HPE delivers solid Q4 results, but server sales fall

Hewlett-Packard reported solid fourth quarter results, but server sales fell 5%. Server sales were lower in the fourth quarter due to timing of AI server shipments and lower US government spending.

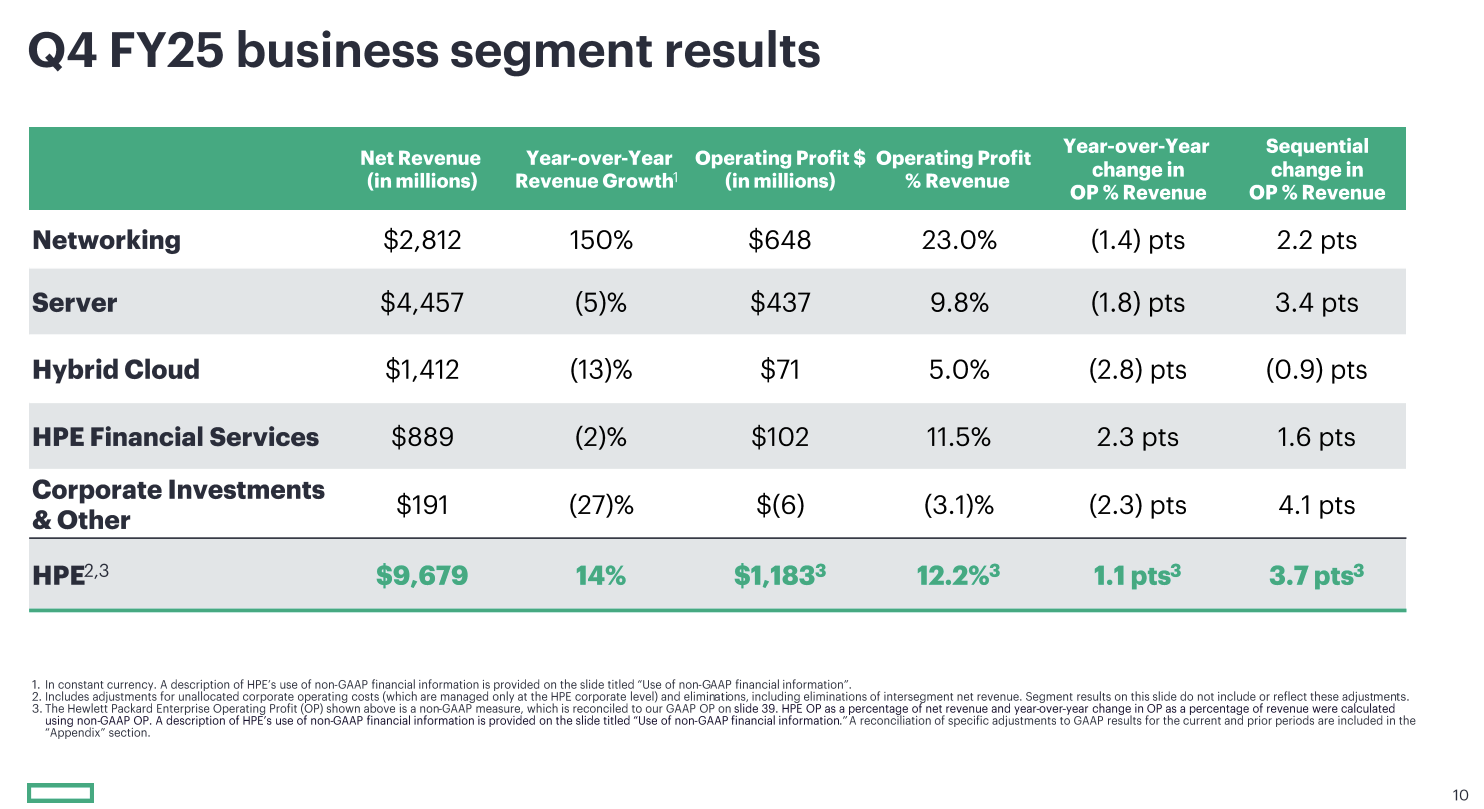

HPE reported fourth quarter earnings of 11 cents a share on revenue of $9.7 billion, up 14% from a year ago. Non-GAAP earnings were 62 cents a share. HPE recently outlined its long-term outlook and strategy on its investor day.

Wall Street was expecting HPE to report non-GAAP fourth quarter earnings of 58 cents a share on revenue of $9.91 billion.

However, HPE's results were mixed by product line. For instance server revenue was down 5% to $4.5 billion. Networking revenue, boosted by the acquisition of Juniper Networks, was $2.8 billion, up 150% from a year ago. Hybrid cloud revenue was $1.2 billion, down 12% from a year ago.

"HPE had a good quarter, but the growth came all from networking. Surprisingly, HPE server revenue was down, and blaming the customer mix change for it is a surprising move," said Constellation Research analyst Holger Mueller. "More interesting is also that half of HPE profit came from networking, but which underlined how important the Juniper acquiaition has been HPE. Now it's all about Antonio Neri and team getting growth back into the server segment."

For the fiscal year, HPE reported a net loss of $59 million, or 4 cents a share, on revenue of $34.3 billion.

CEO Antonio Neri said HPE "finished a transformative year with a strong fourth quarter of profitable growth and disciplined execution."

As for the outlook, HPE projected first quarter revenue of $9 billion to $9.4 billion with non-GAAP per share earnings of 57 cents to 62 cents.

For fiscal 2026, HPE said revenue will grow 17% to 22% with non-GAAP per share earnings between $2.25 to $2.45.

At HPE Discover Barcelona, the company announced new features for Greenlake cloud, launched unified AIOps across Aruba and Juniper Networks and an AI factory partnership with Nvidia.

On a conference call, Neri said:

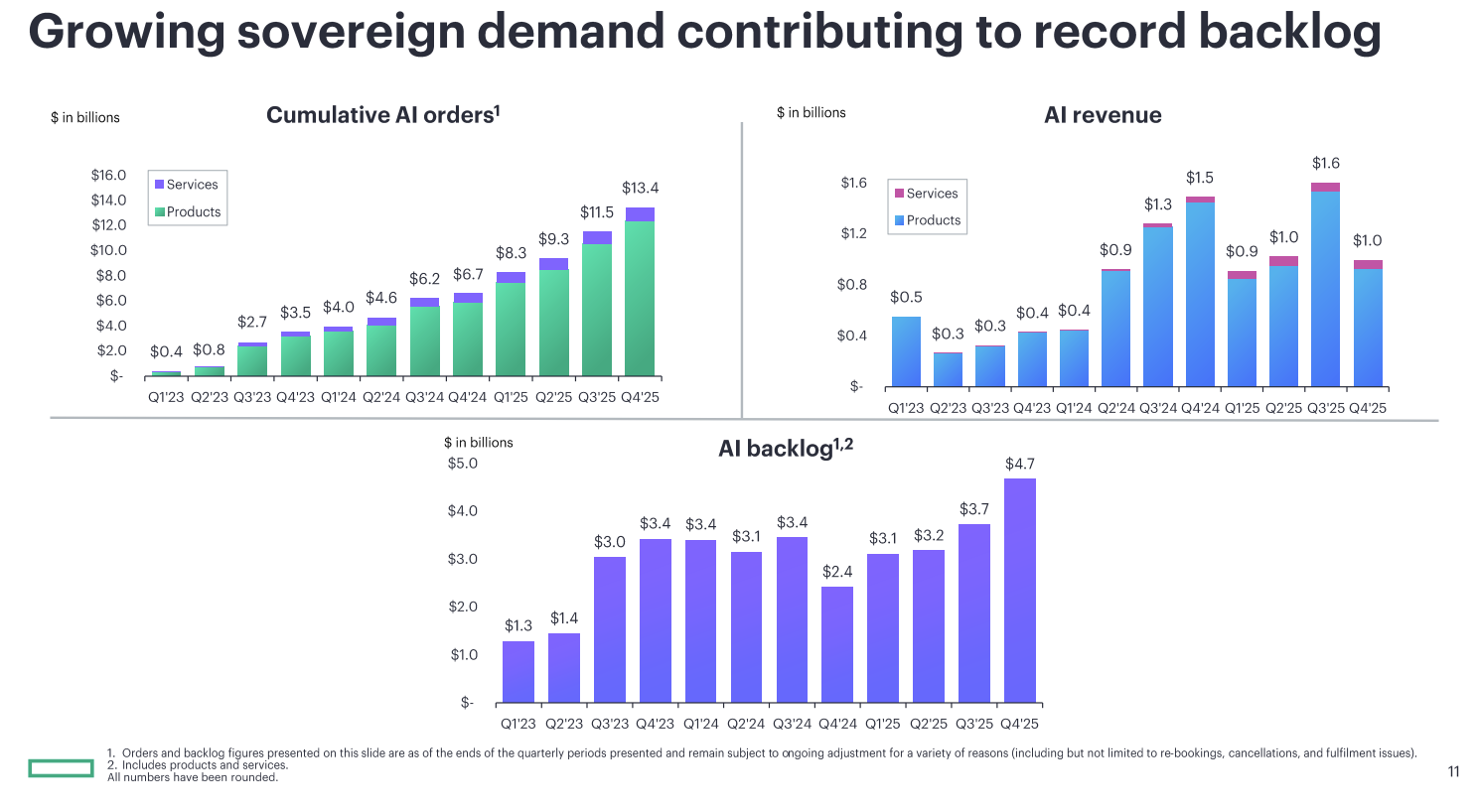

- "The underlying demand environment was strong throughout the quarter with orders growing faster than revenues. We saw an acceleration in orders in the last weeks of the quarter, signaling solid demand for our portfolio."

- "As we look to 2026, we will draw on our supply chain expertise to secure critical commodity supply and exercise our pricing management discipline. We expect DRAM and NAND costs to continue to increase in 2026, the majority of which we expect to pass to the market while monitoring demand."

- "We have discipline in passing through the cost through our pricing which again we already did in November."