Microsoft owns 27% of OpenAI worth $135 billion

Microsoft's stake in OpenAI has a number: $135 billion, or roughly 27% of the AI company.

The disclosure was made as part of OpenAI's recapitalization that solidifies its structure as a public benefit corporation (PBC).

OpenAI and Microsoft previously said they had an understanding about the moving parts in the partnership. The valuation of Microsoft's stake in OpenAI also comes in handy since the software giant reports earnings Wednesday. Questions about the spending and losses related to Microsoft's OpenAI investment were starting to percolate.

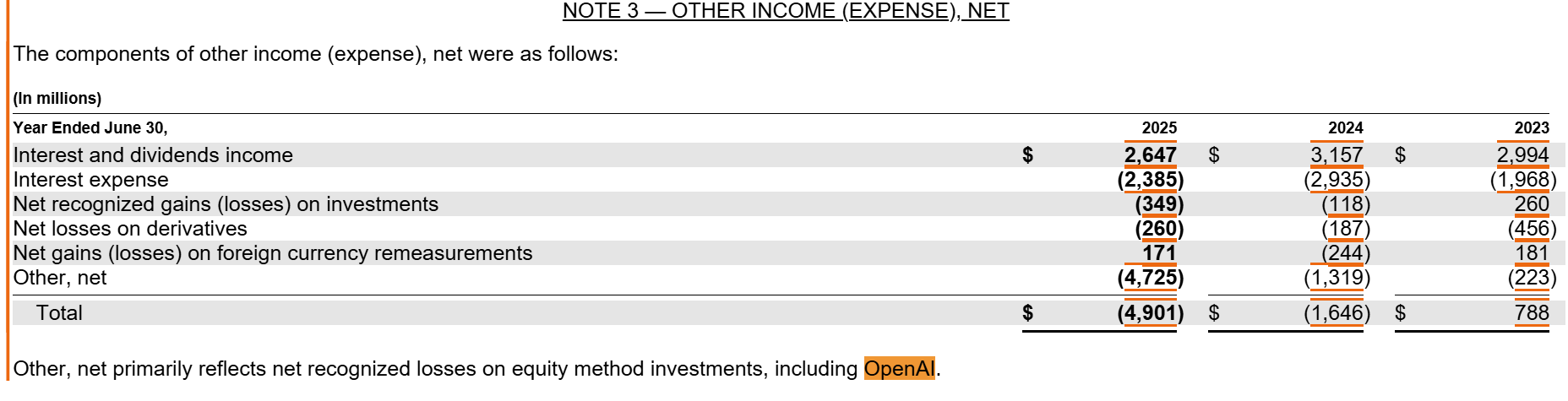

In its annual report, Microsoft listed $4.7 billion OpenAI expenses in an “other net†line that included other items. Microsoft also hasn’t disclosed a carrying valuation for OpenAI.

Microsoft's 27% stake in OpenAI Group PBC, the non-profit that owns OpenAI, is down from the 32.5% stake in the for-profit entity. OpenAI Foundation owns a $130 billion stake in the for profit OpenAI.

Nevertheless, the new agreement gives Microsoft plenty of upside should OpenAI deliver on its growth projections. Microsoft also gets some protection in case OpenAI doesn't and can now pursue AGI on its own, be a key compute provider but without right of first refusal and has rights to models through 2032.

Microsoft and OpenAI increasingly compete:

- Microsoft adds Anthropic models to Researcher, Copilot Studio

- OpenAI, Anthropic increasingly diverge as strategies evolve

- Salesforce expands OpenAI, Anthropic partnerships, eyes Agentforce everywhere

- OpenAI sets SDKs for app integrations, agentic AI building blocks

- OpenAI, AMD ink big GPU deal: What it means for the rest of us

- Anthropic, Microsoft, OpenAI build out AI agent use cases

- Stargate ramps as OpenAI, Oracle, Softbank outline 5 new data centers

The other moving part worth noting is that Microsoft remains OpenAI's lead frontier model partner. Microsoft also has exclusive IP rights and Azure API exclusivity until artificial general intelligence (AGI).

OpenAI's new deal with Microsoft has a few other wrinkles worth noting:

- Once AGI is declared by OpenAI, the claim has to be verified by independent experts.

- Microsoft's IP rights for models and products are extended through 2032 and now include models post-AGI.

- Microsoft's IP rights to research will remain until AGI or through 2030, whichever comes first. Research IP doesn't include model architecture, weights, inference code, finetuning and any IP related to data center hardware and software.

- Microsoft doesn't have IP rights to OpenAI's consumer hardware.

- OpenAI can jointly develop some products with third parties even though API products are exclusive to Azure.

- Microsoft can pursue AGI independently or with other partners.

- OpenAI will purchase an incremental $250 billion of Azure services and Microsoft doesn't have right of first refusal to be OpenAI's compute provider.

- OpenAI can provide API access to US government national security customers.