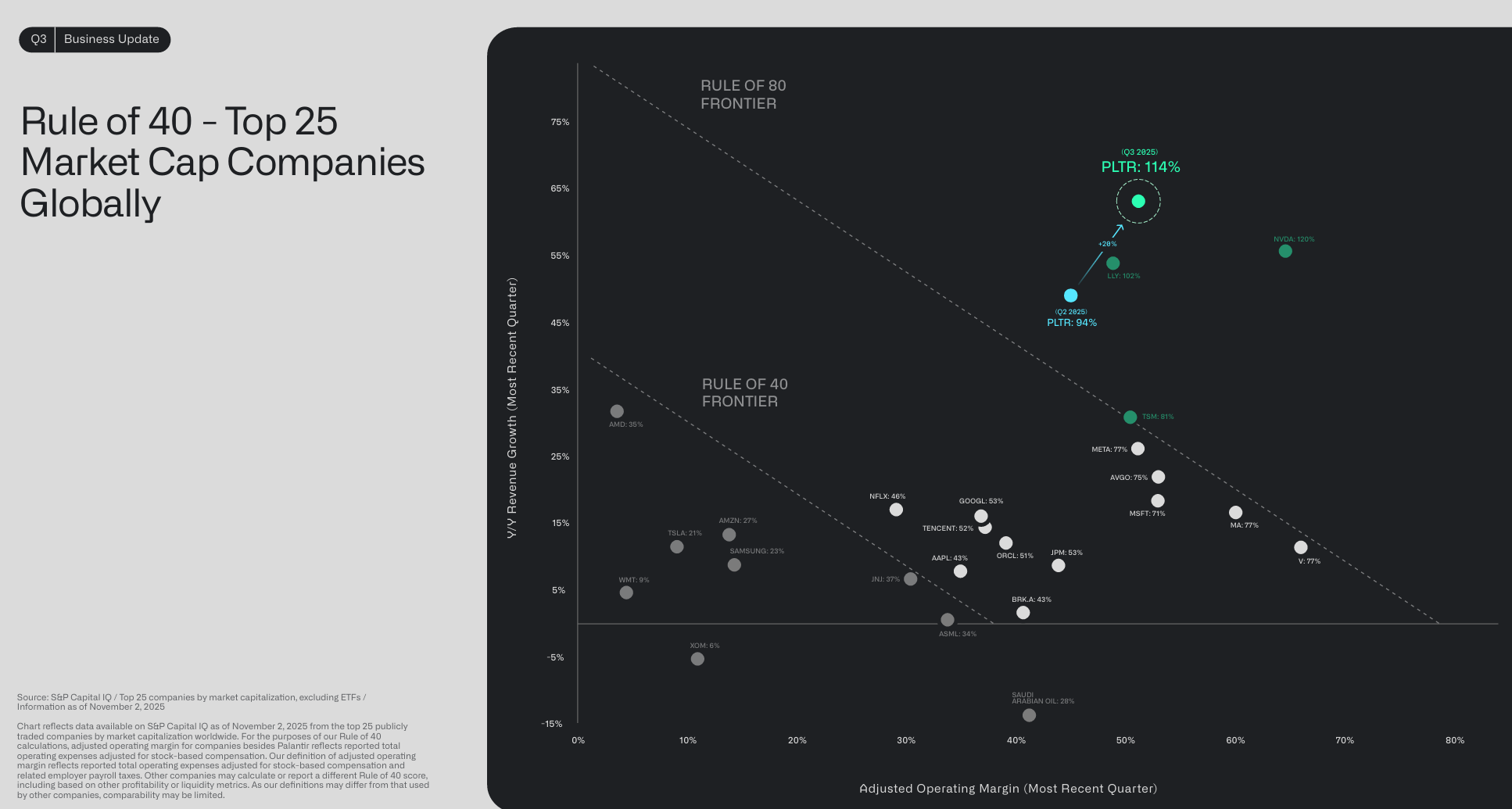

Based on the Rule of 40, Palantir blew that away with a score of 114%. CEO Alex Karp said the company’s US business growth was 77%. Most of Palantir’s revenue is focused on the US as well as western allies.

By the numbers:

- US revenue was $883 million in the third quarter.

- US commercial revenue was $397 million with US government revenue of $486 million, up 52% from a year ago.

- The company said it closed $2.76 billion of total contract value in the third quarter, up 151% from a year ago.

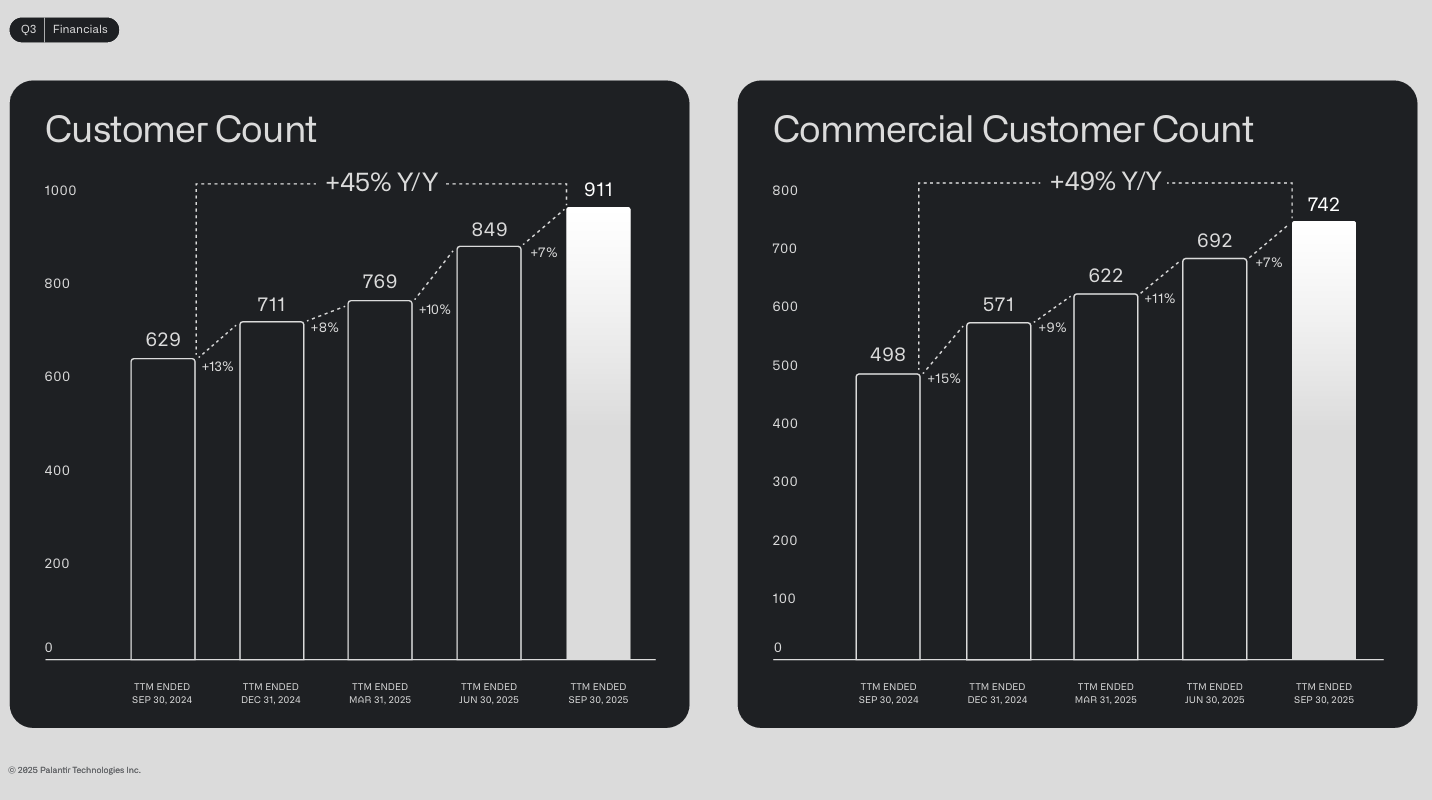

- Customer count was up 45% from a year ago.

- Palantir had $6.4 billion in cash and equivalents.

- In the third quarter, Palantir closed 204 deals worth at least $1 million, 91 worth at least $5 million and 53 worth at least $10 million.

As for the outlook, Palantir raised its outlook and projected 2025 revenue between $4.396 billion and $4.4 billion. Commercial revenue will top $1.43 billion. Fourth quarter revenue will be between $1.327 billion and $1.331 billion.

In a shareholder letter, CEO Alex Karp delivered his usual complement of strong quotes. He said:

- “This remains the beginning, the first moment of a first chapter.â€

- “It is worth remembering that the business is now producing more profit in a single quarter than it did in revenue not long ago. This ascent has confounded most financial analysts and the chattering class, whose frames of reference did not quite anticipate a company of this size and scale growing at such a ferocious and unrelenting rate. Some of our detractors have been left in a kind of deranged and self-destructive befuddlement.â€

- “Our partners in the United States—the earliest and most voracious adopters of the novel language models that are presently reordering human life and of the Ontology that allows them to effectively operate—understand how significantly the terrain beneath us all has shifted.â€