Thoma Bravo buys PROS for $1.4 billion

Thoma Bravo has acquired PROS Holdings, a pricing and revenue management software company, in a deal valued at $1.4 billion.

The deal is the third in less than a month for Thoma Bravo, which recently took Verint and Dayforce private.

- Thoma Bravo acquires Verint for $2 billion, will combine it with Calabrio

- Dayforce goes private with Thoma Bravo $12.3 billion deal

Under the terms of the deal, Thoma Bravo will pay $23.25 per share in cash, nearly a 42% premium over PROS closing price Sept. 19.

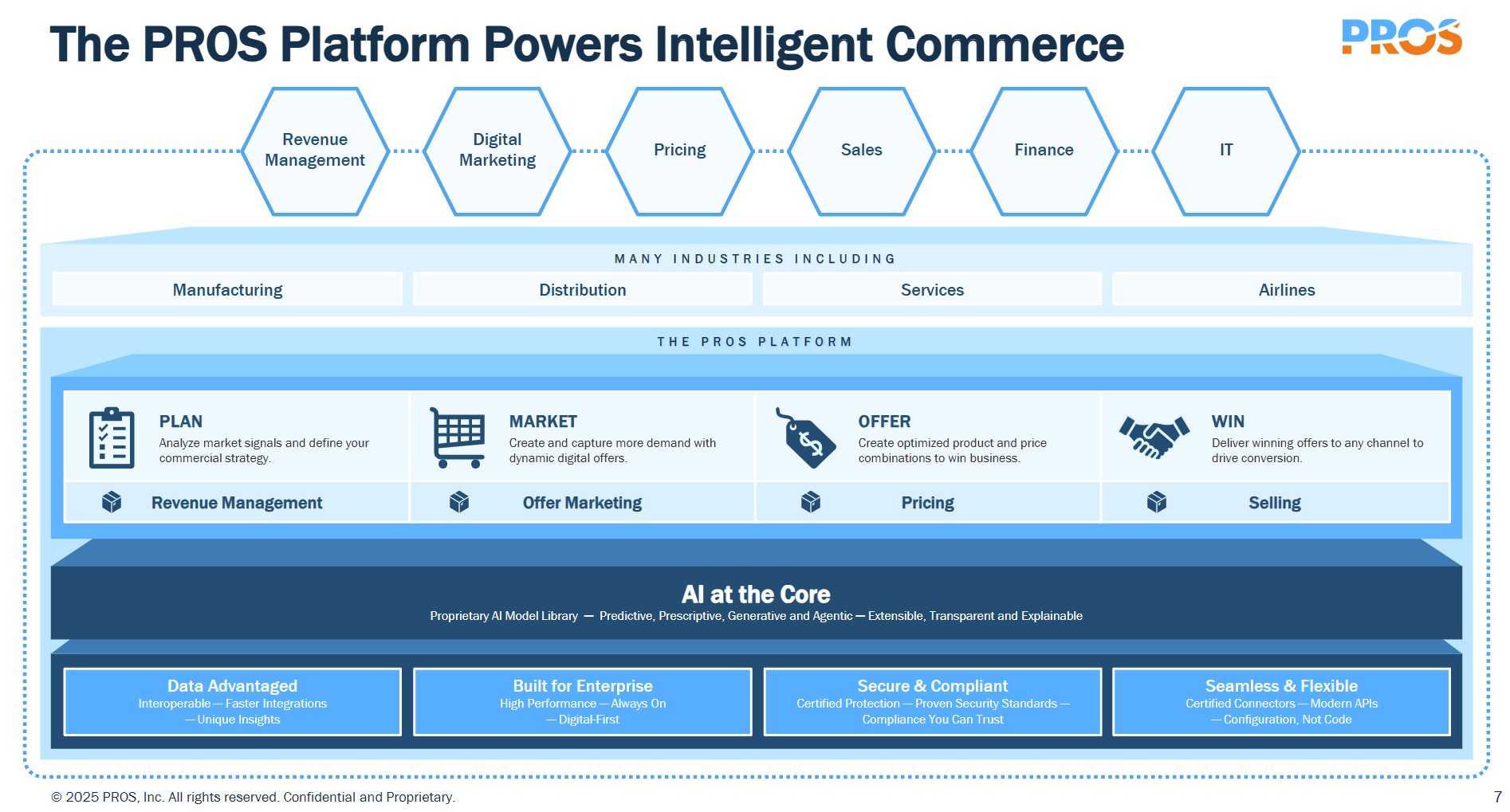

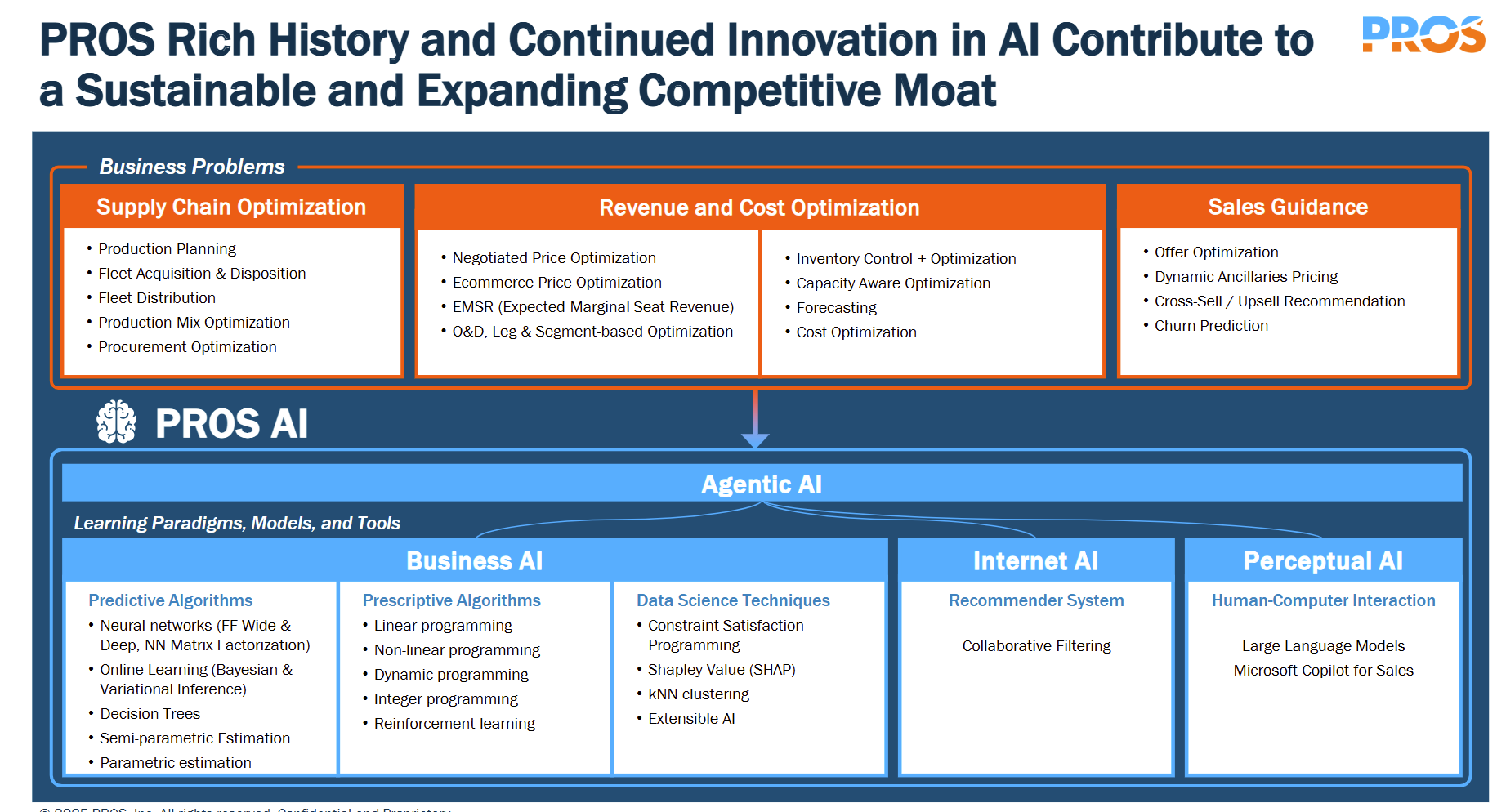

PROS said it will continue to focus on advancing its agentic AI product plans with the capital and expertise of Thoma Bravo. PROS CEO Jeff Cotten said that the company will "be more agile and have greater flexibility to invest in innovation and expand our platform" as a private company.

When PROS reported its second quarter earnings in July, it projected 2025 revenue of $360 million to $362 million with free cash flow of $40 million to $44 million.

Depending on the specific product, PROS competes with Conga, Oracle CPQ, Zilliant, Salesforce Revenue Cloud and others. Conga happens to be a Thoma Bravo portfolio company.

- Constellation ShortListâ„¢ Price Optimization Solutions

- Constellation ShortListâ„¢ Configure Price Quote (CPQ)

Here's a look at PROS platform and use cases.